Buy And Hold: Understanding The Gut-Wrenching Challenges Of The Long Game

Table of Contents

The Emotional Toll of Buy and Hold: Managing Fear and Greed

Long-term investing, particularly using a buy and hold strategy, requires a significant level of emotional resilience. Market fluctuations are inevitable, and managing the resulting fear and greed is crucial for success.

Fear of Market Corrections and Crashes

Market volatility can trigger intense fear in even the most seasoned investors. The sudden drop in portfolio value during a correction or crash can be emotionally devastating. Remember the tech bubble burst in 2000 or the Great Recession of 2008? These events serve as stark reminders of the potential for significant, short-term losses. However, history shows that markets generally recover and even surpass previous highs.

- Strategies for Managing Fear:

- Diversification: Spreading investments across different asset classes (stocks, bonds, real estate) reduces the impact of any single market downturn.

- Dollar-Cost Averaging: Investing a fixed amount at regular intervals, regardless of market fluctuations, mitigates the risk of investing a lump sum at a market peak.

- Long-Term Perspective: Focusing on your long-term financial goals rather than short-term market noise.

The Temptation to Time the Market

Many investors fall prey to the allure of market timing – trying to buy low and sell high. This approach, however, is notoriously difficult to execute successfully. Attempting to predict market peaks and troughs consistently requires exceptional market foresight, which most investors simply do not possess. Studies repeatedly show that most attempts at market timing underperform a disciplined buy and hold long-term strategy.

- Why a Disciplined Buy and Hold Approach is Generally Superior:

- Avoids emotional decision-making: Removes the pressure of constantly monitoring the market and making reactive trades.

- Benefits from compounding: Allows for consistent growth through reinvesting dividends and capital gains.

- Reduces transaction costs: Minimizes trading fees and taxes associated with frequent buying and selling.

Dealing with Underperformance in the Short Term

It's frustrating to see your investments underperform, particularly in the short term. It's crucial to remember that investing is a long-term game, and short-term fluctuations are normal. Focusing solely on short-term gains or losses can lead to impulsive decisions that derail your long-term goals.

- Techniques for Maintaining Perspective and Avoiding Impulsive Decisions:

- Review your investment plan: Regularly revisit your financial goals and investment strategy to ensure alignment.

- Seek professional advice: Consult a financial advisor to discuss your concerns and gain a balanced perspective.

- Focus on the big picture: Remind yourself of your long-term goals and the potential rewards of a patient approach.

Financial Challenges and Considerations in Buy and Hold

While emotionally challenging, a buy and hold long-term strategy also presents some financial hurdles.

Inflation's Impact on Long-Term Returns

Inflation erodes the purchasing power of money over time. This means that the value of your investments needs to grow at a rate that outpaces inflation to maintain real purchasing power. Failure to account for inflation can significantly impact your long-term returns.

- Strategies for Mitigating Inflation Risk:

- Invest in inflation-protected securities (TIPS): These bonds adjust their principal value based on inflation.

- Invest in assets that historically outpace inflation: Real estate and certain commodities are examples.

- Regularly re-evaluate your portfolio: Adjust your holdings as needed to account for changing inflation rates.

Tax Implications of Long-Term Investing

The tax implications of long-term investing can be significant. However, there are ways to minimize your tax burden and maximize returns. Long-term capital gains taxes are generally lower than ordinary income tax rates, providing a tax advantage to long-term investors.

- Tax-Advantaged Accounts:

- IRAs (Individual Retirement Accounts): Offer tax-deferred or tax-free growth depending on the type of IRA.

- 401(k)s: Employer-sponsored retirement plans that often provide tax advantages.

Opportunity Cost and Alternative Investments

A buy and hold strategy requires tying up capital for an extended period. This means that you forgo the opportunity to potentially invest that capital in other ventures that could offer higher returns (though also higher risk).

- When Diversification Beyond Buy and Hold Might Be Considered:

- High-risk tolerance: Investors comfortable with higher risk may consider allocating a portion of their portfolio to alternative assets like private equity or hedge funds.

- Specific financial goals: Some investment goals, like short-term financial needs, might not be suited to a buy and hold strategy.

Overcoming the Challenges: Keys to Successful Buy and Hold

Successfully implementing a buy and hold long-term strategy requires a well-defined plan, regular monitoring, and potentially, professional guidance.

Developing a Robust Investment Plan

A solid investment plan is the cornerstone of successful long-term investing. This plan should outline your financial goals (retirement, education, etc.), your risk tolerance, and your desired asset allocation.

- Steps to Create a Well-Defined Investment Plan:

- Define your financial goals: Be specific about your objectives and the timeline for achieving them.

- Assess your risk tolerance: Understand your comfort level with potential investment losses.

- Determine your asset allocation: Decide how to distribute your investments across different asset classes.

The Importance of Regular Rebalancing

Regularly rebalancing your portfolio helps you maintain your desired asset allocation and manage risk. As market values fluctuate, some asset classes may grow disproportionately, shifting your portfolio away from your target allocation. Rebalancing involves selling some assets that have performed well and buying others that have underperformed to bring your portfolio back to its target allocation.

- Practical Tips for Rebalancing Your Portfolio:

- Rebalance annually or semi-annually: The frequency depends on your portfolio's volatility and your personal preference.

- Consider tax implications: Rebalancing may trigger capital gains taxes.

- Use a systematic approach: This will help you avoid emotional decision-making.

Seeking Professional Financial Advice

Working with a qualified financial advisor can provide invaluable support and guidance throughout your investment journey. A financial advisor can help you develop a personalized investment plan, manage risk, and make informed decisions.

- Questions to Ask a Financial Advisor:

- What is your fee structure?

- What is your investment philosophy?

- How do you manage risk?

Embracing the Buy and Hold Strategy for Long-Term Success

The buy and hold strategy, while presenting both emotional and financial challenges, offers significant potential rewards for those who can navigate the hurdles. Successfully managing fear and greed, understanding the tax implications, and mitigating inflation risk are key. Developing a robust investment plan, regular rebalancing, and seeking professional financial advice are essential for maximizing long-term success. Ready to navigate the challenges and reap the rewards of a successful buy and hold strategy? Contact a financial advisor today to begin your journey towards long-term financial security.

Featured Posts

-

Teenager Arrested For Murder After Darwin Shop Robbery

May 25, 2025

Teenager Arrested For Murder After Darwin Shop Robbery

May 25, 2025 -

Mia Farrow Demands Trump Be Jailed For Deporting Venezuelan Gang Members

May 25, 2025

Mia Farrow Demands Trump Be Jailed For Deporting Venezuelan Gang Members

May 25, 2025 -

The Financial Aspects Of An Escape To The Country

May 25, 2025

The Financial Aspects Of An Escape To The Country

May 25, 2025 -

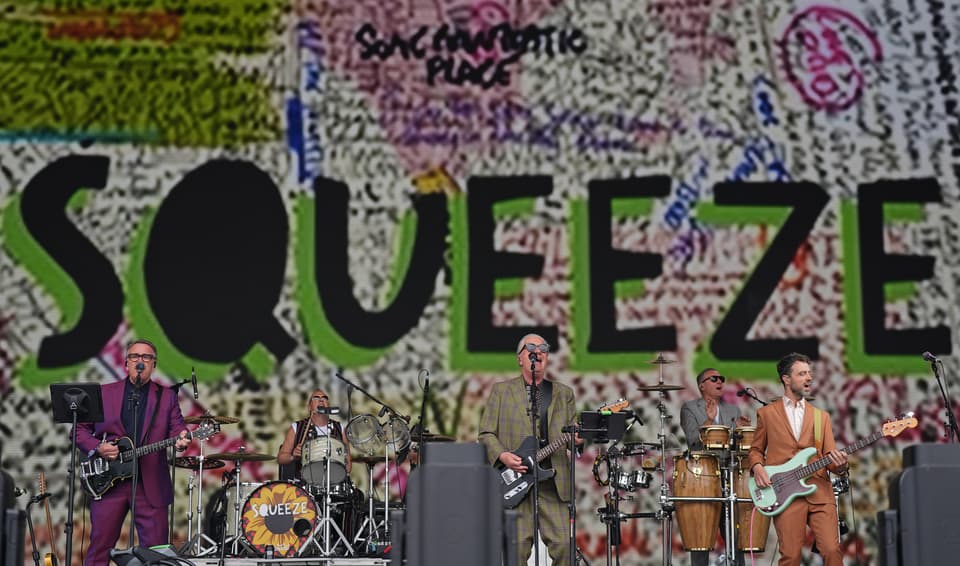

Is Glastonbury 2025s Lineup The Strongest Ever Featuring Charli Xcx Neil Young And Must See Acts

May 25, 2025

Is Glastonbury 2025s Lineup The Strongest Ever Featuring Charli Xcx Neil Young And Must See Acts

May 25, 2025 -

Porsche Investicijos I Elektromobiliu Infrastruktura Europoje

May 25, 2025

Porsche Investicijos I Elektromobiliu Infrastruktura Europoje

May 25, 2025

Latest Posts

-

Rekordnye Podiumy Mercedes Vklad Lyuisa Khemiltona I Dzhordzha Rassela

May 25, 2025

Rekordnye Podiumy Mercedes Vklad Lyuisa Khemiltona I Dzhordzha Rassela

May 25, 2025 -

300 Podiumov Mercedes Analiz Dostizheniy Komandy I Pilotov

May 25, 2025

300 Podiumov Mercedes Analiz Dostizheniy Komandy I Pilotov

May 25, 2025 -

Yubileyniy Podium Mercedes Zasluga Rassela I Dostizheniya Khemiltona

May 25, 2025

Yubileyniy Podium Mercedes Zasluga Rassela I Dostizheniya Khemiltona

May 25, 2025 -

Lewis Hamiltons Gesture To Former Teammate In New F1 Testing Footage

May 25, 2025

Lewis Hamiltons Gesture To Former Teammate In New F1 Testing Footage

May 25, 2025 -

Rassel I 300 Y Podium Mercedes Istoriya Uspekha

May 25, 2025

Rassel I 300 Y Podium Mercedes Istoriya Uspekha

May 25, 2025