Brookfield's US Manufacturing Investment: The Tariff Conundrum

Table of Contents

Brookfield, a global leader in real estate and infrastructure investment, is making significant inroads into the US manufacturing sector. This bold strategy, however, is inextricably linked to the complex and ever-shifting landscape of tariffs and trade policies that are reshaping global supply chains. This article delves into Brookfield's US manufacturing investments, analyzing the benefits, risks, and long-term implications of this ambitious undertaking amidst the ongoing tariff conundrum. We will examine how Brookfield is navigating this challenging environment and the broader economic consequences of its decisions.

Brookfield's Manufacturing Investments in the US

Brookfield's investment portfolio in US manufacturing is expanding rapidly, encompassing diverse sectors such as logistics, food processing, and industrial manufacturing. The company's strategy is driven by a belief in the long-term growth potential of the US manufacturing sector and the increasing trend towards reshoring and nearshoring production.

- Scale and Scope: Brookfield's investments are substantial and far-reaching. Their commitment to the US manufacturing landscape is evident in several key initiatives:

- Acquisition of the leading food processing plant, Acme Foods, in Wisconsin, significantly expanding their presence in the Midwest.

- Development of a state-of-the-art logistics hub near the Port of Savannah, Georgia, streamlining supply chains for numerous manufacturing clients.

- Significant investment in sustainable manufacturing technologies within the automotive parts sector, focusing on reduced environmental impact and increased efficiency.

- Reasons for Focus: Brookfield's focus on US manufacturing stems from several factors:

- Growth Potential: The US market offers a large and robust consumer base, providing a significant opportunity for growth within the manufacturing sector.

- Reshoring Trends: Companies are increasingly bringing manufacturing operations back to the US to reduce reliance on overseas suppliers, mitigate supply chain disruptions, and enhance control over production.

- Government Incentives: Various government programs and incentives aimed at boosting domestic manufacturing are also attractive to investors like Brookfield.

The Impact of Tariffs on Brookfield's Investments

Tariffs significantly impact Brookfield's manufacturing investments, directly affecting profitability and investment decisions. The fluctuating nature of tariff policies adds a layer of complexity to long-term planning and risk assessment.

- Increased Costs: Tariffs on imported raw materials and components directly increase manufacturing costs, reducing profit margins. This is particularly challenging for businesses reliant on global supply chains.

- Regulatory Complexity: Navigating the complexities of tariff regulations and compliance requirements adds administrative burdens and potential legal risks.

- Risk Mitigation Strategies: Brookfield employs several strategies to mitigate tariff-related risks:

- Nearshoring: Shifting production to countries closer to the US, such as Mexico or Canada, reduces reliance on distant suppliers and associated tariffs.

- Supplier Diversification: Working with multiple suppliers from various countries helps to reduce vulnerability to disruptions from specific tariff changes.

- Automation: Implementing automation technologies can help offset higher labor costs associated with reshoring and improve overall efficiency.

- Sectoral Impact: Specific tariffs, such as those on steel and aluminum, have a disproportionate impact on certain sectors within Brookfield's portfolio. For example, the automotive parts sector, heavily reliant on steel, experienced increased costs due to steel tariffs.

Reshoring and Nearshoring Strategies

Brookfield's investment decisions are heavily influenced by the ongoing trend towards reshoring and nearshoring. While both offer benefits, they also present unique challenges.

- Advantages:

- Reduced Transportation Costs & Lead Times: Nearshoring significantly reduces transportation costs and lead times, improving efficiency and responsiveness to market demands.

- Enhanced Supply Chain Security: Reshoring and nearshoring reduce reliance on potentially unstable global supply chains.

- Disadvantages:

- Higher Labor Costs: Labor costs in the US can be higher than in many overseas manufacturing hubs.

- Infrastructure Challenges: The US infrastructure, in some areas, may not be as developed as in certain other countries, potentially increasing operational costs.

- Automation's Role: Automation plays a vital role in mitigating higher labor costs and enhancing productivity, making reshoring and nearshoring economically viable.

- Long-Term Implications: The long-term success of reshoring and nearshoring initiatives will contribute to a more resilient and competitive US manufacturing sector.

The Broader Economic Implications of Brookfield's Strategy

Brookfield's investment strategy in US manufacturing has substantial economic implications, impacting job creation, economic growth, and competition within the sector.

- Job Creation: Brookfield's investments are creating high-skilled manufacturing jobs across various sectors, boosting employment in both urban and rural communities.

- Economic Growth: Increased manufacturing activity stimulates economic growth, creating a ripple effect throughout the economy.

- Increased Competition & Innovation: Brookfield's investments foster competition and innovation within the US manufacturing sector, potentially leading to better products and services for consumers.

- Government Policy's Role: Supportive government policies, such as tax incentives and infrastructure investments, play a crucial role in encouraging further investment in US manufacturing.

Conclusion:

Brookfield's substantial investments in US manufacturing represent a significant bet on the future of American industry. While the tariff conundrum presents significant challenges, Brookfield's strategic use of nearshoring, supplier diversification, and automation is helping to mitigate risks and unlock the potential of the US manufacturing sector. These investments are not only creating jobs and stimulating economic growth but also strengthening the long-term competitiveness of the US economy. Stay informed about Brookfield's continued investments in US manufacturing and the evolving landscape of global trade policies and their impact on Brookfield’s US manufacturing investment strategy. Follow future updates on this crucial intersection of investment and international trade.

Featured Posts

-

Kocaeli Nde 1 Mayis Arbede Olayinin Ayrintili Analizi

May 02, 2025

Kocaeli Nde 1 Mayis Arbede Olayinin Ayrintili Analizi

May 02, 2025 -

Analysis Abu Jinapors Reaction To The Npps 2024 Election Setback

May 02, 2025

Analysis Abu Jinapors Reaction To The Npps 2024 Election Setback

May 02, 2025 -

Fortnite Item Shop Gets A Boost Helpful New Feature Detailed

May 02, 2025

Fortnite Item Shop Gets A Boost Helpful New Feature Detailed

May 02, 2025 -

Protecting Childhood Investing In Mental Wellbeing For Future Generations

May 02, 2025

Protecting Childhood Investing In Mental Wellbeing For Future Generations

May 02, 2025 -

Airbus Confirms Us Airlines To Bear Tariff Costs

May 02, 2025

Airbus Confirms Us Airlines To Bear Tariff Costs

May 02, 2025

Latest Posts

-

Reforme De La Loi Sur Les Partis Algeriens Reactions Du Pt Ffs Rcd Et Jil Jadid

May 03, 2025

Reforme De La Loi Sur Les Partis Algeriens Reactions Du Pt Ffs Rcd Et Jil Jadid

May 03, 2025 -

Khtt Aqtsadyt Jdydt Mn Amant Alastthmar Fy Aljbht Alwtnyt

May 03, 2025

Khtt Aqtsadyt Jdydt Mn Amant Alastthmar Fy Aljbht Alwtnyt

May 03, 2025 -

Alastthmar Fy Zl Aljbht Alwtnyt Wrqt Syasat Jdydt

May 03, 2025

Alastthmar Fy Zl Aljbht Alwtnyt Wrqt Syasat Jdydt

May 03, 2025 -

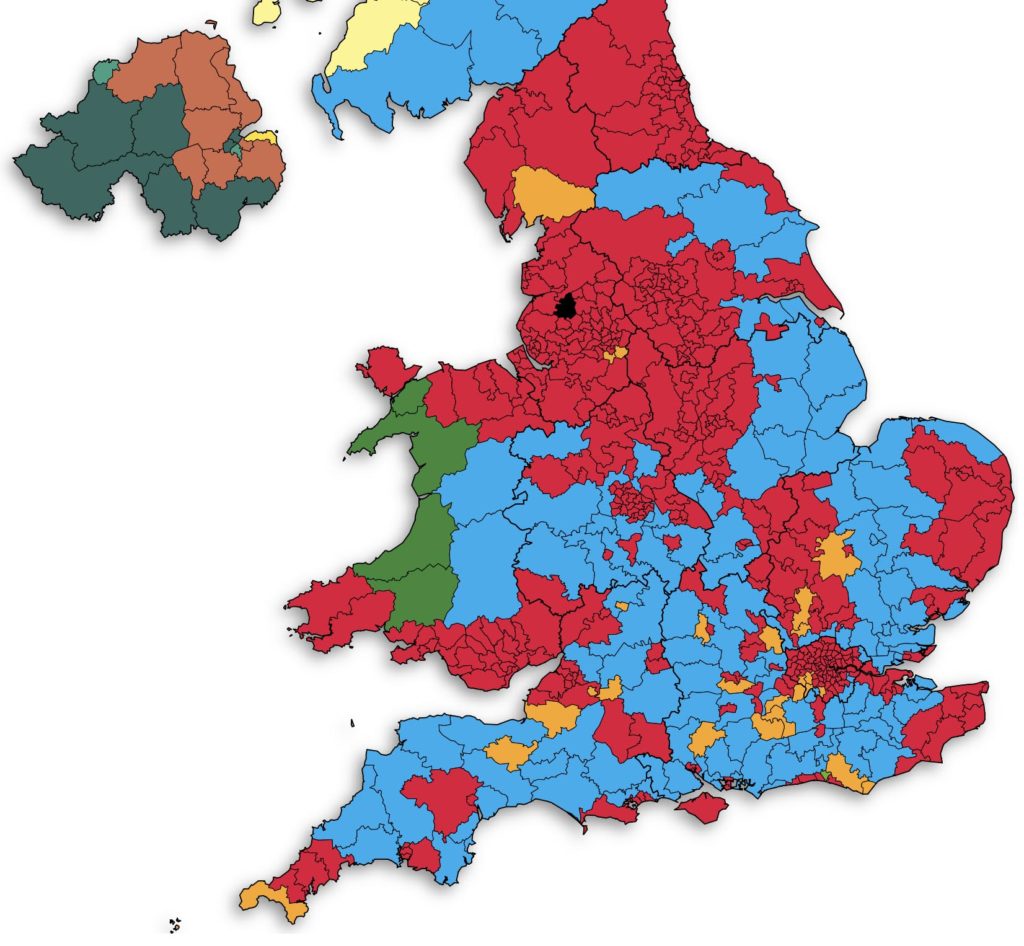

Farages Reform Party Faces The Heat Uk Local Election Results

May 03, 2025

Farages Reform Party Faces The Heat Uk Local Election Results

May 03, 2025 -

Aljbht Alwtnyt Ttlq Wrqt Syasat Aqtsadyt Jdydt

May 03, 2025

Aljbht Alwtnyt Ttlq Wrqt Syasat Aqtsadyt Jdydt

May 03, 2025