Buy-and-Hold: Facing The Challenges Of Long-Term Investing

Table of Contents

Market Volatility and its Impact on Buy-and-Hold Strategies

Market volatility is an inherent characteristic of any investment market. For long-term investors employing a buy-and-hold strategy, this means experiencing periods of significant price swings, both upward and downward. These fluctuations can be unsettling, even for seasoned investors. Understanding how to manage these ups and downs is crucial for success.

- Short-term market fluctuations are normal and shouldn't trigger panic selling. Remember that market corrections and bear markets are a natural part of the economic cycle. Panicked selling during these periods often leads to realizing losses that could have been avoided with a longer-term perspective.

- The importance of a diversified portfolio to mitigate risk. Diversification across different asset classes (stocks, bonds, real estate, etc.) helps to reduce the overall volatility of your portfolio. If one asset class underperforms, others may offset those losses.

- Historical data showing long-term market growth despite short-term downturns. Looking at historical market data reveals a consistent upward trend over the long term, despite numerous short-term corrections. This underscores the power of patience and persistence in long-term investing.

- Strategies for managing emotional responses to market volatility (e.g., dollar-cost averaging). Dollar-cost averaging, a strategy where you invest a fixed amount of money at regular intervals regardless of market price, can help mitigate the impact of volatility. This reduces the risk of investing a large sum at a market peak.

The Temptation to Time the Market and its Pitfalls

Many investors fall prey to the temptation to time the market – trying to buy low and sell high. However, consistently predicting market peaks and troughs is incredibly difficult, if not impossible. Attempting to time the market often leads to missed opportunities and lower overall returns.

- The difficulty in predicting market peaks and troughs. Even expert market analysts struggle to accurately predict market movements. Trying to outsmart the market often results in being out of the market during periods of significant growth.

- The missed opportunities of staying out of the market during periods of growth. While waiting for the "perfect" entry point, investors can miss out on substantial gains. The market's long-term upward trajectory means that missing even a few strong growth periods can significantly impact your overall returns.

- The importance of sticking to a disciplined investment plan. A well-defined buy-and-hold strategy, based on your risk tolerance and financial goals, should be adhered to regardless of short-term market fluctuations.

- Focus on long-term growth rather than short-term gains. Buy-and-hold investing is a long-term game. Focusing on long-term growth, rather than chasing short-term gains, is essential for success.

Unexpected Life Events and Their Influence on Long-Term Investments

Unexpected life events, such as job loss, medical emergencies, or family issues, can significantly impact your long-term investment strategy. These unforeseen circumstances might force you to liquidate assets prematurely, potentially at a loss.

- The importance of having an emergency fund to avoid selling investments at a loss. An emergency fund, typically covering 3-6 months of living expenses, can provide a buffer against unexpected financial shocks, preventing you from needing to sell investments during a market downturn.

- Strategies for protecting your investments during unexpected life events (e.g., insurance, flexible investment options). Adequate insurance coverage (health, life, disability) can help mitigate financial risks. Consider flexible investment options that allow for withdrawals without significant penalties if necessary.

- The role of financial planning in mitigating risk. A comprehensive financial plan, developed with the help of a financial advisor, can help you prepare for and manage unexpected life events, protecting your long-term investments.

Inflation and its Erosion of Investment Returns

Inflation, the rate at which the general level of prices for goods and services is rising, can significantly erode the purchasing power of your investment returns over the long term. Failing to account for inflation can lead to a disappointing outcome, even with positive investment growth.

- How inflation erodes purchasing power over time. If your investment returns don't outpace inflation, your actual purchasing power may decrease over time. What your investments can buy today might be significantly less in the future due to inflation.

- Strategies for mitigating the effects of inflation (e.g., investing in inflation-protected securities). Inflation-protected securities (TIPS) are designed to adjust their value based on inflation, helping to protect your investment's purchasing power. Other strategies include investing in real estate or commodities.

- The importance of considering inflation when setting investment goals. Your investment goals should account for the expected rate of inflation to ensure your investments will provide the desired purchasing power in the future.

Conclusion

Buy-and-hold investing, while offering significant long-term benefits, presents several challenges. Understanding market volatility, resisting the urge to time the market, planning for life's uncertainties, and accounting for inflation are crucial for successful long-term investing. By implementing the strategies discussed, you can increase your chances of achieving your financial goals with a buy-and-hold approach. Remember, careful planning and a disciplined approach are key to navigating the complexities of long-term investing. Don’t hesitate to consult a financial advisor to tailor a buy-and-hold strategy that aligns with your specific needs and risk tolerance. Start your journey toward successful long-term investing with a well-defined buy-and-hold plan today.

Featured Posts

-

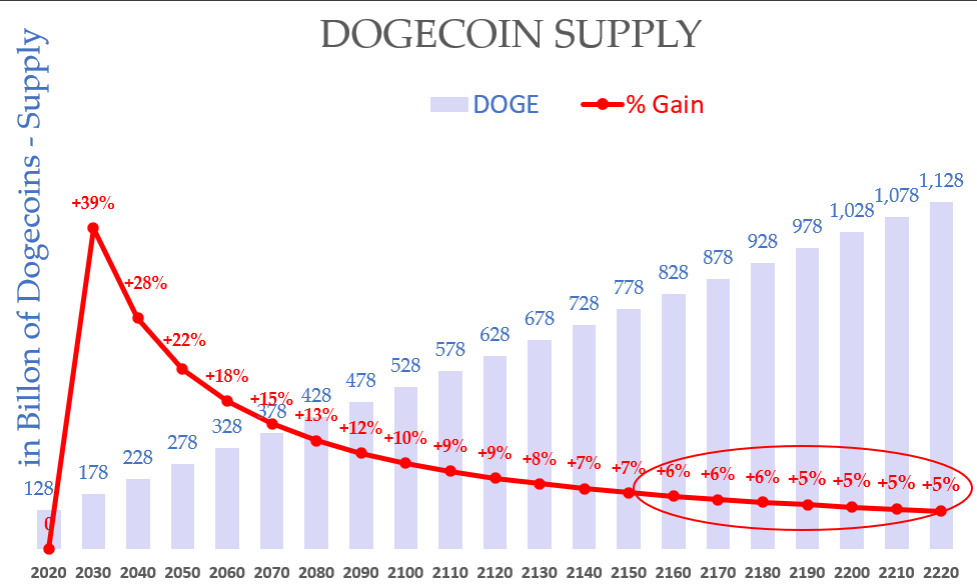

Dogecoin Price Prediction Considering Elon Musks Influence

May 26, 2025

Dogecoin Price Prediction Considering Elon Musks Influence

May 26, 2025 -

Link Live Streaming And Hasil Fp 1 Moto Gp Inggris 2025 Jam Tayang Di Trans7

May 26, 2025

Link Live Streaming And Hasil Fp 1 Moto Gp Inggris 2025 Jam Tayang Di Trans7

May 26, 2025 -

Israeli Premier League Maccabi Tel Avivs Path To Victory

May 26, 2025

Israeli Premier League Maccabi Tel Avivs Path To Victory

May 26, 2025 -

Kapan Sprint Race Moto Gp Argentina 2025 Jadwal Lengkap Di Sini

May 26, 2025

Kapan Sprint Race Moto Gp Argentina 2025 Jadwal Lengkap Di Sini

May 26, 2025 -

2025s Best Nike Running Shoes Reviews And Comparisons

May 26, 2025

2025s Best Nike Running Shoes Reviews And Comparisons

May 26, 2025

Latest Posts

-

Ou Acheter Le Samsung Galaxy S25 256 Go Au Meilleur Prix

May 28, 2025

Ou Acheter Le Samsung Galaxy S25 256 Go Au Meilleur Prix

May 28, 2025 -

Top 5 Des Smartphones Longue Duree De Batterie Avis Et Comparatif

May 28, 2025

Top 5 Des Smartphones Longue Duree De Batterie Avis Et Comparatif

May 28, 2025 -

Meilleur Prix Samsung Galaxy S25 256 Go 5 Etoiles 862 42 E

May 28, 2025

Meilleur Prix Samsung Galaxy S25 256 Go 5 Etoiles 862 42 E

May 28, 2025 -

Voici Les 5 Smartphones Avec La Meilleure Autonomie En 2024

May 28, 2025

Voici Les 5 Smartphones Avec La Meilleure Autonomie En 2024

May 28, 2025 -

15

May 28, 2025

15

May 28, 2025