Canada Facing Ultra-Low Economic Growth: Expert Analysis And Implications

Table of Contents

Causes of Ultra-Low Economic Growth in Canada

Several intertwined factors contribute to Canada's current economic slowdown. These can be broadly categorized into global headwinds, domestic economic challenges, and the impact of government policy.

Global Economic Headwinds

The global economy is facing significant headwinds that directly impact Canada. High inflation, fueled by supply chain disruptions and increased energy prices following the war in Ukraine, has squeezed consumer spending and dampened business investment. Rising interest rates implemented by central banks globally, including the Bank of Canada, aim to curb inflation but also risk slowing economic growth further. These global factors contribute significantly to the ultra-low economic growth in Canada. Keywords: global recession, inflation impact Canada, supply chain bottlenecks.

- Inflationary pressures: Soaring prices for essential goods and services are eroding purchasing power, impacting consumer spending and overall economic activity.

- Supply chain disruptions: Ongoing global supply chain bottlenecks continue to constrain production and increase input costs for businesses.

- Geopolitical instability: The war in Ukraine and other geopolitical uncertainties contribute to market volatility and investor uncertainty, hindering investment and growth.

Domestic Economic Challenges

Beyond global factors, Canada faces several internal economic challenges. The housing market slowdown, characterized by reduced sales and price corrections in several major cities, is a significant contributor. High levels of consumer debt, accumulated over years of low-interest rates, are leaving many Canadians vulnerable to rising borrowing costs. Furthermore, persistent labor shortages in various sectors are hindering productivity and economic expansion. Keywords: Canadian housing market, consumer debt Canada, labor market Canada.

- Housing market correction: The cooling Canadian housing market is impacting construction activity and consumer wealth.

- High consumer debt: Elevated household debt levels limit consumer spending and increase vulnerability to rising interest rates.

- Labor shortages: Difficulties in filling vacant positions in key sectors are constraining economic growth.

Government Policy and its Impact

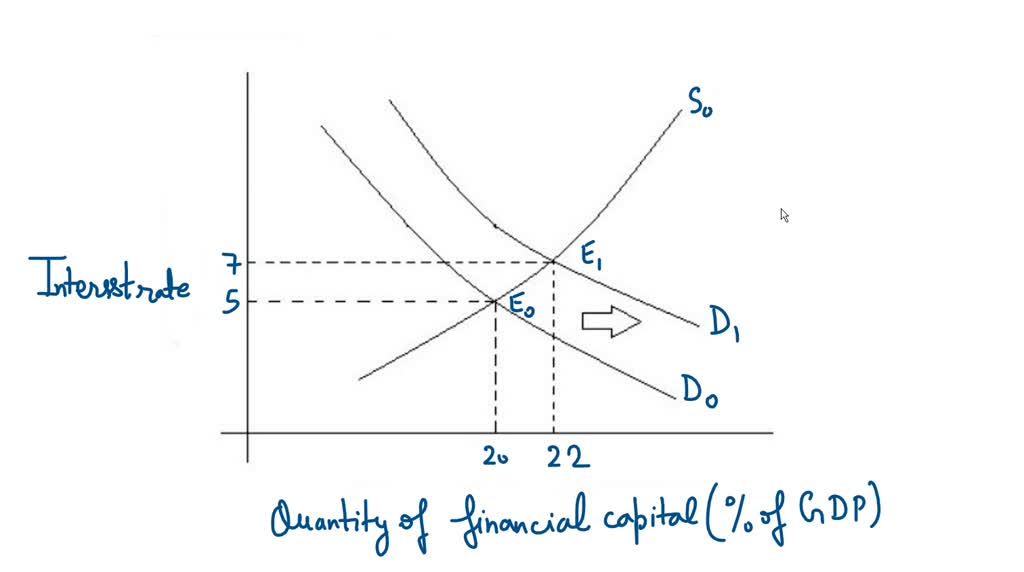

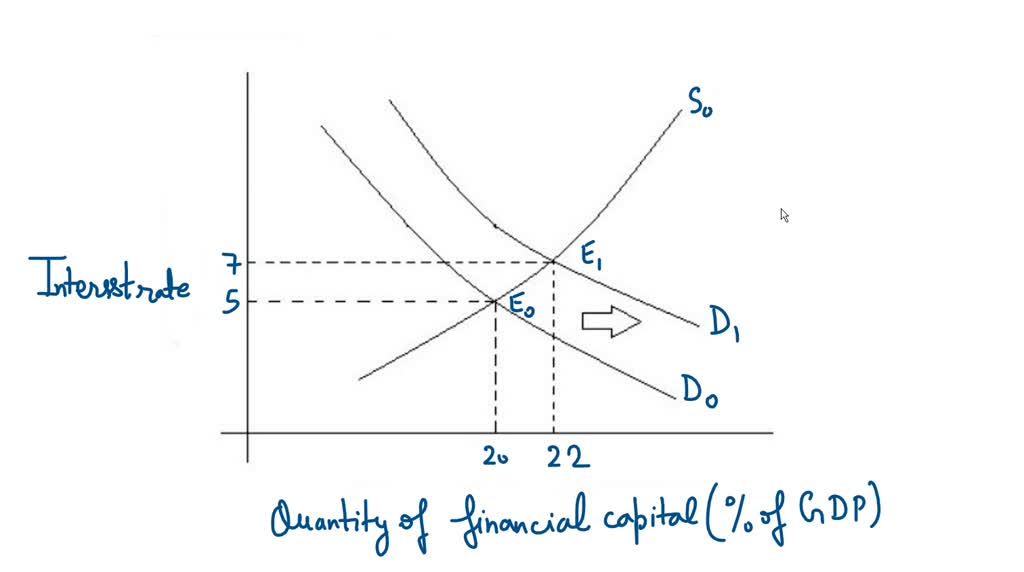

The effectiveness of current government economic policies in addressing ultra-low economic growth in Canada is a subject of ongoing debate. Fiscal policies, such as government spending and taxation, aim to stimulate economic activity, while monetary policies, primarily controlled by the Bank of Canada through interest rate adjustments, influence inflation and borrowing costs. The delicate balance between supporting growth and controlling inflation is crucial. Keywords: Bank of Canada interest rates, Canadian government economic policy.

- Fiscal policy effectiveness: The impact of government spending programs on stimulating economic growth needs continued evaluation.

- Monetary policy tightening: The Bank of Canada's interest rate hikes aim to control inflation but risk slowing economic growth further.

Implications of Ultra-Low Economic Growth in Canada

The prolonged period of ultra-low economic growth in Canada has significant implications across various sectors.

Impact on Employment

Slower economic growth translates into weaker job creation and, in some sectors, potential job losses. Industries particularly vulnerable include those sensitive to interest rate changes, consumer spending, and global demand fluctuations. Keywords: Canadian unemployment rate, job market Canada.

- Reduced job creation: Slow economic growth limits the number of new jobs created, impacting employment rates.

- Sectoral job losses: Certain sectors may experience job cuts as businesses adjust to slower economic activity.

Effect on Consumer Spending and Confidence

Reduced economic growth directly impacts consumer spending and confidence. With inflation eroding purchasing power and uncertainty about the future, consumers may become more cautious, reducing their spending and impacting overall economic activity. Keywords: consumer confidence Canada, retail sales Canada.

- Decreased consumer spending: Falling consumer confidence leads to reduced spending, further dampening economic growth.

- Weakened retail sales: Lower consumer spending translates into reduced sales for businesses, affecting profitability and investment.

Government Budget and Deficit Implications

Sustained ultra-low economic growth puts strain on government finances. Lower tax revenues and increased demand for social programs can widen the budget deficit and increase the national debt. Keywords: Canadian government budget, national debt Canada.

- Reduced tax revenue: Slower economic activity leads to lower tax revenue for the government.

- Increased demand for social programs: Economic hardship can increase demand for government support programs.

Expert Opinions and Predictions for Canada's Economic Future

Leading economists offer diverse perspectives on Canada's economic outlook. Some express cautious optimism, highlighting the resilience of the Canadian economy and potential for recovery. Others warn of a prolonged period of slow growth or even a potential recession. Analyzing these varied predictions provides a more comprehensive understanding of the potential scenarios facing Canada. Keywords: economic forecast Canada, Canadian economic outlook.

- Optimistic scenarios: These forecasts highlight potential for recovery driven by factors such as strong commodity prices and government stimulus measures.

- Pessimistic scenarios: These scenarios point to prolonged slow growth or even a recession, citing factors like high inflation and global uncertainty.

- Most likely scenarios: Many experts predict a period of moderate growth with persistent challenges related to inflation and global instability.

Navigating Ultra-Low Economic Growth in Canada: A Call to Action

Understanding the challenges of ultra-low economic growth in Canada is crucial for navigating the current economic landscape. The interplay of global headwinds, domestic challenges, and government policy has created a complex economic environment. Individuals, businesses, and the government must adapt their strategies to mitigate the impact of this slow growth. Staying informed about the latest economic developments and following expert analyses is essential for making informed decisions. Proactive financial planning, diversification of investments, and responsible budgeting are crucial steps for individuals. Businesses need to adapt their strategies to navigate challenges, focusing on efficiency and innovation. The government needs to implement policies that promote sustainable economic growth while addressing inflationary pressures. Understanding the implications of ultra-low economic growth in Canada is a crucial step towards building a resilient and prosperous future.

Featured Posts

-

Join The Sony Play Station Beta Program Details And Sign Up

May 03, 2025

Join The Sony Play Station Beta Program Details And Sign Up

May 03, 2025 -

M M A 600

May 03, 2025

M M A 600

May 03, 2025 -

Poppy Atkinson Manchester United And Bayern Munichs Moving Tribute

May 03, 2025

Poppy Atkinson Manchester United And Bayern Munichs Moving Tribute

May 03, 2025 -

Belgiums Energy Transition Funding A 270 M Wh Bess Project In A Competitive Market

May 03, 2025

Belgiums Energy Transition Funding A 270 M Wh Bess Project In A Competitive Market

May 03, 2025 -

Fans Accuse Christina Aguilera Of Heavy Photoshopping In Recent Photoshoot

May 03, 2025

Fans Accuse Christina Aguilera Of Heavy Photoshopping In Recent Photoshoot

May 03, 2025

Macron Et L Etat Palestinien Netanyahu Denonce Une Grave Erreur

Macron Et L Etat Palestinien Netanyahu Denonce Une Grave Erreur

Netanyahu Critique La Position De Macron Sur L Etat Palestinien

Netanyahu Critique La Position De Macron Sur L Etat Palestinien