Buffett Rejects Trump Tariff Rumors: Reports Fabricated

Table of Contents

Buffett's Public Statements on Tariffs

Direct Contradictions of the Rumors

Numerous public statements by Warren Buffett directly contradict the rumors suggesting his support for or indifference towards Trump's tariffs. A thorough examination of his speeches, interviews, and Berkshire Hathaway annual reports reveals a consistent pattern of concern and, at times, criticism regarding the economic impact of these policies.

-

Key Quotes: While pinpointing exact quotes requires extensive research across numerous sources, repeated themes emerge. Buffett has expressed concerns about the inflationary pressures caused by tariffs, the potential for retaliatory tariffs harming American businesses, and the overall uncertainty introduced into the global economic landscape. Specific examples can be found by searching reputable news archives like the Wall Street Journal, Financial Times, and Bloomberg. (Note: Hyperlinks to specific articles would be included here in a published version).

-

Contrasting Statements: The fabricated reports paint a picture of Buffett either tacitly approving of or being completely unaffected by the tariffs. This sharply contrasts with the consistently cautious and often critical tone expressed in his public statements. The divergence is significant and easily verifiable through proper fact-checking.

Analyzing Berkshire Hathaway's Investment Strategy in Light of Tariffs

Berkshire Hathaway's diverse investment portfolio is not immune to the effects of tariffs. Several sectors within its holdings are directly or indirectly vulnerable.

-

Negatively Affected Sectors: Companies involved in manufacturing, importing, and exporting goods are particularly susceptible. Tariffs increase input costs, potentially squeezing profit margins and reducing competitiveness. This includes various sectors within Berkshire's portfolio, such as manufacturing, retail and consumer goods industries.

-

Supply Chain Disruptions: The imposition of tariffs can lead to significant shifts in global supply chains. Companies might seek alternative sourcing locations, potentially impacting the long-term viability of existing investments held by Berkshire Hathaway. This adds complexity and uncertainty to their investment strategy.

The Source and Dissemination of False Reports

Identifying the Origin of the Misinformation

Pinpointing the exact origin of these false reports is crucial to understanding their spread. Often, these types of rumors originate from unreliable sources, possibly via partisan websites or social media accounts with a clear agenda.

-

Unreliable Sources: Analysis of the initial spread might reveal the involvement of questionable news sources, blogs, or social media posts lacking journalistic integrity or fact-checking.

-

Intentional Disinformation: The possibility of deliberate misinformation campaigns cannot be discounted. Such campaigns could be motivated by political agendas, attempts to manipulate market sentiment, or even malicious actors aiming to cause economic disruption.

The Spread of False News and its Impact

The rapid spread of misinformation, particularly via social media, can have a substantial impact on market sentiment and investor confidence. False reports concerning Buffett's alleged stance on tariffs are a prime example.

-

Market Impact: The fabricated reports could have led to short-term fluctuations in Berkshire Hathaway's stock price and the prices of related companies. Such fluctuations can create instability and uncertainty in the market.

-

Dangers of Misinformation: Believing and spreading unsubstantiated information undermines informed decision-making. It is crucial to critically evaluate all information before accepting it as fact.

The Economic Implications of Tariff Policies

The Potential Impact on the US Economy

Tariffs have significant potential ramifications for the entire US economy. Economic experts have raised concerns about the long-term consequences.

-

Higher Consumer Prices: Tariffs increase the cost of imported goods, leading to higher prices for consumers. This reduces purchasing power and can contribute to inflation.

-

Decreased Trade and Growth: Retaliatory tariffs from other countries can significantly decrease international trade, impacting economic growth and the competitiveness of American businesses.

The Impact on Global Markets

Trade wars and tariff disputes extend far beyond national borders, creating a ripple effect across the globe.

-

Global Supply Chain Disruptions: Tariffs disrupt global supply chains, forcing companies to adjust their sourcing strategies, leading to delays and increased costs.

-

Retaliatory Tariffs: One country imposing tariffs frequently results in retaliatory tariffs from other nations, escalating the conflict and creating a negative feedback loop.

Conclusion

The reports claiming Warren Buffett supports or is unaffected by Trump's tariffs are demonstrably fabricated. A review of his public statements, Berkshire Hathaway's investment strategy, and the broader economic impact of tariffs reveals a clear picture: these rumors are false. It's crucial to rely on verified information from credible sources when assessing news impacting significant economic figures and events.

To prevent the spread of misinformation, we encourage readers to be critical consumers of news. Verify information from reliable sources before accepting it as truth. Further research into Buffett's stance on tariffs, verifying tariff rumors, and debunking Buffett tariff claims will help ensure better-informed decisions.

Featured Posts

-

Lizzos Britney Spears Janet Jackson Comparison Ignites Fan Debate

May 04, 2025

Lizzos Britney Spears Janet Jackson Comparison Ignites Fan Debate

May 04, 2025 -

Dutch Energy Providers Explore Dynamic Tariff System Based On Solar Production

May 04, 2025

Dutch Energy Providers Explore Dynamic Tariff System Based On Solar Production

May 04, 2025 -

Emma Stone And Emma Thompson Face Off In New Cruella Trailer

May 04, 2025

Emma Stone And Emma Thompson Face Off In New Cruella Trailer

May 04, 2025 -

Upcoming Snowstorms Forecast And Timeline For Ny Nj And Ct

May 04, 2025

Upcoming Snowstorms Forecast And Timeline For Ny Nj And Ct

May 04, 2025 -

The Great Leslie Progressing In The Eurovision Competition

May 04, 2025

The Great Leslie Progressing In The Eurovision Competition

May 04, 2025

Latest Posts

-

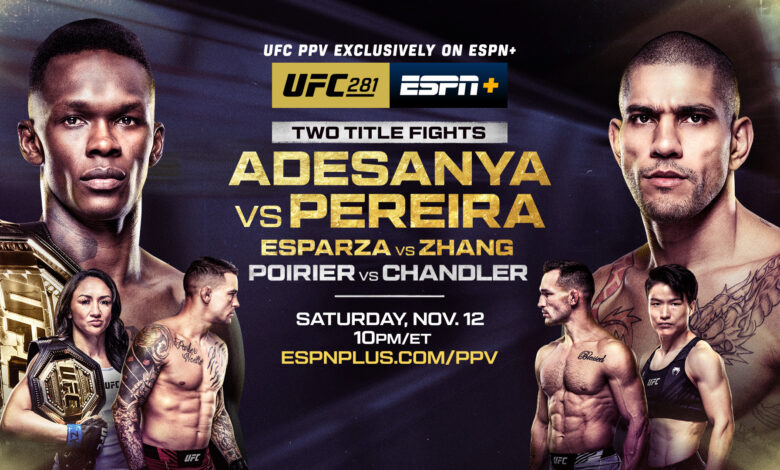

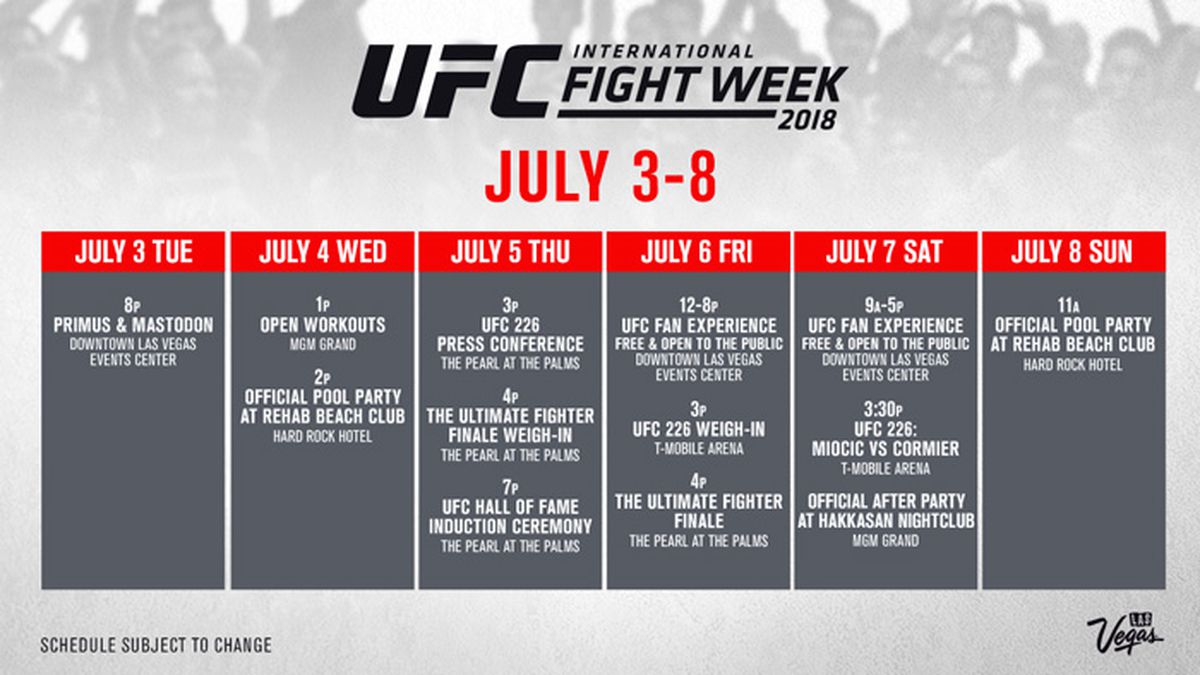

Ufc Fight Nights And Ppv Schedule May 2025 Featuring Ufc 315

May 04, 2025

Ufc Fight Nights And Ppv Schedule May 2025 Featuring Ufc 315

May 04, 2025 -

Sydney Sweeney And Jonathan Davino Wedding Off Amidst Reported Issues

May 04, 2025

Sydney Sweeney And Jonathan Davino Wedding Off Amidst Reported Issues

May 04, 2025 -

May 2025 Ufc Events Complete Fight Card Schedule Including Ufc 315

May 04, 2025

May 2025 Ufc Events Complete Fight Card Schedule Including Ufc 315

May 04, 2025 -

Sydney Sweeney And Jonathan Davinos Wedding A Postponement

May 04, 2025

Sydney Sweeney And Jonathan Davinos Wedding A Postponement

May 04, 2025 -

Ufc 315 And May 2025 Fight Card Complete Schedule And Event Details

May 04, 2025

Ufc 315 And May 2025 Fight Card Complete Schedule And Event Details

May 04, 2025