Broadcom's VMware Acquisition: AT&T Highlights A 1,050% Price Surge

Table of Contents

The Deal's Magnitude and Market Reactions

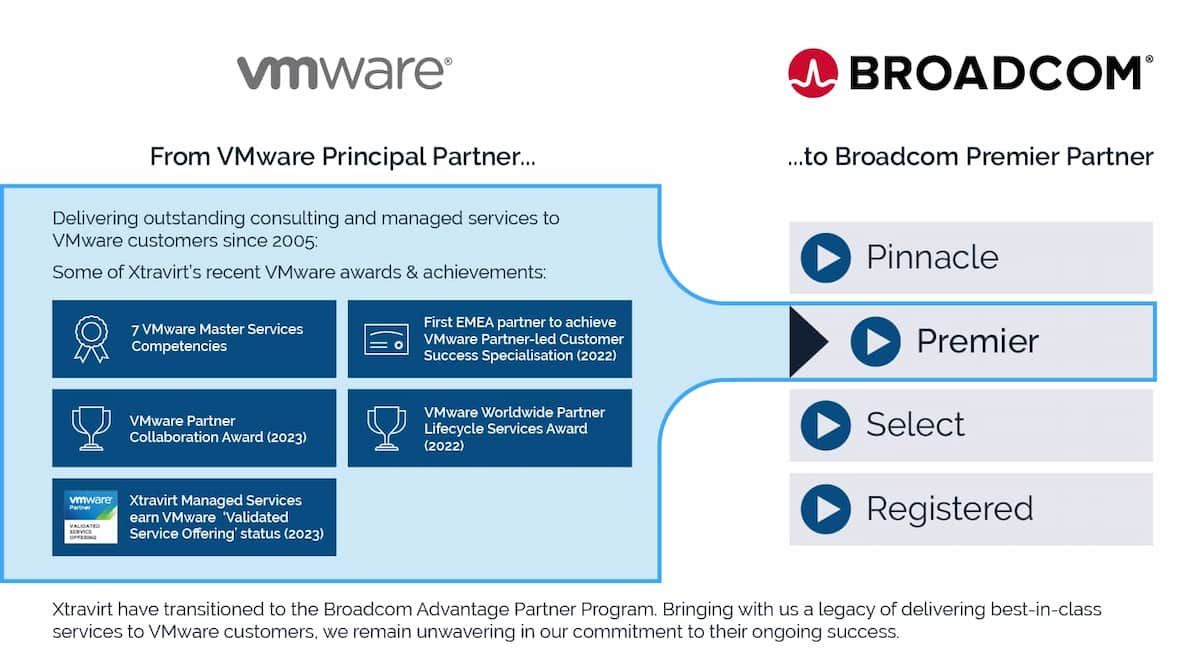

Broadcom's acquisition of VMware, finalized in late 2022, was a monumental transaction valued at approximately $61 billion. This mega-merger instantly reshaped the landscape of enterprise software and networking. The sheer size of the deal led to immediate market fluctuations. Broadcom's market capitalization saw significant changes following the announcement, reflecting investor sentiment. VMware's stock performance, naturally, experienced considerable shifts, both before and after the acquisition was finalized. This ripple effect extended to other companies within the tech ecosystem, including unexpected players like AT&T.

- Acquisition cost: Approximately $61 billion.

- Broadcom's market capitalization post-acquisition: A substantial increase, reflecting investor confidence (Specific figures would need to be added here based on current market data).

- VMware's stock performance before and after the announcement: Initially a surge, followed by stabilization (Specific figures would need to be added here based on current market data).

- Impact on competitor stock prices: Mixed reactions across competitors, with some experiencing gains and others losses depending on their market positioning relative to Broadcom and VMware (Specific examples and data would need to be added here based on current market data).

AT&T's Unexpected Price Surge: Unpacking the 1050% Jump

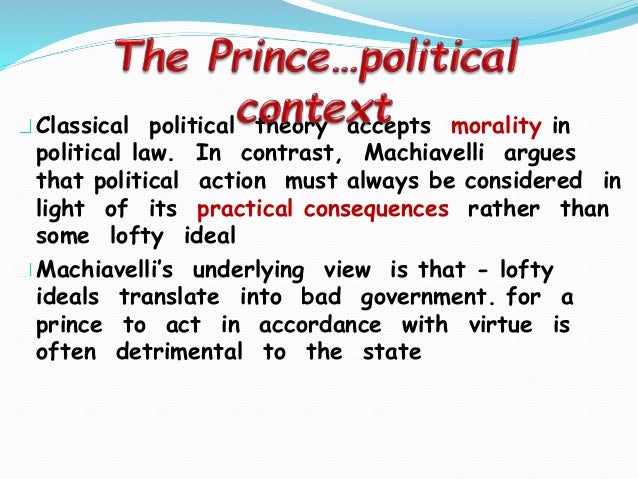

The most surprising aspect of Broadcom's VMware acquisition is the unprecedented 1050% price surge experienced by AT&T. While seemingly unconnected at first glance, several factors could explain this extraordinary jump. The connection is likely indirect, perhaps stemming from market sentiment shifts, or a re-evaluation of AT&T's position in the evolving telecommunications and data infrastructure landscape following the merger's implications. It could also be attributed to general market speculation and trading activities rather than a direct link to the Broadcom-VMware deal.

- AT&T's business relationship with VMware or Broadcom: While not a direct partnership, AT&T leverages VMware technology in its network infrastructure, potentially influencing investor perceptions.

- Market analysts' interpretations of the price surge: Experts are divided, with some attributing it to broader market trends and others pointing to possible misinterpretations or speculation related to AT&T's potential to benefit from the consolidation of tech giants.

- Potential contributing factors beyond the direct impact of the acquisition: Other significant events impacting the telecommunications sector at that time could have played a role, requiring further investigation.

- Comparison to other companies' stock performance in the same sector: Analyzing the performance of similar telecom companies during the same period would provide context and highlight whether this surge was a unique event.

Long-Term Implications for the Tech Landscape

Broadcom's acquisition of VMware carries profound long-term implications for the tech landscape. It significantly impacts the cloud computing market, potentially altering market share and competition. The merger creates a formidable entity with vast influence over software infrastructure, networking solutions, and data center technologies. This concentration of power inevitably raises concerns about potential stifling of competition and innovation. Regulatory bodies around the world are likely to scrutinize the deal closely for potential antitrust violations.

- Impact on cloud computing market share: Increased concentration and potential shifts in market share among major cloud providers.

- Changes to the competitive landscape: A more consolidated market with fewer major players, potentially leading to less competition.

- Potential for increased innovation or stifled competition: The outcome remains uncertain, depending on Broadcom's strategies post-acquisition.

- Regulatory scrutiny and potential outcomes: Antitrust investigations and potential regulatory hurdles are expected in various jurisdictions.

Navigating the Post-Acquisition Landscape of Broadcom's VMware Deal

Broadcom's acquisition of VMware represents a watershed moment in the tech industry. The surprising surge in AT&T's stock price underscores the far-reaching and sometimes unpredictable consequences of such mega-mergers. The long-term impact on competition, innovation, and regulatory frameworks remains to be seen, requiring close observation and analysis. Understanding the intricacies of "Broadcom's VMware acquisition" is crucial for navigating the evolving tech landscape. Stay informed about further developments by subscribing to industry news sources like [insert relevant news sources here] and following key players in the market. The effects of this transformative deal will continue to unfold, demanding our continued attention.

Featured Posts

-

Man Utd Analyzing Amorims Latest Signing

May 20, 2025

Man Utd Analyzing Amorims Latest Signing

May 20, 2025 -

Trump Administration Aerospace Deals Big Promises Unclear Deliverables

May 20, 2025

Trump Administration Aerospace Deals Big Promises Unclear Deliverables

May 20, 2025 -

Nigeria Pragmatism Vs Idealism A Kite Runner Conundrum

May 20, 2025

Nigeria Pragmatism Vs Idealism A Kite Runner Conundrum

May 20, 2025 -

Complete Guide To Nyt Mini Crossword March 5 2025

May 20, 2025

Complete Guide To Nyt Mini Crossword March 5 2025

May 20, 2025 -

Yeni Formula 1 Sezonu Icin Tam Bir Rehber

May 20, 2025

Yeni Formula 1 Sezonu Icin Tam Bir Rehber

May 20, 2025