Broadcom's VMware Deal: An Extreme Price Hike Of 1050%

Table of Contents

The Sheer Magnitude of the Broadcom VMware Deal

A 1050% Increase: Breaking Down the Numbers

The 1050% price increase figure reflects the massive jump in VMware's valuation since its IPO. To illustrate, let's consider a hypothetical scenario: If you had invested $1,000 in VMware at its IPO, that investment would be worth approximately $10,500 based on Broadcom's acquisition price. This dramatic increase is unparalleled in recent tech history and warrants a detailed examination.

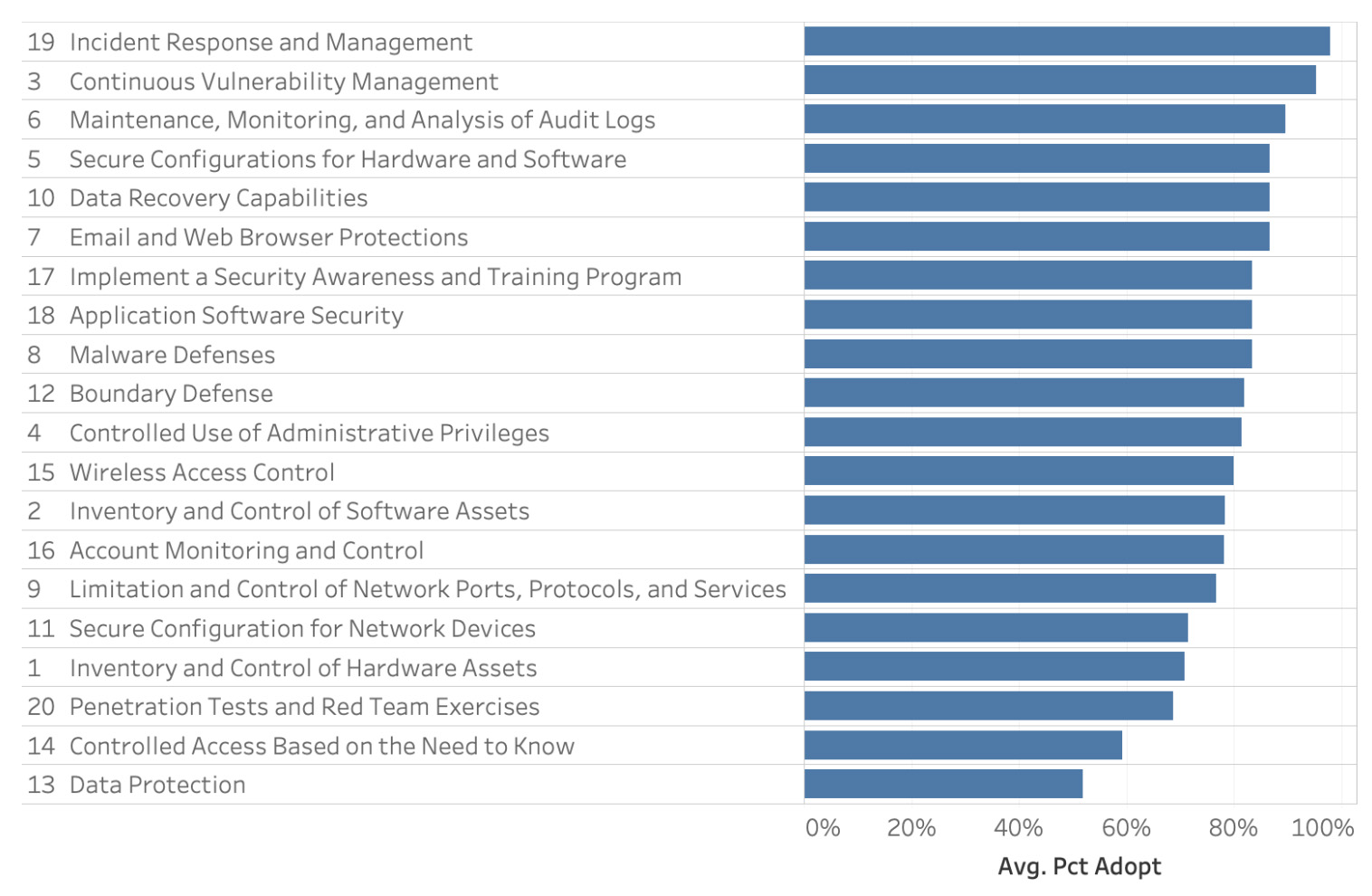

[Insert a chart or graph here visually representing VMware's stock price growth from IPO to acquisition, clearly highlighting the 1050% increase.]

- Detailed breakdown of the acquisition cost: Broadcom agreed to acquire VMware for approximately $61 billion, a staggering sum that underscores the immense value placed on VMware's enterprise software portfolio and market position.

- Comparison to other major tech acquisitions: This deal dwarfs many other recent tech acquisitions, significantly surpassing the valuations of previous mergers and acquisitions in the enterprise software space. A comparison with similar deals will provide context for this exceptional price.

- Analysis of VMware's historical stock performance: Leading up to the acquisition, VMware experienced consistent growth, reflecting its strong market position and the demand for its virtualization and cloud computing solutions. However, this doesn't fully account for the massive premium paid by Broadcom.

- Discussion of the premium Broadcom paid over VMware's market price: Broadcom's offer represented a significant premium over VMware's prevailing market price, indicating a strategic bet on future synergies and market dominance.

Antitrust Concerns and Regulatory Scrutiny

Potential Monopolies and Market Domination

The Broadcom-VMware merger raises significant antitrust concerns due to the overlap in their product portfolios. Broadcom is a major player in networking and semiconductor solutions, while VMware dominates the virtualization and cloud management market. This combination could lead to a near-monopoly in certain sectors, potentially stifling competition and innovation.

- Examination of potential antitrust lawsuits or regulatory investigations: Regulatory bodies in the US, Europe, and other jurisdictions are likely to scrutinize the deal intensely, potentially leading to lengthy investigations and legal challenges.

- Analysis of the arguments for and against the deal from a regulatory perspective: Arguments for the deal might center on increased efficiency and innovation, while counterarguments will focus on the potential for reduced competition and higher prices for customers.

- Mention of any similar past cases involving major tech acquisitions and their outcomes: Examining previous antitrust cases involving large tech mergers will provide valuable context and predict potential outcomes for this deal.

- Discussion on the impact this could have on competition within the market: The merger's impact on competition will be a crucial factor in determining its ultimate success or failure, influencing the pricing, innovation, and choices available to enterprise customers.

Implications for the Enterprise Software Market

Future of VMware's Products and Services

The acquisition's impact on VMware's product roadmap, pricing, and customer support remains uncertain. Broadcom's history with acquired companies will offer insights into potential changes.

- Analysis of Broadcom's historical track record with acquired companies: A review of Broadcom's past acquisitions will reveal whether they maintain the acquired company's independence or integrate it fully into their existing structure.

- Potential changes in VMware's pricing model: Concerns exist regarding potential price increases for VMware's products and services following the acquisition, potentially affecting enterprise budgets and competitiveness.

- Predicted effects on customer relationships and support services: Customers will be closely monitoring any changes to customer service, support levels, and the overall customer experience.

- Discussion of the future of VMware's open-source contributions and community involvement: The impact on VMware's open-source contributions and community engagement is a key consideration for developers and users who rely on its open-source initiatives.

Investor Perspectives and Market Reactions

Stock Market Performance After the Announcement

The announcement had a mixed impact on Broadcom and VMware’s stock prices. While some investors saw it as a positive sign, others expressed concerns about regulatory hurdles and potential integration challenges.

- Analysis of stock price movements following the announcement: Charting the stock price movements for both companies immediately following the announcement will show investor reaction.

- Expert opinions and analyst predictions on the long-term effects of the deal: Gathering and analyzing opinions from financial experts and analysts will provide a range of perspectives on the deal's long-term effects.

- Discussion of investor concerns and opportunities related to the acquisition: Identifying the key investor concerns and potential opportunities will provide a balanced overview of the investment landscape.

- Evaluation of the potential long-term impact on shareholder value for both companies: Ultimately, the long-term success of this merger will be measured by its impact on shareholder value for both Broadcom and VMware.

Conclusion

Broadcom's acquisition of VMware, marked by an astonishing 1050% price increase, represents a watershed moment in the tech industry. This deal raises significant questions about market dominance, regulatory oversight, and the future of enterprise software. While potentially lucrative for shareholders, the deal's long-term implications require careful consideration. The extensive regulatory scrutiny and potential for monopolistic practices highlight the need for a thorough evaluation of this massive transaction. Understanding the complexities of the Broadcom VMware acquisition is crucial for anyone invested in the tech industry or concerned about the future of competition in the enterprise software market. Stay informed on further developments regarding this monumental Broadcom VMware merger.

Featured Posts

-

Predicting The Giants Padres Game Padres Victory Or A Narrow Margin

May 16, 2025

Predicting The Giants Padres Game Padres Victory Or A Narrow Margin

May 16, 2025 -

Trump Tariffs And Californias Economy 16 Billion Revenue Loss Projected

May 16, 2025

Trump Tariffs And Californias Economy 16 Billion Revenue Loss Projected

May 16, 2025 -

Ps 1 Classics On Steam Deck A Look At Verified Games

May 16, 2025

Ps 1 Classics On Steam Deck A Look At Verified Games

May 16, 2025 -

16 Million Fine For T Mobile Details Of Three Years Of Data Security Failures

May 16, 2025

16 Million Fine For T Mobile Details Of Three Years Of Data Security Failures

May 16, 2025 -

Pembangunan Giant Sea Wall Solusi Lindungi Warga Pesisir Dari Ancaman Bencana

May 16, 2025

Pembangunan Giant Sea Wall Solusi Lindungi Warga Pesisir Dari Ancaman Bencana

May 16, 2025