Buy The Dip? Analyst Outlook On This Entertainment Stock

Table of Contents

Recent Performance and Market Factors Affecting Disney Stock

Disney stock (DIS) experienced a notable dip in recent months, dropping approximately X% between [Start Date] and [End Date]. Several factors contributed to this decline.

- Impact of broader market trends: Rising inflation and increasing interest rates have created a challenging macroeconomic environment, impacting investor sentiment across various sectors, including entertainment. The fear of a recession has led to a flight to safety, pushing investors away from riskier assets like entertainment stocks.

- Specific company news: Disney's recent quarterly earnings report revealed [mention specific data points, e.g., slower-than-expected subscriber growth for Disney+]. This, coupled with [mention other news, e.g., a less-than-stellar box office performance for a major film release], negatively impacted investor confidence.

- Competitive landscape within the entertainment industry: The ongoing "streaming wars" present a significant challenge. Competition from Netflix, Amazon Prime Video, HBO Max, and other streaming platforms intensifies the pressure on Disney+ to retain subscribers and attract new ones. This competitive pressure affects Disney's overall profitability and growth potential.

- Geopolitical events: Global uncertainties, such as [mention specific geopolitical event and its impact on Disney's business, e.g., international market performance], can also influence the stock price.

The interplay of these factors created a perfect storm, leading to the recent decline in Disney's stock price. Analyzing these factors individually and collectively is crucial for understanding the current market sentiment. (Insert relevant chart showing Disney's stock price performance over the relevant period here)

Analyst Ratings and Price Targets for Disney Stock

The consensus opinion among analysts regarding Disney stock is currently mixed. While some maintain a bullish outlook, others are more cautious.

- Average price target: The average price target among analysts currently stands at $[Average Price Target], ranging from $[Low Price Target] to $[High Price Target].

- Analyst ratings: A significant portion of analysts rate Disney stock as a "hold," while others are split between "buy" and "sell." [Insert specific data on buy/hold/sell ratings from reputable sources].

- Bullish arguments: Proponents of a bullish outlook highlight Disney's strong brand recognition, diverse revenue streams (including theme parks, merchandise, and licensing), and the long-term growth potential of its streaming services. They argue that the recent dip presents a buying opportunity for long-term investors.

- Bearish arguments: Analysts with a bearish outlook express concern over the increasing competition in the streaming market, the company's debt levels, and the potential impact of economic headwinds. They believe that the company needs to demonstrate stronger growth and profitability to justify a higher valuation. [Cite specific analyst firms and their reports with links, e.g., "Morgan Stanley recently downgraded Disney stock citing concerns about..."].

The divergence in analyst opinions highlights the uncertainty surrounding Disney's future performance, emphasizing the importance of thorough due diligence before making any investment decisions.

Fundamental Analysis of Disney Stock

Analyzing Disney's fundamentals reveals a complex picture. While the company boasts a strong brand and diverse revenue streams, certain challenges exist.

- Revenue and earnings growth trajectory: Disney's revenue growth has been [describe the growth trajectory - e.g., fluctuating, slowing down etc.], particularly in its streaming segment. Earnings have also been [describe earnings trends - e.g., impacted by increased spending on content].

- Debt levels and financial stability: Disney carries a significant debt load, which could impact its financial flexibility during economic downturns. However, the company's overall financial stability remains relatively strong.

- Competitive advantages and brand strength: Disney's strong brand recognition, vast intellectual property portfolio, and iconic characters remain significant competitive advantages. This gives the company a substantial edge in attracting audiences and generating revenue.

- Future growth potential: Disney's continued investment in original content, expansion into new markets, and exploration of new technologies (e.g., metaverse) offer substantial long-term growth potential.

Disney's valuation metrics, such as its P/E ratio and Price-to-Sales ratio, should be carefully considered in conjunction with its fundamental strengths and weaknesses. A comprehensive valuation analysis is crucial for determining whether the current stock price reflects the company's intrinsic value.

Risk Assessment for Investing in Disney Stock

Investing in Disney stock comes with several risks:

- Market volatility and sector-specific risks: The entertainment industry is inherently volatile, susceptible to economic downturns and changing consumer preferences. Broader market fluctuations will impact Disney's stock price.

- Dependence on specific revenue streams: Disney's profitability is significantly reliant on the performance of its streaming services and theme parks. Underperformance in either area could negatively impact its overall financial health.

- Regulatory changes and their potential impact: Changes in regulations concerning streaming content or intellectual property could significantly influence Disney's business operations.

- Competitive threats from other entertainment companies: The intense competition from other streaming services, particularly Netflix and other major players, poses a significant threat to Disney's market share and profitability.

These risks must be carefully considered before making any investment decisions. A thorough understanding of the potential downsides is essential for effective risk management.

Conclusion

The analyst outlook on Disney stock is currently mixed, reflecting the uncertainty surrounding its future performance. While the recent price dip might present a buying opportunity for some long-term investors, it's essential to weigh the potential upside against the substantial risks involved. The strong brand, diverse revenue streams, and growth potential in streaming and other segments are positive factors. However, intense competition, economic headwinds, and reliance on specific revenue streams present considerable challenges.

Should you buy the dip in Disney Stock? The answer depends on your individual risk tolerance, investment horizon, and thorough due diligence. Weighing the risks and rewards of buying this entertainment stock is crucial. Is now the time to invest in this entertainment stock? Only you can decide after conducting your own in-depth research and potentially consulting with a financial advisor. Remember, this analysis is for informational purposes only and does not constitute financial advice. Always conduct your own research and understand the risks before investing in any stock.

Featured Posts

-

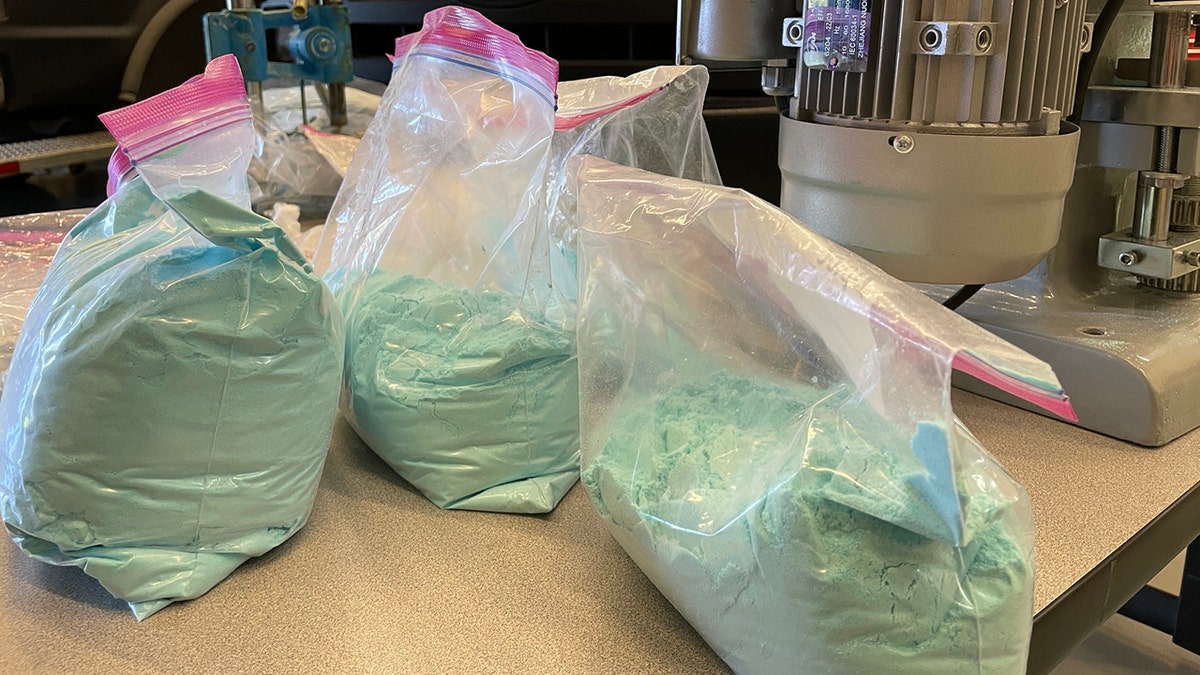

Frances New Strategy Confiscation Of Phones From Drug Users And Dealers

May 29, 2025

Frances New Strategy Confiscation Of Phones From Drug Users And Dealers

May 29, 2025 -

Latin Women Musicians Shaping The Soundscape Of 2025

May 29, 2025

Latin Women Musicians Shaping The Soundscape Of 2025

May 29, 2025 -

Caitlyn And Vis Arcane Story Producers Tease Future Developments

May 29, 2025

Caitlyn And Vis Arcane Story Producers Tease Future Developments

May 29, 2025 -

Uerduen Gazze Deki Kanser Hastasi Cocuklari Kabul Ediyor Bir Insani Yardim Hareketi

May 29, 2025

Uerduen Gazze Deki Kanser Hastasi Cocuklari Kabul Ediyor Bir Insani Yardim Hareketi

May 29, 2025 -

Indianola And Norwalk Students Shine At Lhc Art Show

May 29, 2025

Indianola And Norwalk Students Shine At Lhc Art Show

May 29, 2025

Latest Posts

-

Del Toros Pick The Best Realized World In Gaming

May 30, 2025

Del Toros Pick The Best Realized World In Gaming

May 30, 2025 -

Guillermo Del Toro Names Top Video Game World A Fully Realized Vision

May 30, 2025

Guillermo Del Toro Names Top Video Game World A Fully Realized Vision

May 30, 2025 -

Guillermo Del Toro Praises Popular Shooters World Building

May 30, 2025

Guillermo Del Toro Praises Popular Shooters World Building

May 30, 2025 -

Global Investment Opportunities In Saudi Arabia A Deutsche Bank Perspective

May 30, 2025

Global Investment Opportunities In Saudi Arabia A Deutsche Bank Perspective

May 30, 2025 -

L Ere Moderne De La Deutsche Bank Un Recit Complexe De Hauts Et De Bas

May 30, 2025

L Ere Moderne De La Deutsche Bank Un Recit Complexe De Hauts Et De Bas

May 30, 2025