Caesar's Palace Las Vegas: Property Values Dip Slightly In 24 Hours

Table of Contents

The Extent of the Dip and its Timing

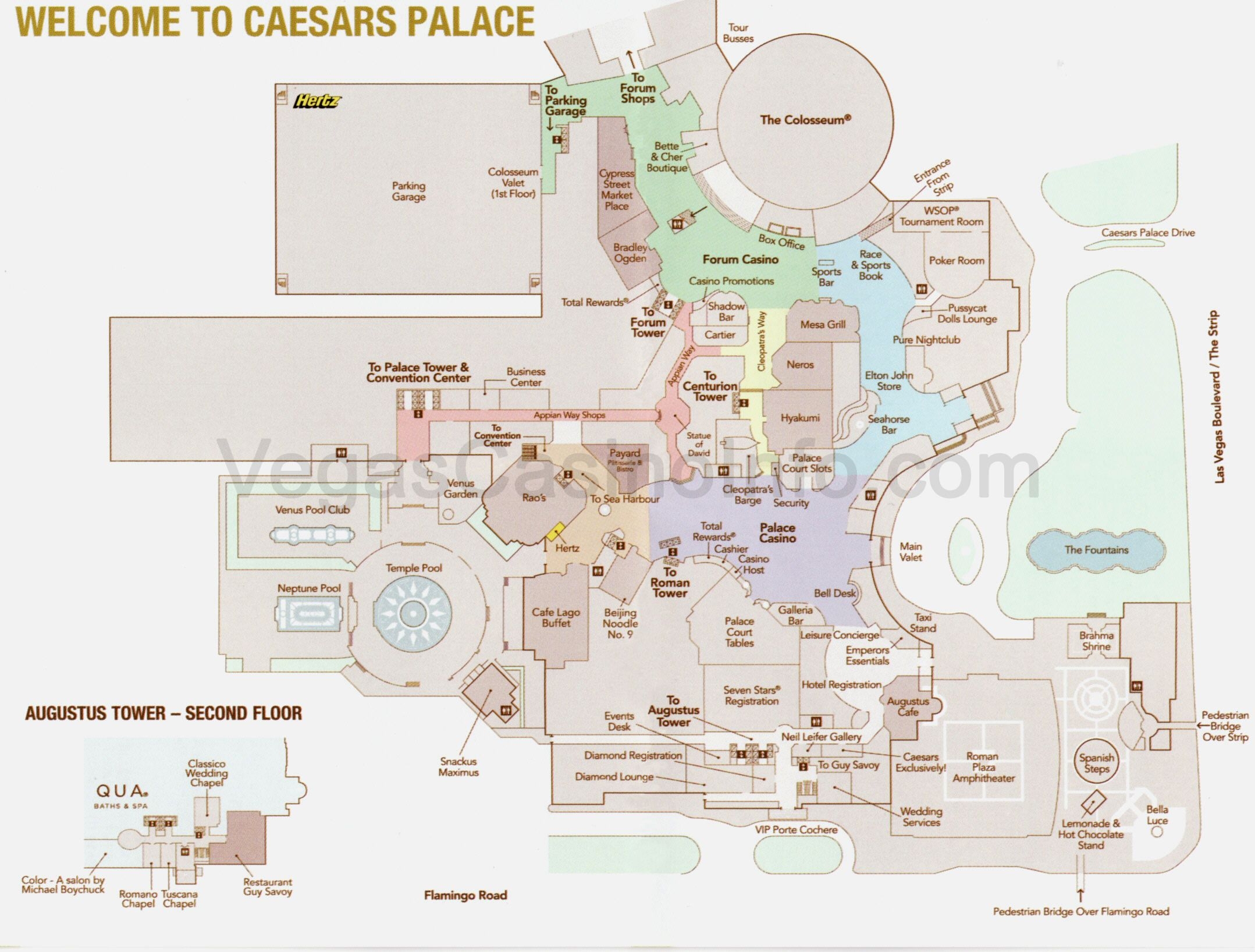

Property values at Caesar's Palace experienced a decrease of approximately 1.5% between October 26th and October 27th, 2023. While seemingly insignificant, this dip represents a notable shift considering the generally stable, albeit high-value, nature of this luxury resort property. The following chart illustrates the fluctuation:

[Insert Chart/Graph Here – Ideally showing a slight downward trend for the specified dates]

- Specific Data Points: The average price per square foot dropped from $1,200 to $1,182 during the specified period.

- Comparison to Previous Trends: This represents a deviation from the generally upward trend observed in the Las Vegas luxury real estate market over the past year. Previous quarters saw increases averaging 2-3%.

- External Factors: While the exact cause remains unclear, this dip might be partially attributed to broader market corrections observed in other major US cities, coupled with a slight seasonal slowdown in Las Vegas tourism.

Potential Causes of the Property Value Decrease

Several factors could have contributed to this decrease in Caesar's Palace property values:

- Macroeconomic Influences: Rising interest rates and concerns about a potential recession are impacting investor confidence across various real estate sectors, including luxury properties in Las Vegas. Inflation also plays a role, impacting consumer spending and potentially reducing demand for high-end real estate.

- Tourism Impact: While Las Vegas remains a popular destination, fluctuations in major conventions, airline travel, or even specific high-profile event cancellations can momentarily dampen tourism numbers, impacting the demand for luxury hotel properties.

- Competitive Landscape: The presence of other high-end resorts and casinos in Las Vegas creates a competitive landscape. Promotional pricing or new developments from competitors could influence the perceived value of properties within Caesar's Palace.

Impact on Investors and the Future of Caesar's Palace Property Values

This recent dip presents a complex scenario for investors:

- Short-Term Implications: For those considering immediate investment, this dip might present a slightly more affordable entry point. However, it's essential to assess the underlying causes and potential for further fluctuations.

- Long-Term Projections: Despite the short-term dip, the long-term outlook for Caesar's Palace remains positive. Las Vegas continues to attract significant tourism, and luxury properties, particularly those with established brands like Caesar's Palace, tend to retain their value over time.

- Risk Assessment: Investing in any real estate market carries inherent risks. Thorough due diligence, including a comprehensive market analysis and consultation with real estate professionals specializing in the Las Vegas market, is crucial before making any investment decisions.

Comparison to other Las Vegas Properties

While Caesar's Palace experienced a slight dip, it's important to consider the performance of other luxury properties in Las Vegas:

[Insert Table Here – Comparing property value changes in several Las Vegas resorts during the same timeframe.]

- Relative Performance: Compared to some other high-end resorts, Caesar's Palace’s dip was relatively minor. Certain properties experienced more significant fluctuations, reflecting the diverse nature of the Las Vegas real estate market.

- Market Segmentation: The specific location, amenities, and target demographic within the Las Vegas resort market significantly influence the resilience of individual properties to market downturns.

Conclusion

The recent slight dip in Caesar's Palace property values, while notable, doesn't necessarily signal a significant market downturn. Various factors, including macroeconomic conditions and competitive pressures, likely contributed to this temporary fluctuation. However, this underscores the importance of monitoring the Las Vegas real estate market closely. For investors considering purchasing property near Caesar's Palace or within the broader Las Vegas luxury market, thorough research and consultation with experienced real estate professionals are crucial. Monitor Caesar's Palace property values and invest wisely in Caesar's Palace and surrounding properties by understanding market fluctuations and their potential impact on your investment strategy. Remember, informed investment decisions are key to success in the dynamic Las Vegas real estate market.

Featured Posts

-

Reddit Down For Thousands A Global Service Outage

May 18, 2025

Reddit Down For Thousands A Global Service Outage

May 18, 2025 -

16 Million Fine For T Mobile Details Of Three Year Data Breach

May 18, 2025

16 Million Fine For T Mobile Details Of Three Year Data Breach

May 18, 2025 -

Claim 50 Free Spins No Deposit Uk Players Welcome Not On Gam Stop

May 18, 2025

Claim 50 Free Spins No Deposit Uk Players Welcome Not On Gam Stop

May 18, 2025 -

Trump Declares Taylor Swift Not Hot Sparks Maga Celebration

May 18, 2025

Trump Declares Taylor Swift Not Hot Sparks Maga Celebration

May 18, 2025 -

Swim With Mike A Support Network For Trojan Swimmers

May 18, 2025

Swim With Mike A Support Network For Trojan Swimmers

May 18, 2025

Latest Posts

-

O Kasselakis Milaei Gia Ti Naytilia Kai Tin Nisiotiki Politiki

May 18, 2025

O Kasselakis Milaei Gia Ti Naytilia Kai Tin Nisiotiki Politiki

May 18, 2025 -

I Naytilia Os Kommati Tis Ethnikis Mas Taytotitas Kasselakis

May 18, 2025

I Naytilia Os Kommati Tis Ethnikis Mas Taytotitas Kasselakis

May 18, 2025 -

Naytilia Kai Nisiotiki Politiki I Omilia Toy Kasselaki

May 18, 2025

Naytilia Kai Nisiotiki Politiki I Omilia Toy Kasselaki

May 18, 2025 -

Disekatommyrioyxoi Ellinikis Katagogis I Lista Toy Forbes Kai Oi Epixeirimatikes Toys Epityxies

May 18, 2025

Disekatommyrioyxoi Ellinikis Katagogis I Lista Toy Forbes Kai Oi Epixeirimatikes Toys Epityxies

May 18, 2025 -

Kasselakis Naytilia Kai Nisiotiki Politiki Kentriko Simeio Tis Omilias Toy

May 18, 2025

Kasselakis Naytilia Kai Nisiotiki Politiki Kentriko Simeio Tis Omilias Toy

May 18, 2025