Can Palantir Reach A Trillion-Dollar Valuation By 2030?

Table of Contents

Palantir's Current Market Position and Growth Trajectory

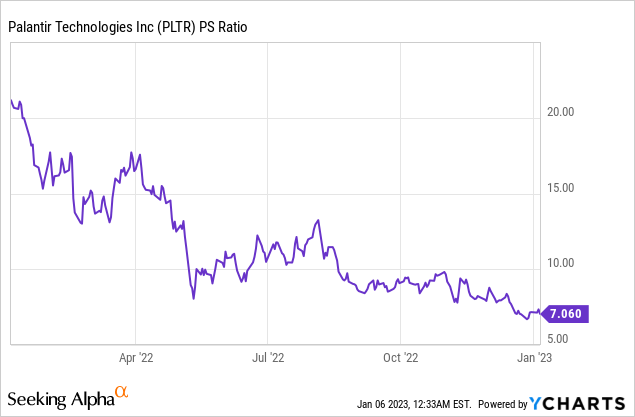

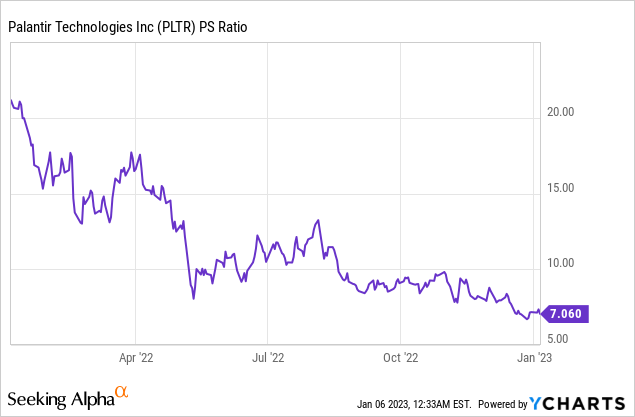

Palantir's current market position and future growth trajectory are crucial factors in determining its potential to reach a trillion-dollar valuation. Analyzing these aspects requires examining several key metrics and trends.

-

Current Market Capitalization and Revenue Growth: As of [Insert Current Date], Palantir's market capitalization stands at approximately [Insert Current Market Cap]. The company has demonstrated consistent year-over-year revenue growth, although the rate fluctuates. Understanding this growth rate’s sustainability is critical to predicting future valuation.

-

Key Products and Market Penetration: Palantir's flagship products, Gotham and Foundry, cater to distinct markets. Gotham, primarily used by government agencies for intelligence gathering and operational efficiency, boasts a significant portion of Palantir's revenue. Foundry, aimed at commercial clients, is experiencing strong growth as more businesses adopt data-driven decision-making. The penetration rate of these products in their respective markets will be a major indicator of future success.

-

Customer Base: Palantir's customer base includes a diverse range of government agencies and commercial organizations. Key government clients often represent large, long-term contracts, providing revenue stability. The commercial sector offers high growth potential but also faces higher competition.

-

Market Share: Palantir holds a significant market share in certain niche sectors like government intelligence and specific financial services applications. However, its share in the broader data analytics market is still developing. Gaining wider market share will be essential for achieving a trillion-dollar valuation.

-

Bullet Points:

- Current market capitalization: [Insert Current Market Cap]

- Year-over-year revenue growth rate: [Insert Current Growth Rate]

- Key government clients: [List prominent examples]

- Key commercial clients: [List prominent examples]

- Market share in government intelligence: [Insert estimated percentage]

- Market share in financial services: [Insert estimated percentage]

Competitive Landscape and Technological Advantages

Palantir operates in a highly competitive landscape, facing established players and disruptive startups alike. Understanding its competitive advantages is essential to evaluating its future prospects.

-

Main Competitors: Key competitors include Databricks, Snowflake, and other data analytics firms. These companies offer competing products and services, often focusing on specific niches within the broader data analytics market. Their strengths and weaknesses should be carefully considered.

-

Technological Advantages and USPs: Palantir distinguishes itself through its unique data integration and analytics capabilities. Its platforms are known for their ability to handle large, complex datasets from diverse sources, enabling advanced analytics and decision-making. This strength constitutes a crucial USP.

-

Disruptive Technologies: Emerging technologies, particularly advancements in AI and machine learning, pose both opportunities and threats. Palantir must adapt and integrate these technologies to maintain its competitive edge. Failure to do so could significantly impact its growth trajectory.

-

Data Security and Compliance: Palantir’s emphasis on robust data security and compliance with regulations is a significant competitive advantage, especially in sectors with stringent requirements.

-

Bullet Points:

- Direct competitors: Databricks, Snowflake, [List others]

- Palantir's USP: Advanced data integration and analytics

- Potential impact of AI/ML: Enhanced analytics capabilities, automation

- Data security and compliance certifications: [List relevant certifications]

Challenges and Risks to Reaching a Trillion-Dollar Valuation

Achieving a trillion-dollar valuation presents numerous challenges and risks for Palantir. Understanding these hurdles is crucial for a realistic assessment of its prospects.

-

Increased Competition: The data analytics market is highly competitive and continues to attract new entrants and innovations. Maintaining its market share and competitive advantage will be an ongoing challenge.

-

Economic Downturns: Economic recessions can significantly impact technology spending, potentially slowing Palantir's growth rate and impacting its valuation. The company's reliance on government contracts makes it particularly vulnerable to budgetary constraints.

-

Regulatory Hurdles: Navigating complex regulations, particularly in the government sector, poses ongoing risks. Compliance failures could result in significant financial and reputational damage.

-

Scalability: Palantir's ability to scale its operations to meet increasing demand while maintaining profitability is essential for sustained growth. Challenges related to infrastructure and personnel will need to be addressed.

-

Bullet Points:

- Economic factors: Recessionary pressures, reduced government spending

- Regulatory risks: Data privacy regulations, cybersecurity compliance

- Competitive threats: Innovation from competitors, market share erosion

- Scalability challenges: Expanding infrastructure, recruiting and retaining talent

Potential Catalysts for Achieving a Trillion-Dollar Valuation

Several factors could act as catalysts, propelling Palantir towards a trillion-dollar valuation. These potential drivers need to be closely monitored.

-

Expansion into New Markets: Diversification into new market segments, such as healthcare, manufacturing, or supply chain management, could significantly boost revenue and valuation.

-

Product Diversification: Developing and launching innovative new products and services that complement its existing offerings could expand its market reach and address unmet needs.

-

Strategic Partnerships: Forming strategic alliances with major technology players or industry leaders could enhance Palantir's market reach and capabilities.

-

Successful Acquisitions: Carefully chosen acquisitions of companies with complementary technologies or expertise could enhance Palantir's capabilities and accelerate its growth.

-

Bullet Points:

- New market expansion: Healthcare, supply chain, manufacturing

- New product development: AI-powered solutions, advanced analytics tools

- Strategic partnerships: Cloud providers, enterprise software companies

- Successful acquisitions: Companies with complementary technologies

Conclusion

This analysis of Palantir's potential to reach a trillion-dollar valuation by 2030 reveals a complex picture. While the company possesses significant strengths, including cutting-edge technology and a strong customer base, it also faces substantial challenges, including intense competition and economic uncertainty. Reaching such a lofty valuation requires sustained high growth, successful navigation of market risks, and the realization of several key catalysts.

Whether you believe Palantir can achieve this ambitious goal or not, the future of this data analytics giant is undoubtedly worth following. Stay informed on the latest developments in Palantir's journey towards a trillion-dollar valuation by continuing to research the company and its performance. Keywords: Palantir stock analysis, Palantir future, Palantir investment, Palantir growth potential.

Featured Posts

-

Palantirs Potential Can It Achieve A Trillion Dollar Valuation By The End Of The Decade

May 09, 2025

Palantirs Potential Can It Achieve A Trillion Dollar Valuation By The End Of The Decade

May 09, 2025 -

Is This Underrated Character The Perfect Season 2 Victim High Potential

May 09, 2025

Is This Underrated Character The Perfect Season 2 Victim High Potential

May 09, 2025 -

Celebrity Antiques Road Trip How To Participate And Become A Part Of The Action

May 09, 2025

Celebrity Antiques Road Trip How To Participate And Become A Part Of The Action

May 09, 2025 -

Preview Bayern Munich Vs Fc St Pauli Form Team News And Prediction

May 09, 2025

Preview Bayern Munich Vs Fc St Pauli Form Team News And Prediction

May 09, 2025 -

El Salvador Prison Transfers Jeanine Pirros Stance On Due Process Rights

May 09, 2025

El Salvador Prison Transfers Jeanine Pirros Stance On Due Process Rights

May 09, 2025