Broadcom's Proposed VMware Price Hike: AT&T Reports A 1050% Surge In Costs

Table of Contents

AT&T's 1050% VMware Cost Surge: A Case Study

AT&T's experience serves as a stark warning for other businesses relying on VMware products. The reported 1050% increase in VMware licensing costs represents a massive financial burden. While the exact details of AT&T's contracts and negotiations remain confidential, the sheer magnitude of the increase points to significant changes in VMware's pricing structure post-acquisition.

- Contract Renegotiation: The price surge likely stems from renegotiated contracts following Broadcom's takeover. New terms and conditions, potentially including higher per-unit licensing fees or changes to support and maintenance agreements, could be the culprits.

- Bundled Services: Broadcom may be bundling services previously offered separately, resulting in a higher overall cost even if individual components remain relatively unchanged.

- Financial Impact: A 1050% increase represents millions, if not billions, of dollars in additional expenditure for AT&T. This impacts their bottom line and could force strategic re-evaluation of IT spending. This case study highlights the vulnerability of large organizations reliant on VMware solutions.

The implications for AT&T extend beyond immediate financial strain. It forces a re-evaluation of their IT infrastructure, potentially impacting operational efficiency and strategic planning. Understanding the specifics of AT&T's situation offers vital lessons for other organizations.

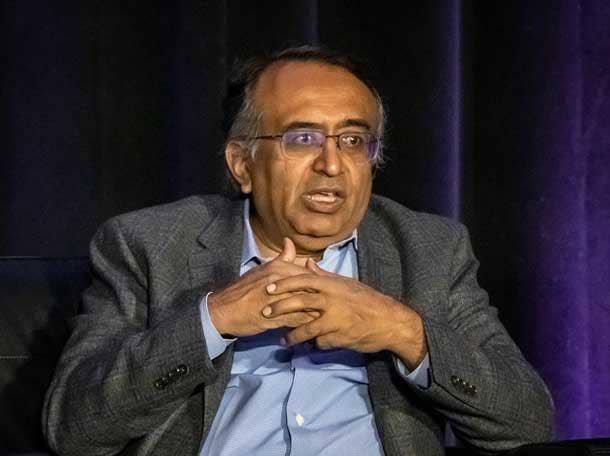

Broadcom's VMware Acquisition and Pricing Strategy

Broadcom's acquisition of VMware, valued at approximately $61 billion, was a major move in the enterprise software market. Broadcom's stated rationale centers around expanding its portfolio and integrating VMware's virtualization technology into its existing infrastructure offerings. However, the subsequent price increases raise concerns about Broadcom's pricing strategy.

- Market Dominance: The acquisition significantly strengthens Broadcom's market position, potentially leading to less competition and justifying higher prices.

- Profit Maximization: Broadcom may be prioritizing profit maximization after the substantial investment in acquiring VMware.

- Pricing Justification: Broadcom has yet to publicly and comprehensively justify the dramatic price increases witnessed by AT&T and potentially other clients. Transparency on this issue is vital for building trust and managing stakeholder expectations.

Potential Impacts on Businesses and the Cloud Computing Market

The ripple effects of Broadcom's pricing strategy extend far beyond AT&T. Businesses relying on VMware's virtualization and cloud computing solutions could face similar cost increases, impacting their budgets and strategic planning.

- Cloud Computing Costs: Higher VMware licensing costs could increase the overall cost of cloud computing, making it less accessible for smaller businesses and potentially affecting market competition.

- VMware Alternatives: Businesses are actively seeking alternatives to VMware, such as open-source virtualization platforms or other commercial solutions. This shift in the market could influence future technological choices and vendor lock-in considerations.

- Enterprise Software Spending: The Broadcom VMware price hike underscores the need for businesses to carefully analyze and manage enterprise software spending. Budget allocation and long-term planning must account for these unexpected cost increases.

Regulatory Scrutiny and Antitrust Concerns

Given the scale of the acquisition and the subsequent price increases, regulatory scrutiny and antitrust concerns are inevitable. The dramatic increase experienced by AT&T raises questions about whether Broadcom's pricing practices are anti-competitive.

- Ongoing Investigations: It's plausible that regulatory bodies in various jurisdictions might initiate investigations into Broadcom's pricing practices following the acquisition.

- Legal Implications: Lawsuits from affected businesses could emerge, challenging the legality and fairness of the price hikes imposed by Broadcom.

- Future Mergers & Acquisitions: The outcome of any investigations or lawsuits will significantly impact future mergers and acquisitions in the technology sector.

Conclusion: Navigating the Post-Acquisition VMware Landscape

Broadcom's acquisition of VMware and the subsequent price hikes, exemplified by AT&T's 1050% cost surge, have created significant uncertainty in the enterprise software market. Understanding these complexities is crucial for effective budget planning and ensuring the long-term health of your IT infrastructure. Businesses must proactively plan for potential cost increases, explore alternative solutions, negotiate favorable contract terms, and optimize their VMware deployments to mitigate the impact of these changes. Stay ahead of the curve and learn more about mitigating the risks of Broadcom's VMware price hikes.

Featured Posts

-

Novo Nordisks Ozempic Falling Behind In The Weight Loss Market

May 30, 2025

Novo Nordisks Ozempic Falling Behind In The Weight Loss Market

May 30, 2025 -

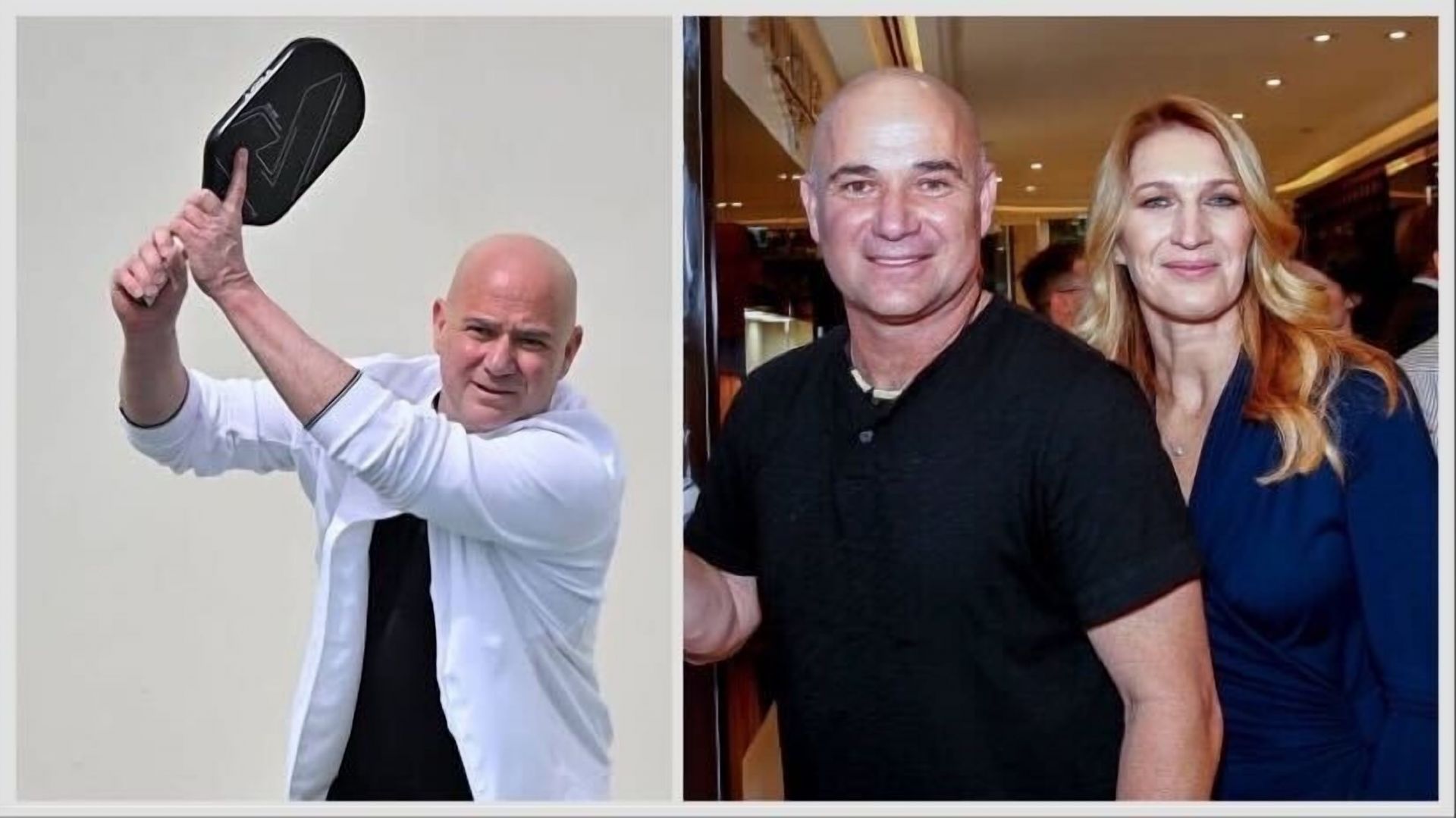

Steffi Graf Und Andre Agassi Enthuellen Ihre Pickleball Strategie

May 30, 2025

Steffi Graf Und Andre Agassi Enthuellen Ihre Pickleball Strategie

May 30, 2025 -

Ditte Okmans Udstilling En Dybere Forstaelse Af Kare Quist Og Han Taler Udenom

May 30, 2025

Ditte Okmans Udstilling En Dybere Forstaelse Af Kare Quist Og Han Taler Udenom

May 30, 2025 -

Gorillaz 25th Anniversary Your Guide To The House Of Kong Exhibition

May 30, 2025

Gorillaz 25th Anniversary Your Guide To The House Of Kong Exhibition

May 30, 2025 -

Pegula Rallies Past Collins To Win Charleston Title

May 30, 2025

Pegula Rallies Past Collins To Win Charleston Title

May 30, 2025

Latest Posts

-

Minnesota Suffers From Degraded Air Quality Canadian Wildfires To Blame

May 31, 2025

Minnesota Suffers From Degraded Air Quality Canadian Wildfires To Blame

May 31, 2025 -

Poor Air Quality In Minnesota Due To Canadian Wildfires

May 31, 2025

Poor Air Quality In Minnesota Due To Canadian Wildfires

May 31, 2025 -

Canadian Wildfires Send Dangerous Smoke To Minnesota

May 31, 2025

Canadian Wildfires Send Dangerous Smoke To Minnesota

May 31, 2025 -

Minnesota Air Quality Crisis Impact Of Canadian Wildfires

May 31, 2025

Minnesota Air Quality Crisis Impact Of Canadian Wildfires

May 31, 2025 -

Reflecting On Recovery The Texas Panhandle One Year Post Wildfire

May 31, 2025

Reflecting On Recovery The Texas Panhandle One Year Post Wildfire

May 31, 2025