CAAT Pension Plan Seeks Increased Canadian Private Investment

Table of Contents

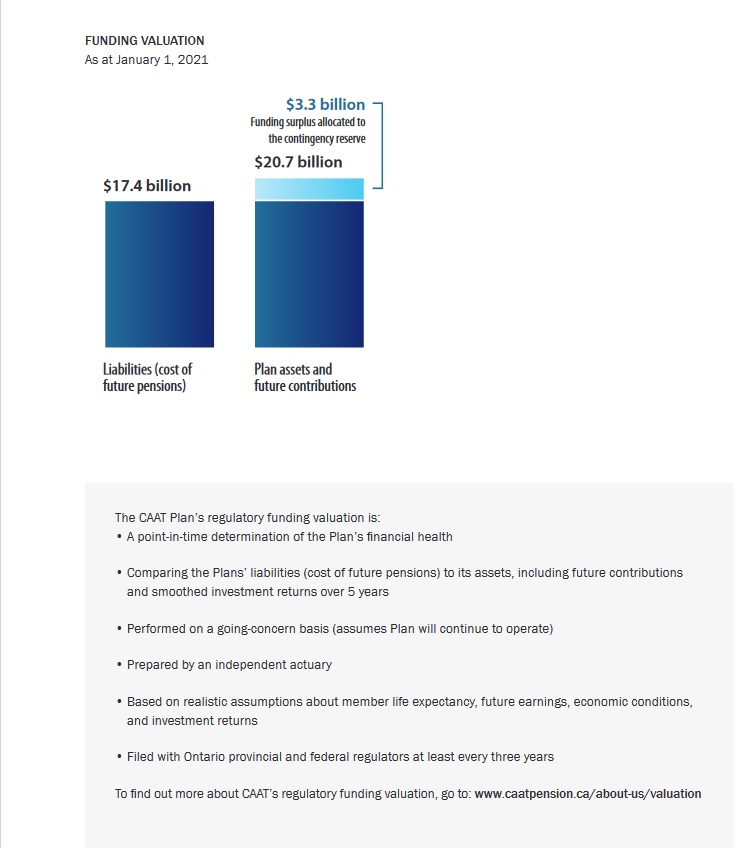

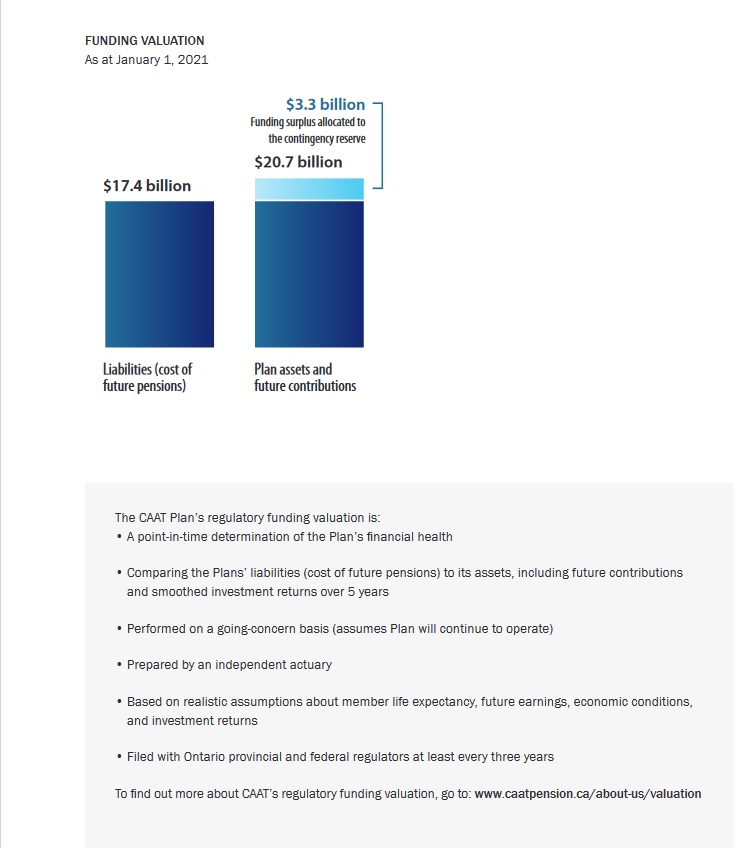

Why CAAT is Targeting Canadian Private Investment

CAAT's focus on Canadian private investment is a strategic move driven by several key factors. Their investment strategy prioritizes diversification, higher returns, domestic economic growth, and responsible investing.

-

Diversification beyond traditional public markets to reduce overall portfolio risk: Investing solely in publicly traded assets exposes a portfolio to market volatility. Diversifying into Canadian private equity, infrastructure investment, and real estate provides a buffer against these fluctuations, leading to a more stable and resilient portfolio for CAAT's pensioners. This reduces the overall risk profile of the pension plan.

-

Opportunities for higher returns compared to publicly traded assets: Private markets often offer the potential for higher returns than publicly traded assets, particularly in the long term. This is due to factors such as illiquidity premiums (compensation for the lack of easy exit options) and the potential for significant capital appreciation in fast-growing private companies. Canadian private equity, for example, has shown promising returns in recent years.

-

Contribution to the growth of Canadian businesses and infrastructure: By investing in Canadian private companies and infrastructure projects, CAAT directly contributes to the growth of the domestic economy. This aligns with their commitment to responsible investing and supports the development of Canadian businesses, creating jobs and boosting economic activity.

-

Alignment with CAAT's Environmental, Social, and Governance (ESG) investment principles and responsible investing strategies: CAAT is increasingly focused on ESG factors when making investment decisions. This means they prioritize companies and projects with strong environmental, social, and governance practices. By investing in Canadian private companies committed to ESG principles, CAAT can generate both financial returns and positive social and environmental impact.

Attracting Canadian Private Investment: Challenges and Opportunities

While the potential benefits are significant, increasing private investment in Canada presents challenges.

-

Finding suitable investment opportunities that meet CAAT's stringent risk and return requirements: The private market requires meticulous due diligence to identify opportunities that offer both high growth potential and acceptable risk levels. CAAT needs to carefully evaluate various sectors like private equity, venture capital, and real estate to find the best fit for their portfolio.

-

Navigating the regulatory landscape surrounding private market investments: The regulatory environment for private market investments can be complex and vary depending on the type of investment and jurisdiction. CAAT must ensure all its investments comply with all relevant regulations.

-

Partnering with experienced Canadian investment fund managers: Successful investment in the private market often requires working with experienced and reputable fund managers who possess the expertise to identify and manage investments effectively. CAAT's due diligence extends to selecting appropriate partners.

-

Conducting thorough due diligence to mitigate investment risks: Private market investments are inherently less liquid than publicly traded assets. Thorough due diligence, including comprehensive financial analysis, risk assessment, and management team evaluation, is crucial to mitigate risks and safeguard the pension fund's assets. This process requires specialized expertise.

The opportunity for CAAT lies in accessing potentially higher returns and contributing to the growth of the Canadian economy. Overcoming these challenges involves proactive engagement with the private market, developing strong partnerships, and refining their due diligence processes. The illiquidity premium offered by private investments makes them attractive, despite the challenges.

The Impact on the Canadian Economy

Increased CAAT investment in Canadian private markets has the potential to significantly impact the Canadian economy.

-

Increased capital flows to Canadian businesses leading to job creation and economic growth: The infusion of capital from CAAT will provide a much-needed boost to Canadian businesses, enabling them to expand operations, hire more employees, and contribute to overall economic growth. This directly translates into job creation and increased GDP.

-

Funding for crucial infrastructure projects, improving the country's infrastructure and competitiveness: CAAT's investment can provide crucial funding for large-scale infrastructure projects, such as renewable energy facilities, transportation networks, and telecommunications infrastructure. This enhances the country's competitiveness and long-term economic prospects.

-

Support for innovative startups and high-growth companies: Investing in early-stage companies can foster innovation and support the growth of high-potential businesses that can contribute to the long-term economic prosperity of Canada. Venture capital investments within this sector would see a boost.

-

Potential for positive spillover effects on related industries: Investments in one sector often have ripple effects across other industries, leading to broader economic growth. For example, infrastructure investments can stimulate activity in construction, manufacturing, and related sectors.

The economic stimulus from this increased Canadian private investment could be substantial, potentially accelerating Canadian GDP growth and creating numerous high-quality jobs across various sectors. The long-term implications for sustainable economic development are considerable.

Conclusion

The CAAT Pension Plan's strategic focus on increasing Canadian private investment represents a significant opportunity for both the pension fund and the Canadian economy. By diversifying its portfolio, generating higher returns, and fostering domestic economic growth, CAAT is setting a precedent for other major pension funds to follow. This initiative highlights the importance of responsible investing and the potential for private markets to drive sustainable economic development in Canada. The increased focus on Canadian private investment is a positive development, offering both financial benefits to CAAT and considerable economic stimulus to Canada.

Call to Action: Learn more about CAAT’s investment strategy and how increased Canadian private investment is shaping the future of pension funding and economic growth. Explore the opportunities for Canadian private investment and consider how your business can benefit from increased access to capital. [Link to CAAT website or relevant resource]

Featured Posts

-

Allemagne J 6 Avant Les Legislatives Decryptage

Apr 23, 2025

Allemagne J 6 Avant Les Legislatives Decryptage

Apr 23, 2025 -

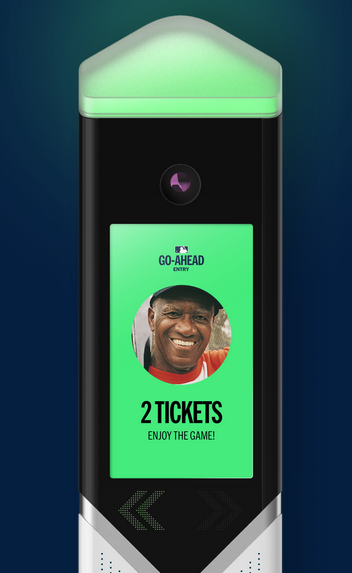

Target Fields Go Ahead Entry Facial Recognition Speeds Up Lines

Apr 23, 2025

Target Fields Go Ahead Entry Facial Recognition Speeds Up Lines

Apr 23, 2025 -

Trump Supporter Ray Epps Defamation Suit Against Fox News Jan 6th Falsehoods Alleged

Apr 23, 2025

Trump Supporter Ray Epps Defamation Suit Against Fox News Jan 6th Falsehoods Alleged

Apr 23, 2025 -

M3 As Autopalya Hetekig Tarto Forgalomkorlatozasok

Apr 23, 2025

M3 As Autopalya Hetekig Tarto Forgalomkorlatozasok

Apr 23, 2025 -

Aldhhb Alywm Asearh Balsaght Bed Alankhfad

Apr 23, 2025

Aldhhb Alywm Asearh Balsaght Bed Alankhfad

Apr 23, 2025