Buy Baazar Style Retail Shares: JM Financial - Rs 400 Price Target

Table of Contents

JM Financial's Rationale Behind the Rs 400 Price Target

JM Financial's optimistic price target is based on a combination of strong company fundamentals and a positive outlook for the Indian retail sector. Let's examine the key factors contributing to this prediction.

Strong Fundamentals of Bazaar Style Retail

Bazaar Style Retail boasts impressive financial performance. Their business model, focused on [ Insert specific business model details, e.g., a unique omnichannel approach targeting a specific demographic] has driven significant growth.

- Consistent Revenue Growth for the last three quarters. [Insert percentage growth figures and source if available]. This showcases a steady upward trajectory and indicates strong market demand.

- Expanding Market Share in the [Specific Retail Segment, e.g., budget fashion] segment. Bazaar Style Retail has successfully carved a niche for itself, outperforming competitors in [mention specific metrics, e.g., customer acquisition, sales per square foot].

- Strong Profit Margins Compared to Competitors. Their efficient operations and strategic cost management have resulted in higher profit margins, creating a robust financial foundation. [Include comparative data if possible].

Positive Market Outlook for the Retail Sector

The Indian retail sector is experiencing robust growth, fueled by several key factors:

- Rising consumer spending power in [Target demographic, e.g., the young adult and millennial population]. Increasing disposable incomes and a burgeoning middle class are driving higher retail spending.

- Increased adoption of online and omnichannel retail strategies. Bazaar Style Retail’s adaptability to these trends positions them for continued success in an evolving marketplace.

- Government initiatives promoting retail sector growth. Favorable government policies and infrastructure development are further stimulating the sector's expansion. [Mention specific policies if relevant].

Investment Risks and Considerations

While the outlook is positive, it's crucial to acknowledge potential risks:

- Vulnerability to economic downturns. Like any retail business, Bazaar Style Retail is susceptible to economic fluctuations. A recession could impact consumer spending and affect their profitability.

- Intense competition from established players. The retail landscape is competitive, and Bazaar Style Retail faces challenges from both established large chains and emerging online retailers.

- Dependence on specific supply chains. Disruptions in their supply chain, whether due to logistical challenges or geopolitical factors, could impact operations and profitability.

Should You Buy Bazaar Style Retail Shares Based on the Rs 400 Target?

Weighing the Pros and Cons

The Rs 400 price target reflects JM Financial's confidence in Bazaar Style Retail's strong fundamentals and the positive retail sector outlook. However, investors must carefully consider the inherent risks before making a decision. The potential for high returns is balanced by the vulnerabilities to economic shifts and competitive pressures.

Alternative Investment Options

Before committing to Bazaar Style Retail, consider diversifying your portfolio by exploring other opportunities within the retail sector. Research companies with similar growth potential but different risk profiles.

Recommendation and Disclaimer

Based on our analysis, Bazaar Style Retail presents an interesting investment opportunity. However, a cautious approach is recommended. Conduct thorough due diligence and consider your own risk tolerance before investing.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making any investment decisions.

Conclusion: Making Informed Decisions About Bazaar Style Retail Shares

JM Financial's Rs 400 price target for Bazaar Style Retail shares reflects a positive outlook based on strong company performance and favorable market trends. However, potential risks associated with economic downturns and competition must be carefully evaluated. Remember to conduct thorough due diligence, research other investment options in the retail sector, and consider your individual risk profile before deciding whether to buy Bazaar Style Retail shares or invest in Bazaar Style Retail stock. Making informed decisions is crucial for successful investing.

Featured Posts

-

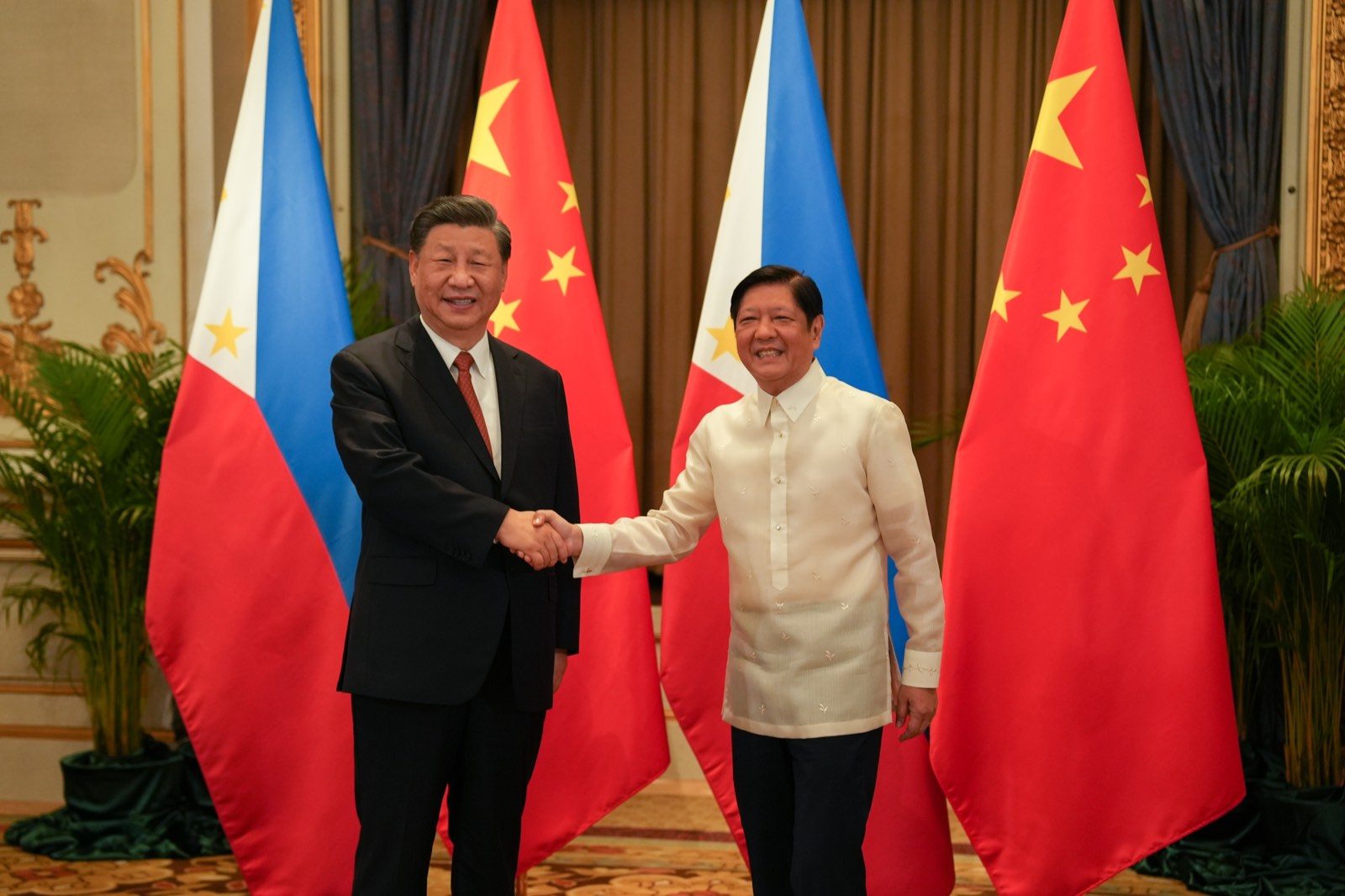

High Level Talks China Seeks Us Deal With Expert Support

May 15, 2025

High Level Talks China Seeks Us Deal With Expert Support

May 15, 2025 -

Analyzing The Collapse Of The King Of Davoss Authority

May 15, 2025

Analyzing The Collapse Of The King Of Davoss Authority

May 15, 2025 -

Leeflang Zaak Bruins En Npo Moeten Toezichthouder Raadplegen

May 15, 2025

Leeflang Zaak Bruins En Npo Moeten Toezichthouder Raadplegen

May 15, 2025 -

Reciprocal Tariffs And Their Impact On Key Indian Sectors

May 15, 2025

Reciprocal Tariffs And Their Impact On Key Indian Sectors

May 15, 2025 -

Berlin And Brandenburg Aktuelle Verkehrsbehinderungen Durch Tram Unfall

May 15, 2025

Berlin And Brandenburg Aktuelle Verkehrsbehinderungen Durch Tram Unfall

May 15, 2025