Breaking The Deadlock: Understanding The US-China Trade Agreement

Table of Contents

The agreement's genesis lies in years of escalating trade tensions. Prior negotiations yielded limited progress, culminating in the imposition of tariffs on billions of dollars worth of goods by both countries. These tariffs, along with other trade restrictions, significantly disrupted global commerce and fueled uncertainty. The US-China Trade Agreement, particularly its "Phase One" deal, represents a significant—though partial—attempt to resolve these issues.

Key Provisions of the Phase One US-China Trade Deal

The Phase One US-China Trade Agreement, signed in January 2020, outlined several key commitments from China. While not a comprehensive resolution of all trade disputes, it marked a crucial step in stabilizing the relationship.

Increased Purchase of US Goods and Services

A central pillar of the agreement was China's commitment to substantially increase its purchases of American goods and services. This involved specific targets across various sectors:

- Agricultural Products: China pledged to significantly increase its imports of soybeans, pork, and other agricultural products.

- Manufactured Goods: Increased purchases of American manufactured goods were also targeted, although specific product categories were less clearly defined.

- Energy: The agreement included commitments regarding increased imports of US energy products.

These targets were accompanied by timelines, though meeting them proved challenging. The impact on American farmers and businesses was significant, with some sectors experiencing a boost while others faced ongoing difficulties. Factors such as global market fluctuations and internal Chinese policies impacted the realization of these purchase commitments.

Intellectual Property Rights Protection

Concerns over intellectual property (IP) theft and forced technology transfer have long been a major point of contention. The US-China Trade Agreement included provisions aimed at strengthening IP rights protection in China:

- Enhanced enforcement of existing IP laws.

- Increased penalties for IP infringement.

- Mechanisms to address forced technology transfer.

While these measures represented progress, their effectiveness remains a subject of ongoing debate and monitoring. The actual implementation and enforcement of these provisions continue to be crucial aspects of the agreement's success.

Financial Services Market Access

The agreement also addressed market access for US financial institutions in China. This involved:

- Increased access to China's financial services market for American banks and financial technology companies.

- Reduced restrictions on foreign ownership and operational limitations.

This increased market access holds significant potential benefits for American financial companies, but also presents challenges and risks related to navigating the complexities of the Chinese financial system.

Currency Manipulation

The agreement included provisions addressing concerns about currency manipulation and exchange rate stability. The US had previously accused China of artificially undervaluing its currency, giving its exports an unfair advantage. The agreement incorporated mechanisms for:

- Monitoring exchange rate movements.

- Addressing concerns regarding unfair currency practices.

- Promoting transparency and accountability in currency policies.

Impact of the US-China Trade Agreement

The US-China Trade Agreement has had multifaceted economic consequences for both countries and the global economy.

Economic Consequences for the US

The economic impact on the US has been mixed. While some sectors, like agriculture, initially benefited from increased exports, the overall effect on job creation, the trade balance, and economic growth remains a subject of ongoing analysis and debate. Quantifying the precise economic impact requires careful consideration of various factors and statistical modeling.

Economic Consequences for China

For China, the agreement presented both challenges and opportunities. While increased purchases of US goods might have strained some domestic industries, it also provided access to American technology and financial markets. The long-term impact on China's economic growth and its position in the global trade system requires further observation.

Global Implications

The US-China Trade Agreement has had ripple effects on the global economy, influencing international trade, supply chains, and global economic stability. The agreement's impact on other countries, particularly those heavily involved in the global supply chain, has been varied and often indirect.

Challenges and Future Outlook of the US-China Trade Agreement

Despite its significance, the agreement faces considerable challenges.

Enforcement and Compliance

Ensuring compliance from both sides remains a significant hurdle. Disputes over implementation and enforcement mechanisms are possible, necessitating clear and effective dispute resolution processes.

Geopolitical Tensions

The ongoing geopolitical tensions between the US and China pose a significant risk to the agreement's long-term success. These broader geopolitical factors can easily overshadow even the most carefully crafted trade agreements.

Future Negotiations

The possibility of future negotiations to address unresolved trade issues remains a key element of the US-China trade relationship. These future talks could focus on broader aspects of the economic and technological competition between the two countries.

Navigating the Future of US-China Trade

The US-China Trade Agreement, particularly the Phase One deal, represents a significant but incomplete step in managing a complex and evolving relationship. Understanding its key provisions, implications, and challenges is crucial for businesses, policymakers, and anyone interested in the global economy. The US-China trade relationship remains dynamic and requires continued monitoring and analysis. To stay informed about developments, consult resources such as the Office of the United States Trade Representative (USTR) website and reports from reputable research institutions. Stay informed about developments in the US-China Trade Agreement to effectively navigate its implications for your industry.

Featured Posts

-

The Dark Side Of Ai Therapy Surveillance And The Erosion Of Civil Liberties

May 16, 2025

The Dark Side Of Ai Therapy Surveillance And The Erosion Of Civil Liberties

May 16, 2025 -

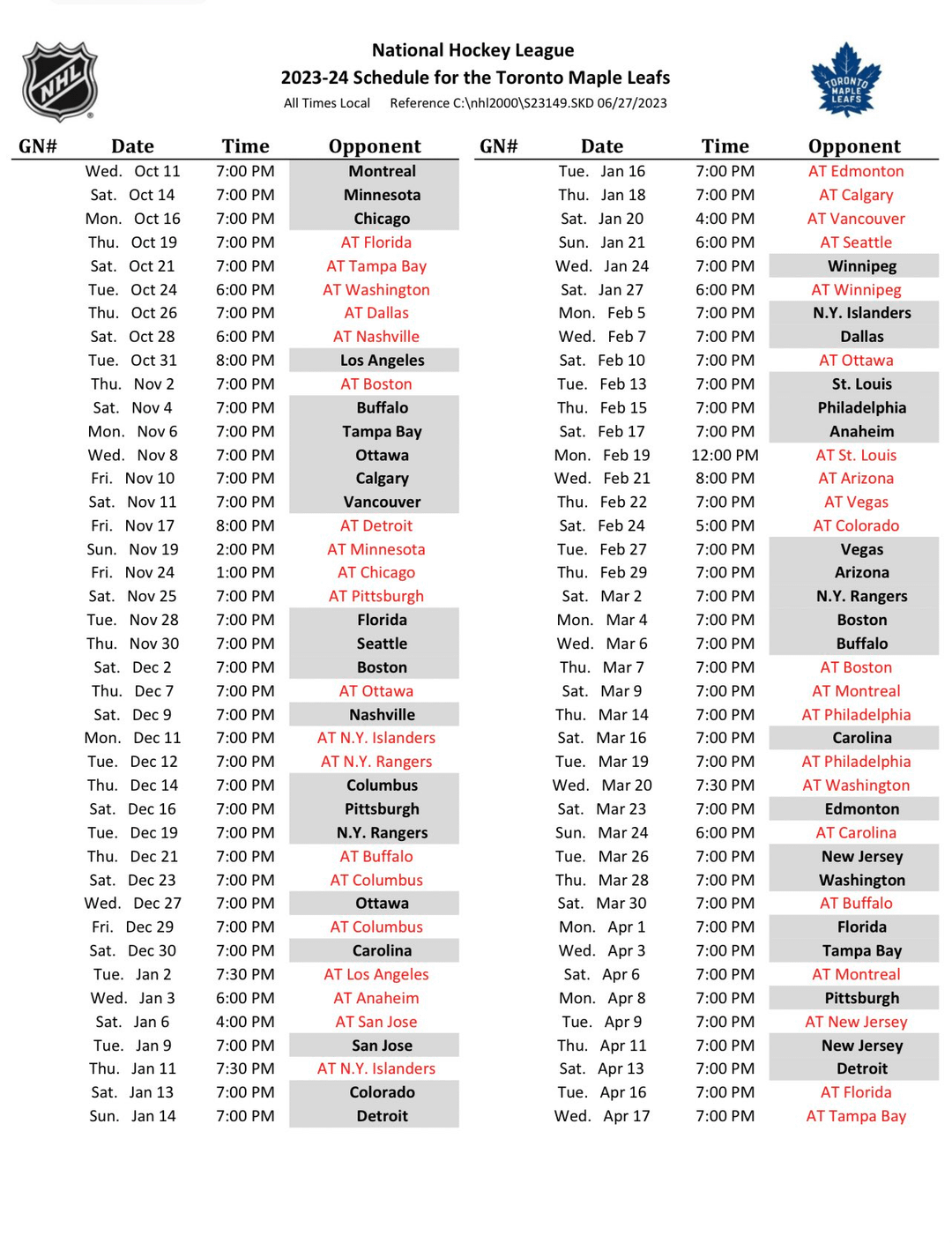

Toronto Maple Leafs Playoff Clinch Within Reach Against Florida Panthers

May 16, 2025

Toronto Maple Leafs Playoff Clinch Within Reach Against Florida Panthers

May 16, 2025 -

Knicks Narrow Escape A Look At The Overtime Defeat

May 16, 2025

Knicks Narrow Escape A Look At The Overtime Defeat

May 16, 2025 -

Nhl Predictions Colorado Avalanche Vs Toronto Maple Leafs March 19th

May 16, 2025

Nhl Predictions Colorado Avalanche Vs Toronto Maple Leafs March 19th

May 16, 2025 -

Is Creatine Safe And Effective Exploring The Evidence

May 16, 2025

Is Creatine Safe And Effective Exploring The Evidence

May 16, 2025