BSE Market Surge: Stocks Up Over 10% - Sensex Gains

Table of Contents

Factors Contributing to the BSE Market Surge

Several interconnected factors contributed to this extraordinary BSE market surge. Let's break down the key elements that fueled this impressive rally.

Global Economic Indicators

Positive global economic news played a significant role in boosting investor confidence. Improved US economic data, including stronger-than-expected GDP growth and positive job creation numbers, instilled optimism in global markets. Easing geopolitical tensions in certain regions also contributed to a more stable and predictable global economic landscape.

- Improved US GDP Growth: The US economy showed [Insert Percentage]% growth in [Quarter], exceeding analyst expectations and signaling continued economic strength. This positive development often has a ripple effect on global markets, including India.

- Positive Global Trade Developments: [Mention specific trade agreements or positive developments, e.g., easing trade tensions between major economies]. Reduced trade uncertainties encourage increased cross-border investments, benefiting the Indian stock market.

- Easing Geopolitical Tensions: Reduced tensions in [Mention specific region/conflict] lessened global uncertainty, leading investors to seek higher-risk, higher-reward investments, including Indian stocks.

Domestic Economic Growth

Strong domestic economic indicators further fueled the BSE market surge. Positive government policies, robust corporate earnings, and increased foreign investment all played a part.

- Strong Corporate Earnings Reports: Several major Indian companies reported exceeding expectations in their [Quarter] earnings reports, showcasing strong financial health and growth potential. [Mention examples of companies and sectors].

- Positive Government Policies: Government initiatives focused on [Mention specific policies e.g., infrastructure development, tax reforms] boosted investor confidence and created a favorable environment for business growth.

- Increase in Foreign Investment: Foreign Institutional Investors (FIIs) significantly increased their investments in the Indian stock market, injecting substantial capital and driving up stock prices. [Mention data on FII investments].

- Positive Consumer Sentiment: Increased consumer spending and confidence indicated a healthy domestic economy, further supporting market optimism.

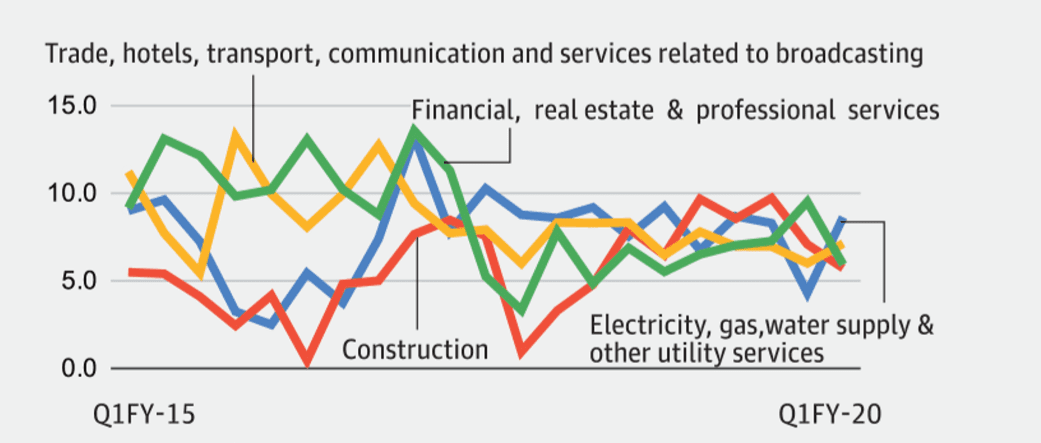

Sector-Specific Performance

The BSE market surge wasn't uniform across all sectors. Certain sectors experienced exceptional growth, outperforming others.

- IT Sector: The IT sector witnessed significant gains, driven by strong global demand for technology services and positive earnings reports from major IT companies. [Mention specific company examples and their percentage gains].

- Banking Sector: Positive economic indicators and government reforms in the banking sector contributed to its robust performance. [Mention specific company examples and their percentage gains].

- Pharmaceutical Sector: The pharmaceutical sector also showed strong growth, driven by [Mention specific factors e.g., increased demand for certain drugs, successful new product launches]. [Mention specific company examples and their percentage gains].

Investor Sentiment and Trading Activity

The BSE market surge was accompanied by a noticeable increase in trading volume and a clear shift towards bullish investor sentiment.

- Increased Trading Volume: Trading volume on the BSE significantly increased on [Date of Surge], indicating heightened investor activity and participation. [Mention specific data on trading volume].

- Participation of FIIs: FIIs played a significant role, injecting substantial capital into the market and contributing to the upward momentum.

- Retail Investor Activity: Retail investors also actively participated, driven by increased confidence in the market's future potential.

Analysis of Sensex Gains and its Implications

The Sensex's performance on [Date of Surge] was truly remarkable.

Sensex Performance Breakdown

The Sensex reached a high of [Highest Point Reached] on [Date of Surge], representing a [Percentage Gain]% increase compared to the previous day's closing value. The closing value stood at [Closing Value]. [Insert chart or graph visually representing the Sensex's performance on that day].

Impact on Investor Portfolios

The surge had a significant impact on investor portfolios. Investors who held stocks that performed well saw substantial gains. However, it's crucial to remember that market volatility can lead to both gains and losses. Investors with a diversified portfolio were likely to experience a more balanced outcome.

Future Market Outlook

While the recent surge is positive, it's crucial to maintain a balanced perspective. Market volatility is inherent, and several factors could influence future performance. While the outlook remains cautiously optimistic based on current economic trends, investors should adopt a long-term investment strategy and be prepared for potential market corrections. Factors to watch include global economic uncertainty, domestic policy changes, and the overall global geopolitical landscape. Keywords: market volatility, long-term investment strategy.

Conclusion: Navigating the BSE Market Surge – Your Next Steps

The significant BSE market surge and the impressive Sensex gains were driven by a combination of positive global and domestic economic indicators, robust corporate earnings, and strong investor sentiment. This surge presents both opportunities and risks for investors. While the potential for further growth exists, it's crucial to approach investment decisions with caution and a well-defined strategy. Consult with a financial advisor to understand how this BSE market surge impacts your portfolio and to develop a personalized investment plan. Learn more about investing in the Indian stock market and capitalize on future opportunities by exploring our resources on BSE market analysis and Sensex investment strategies.

Featured Posts

-

One Month Out Jalen Brunsons Ankle Injury And Potential Sunday Return

May 15, 2025

One Month Out Jalen Brunsons Ankle Injury And Potential Sunday Return

May 15, 2025 -

Padres Vs Yankees Prediction Will San Diego Win 7 Straight Games

May 15, 2025

Padres Vs Yankees Prediction Will San Diego Win 7 Straight Games

May 15, 2025 -

893 Goals And Counting Ovechkins Pursuit Of Gretzkys Nhl Record

May 15, 2025

893 Goals And Counting Ovechkins Pursuit Of Gretzkys Nhl Record

May 15, 2025 -

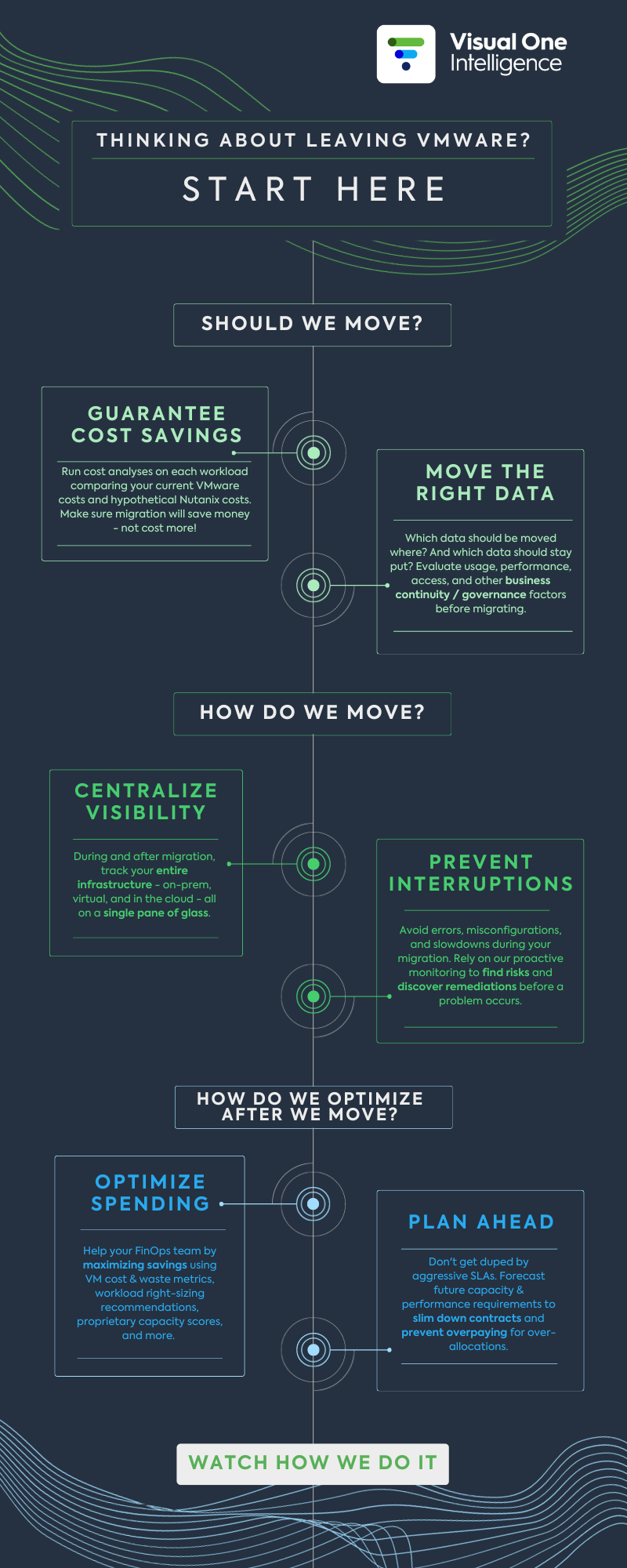

Extreme V Mware Price Increase At And T Highlights 1 050 Jump Proposed By Broadcom

May 15, 2025

Extreme V Mware Price Increase At And T Highlights 1 050 Jump Proposed By Broadcom

May 15, 2025 -

Ontarios 15 Billion Honda Ev Plant Project Slowdown Explained

May 15, 2025

Ontarios 15 Billion Honda Ev Plant Project Slowdown Explained

May 15, 2025