Broadcom's VMware Deal: An Extreme Price Increase For AT&T?

Table of Contents

2. Analyzing the Potential Price Increases for AT&T

H2: VMware's Role in AT&T's Infrastructure:

VMware's software is deeply integrated into AT&T's infrastructure, playing a crucial role in its network virtualization and data center operations. AT&T leverages VMware's solutions for efficient management and optimization of its vast network and cloud resources. This reliance makes the company particularly vulnerable to any post-merger price increases. AT&T's dependence on VMware's robust ecosystem is undeniable, and the potential for cost escalation is a major concern.

- Network Virtualization: VMware's NSX provides AT&T with a software-defined networking (SDN) solution, crucial for agility and efficiency in managing its complex network.

- Data Center Infrastructure: vSphere, VMware's flagship virtualization platform, underpins much of AT&T's data center operations, enabling efficient resource utilization and scalability.

- Cloud Computing: VMware's cloud solutions are likely integrated into AT&T's hybrid cloud strategy, further solidifying the company's reliance on VMware's technology.

H2: Broadcom's Acquisition Strategy and Potential Price Hikes:

Broadcom has a history of acquiring companies and subsequently increasing prices for key products and services. This raises legitimate concerns about potential price hikes for AT&T post-acquisition. Broadcom’s established pattern of consolidation and subsequent price increases suggests that AT&T might face significant cost pressures across several areas. The merger's potential impact on competition is also a major factor, potentially giving Broadcom greater pricing power.

- Licensing Fees: Expect increases in licensing fees for existing VMware products used by AT&T.

- Support Contracts: Support costs for VMware products might also increase significantly.

- New Product Pricing: Newly introduced products or features after the merger could be priced aggressively to maximize profits.

- Reduced Innovation: The lack of competition could stifle innovation and lead to less attractive pricing models.

H2: Alternative Solutions and Mitigation Strategies for AT&T:

Facing potentially steep price increases, AT&T needs to explore alternative virtualization solutions and develop effective mitigation strategies. This could involve negotiating favorable contracts with Broadcom, exploring open-source alternatives, or diversifying its technology stack. Proactive planning is critical to maintaining a competitive edge.

- Alternative Vendors: Companies like Red Hat, Citrix, and Nutanix offer competing virtualization technologies that AT&T could explore.

- Open-Source Solutions: OpenStack and other open-source virtualization platforms could offer a cost-effective alternative, although they might require significant investment in migration and support.

- Contract Negotiation: AT&T's negotiating power could be leveraged to secure favorable pricing and contract terms with Broadcom.

- Phased Migration: A phased approach to migrating away from VMware products could help minimize disruption while maximizing cost savings.

3. The Broader Implications of the Broadcom-VMware Deal

H2: Impact on the Telecommunications Industry:

The Broadcom-VMware deal will undoubtedly impact other telecommunications companies relying on VMware's technology. Many firms will face similar challenges in navigating increased prices and exploring alternative solutions, potentially leading to industry-wide cost increases and a reshaping of the competitive landscape.

H2: Regulatory Scrutiny and Antitrust Concerns:

The merger is likely to face significant regulatory scrutiny and potential antitrust investigations. Concerns about reduced competition and potential monopolistic practices will be central to these reviews. The outcome of these investigations will significantly influence the future pricing strategies of Broadcom.

H2: Long-Term Effects on Innovation and Competition:

The long-term consequences of this merger remain uncertain, but it could stifle innovation and reduce competition within the virtualization and data center infrastructure markets. This reduced competition could lead to higher prices and less choice for consumers and businesses.

4. Conclusion: Navigating the Future After Broadcom's VMware Deal

Broadcom's VMware deal presents significant challenges for AT&T, potentially leading to substantial price increases across several key areas of its infrastructure. Proactive planning, strategic decision-making, and exploration of alternative solutions are critical for AT&T to navigate this complex situation successfully. The ramifications extend far beyond AT&T, impacting the entire telecommunications sector and demanding a careful analysis of the evolving market landscape. We encourage further research into the specific implications of this merger and the development of proactive strategies to mitigate the negative effects of Broadcom's VMware deal on telecommunications companies. You can find more information on the regulatory approvals and market analysis by following the links to relevant industry publications and government websites. [Insert relevant links here].

Featured Posts

-

Nonna On Netflix Review Of A Charismatic Food Film

May 14, 2025

Nonna On Netflix Review Of A Charismatic Food Film

May 14, 2025 -

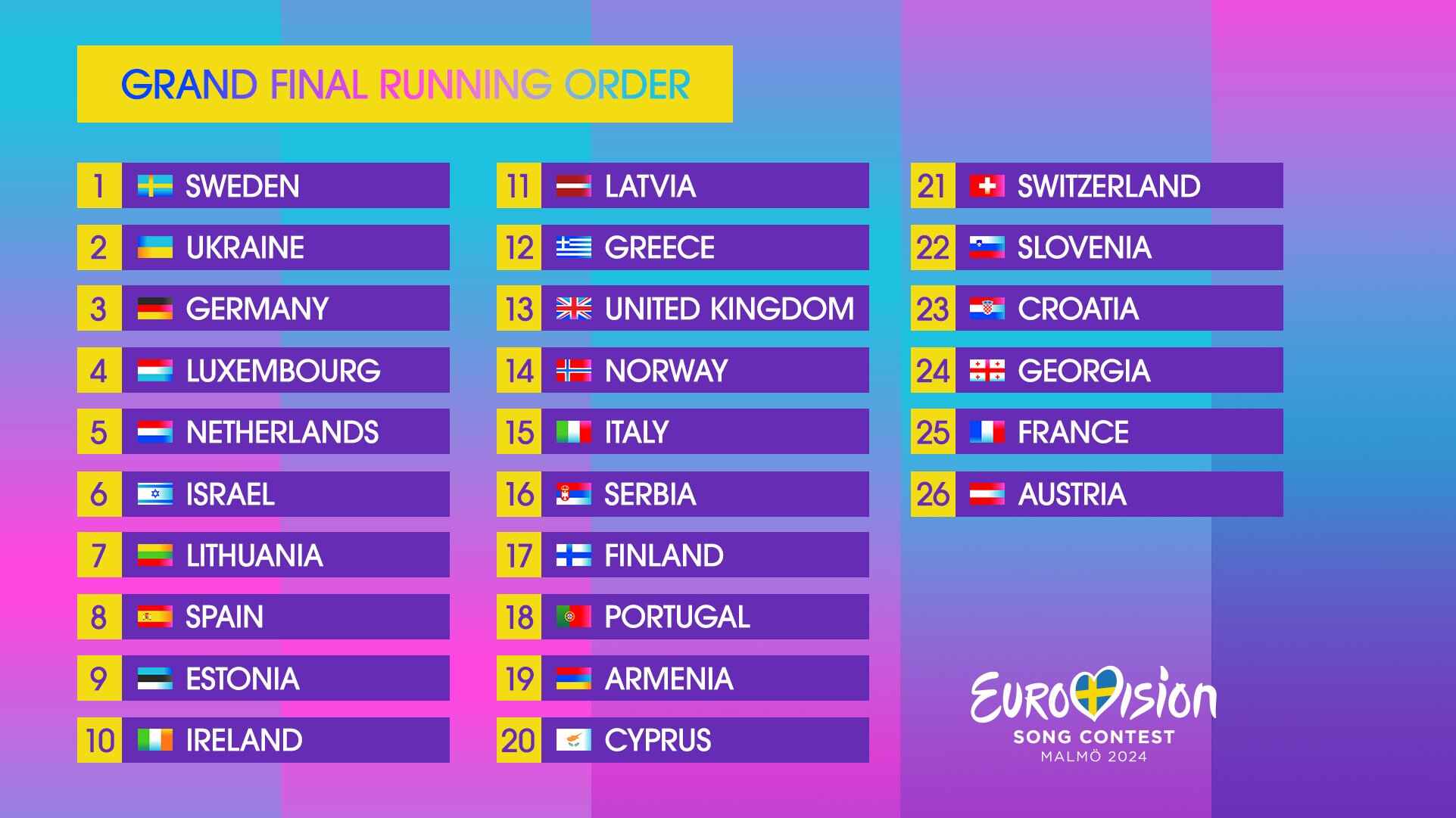

Sweden Eurovision 2024 Frontrunner

May 14, 2025

Sweden Eurovision 2024 Frontrunner

May 14, 2025 -

Federer Honorary Starter At The 24 Hours Of Le Mans

May 14, 2025

Federer Honorary Starter At The 24 Hours Of Le Mans

May 14, 2025 -

Chinas Lithium Export Restrictions A Boon For Eramet

May 14, 2025

Chinas Lithium Export Restrictions A Boon For Eramet

May 14, 2025 -

Captain America Brave New World Disney Release Date When To Stream

May 14, 2025

Captain America Brave New World Disney Release Date When To Stream

May 14, 2025