Broadcom's VMware Acquisition: AT&T Highlights Extreme Price Hike Concerns

Table of Contents

AT&T's Concerns and the Justification for Price Hike Fears

AT&T's anxieties regarding Broadcom's VMware acquisition center on the potential for substantial cost escalation and reduced competition. The telecom giant argues that the combined market power of Broadcom and VMware could lead to a monopoly, allowing the newly formed entity to dictate prices and limit choices for customers. This "monopoly power" is a primary driver of their worry.

The potential impact on AT&T's operations is significant. Their extensive infrastructure relies heavily on VMware's virtualization technologies, and any substantial price increase would directly impact their operational costs and bottom line. AT&T further argues that this acquisition could stifle innovation due to a lack of competitive pressure.

AT&T's arguments against the acquisition include:

- Increased licensing fees for VMware products: A significant price hike on existing VMware licenses would severely impact AT&T's IT budget.

- Limited choices and vendor lock-in: The merger could create a situation where AT&T and other businesses have fewer viable alternatives, leading to vendor lock-in and reduced bargaining power.

- Potential for reduced innovation due to lack of competition: Without competitive pressure, Broadcom may have less incentive to innovate and improve VMware's products.

- Impact on overall IT spending budgets: The increased costs could force businesses to reassess their IT spending priorities and potentially delay or cancel crucial projects.

Broadcom's Response and the Defense of the Acquisition

Broadcom has countered AT&T's concerns, asserting that the acquisition will ultimately lead to synergies and efficiencies that will benefit customers. They insist the merger will drive innovation and improve VMware's product offerings. Broadcom's official statements emphasize cost savings achieved through integration and economies of scale. They highlight planned investments in research and development to enhance VMware's technology.

Broadcom’s defense rests on the following points:

- Broadcom's promises regarding pricing and customer support: Broadcom has publicly committed to maintaining competitive pricing and providing excellent customer support.

- Planned investments in research and development for VMware products: Broadcom intends to significantly increase R&D spending on VMware products, leading to improved functionality and performance.

- Projected benefits for VMware customers: Broadcom anticipates offering a more comprehensive and integrated suite of products and services, enhancing value for customers.

- Broadcom’s strategy for integrating VMware into its existing portfolio: The integration strategy aims to leverage synergies between the two companies' technologies and operations, ultimately improving efficiency.

The Potential Impact on the Enterprise IT Landscape

The Broadcom-VMware merger has profound implications for the enterprise IT landscape. The acquisition could reshape the competitive dynamics within the enterprise software market, particularly in areas such as cloud computing, data center infrastructure, and virtualization. The potential for further consolidation within the industry is a major concern. This lack of competition could potentially stifle innovation and limit choices for businesses.

The potential impacts include:

- Impact on cloud migration strategies: Businesses may need to rethink their cloud migration strategies given the changing competitive landscape.

- Changes in enterprise software licensing models: The acquisition could lead to alterations in licensing models and pricing structures.

- Potential shifts in the competitive landscape: The merger will undoubtedly lead to a reshuffling of the competitive landscape, with significant implications for market share and dominance.

- The long-term implications for IT budgets and spending: Businesses need to prepare for potential long-term changes in their IT budgets and spending patterns.

Regulatory Scrutiny and Antitrust Concerns

Given the size and significance of the Broadcom-VMware deal, regulatory scrutiny and antitrust concerns are inevitable. Competition authorities worldwide are likely to investigate the merger to ensure it doesn't lead to monopolistic practices that harm consumers. Keywords like "antitrust," "regulatory review," and "competition concerns" are central to this discussion. The potential outcomes range from the imposition of conditions on the merger to its complete blockage.

Key considerations include:

- Ongoing investigations by relevant regulatory agencies: Several regulatory bodies are expected to launch investigations into the merger's potential anti-competitive implications.

- Potential for regulatory hurdles and delays: The regulatory review process could lead to significant delays in completing the acquisition.

- The likelihood of conditions being imposed on the merger: Regulatory bodies might impose conditions on the merger to mitigate anti-competitive concerns.

- Potential for the merger to be blocked entirely: There's a possibility that the merger could be blocked altogether if regulators deem it anti-competitive.

Conclusion: Understanding the Implications of Broadcom's VMware Acquisition

AT&T's concerns about potential price hikes following Broadcom's acquisition of VMware are a significant factor in the ongoing debate. While Broadcom insists the merger will drive innovation and efficiency, the potential for reduced competition and increased costs remains a valid concern. The impact on the enterprise IT landscape will be far-reaching, affecting cloud migration strategies, software licensing, and overall IT spending. Regulatory scrutiny will be crucial in preventing potential monopolistic practices. The long-term implications of this acquisition remain to be seen, but businesses should stay informed about its unfolding effects.

To stay updated on the ongoing developments concerning Broadcom's VMware acquisition, its potential effects on pricing and competition, and the subsequent regulatory responses, continue to monitor reputable news sources and industry publications. Understanding this dynamic situation is crucial for making informed decisions about your business's IT infrastructure and strategy.

Featured Posts

-

V Mware Costs To Skyrocket 1 050 At And Ts Concerns Over Broadcoms Price Hike

Apr 27, 2025

V Mware Costs To Skyrocket 1 050 At And Ts Concerns Over Broadcoms Price Hike

Apr 27, 2025 -

Hhss Controversial Choice Anti Vaccine Advocate To Examine Debunked Autism Vaccine Connection

Apr 27, 2025

Hhss Controversial Choice Anti Vaccine Advocate To Examine Debunked Autism Vaccine Connection

Apr 27, 2025 -

Caida De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025

Caida De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025 -

Motherhood And Victory Belinda Bencics Wta Return

Apr 27, 2025

Motherhood And Victory Belinda Bencics Wta Return

Apr 27, 2025 -

Hhss Controversial Choice Anti Vaccine Activist To Examine Debunked Autism Vaccine Claims

Apr 27, 2025

Hhss Controversial Choice Anti Vaccine Activist To Examine Debunked Autism Vaccine Claims

Apr 27, 2025

Latest Posts

-

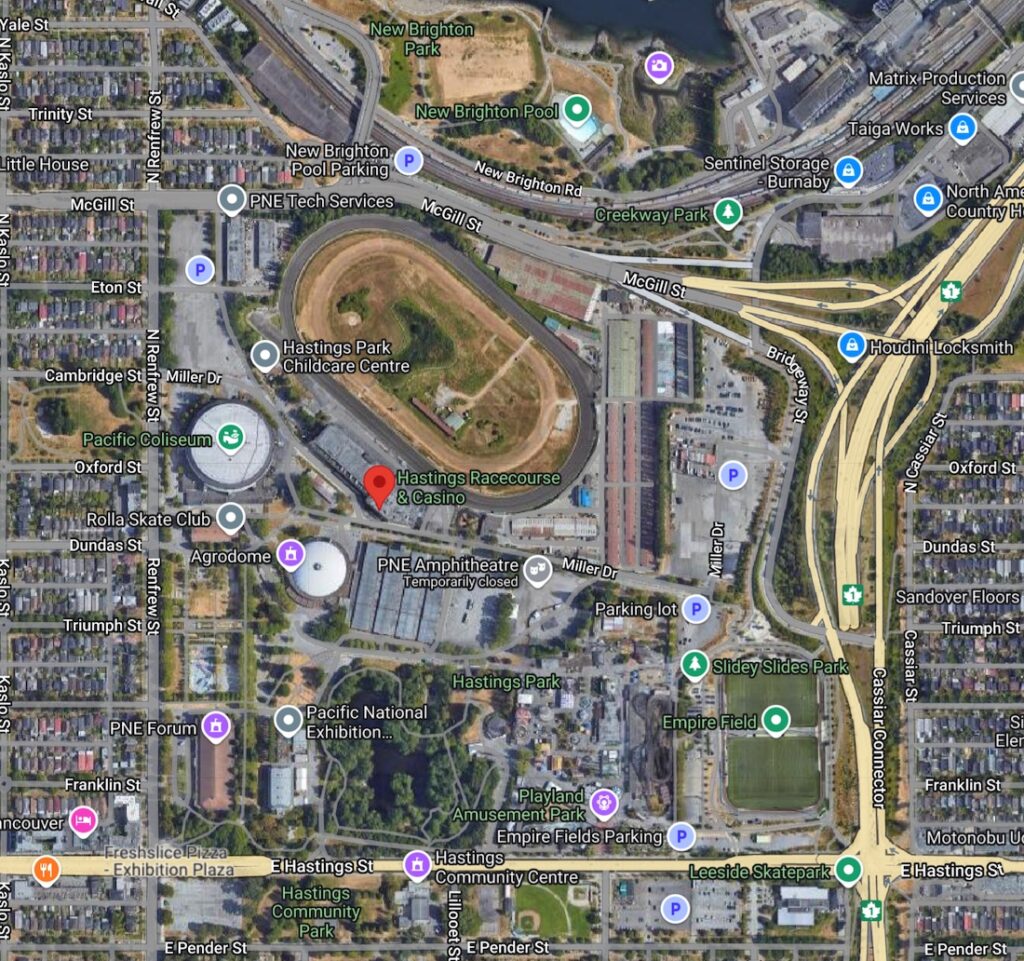

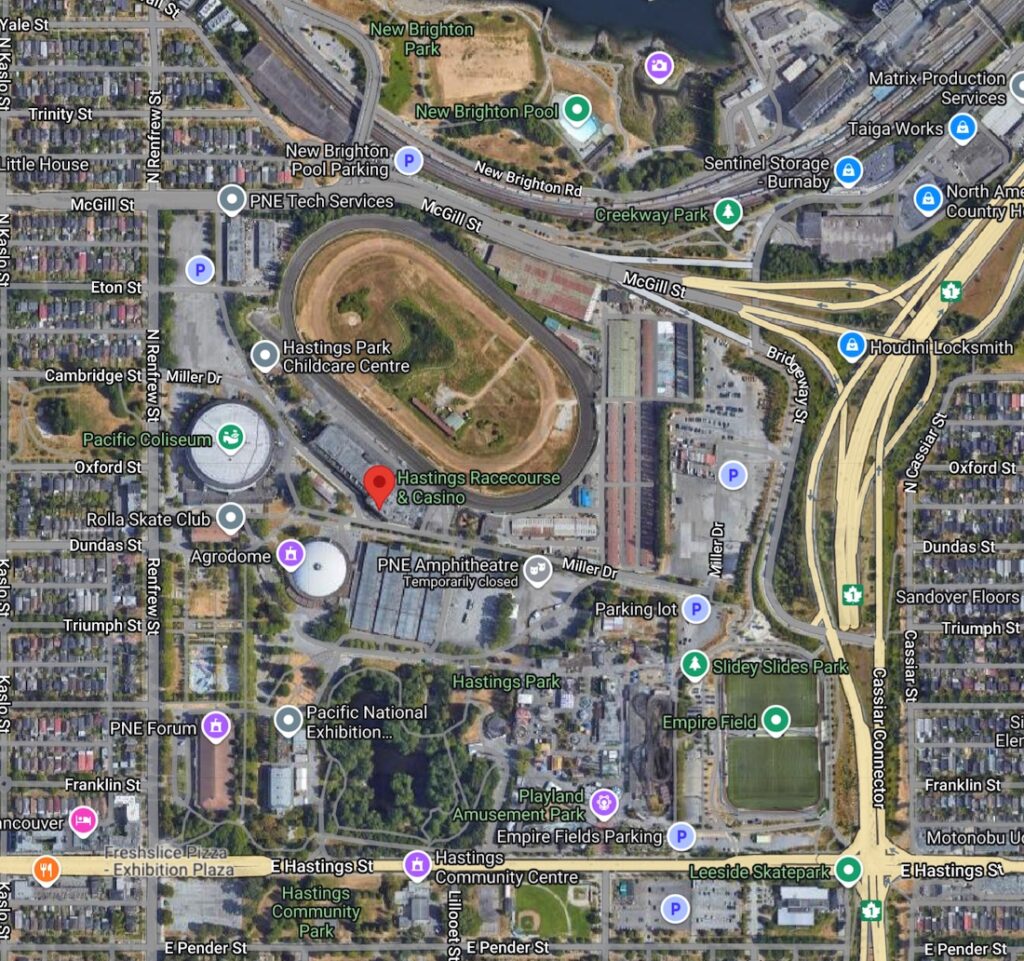

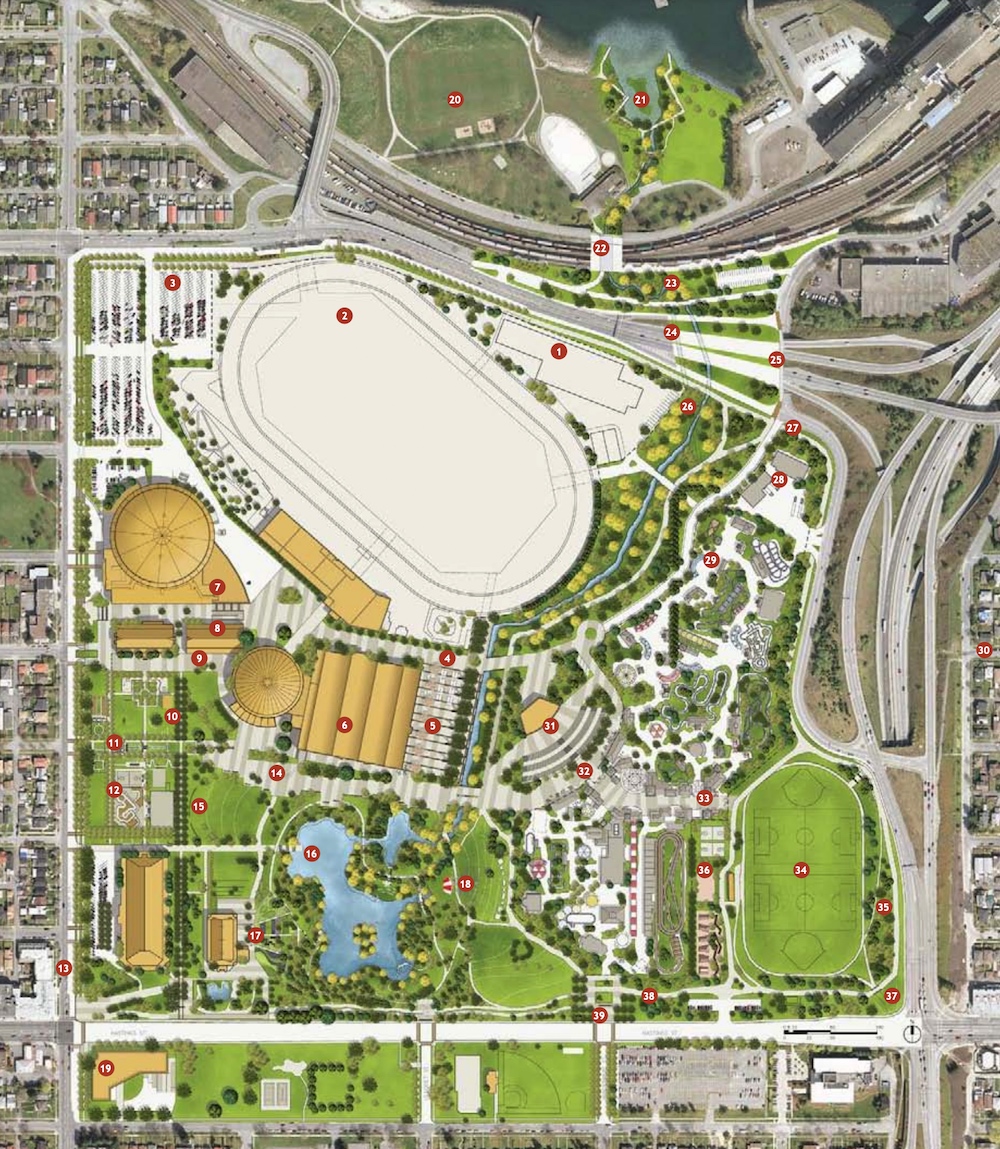

Whitecaps Pne Stadium Plan Updates On Negotiations And Timeline

Apr 27, 2025

Whitecaps Pne Stadium Plan Updates On Negotiations And Timeline

Apr 27, 2025 -

New Vancouver Whitecaps Stadium Pne Fairgrounds A Potential Site

Apr 27, 2025

New Vancouver Whitecaps Stadium Pne Fairgrounds A Potential Site

Apr 27, 2025 -

Bc Place Alternative Whitecaps Explore Pne Stadium Development

Apr 27, 2025

Bc Place Alternative Whitecaps Explore Pne Stadium Development

Apr 27, 2025 -

Whitecaps Eyeing New Stadium Pne Fairgrounds Negotiations Underway

Apr 27, 2025

Whitecaps Eyeing New Stadium Pne Fairgrounds Negotiations Underway

Apr 27, 2025 -

Whitecaps Stadium Talks New Pne Fairgrounds Venue Possible

Apr 27, 2025

Whitecaps Stadium Talks New Pne Fairgrounds Venue Possible

Apr 27, 2025