Buy XRP (Ripple)? A Detailed Analysis Below $3

Table of Contents

Introduction: The price of XRP, Ripple's native cryptocurrency, fluctuating below $3, has many investors wondering whether now is the time to buy. This comprehensive guide delves into the current market conditions, Ripple's ongoing legal battles, technological advancements, and future prospects to help you decide if investing in XRP below $3 aligns with your risk tolerance and financial goals. We'll explore the potential rewards and the inherent risks associated with this volatile digital asset.

Understanding XRP and Ripple's Technology

XRP's primary function is facilitating fast and inexpensive cross-border payments through RippleNet, Ripple's payment network. Unlike many cryptocurrencies reliant on Proof-of-Work, XRP uses a unique consensus mechanism, resulting in significantly lower energy consumption and faster transaction speeds. This makes it a potentially attractive alternative to traditional banking systems, which often involve high fees and slow processing times.

- RippleNet's Global Reach and Partnerships: RippleNet boasts a substantial network of financial institutions, banks, and payment providers globally, demonstrating a level of institutional adoption that many other cryptocurrencies lack. These partnerships are crucial for XRP's potential for mainstream adoption.

- XRP's Consensus Mechanism and Energy Efficiency: The XRP Ledger employs a unique consensus mechanism, offering high throughput and low energy consumption compared to Proof-of-Work blockchains like Bitcoin. This energy efficiency is an increasingly important factor for environmentally conscious investors.

- Scalability of the XRP Ledger: The XRP Ledger's architecture allows for a high volume of transactions per second, making it highly scalable and capable of handling large-scale payment operations. This scalability is critical for its potential use in a global payment system.

Related Keywords: XRP Ledger, RippleNet, cross-border payments, cryptocurrency technology, blockchain technology, low transaction fees, fast transactions, scalability, energy efficiency

Ripple's Legal Battle and its Impact on XRP Price

The ongoing SEC lawsuit against Ripple Labs significantly impacts XRP's price. The SEC alleges that XRP is an unregistered security, a claim Ripple vehemently denies. The outcome of this legal battle remains uncertain and heavily influences investor sentiment and XRP's volatility.

- Key Arguments from Both Sides: The SEC argues that Ripple sold XRP as an unregistered security, while Ripple counters that XRP is a digital currency used for facilitating payments, not an investment contract.

- Expert Opinions on Potential Legal Outcomes: Legal experts offer differing opinions on the likely outcome, with some predicting a settlement, others forecasting a ruling in favor of either the SEC or Ripple. This uncertainty contributes to the price volatility.

- Impact of a Favorable or Unfavorable Ruling: A favorable ruling for Ripple could potentially send XRP's price soaring, while an unfavorable outcome could lead to a significant price drop. The uncertainty surrounding the legal outcome is a major risk factor for investors.

Related Keywords: SEC lawsuit, Ripple lawsuit, regulatory uncertainty, cryptocurrency regulation, legal risk, XRP price prediction, SEC vs Ripple, legal outcome, court ruling

Analyzing XRP's Market Position and Potential Growth

XRP consistently ranks among the top cryptocurrencies by market capitalization, though its position fluctuates. Its potential for widespread adoption by financial institutions remains a significant factor in its price trajectory.

- XRP's Market Cap Compared to Other Major Cryptocurrencies: While XRP's market capitalization is substantial, it’s significantly smaller than Bitcoin and Ethereum. However, its position within the broader cryptocurrency market reflects a degree of established presence.

- Adoption Rate by Banks and Payment Providers: The growing number of financial institutions using RippleNet suggests a positive trend in adoption, potentially driving future price appreciation. This institutional interest contrasts with some other cryptocurrencies heavily reliant on retail adoption.

- Potential Future Use Cases: Beyond cross-border payments, XRP could find applications in other areas such as micropayments, supply chain management, and other financial transactions. This expansion of use cases could fuel future growth.

Related Keywords: Market capitalization, cryptocurrency ranking, market adoption, financial institutions, institutional investors, long-term investment, growth potential, future use cases, price prediction

Risk Assessment and Investment Strategies for XRP Below $3

Investing in XRP, like any cryptocurrency, involves significant risk due to its inherent volatility and regulatory uncertainty. A well-defined investment strategy and risk management are essential.

- Importance of Risk Tolerance Assessment: Before investing in XRP, understand your own risk tolerance. Cryptocurrencies can experience significant price swings, and you should only invest what you can afford to lose.

- Strategies for Diversification: Diversification is crucial in mitigating risk. Don't put all your eggs in one basket; spread your investments across different asset classes, including other cryptocurrencies and traditional investments.

- Need for Careful Research and Due Diligence: Thoroughly research XRP and the cryptocurrency market before investing. Understand the technology, the legal landscape, and the potential risks and rewards.

Related Keywords: Risk management, investment strategy, cryptocurrency volatility, portfolio diversification, risk tolerance, due diligence, research, investment advice

Conclusion

Deciding whether to buy XRP (Ripple) below $3 requires a careful consideration of its technological advantages, the ongoing legal challenges, and the inherent volatility of the cryptocurrency market. While XRP offers potential for growth given its use in cross-border payments and its potential for broader adoption, significant risks remain. Thorough research, risk assessment, and a well-diversified investment strategy are crucial for any investor contemplating purchasing XRP. Ultimately, the decision to buy XRP (Ripple) rests on your individual financial goals, risk tolerance, and understanding of the complexities involved. Do your own research and consider all aspects before making any investment in XRP.

Featured Posts

-

Road To Ofc U 19 Womens Championship 2025 Tongas Qualifying Journey

May 02, 2025

Road To Ofc U 19 Womens Championship 2025 Tongas Qualifying Journey

May 02, 2025 -

Fortnite Cowboy Bebop Collaboration Free Rewards Available For A Short Time

May 02, 2025

Fortnite Cowboy Bebop Collaboration Free Rewards Available For A Short Time

May 02, 2025 -

Enhancing Research Collaboration The Project Muse Shared Experience

May 02, 2025

Enhancing Research Collaboration The Project Muse Shared Experience

May 02, 2025 -

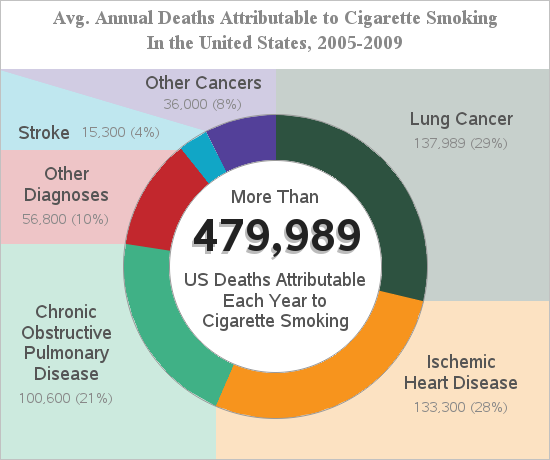

The Food Doctor Blames For Early Deaths Worse Than Smoking

May 02, 2025

The Food Doctor Blames For Early Deaths Worse Than Smoking

May 02, 2025 -

1 Mayis Emek Ve Dayanisma Guenue Tarihsel Arbedeler Ve Guencel Anlami

May 02, 2025

1 Mayis Emek Ve Dayanisma Guenue Tarihsel Arbedeler Ve Guencel Anlami

May 02, 2025

Latest Posts

-

Mini Camera Chaveiro Pequena Discreta E Muito Popular

May 02, 2025

Mini Camera Chaveiro Pequena Discreta E Muito Popular

May 02, 2025 -

Mini Camera Chaveiro Funcoes Precos E Melhores Lojas

May 02, 2025

Mini Camera Chaveiro Funcoes Precos E Melhores Lojas

May 02, 2025 -

Sucesso Nas Redes A Mini Camera Chaveiro Que Voce Precisa Conhecer

May 02, 2025

Sucesso Nas Redes A Mini Camera Chaveiro Que Voce Precisa Conhecer

May 02, 2025 -

Mini Cameras Chaveiro Guia Completo De Compra E Utilizacao

May 02, 2025

Mini Cameras Chaveiro Guia Completo De Compra E Utilizacao

May 02, 2025 -

Mini Camera Chaveiro Onde Comprar E Como Usar

May 02, 2025

Mini Camera Chaveiro Onde Comprar E Como Usar

May 02, 2025