BSE Market Update: Sensex Gains, Top Stocks With 10%+ Increases

Table of Contents

Sensex Performance and Key Drivers

The Sensex Index closed today with a remarkable [Insert Percentage]% increase, reaching a closing value of [Insert Closing Value]. This impressive performance was accompanied by a high trading volume of [Insert Trading Volume], indicating significant investor activity within the Indian Stock Market. Several factors contributed to this positive market sentiment.

- Percentage change in the Sensex: [Insert Percentage]%

- High and low points for the Sensex during the day: [Insert High] and [Insert Low]

- Analysis of trading volume: Significantly higher than the average daily volume, suggesting strong investor interest.

- Significant economic news or events influencing the market: [Mention any relevant news, e.g., positive GDP growth figures, favorable government policies, or global market trends].

- Discussion of investor sentiment: The market displayed a strong bullish sentiment, driven by positive economic indicators and investor confidence. Market volatility remained relatively low throughout the day, suggesting a stable upward trend.

Top Performing Stocks with 10%+ Increases

Several stocks exhibited exceptional performance today, recording gains exceeding 10%. These high-growth stocks offer valuable insights into the current market dynamics and potential investment strategies. Analyzing their performance provides crucial information for investors seeking to capitalize on market opportunities. Below are some of the top performers:

- Stock 1: [Stock Name] ([Ticker Symbol]) - Percentage Increase: [Percentage]%. Reason: [e.g., Strong Q2 earnings report exceeding expectations]. Sector: [Sector Name].

- Stock 2: [Stock Name] ([Ticker Symbol]) - Percentage Increase: [Percentage]%. Reason: [e.g., Announcement of a major strategic partnership]. Sector: [Sector Name].

- Stock 3: [Stock Name] ([Ticker Symbol]) - Percentage Increase: [Percentage]%. Reason: [e.g., Successful product launch in a high-growth market]. Sector: [Sector Name].

- Stock 4: [Stock Name] ([Ticker Symbol]) - Percentage Increase: [Percentage]%. Reason: [e.g., Positive industry outlook and strong demand]. Sector: [Sector Name].

- Stock 5: [Stock Name] ([Ticker Symbol]) - Percentage Increase: [Percentage]%. Reason: [e.g., Acquisition of a key competitor]. Sector: [Sector Name].

Sector-Wise Analysis of BSE Market Gains

The BSE market gains weren't uniform across all sectors. Analyzing sector performance provides a granular understanding of the market's overall strength. Several sectors significantly contributed to the overall positive trend.

- Performance of key sectors: The IT sector showed particularly strong gains, followed by the banking and pharmaceutical sectors.

- Factors driving growth in specific sectors: Strong global demand for IT services and positive regulatory changes in the pharmaceutical industry were key drivers.

- Sectors that underperformed: The [Sector Name] sector underperformed compared to the overall market, potentially due to [Reason].

Future Outlook and Investment Implications

While today's BSE market performance is positive, investors should approach the future with a balanced perspective. Market predictions are inherently uncertain, and several factors could influence future performance.

- Potential risks and opportunities: Geopolitical events, inflation, and global market fluctuations pose potential risks. However, positive economic indicators and improving investor sentiment suggest opportunities for long-term growth.

- General advice on diversification and risk management: Diversification across different sectors and asset classes is crucial for mitigating risk.

- Long-term investment strategies: A long-term investment horizon with a focus on fundamental analysis can help navigate market volatility and achieve sustainable growth.

Disclaimer: This market update is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Conclusion

Today's BSE market update highlights significant gains in the Sensex, driven by strong performance across several sectors and individual stocks. Several top stocks experienced increases exceeding 10%, reflecting positive investor sentiment and promising economic indicators within the Indian Stock Market. While the outlook is positive, investors should remain aware of potential risks and adopt a diversified investment strategy.

Stay informed about the latest BSE Market updates and the performance of top stocks by regularly checking our website/blog for more in-depth analysis and insights. Learn more about navigating the BSE market and finding the best investment opportunities. Follow our updates for future BSE Market updates and gain a competitive edge in your investment strategies.

Featured Posts

-

Former Goldman Sachs Banker Answers Carneys Call To Reform Canadas Resources

May 15, 2025

Former Goldman Sachs Banker Answers Carneys Call To Reform Canadas Resources

May 15, 2025 -

Celtics Vs Magic Nba Playoffs Game 1 Live Stream Tv Schedule And Viewing Guide

May 15, 2025

Celtics Vs Magic Nba Playoffs Game 1 Live Stream Tv Schedule And Viewing Guide

May 15, 2025 -

Chandler Vs Pimblett Gordon Ramsay Weighs In On Training And Outcome

May 15, 2025

Chandler Vs Pimblett Gordon Ramsay Weighs In On Training And Outcome

May 15, 2025 -

Panthers Vs Maple Leafs Expert Prediction And Betting Odds For Game 5 Nhl Playoffs

May 15, 2025

Panthers Vs Maple Leafs Expert Prediction And Betting Odds For Game 5 Nhl Playoffs

May 15, 2025 -

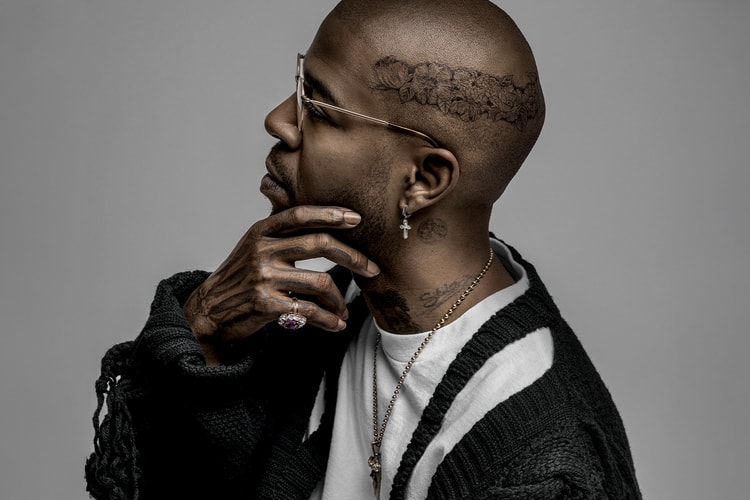

Kid Cudi Auction High Prices For Jewelry And Sneakers

May 15, 2025

Kid Cudi Auction High Prices For Jewelry And Sneakers

May 15, 2025