Broadcom's VMware Acquisition: AT&T Highlights Extreme Price Surge

Table of Contents

The VMware-Broadcom Deal: A Deeper Dive

Broadcom's $61 billion acquisition of VMware, finalized in late 2022, represents one of the largest tech mergers in history. This deal significantly altered the competitive landscape of enterprise software and virtualization solutions, immediately impacting companies heavily reliant on VMware's products. The acquisition gave Broadcom control over a dominant player in the virtualization market, giving them substantial market share and influence over pricing.

- Key Players: Broadcom (acquiring company), VMware (acquired company), Hock Tan (Broadcom CEO), Raghu Raghuram (former VMware CEO).

- Timeline: The acquisition was announced in May 2022 and officially closed in November 2022, following regulatory approvals.

- Regulatory Approvals: The deal faced scrutiny from various regulatory bodies globally, but ultimately received the necessary approvals to proceed. Potential antitrust concerns were raised, but were ultimately addressed.

Analyzing AT&T's Reliance on VMware Technologies

AT&T, a major player in the telecommunications industry, heavily utilizes VMware's virtualization technologies to manage its vast and complex network infrastructure. This reliance makes them particularly vulnerable to price increases following the Broadcom acquisition.

- Specific VMware Products: AT&T employs a range of VMware solutions, including vSphere for server virtualization, NSX for network virtualization, and vRealize for cloud management.

- Scale of Deployment: AT&T's VMware deployment is massive, supporting a critical portion of their network operations and services. The exact scale remains undisclosed for competitive reasons.

- Critical Role: VMware is integral to AT&T's network management, enabling efficient resource allocation, improved scalability, and enhanced security.

The Price Surge Explained: Factors Contributing to Increased Costs for AT&T

The substantial price increases experienced by AT&T post-acquisition stem from several interconnected factors:

- Increased Licensing Fees: Broadcom's acquisition has led to significant increases in VMware licensing fees for existing customers like AT&T. This is a direct consequence of market consolidation and increased pricing power.

- Changes in Support and Maintenance: Support and maintenance contracts have likely seen price adjustments, adding further financial strain on AT&T's IT budget.

- Impact of Market Consolidation: The Broadcom-VMware merger reduced competition in the virtualization market, allowing Broadcom to leverage its market dominance for higher pricing.

- Broadcom's Pricing Strategies: Broadcom's history indicates a focus on aggressive cost-cutting and potential price increases after acquisitions. This strategy directly impacts AT&T's cost structure.

Implications for AT&T and the Telecom Industry

The price surge resulting from the Broadcom VMware acquisition has profound implications for AT&T and the broader telecom industry:

- Cost-Cutting Measures: AT&T may need to implement aggressive cost-cutting measures across various departments to offset the increased expenses.

- Shifting to Alternatives: AT&T might explore alternative virtualization technologies to reduce its dependence on VMware and negotiate better pricing.

- Ripple Effect: Other telecom companies reliant on VMware are likely experiencing similar price increases, creating a ripple effect throughout the sector.

- Long-Term Implications: The acquisition's long-term effects could reshape the competitive landscape, potentially favoring companies with robust internal infrastructure or those able to adopt alternative solutions.

Conclusion: Navigating the Post-Acquisition Landscape: The Future of AT&T's VMware Costs

The drastic price surge faced by AT&T following Broadcom's acquisition of VMware is primarily due to increased licensing fees, changes in support contracts, and the impact of market consolidation. This has significant financial and strategic implications for AT&T, forcing them to re-evaluate their technology spending and potentially seek alternative virtualization solutions. Understanding the impact of the Broadcom VMware acquisition on AT&T is crucial for staying ahead of the curve in the ever-changing telecom landscape. Keep an eye on future developments related to Broadcom's pricing strategies and AT&T's response to this significant price surge. The long-term effects of this acquisition will continue to unfold, significantly impacting the future of the telecom industry's technology costs.

Featured Posts

-

Massive Office365 Data Breach Exposes Millions In Losses

May 07, 2025

Massive Office365 Data Breach Exposes Millions In Losses

May 07, 2025 -

Warriors Blowout History Putting Recent Defeat In Perspective

May 07, 2025

Warriors Blowout History Putting Recent Defeat In Perspective

May 07, 2025 -

Steph Currys All Star Weekend Victory A New Formats Debut

May 07, 2025

Steph Currys All Star Weekend Victory A New Formats Debut

May 07, 2025 -

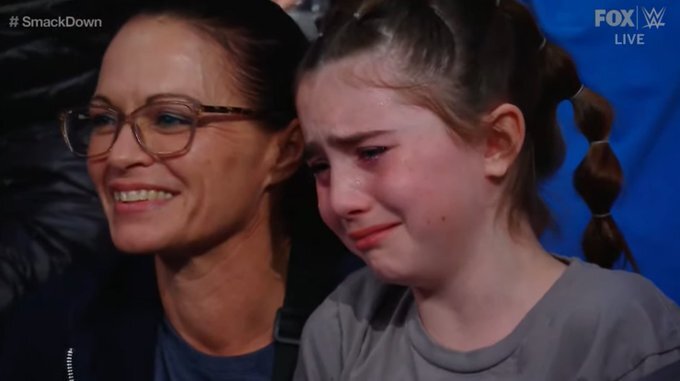

Lewis Capaldi Su Aparicion En Wwe Smack Down Tras Superar Dificultades De Salud

May 07, 2025

Lewis Capaldi Su Aparicion En Wwe Smack Down Tras Superar Dificultades De Salud

May 07, 2025 -

Opinia Nawrockiego Zrownowazony Rozwoj Poprzez Inwestycje W Drogi S8 I S16

May 07, 2025

Opinia Nawrockiego Zrownowazony Rozwoj Poprzez Inwestycje W Drogi S8 I S16

May 07, 2025

Latest Posts

-

The Hunger Games Directors New Stephen King Horror Movie 2025 Release Date

May 08, 2025

The Hunger Games Directors New Stephen King Horror Movie 2025 Release Date

May 08, 2025 -

Cinema Con 2024 Stephen Kings The Long Walk Gets A Release Date

May 08, 2025

Cinema Con 2024 Stephen Kings The Long Walk Gets A Release Date

May 08, 2025 -

Okc Thunder Vs Portland Trail Blazers How To Watch On March 7th

May 08, 2025

Okc Thunder Vs Portland Trail Blazers How To Watch On March 7th

May 08, 2025 -

March 29th Thunder Vs Pacers Latest Injury News And Analysis

May 08, 2025

March 29th Thunder Vs Pacers Latest Injury News And Analysis

May 08, 2025 -

Thunder Vs Trail Blazers Game On March 7th Time Tv Channel And Live Stream

May 08, 2025

Thunder Vs Trail Blazers Game On March 7th Time Tv Channel And Live Stream

May 08, 2025