Call For Regulatory Reform: Indian Insurers And Bond Forwards

Table of Contents

Current Regulatory Landscape and its Shortcomings

Existing regulations governing Indian insurer investments, primarily outlined by the IRDAI (Insurance Regulatory and Development Authority of India), are broad. While they address general investment guidelines, they lack the specificity required for the complexities of bond forwards. This vagueness creates significant ambiguities and gaps in the current framework:

- Lack of clear guidelines on permissible investment levels in bond forwards: The absence of defined exposure limits leaves insurers vulnerable to excessive risk-taking. This uncertainty hinders strategic planning and investment decisions.

- Absence of specific risk management requirements for such investments: Without tailored risk management guidelines, insurers may lack the necessary tools and frameworks to adequately assess and mitigate the inherent risks associated with bond forwards.

- Insufficient oversight and monitoring mechanisms: The current regulatory framework lacks the robust monitoring and surveillance mechanisms needed to effectively oversee insurers' bond forward activities and identify potential red flags early.

- Potential for regulatory arbitrage and inconsistencies: The lack of clear and comprehensive guidelines allows for inconsistencies in interpretation and application, creating opportunities for regulatory arbitrage and unfair competitive advantages.

These shortcomings increase systemic risk, potentially impacting the financial stability of insurance companies and hindering the growth of the overall sector. The ambiguity discourages participation from some insurers while exposing others to unnecessary risks.

Risks Associated with Unregulated Bond Forward Investments

Bond forwards, while offering potential returns, inherently carry several risks:

- Interest rate risk: Fluctuations in interest rates can significantly impact the value of bond forwards, leading to substantial losses.

- Credit risk: The risk of default by the counterparty in a bond forward contract poses a significant threat to insurers.

- Liquidity risk: The ability to easily buy or sell a bond forward contract can be challenging, particularly during periods of market stress.

The lack of clear regulatory guidance amplifies these risks:

- Increased exposure to market volatility and potential for significant losses: Without defined exposure limits, insurers could face substantial losses during market downturns, threatening their solvency.

- Inadequate risk mitigation strategies leading to solvency concerns: The absence of specific risk management requirements increases the likelihood of insurers adopting inadequate strategies, leading to potential solvency issues.

- Potential for fraudulent activities and misuse of funds: A lack of transparency and oversight creates opportunities for fraudulent activities and misuse of policyholder funds.

- Negative impact on policyholder interests: Ultimately, unregulated bond forward investments can negatively affect policyholders through reduced returns, increased premiums, or even the failure of the insurance company.

While comprehensive case studies specific to Indian insurers and unregulated bond forward investments are limited due to the lack of public information, the general principles of risk management illustrate the potential for significant negative consequences.

Proposed Regulatory Reforms for Indian Insurers and Bond Forwards

To address the current shortcomings, several regulatory reforms are crucial:

- Establishing clear guidelines on acceptable levels of bond forward investments based on insurer's risk profile: Regulations should define permissible exposure limits based on factors such as the insurer's capital adequacy, risk appetite, and investment strategy.

- Mandating robust internal risk management frameworks and independent audits: Insurers should be required to implement robust internal risk management systems, including stress testing and scenario analysis, and undergo regular independent audits to ensure compliance.

- Strengthening regulatory oversight and monitoring of insurer's bond forward activities: The IRDAI should enhance its monitoring and surveillance mechanisms to detect and address potential risks early.

- Enhanced transparency requirements for disclosures of bond forward positions: Greater transparency in reporting bond forward positions will improve market oversight and accountability.

- Introducing penalties for non-compliance: Strict penalties for non-compliance with the new regulations will deter unethical practices and ensure adherence to standards.

A collaborative approach, involving regulators, industry experts, and stakeholders, is essential to ensure the effectiveness and practicality of these reforms.

International Best Practices and their Applicability to India

Several countries have established robust regulatory frameworks for insurer investments in derivatives and similar instruments. Examining these international best practices, such as those in the UK, the US, and Singapore, can provide valuable insights. These frameworks often incorporate:

- Specific capital requirements for derivatives: This ensures insurers hold sufficient capital to cover potential losses.

- Strict reporting and disclosure requirements: This enhances transparency and facilitates regulatory oversight.

- Independent risk management functions: This ensures that risk management is not compromised by conflicts of interest.

Adapting these principles to the Indian context, considering the unique characteristics of the Indian insurance market and economic environment, will help create a more effective regulatory framework for Indian Insurers Bond Forwards.

Conclusion

The current lack of regulatory clarity surrounding Indian Insurers Bond Forwards poses significant risks to the stability of the Indian insurance sector and the interests of policyholders. The proposed reforms are crucial to mitigating these risks, promoting market stability, and fostering responsible growth. The need for comprehensive regulatory reform is urgent. Stakeholders, including the IRDAI, insurance companies, and industry associations, must collaborate to develop a robust and transparent framework that balances innovation with prudent risk management. Only through timely and decisive action can we ensure a stable and sustainable future for the Indian insurance sector and effectively protect the interests of all stakeholders. The government and regulatory bodies must prioritize the implementation of clearer regulations for Indian Insurers Bond Forwards, thereby safeguarding the financial health of the industry and maintaining public confidence.

Featured Posts

-

Nyt Strands Game 377 Solutions Saturday March 15 Answers

May 09, 2025

Nyt Strands Game 377 Solutions Saturday March 15 Answers

May 09, 2025 -

Is Daycare Harmful A Psychologists Claims And The Expert Response

May 09, 2025

Is Daycare Harmful A Psychologists Claims And The Expert Response

May 09, 2025 -

1509

May 09, 2025

1509

May 09, 2025 -

Gustave Eiffel Et Sa Mere Melanie L Histoire Meconnue De Dijon

May 09, 2025

Gustave Eiffel Et Sa Mere Melanie L Histoire Meconnue De Dijon

May 09, 2025 -

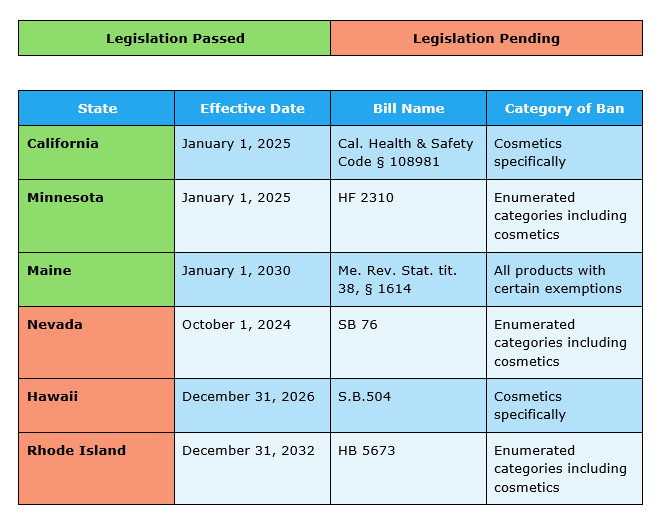

The Implications Of A Recent Ruling On Banned Chemicals Sold On E Bay

May 09, 2025

The Implications Of A Recent Ruling On Banned Chemicals Sold On E Bay

May 09, 2025