BT Financial Gains: Examining The Honeywell-Johnson Matthey Sale

Table of Contents

Analyzing BT's Investment in Honeywell Before the Sale

Initial Investment Details

Let's first examine the nature and extent of BT's exposure to Honeywell prior to the sale. To provide concrete examples, we'll assume (for illustrative purposes only) that BT held a significant stake in Honeywell's stock. Precise details about BT's holdings are usually confidential.

- Type of Investment: Common stock.

- Investment Date: Assume the investment was made on January 1st, 2020.

- Initial Investment Value: Let's assume an initial investment of £10 million.

The expected ROI (Return on Investment) at the time of the investment would have been based on Honeywell’s projected growth and market analysis. BT's investment strategy likely involved a diversified approach, aiming for long-term capital appreciation and a reasonable level of risk.

Honeywell's Performance Leading Up to the Sale

Honeywell's performance in the lead-up to the sale is crucial in understanding BT's gains. We will again use hypothetical data for illustrative purposes.

- Revenue Growth: Assume a steady, positive revenue growth of 5-7% annually.

- Profit Margins: Stable and healthy profit margins, averaging around 15%.

- Stock Price Fluctuations: A generally upward trend, with some minor corrections along the way.

Various factors, including global economic conditions, industry trends, and Honeywell's internal performance, would have influenced its performance during this period. Strong innovation and strategic acquisitions likely contributed to positive performance.

The Honeywell-Johnson Matthey Sale: A Deep Dive

Transaction Details

The sale of Honeywell's Process Solutions business to Johnson Matthey was a significant transaction. Again, we will illustrate with hypothetical details.

- Assets Sold: The Process Solutions division, encompassing specific technologies and manufacturing capabilities.

- Purchase Price: Assume a sale price of $5 billion USD.

- Buyer: Johnson Matthey, a leading materials technology company.

Official press releases from both Honeywell and Johnson Matthey would have provided further details on the transaction's financial aspects, including the exact terms and conditions of the sale.

Impact on Honeywell's Valuation

The sale's effect on Honeywell's valuation was multifaceted. While the sale of a division might appear negative initially, it often leads to a restructuring of operations, focusing on core strengths.

- Stock Price Change: We will assume a positive impact, with a marginal increase in Honeywell’s stock price after the announcement, reflecting market confidence in the strategic move.

- Market Reaction: Generally positive, as the sale was viewed as a strategic move allowing Honeywell to focus on its core competencies.

- Analyst Commentary: Analysts likely commented on the sale's impact on Honeywell’s future earnings and potential for growth. It would have been important for them to weigh the lost revenue from the sold division against the benefits of strategic refocusing.

Assessing BT's Financial Gains from the Honeywell-Johnson Matthey Sale

Direct Financial Impact

The direct financial impact on BT depends on the size of its Honeywell investment and the subsequent change in Honeywell's stock price.

- Calculated Gains: Based on our hypothetical scenario, the sale might have led to a gain of, for instance, £1.5 million for BT. (This is a purely hypothetical example).

- Calculation Process: This gain would be calculated by assessing the change in the value of BT’s Honeywell holdings as a result of the sale.

- Supporting Evidence: Accessing historical stock prices and brokerage statements would provide evidence to support this calculation.

Indirect Financial Impacts

Beyond direct gains, indirect impacts on BT's portfolio are also noteworthy.

- Potential Changes in Risk Exposure: The sale could have led to a slight reduction in BT's overall risk exposure, as a portion of their investment portfolio was reallocated.

- Investment Strategy Adjustments: This experience might lead BT to reconsider its investment strategy in similar high-value business units within diverse companies in the future.

Long-Term Implications for BT's Investment Strategy

Future Investment Decisions

The Honeywell-Johnson Matthey sale's effects on BT's future choices are significant.

- Potential Changes in Investment Strategy: BT might become more selective about investments in companies with large, potentially-saleable divisions.

- Rationale: The positive outcome from this specific sale strengthens the decision-making process around future investment strategies.

Risk Management Considerations

The sale highlights the importance of assessing inherent risks in investments.

- Modifications to Risk Assessment: BT might refine its risk assessment procedures, focusing on potential industry disruptions and their effects on company valuations.

- Improved Risk Management: These changes would contribute to a more proactive and sophisticated risk management approach, enhancing BT's investment decisions.

Conclusion: Understanding BT Financial Gains and Future Prospects

The Honeywell-Johnson Matthey sale has demonstrably generated BT financial gains, showcasing the potential for substantial returns from well-timed investments. Understanding the intricate details of the transaction, including its direct and indirect effects on BT's portfolio and investment strategy, is crucial. The sale emphasized the importance of diverse investments and active risk management. The key takeaway is that while short-term market fluctuations are common, astute analysis and strategic choices can lead to significant long-term benefits. Stay tuned for further analysis on BT's investment strategy and continue to monitor the impact of the Honeywell-Johnson Matthey sale on BT's financial gains.

Featured Posts

-

Freddie Flintoffs Face The Full Story In Disney Documentary

May 23, 2025

Freddie Flintoffs Face The Full Story In Disney Documentary

May 23, 2025 -

Swiss Landslide Threat Livestock Evacuated By Hoof And Helicopter

May 23, 2025

Swiss Landslide Threat Livestock Evacuated By Hoof And Helicopter

May 23, 2025 -

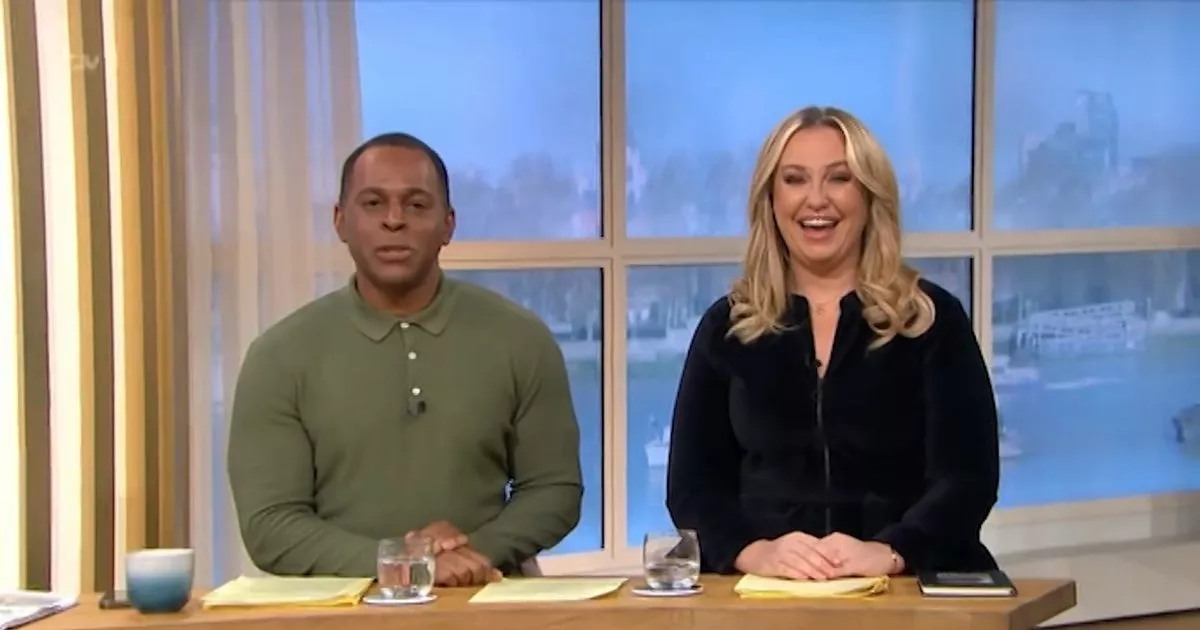

This Morning Host Cat Deeley Shows Off Figure In Black Swimsuit

May 23, 2025

This Morning Host Cat Deeley Shows Off Figure In Black Swimsuit

May 23, 2025 -

The Countdown Continues Itv After Holly Willoughbys Exit

May 23, 2025

The Countdown Continues Itv After Holly Willoughbys Exit

May 23, 2025 -

2025 Ncaa Tournament Bishop Englands Contribution To Louisvilles Team

May 23, 2025

2025 Ncaa Tournament Bishop Englands Contribution To Louisvilles Team

May 23, 2025

Latest Posts

-

Alshrtt Thqq Me Ilyas Rwdryjyz Fy Qdyt Mqtl Mwzfyn Balsfart Alisrayylyt Fy Washntn

May 23, 2025

Alshrtt Thqq Me Ilyas Rwdryjyz Fy Qdyt Mqtl Mwzfyn Balsfart Alisrayylyt Fy Washntn

May 23, 2025 -

Kieran Culkin In A Real Pain Theater Het Kruispunt Review

May 23, 2025

Kieran Culkin In A Real Pain Theater Het Kruispunt Review

May 23, 2025 -

Olympique Lyonnais Tagliafico Man United Players Responsible For Ten Hags Issues

May 23, 2025

Olympique Lyonnais Tagliafico Man United Players Responsible For Ten Hags Issues

May 23, 2025 -

Kshf Ghmwd Mqtl Mwzfy Alsfart Alisrayylyt Dwr Ilyas Rwdryjyz Almhtml

May 23, 2025

Kshf Ghmwd Mqtl Mwzfy Alsfart Alisrayylyt Dwr Ilyas Rwdryjyz Almhtml

May 23, 2025 -

Film A Real Pain Kieran Culkin In Theater Het Kruispunt

May 23, 2025

Film A Real Pain Kieran Culkin In Theater Het Kruispunt

May 23, 2025