Broadcom's VMware Acquisition: AT&T Highlights Extreme Cost Increases

Table of Contents

The Broadcom-VMware Merger: A Deep Dive

Broadcom's $61 billion acquisition of VMware, finalized in late 2022, represents one of the largest tech mergers in history. Broadcom, a prominent player in semiconductor and infrastructure software, aims to integrate VMware's leading virtualization and cloud computing technologies into its existing portfolio. This expansion significantly broadens Broadcom's reach into the enterprise software market.

- VMware's Market Dominance: VMware holds a dominant position in server virtualization and cloud computing, providing essential infrastructure for countless businesses globally. Their vSphere platform is a cornerstone of many data centers.

- Broadcom's Strategic Expansion: The acquisition allows Broadcom to offer a comprehensive suite of networking, security, and cloud solutions, strengthening its position against competitors like Cisco and Microsoft.

- Regulatory Scrutiny: The merger faced significant regulatory scrutiny, with concerns raised about potential anti-competitive practices. However, the deal ultimately received regulatory approval, paving the way for integration.

These factors, combined with the inherent complexities of such a large-scale merger, have raised concerns across the industry, especially for companies heavily reliant on VMware's solutions.

AT&T's Public Statements on Increased Costs

AT&T, a major user of VMware's virtualization technologies, has publicly expressed concerns about substantial price increases following the Broadcom-VMware merger. While specific figures haven't been publicly disclosed, AT&T executives have indicated that the acquisition will likely lead to significantly higher costs for their enterprise software infrastructure.

- Official Statements: Although AT&T hasn't released explicit quotes detailing predicted cost increases, their financial reports reflect a heightened awareness and concern regarding the impact of the merger on their IT budget.

- Budgetary Impact: The increased costs associated with VMware products following the acquisition could significantly impact AT&T's budget allocation, potentially diverting funds from other crucial areas like network expansion and 5G deployment.

- Cost-Cutting Measures: In response to the anticipated cost increases, AT&T is likely to explore various cost-cutting measures, including negotiating more favorable contracts with Broadcom and potentially evaluating alternative solutions for certain aspects of its infrastructure.

Industry-Wide Implications of the Acquisition

The Broadcom-VMware merger has far-reaching consequences extending beyond AT&T. The deal's impact on the broader telecommunications and technology landscapes is multifaceted.

- Competitive Landscape: The merger's impact on competition within the enterprise software market remains a key concern. Critics argue that Broadcom's increased market power could lead to less competitive pricing and reduced innovation.

- Pricing Strategies: Many industry analysts anticipate that Broadcom will implement revised pricing strategies for VMware products, potentially resulting in price hikes for existing customers.

- Impact on Other Telecoms: Other large telecommunication companies that rely heavily on VMware solutions are also facing similar challenges, prompting them to re-evaluate their IT strategies and explore alternative options.

Alternative Solutions and Mitigation Strategies for AT&T (and other companies)

Faced with potentially exorbitant cost increases, AT&T and other companies have several options for mitigating the impact of the Broadcom-VMware acquisition:

- Open-Source Alternatives: Exploring and adopting open-source virtualization solutions like Proxmox VE or OpenStack could significantly reduce dependence on VMware products and their associated costs.

- Contract Negotiation: Robust negotiations with Broadcom are essential to secure more favorable pricing and licensing agreements, limiting the impact of price increases.

- Infrastructure Optimization: Optimizing existing infrastructure through consolidation, virtualization enhancements, and cloud migration can help reduce reliance on VMware and overall IT costs.

Conclusion: Navigating the Post-Acquisition Landscape of Broadcom's VMware Deal

The Broadcom-VMware merger presents significant challenges for AT&T and the broader telecommunications industry. The potential for substantial cost increases due to this acquisition necessitates a careful review of existing IT infrastructure and the exploration of alternative solutions. AT&T's financial strategy must adapt to navigate the newly formed landscape of enterprise software pricing. The long-term implications for competition and innovation within the market also remain a crucial consideration. Stay updated on the Broadcom VMware acquisition, monitor cost increases, and assess your VMware spending to proactively manage potential financial strain. The future of enterprise software, particularly within the telecom sector, will be significantly shaped by how companies respond to this momentous merger.

Featured Posts

-

M M A 600

May 03, 2025

M M A 600

May 03, 2025 -

Los Angeles Wildfires A Reflection Of Our Times Through Gambling

May 03, 2025

Los Angeles Wildfires A Reflection Of Our Times Through Gambling

May 03, 2025 -

Chloe Kellys England Call Up Two Withdrawals Open The Door

May 03, 2025

Chloe Kellys England Call Up Two Withdrawals Open The Door

May 03, 2025 -

New Economic Agreement Ukraine And The U S Partner On Rare Earth Minerals

May 03, 2025

New Economic Agreement Ukraine And The U S Partner On Rare Earth Minerals

May 03, 2025 -

Blay Styshn 6 Dlyl Shaml Llmelwmat Waltfasyl Almtwfrt

May 03, 2025

Blay Styshn 6 Dlyl Shaml Llmelwmat Waltfasyl Almtwfrt

May 03, 2025

Latest Posts

-

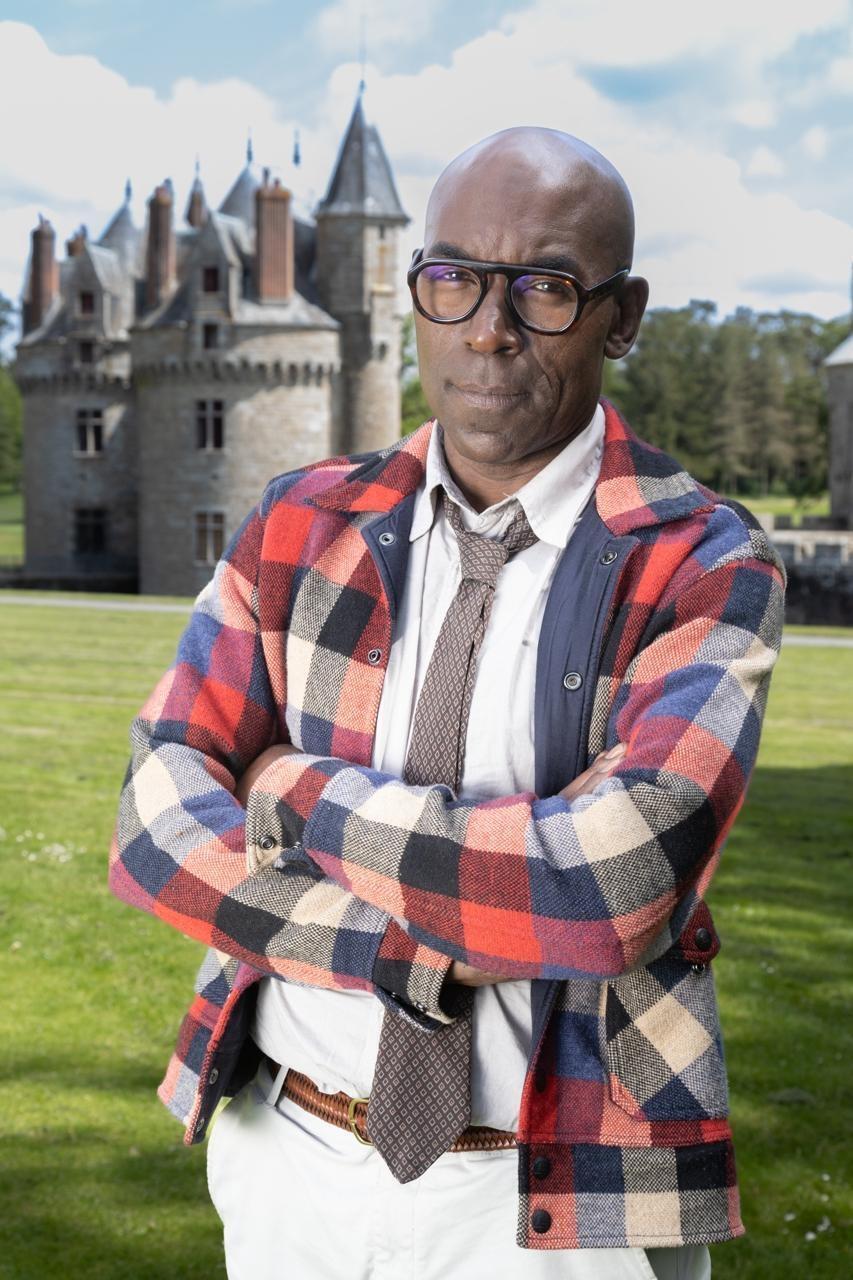

Serie Joseph Tf 1 Critique Et Analyse De La Nouvelle Serie Policiere

May 03, 2025

Serie Joseph Tf 1 Critique Et Analyse De La Nouvelle Serie Policiere

May 03, 2025 -

Grant Assistance To Mauritius Details Of The Signing And Exchange Of Notes

May 03, 2025

Grant Assistance To Mauritius Details Of The Signing And Exchange Of Notes

May 03, 2025 -

Joseph Sur Tf 1 Lucien Jean Baptiste Digne Successeur De Columbo

May 03, 2025

Joseph Sur Tf 1 Lucien Jean Baptiste Digne Successeur De Columbo

May 03, 2025 -

Un Violon A L Ecran La Matinale Musicale De Mathieu Spinosi

May 03, 2025

Un Violon A L Ecran La Matinale Musicale De Mathieu Spinosi

May 03, 2025 -

Dedicace Speciale Dans Les Tuche 5

May 03, 2025

Dedicace Speciale Dans Les Tuche 5

May 03, 2025