Buffett's Apple Bet: A Deep Dive Into Tariff-Related Risks And Rewards

Table of Contents

Understanding Buffett's Apple Investment

H3: The Scale of the Investment: Berkshire Hathaway's Apple holdings represent a substantial portion of its overall portfolio, solidifying Apple as a cornerstone investment. This isn't a fleeting speculation; it's a long-term strategic bet reflecting Buffett's enduring faith in the company. The sheer size of this investment underscores its importance within Berkshire Hathaway's diversified strategy.

H3: Buffett's Investment Philosophy: Buffett's investment philosophy centers on identifying companies with strong brands, enduring competitive advantages, and exceptional management. Apple neatly aligns with these criteria. Its powerful brand recognition, loyal customer base, and innovative product development consistently deliver strong returns. This aligns perfectly with Buffett's preference for established companies with demonstrably strong long-term growth potential.

- Percentage of Berkshire Hathaway's portfolio held in Apple stock: Currently, Apple represents a significant percentage of Berkshire Hathaway's holdings, making it a pivotal component of their investment strategy. (Note: The exact percentage fluctuates; refer to current financial reports for up-to-date information.)

- Timeline of the investment – when did it begin and how has it grown? Berkshire Hathaway's investment in Apple began gradually, increasing significantly over several years, demonstrating a phased approach to building a substantial position.

- Key factors that attracted Buffett to Apple: The factors that drew Buffett to Apple include its strong brand, loyal customer base, consistent profitability, and innovative product pipeline, demonstrating a company that fits his criteria for long-term value creation.

Tariff-Related Risks to Apple and Buffett's Investment

H3: Impact of Tariffs on Apple's Supply Chain: Apple's extensive supply chain, heavily reliant on manufacturing in China and other countries, makes it vulnerable to tariffs on imported components and finished goods. Tariffs increase production costs, directly impacting Apple's profitability. The geographic distribution of Apple's manufacturing is a key factor to consider when assessing the impact of trade policies.

H3: Consumer Demand and Pricing Strategies: Increased production costs resulting from tariffs could force Apple to raise prices, potentially impacting consumer demand. This necessitates careful consideration of pricing strategies to balance profitability with maintaining market share. The elasticity of demand for Apple products will play a crucial role in determining the ultimate impact of tariff-related price increases.

- Specific examples of tariffs impacting Apple products: Specific examples of tariffs impacting Apple products include tariffs on various components sourced from China and other countries impacting the cost of production for iPhones, iPads, and Mac computers.

- Analysis of Apple's cost structure and its vulnerability to tariffs: Apple's cost structure, with a significant portion tied to manufacturing and components, makes it particularly sensitive to fluctuations in tariff rates.

- Potential impact on Apple’s market share due to price increases: Price increases stemming from tariffs could impact Apple's competitive position and potentially reduce its market share.

Potential Rewards Despite Tariff Challenges

H3: Apple's Resilience and Brand Loyalty: Despite tariff-related headwinds, Apple's strong brand loyalty and robust ecosystem create significant resilience. The company's ability to absorb some cost increases while maintaining market share highlights its pricing power and customer commitment.

H3: Long-Term Growth Potential: Apple’s long-term growth prospects remain promising, particularly in emerging markets and through innovation in areas like services and wearables. This diversification strategy, combined with ongoing product innovation, can mitigate tariff risks.

- Examples of Apple's successful navigation of previous economic downturns: Apple has demonstrated its ability to navigate past economic downturns, further illustrating its resilience and adaptability in challenging markets.

- Projected growth in key markets: Apple continues to exhibit strong growth potential in various emerging markets, further offsetting tariff-related concerns.

- Innovation initiatives that could mitigate tariff risks: Apple's continuous innovation efforts, such as the expansion of its services business, represent strategic moves to diversify revenue streams and potentially mitigate tariff-related vulnerabilities.

Analyzing the Risk/Reward Ratio of Buffett's Apple Bet

H3: Diversification and Portfolio Management: The Apple investment, while significant, represents only a portion of Berkshire Hathaway's highly diversified portfolio. This diversification significantly mitigates the risk associated with any single investment, including Apple.

H3: Long-Term Perspective vs. Short-Term Volatility: Buffett’s famed long-term investment approach minimizes the impact of short-term market fluctuations and tariff-related uncertainties. This strategy emphasizes the importance of focusing on the long-term growth potential rather than being swayed by short-term volatility.

- A comparison of Apple's performance with other investments in Berkshire Hathaway's portfolio: A comparison of Apple's performance against other investments within the Berkshire Hathaway portfolio illustrates its role within the context of a broader diversified strategy.

- An assessment of the overall risk tolerance of Berkshire Hathaway: Berkshire Hathaway's established risk tolerance profile demonstrates a capacity for significant long-term investments, allowing them to weather short-term market fluctuations.

Conclusion

Buffett's Apple bet presents a compelling case study in navigating the complex interplay of investment opportunities and global trade dynamics. While tariffs pose considerable risks to Apple's supply chain and profitability, the company's strong brand, loyal customer base, and diversification strategies offer significant resilience and long-term growth potential. The diversification within Berkshire Hathaway's portfolio further mitigates the risk associated with this substantial investment. Ultimately, the long-term perspective adopted by Buffett and his team suggests a calculated risk with potentially significant rewards.

Understand the implications of Buffett's Apple bet, and learn more about tariff risks and rewards in your own investment portfolio. Analyze your own investment portfolio in light of global trade dynamics and consider the long-term implications of investing in companies exposed to tariff fluctuations.

Featured Posts

-

Pobediteli Evrovideniya Poslednie 10 Let Ikh Sudba I Nyneshnyaya Zhizn

May 24, 2025

Pobediteli Evrovideniya Poslednie 10 Let Ikh Sudba I Nyneshnyaya Zhizn

May 24, 2025 -

Jordan Bardella A Profile Of The National Rallys Presidential Hopeful

May 24, 2025

Jordan Bardella A Profile Of The National Rallys Presidential Hopeful

May 24, 2025 -

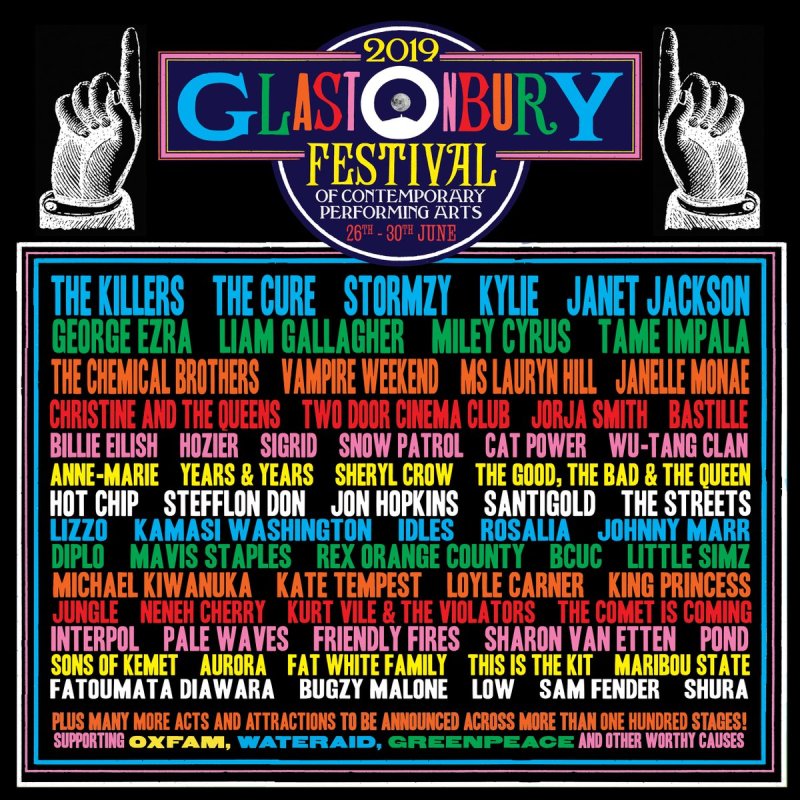

Leak Reveals Glastonbury 2025 Lineup Confirmed Acts And Ticket Details

May 24, 2025

Leak Reveals Glastonbury 2025 Lineup Confirmed Acts And Ticket Details

May 24, 2025 -

Bbc Radio 1 Big Weekend 2025 Sefton Park Ticket Information And Application

May 24, 2025

Bbc Radio 1 Big Weekend 2025 Sefton Park Ticket Information And Application

May 24, 2025 -

Nightcliff Robbery Leads To Teens Arrest In Darwin Murder Case

May 24, 2025

Nightcliff Robbery Leads To Teens Arrest In Darwin Murder Case

May 24, 2025

Latest Posts

-

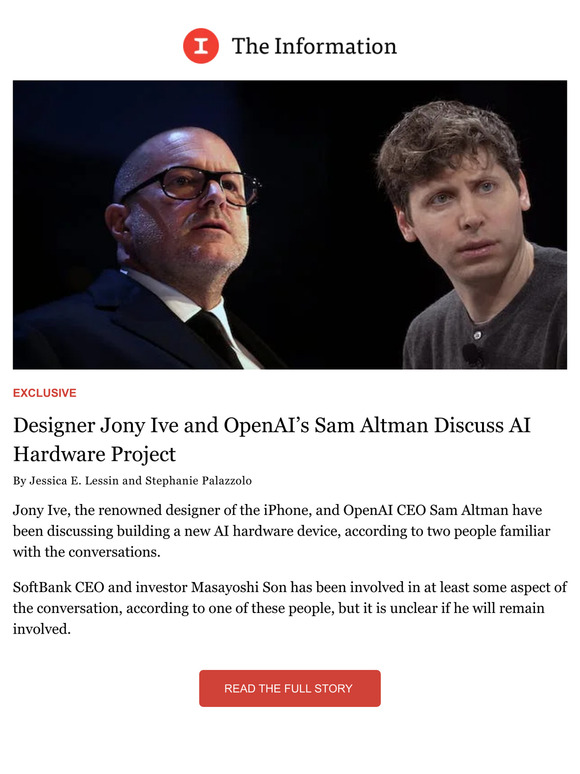

The Exclusive Collaboration Between Sam Altman And Jony Ive A New Device

May 24, 2025

The Exclusive Collaboration Between Sam Altman And Jony Ive A New Device

May 24, 2025 -

Universals Epic 7 Billion Investment Escalating The Theme Park Arms Race Against Disney

May 24, 2025

Universals Epic 7 Billion Investment Escalating The Theme Park Arms Race Against Disney

May 24, 2025 -

Exclusive Sam Altman And Jony Ives Undisclosed Project Details Revealed

May 24, 2025

Exclusive Sam Altman And Jony Ives Undisclosed Project Details Revealed

May 24, 2025 -

Universals 7 Billion Theme Park A New Era In The Disney Universal Rivalry

May 24, 2025

Universals 7 Billion Theme Park A New Era In The Disney Universal Rivalry

May 24, 2025 -

From Tik Tok To Dancing With The Stars Alix Earles Influencer Marketing Strategy

May 24, 2025

From Tik Tok To Dancing With The Stars Alix Earles Influencer Marketing Strategy

May 24, 2025