Canada's Economic Outlook: OECD Predicts No Recession, But Weak Growth In 2025

Table of Contents

Global Economic Headwinds and Their Impact on Canada

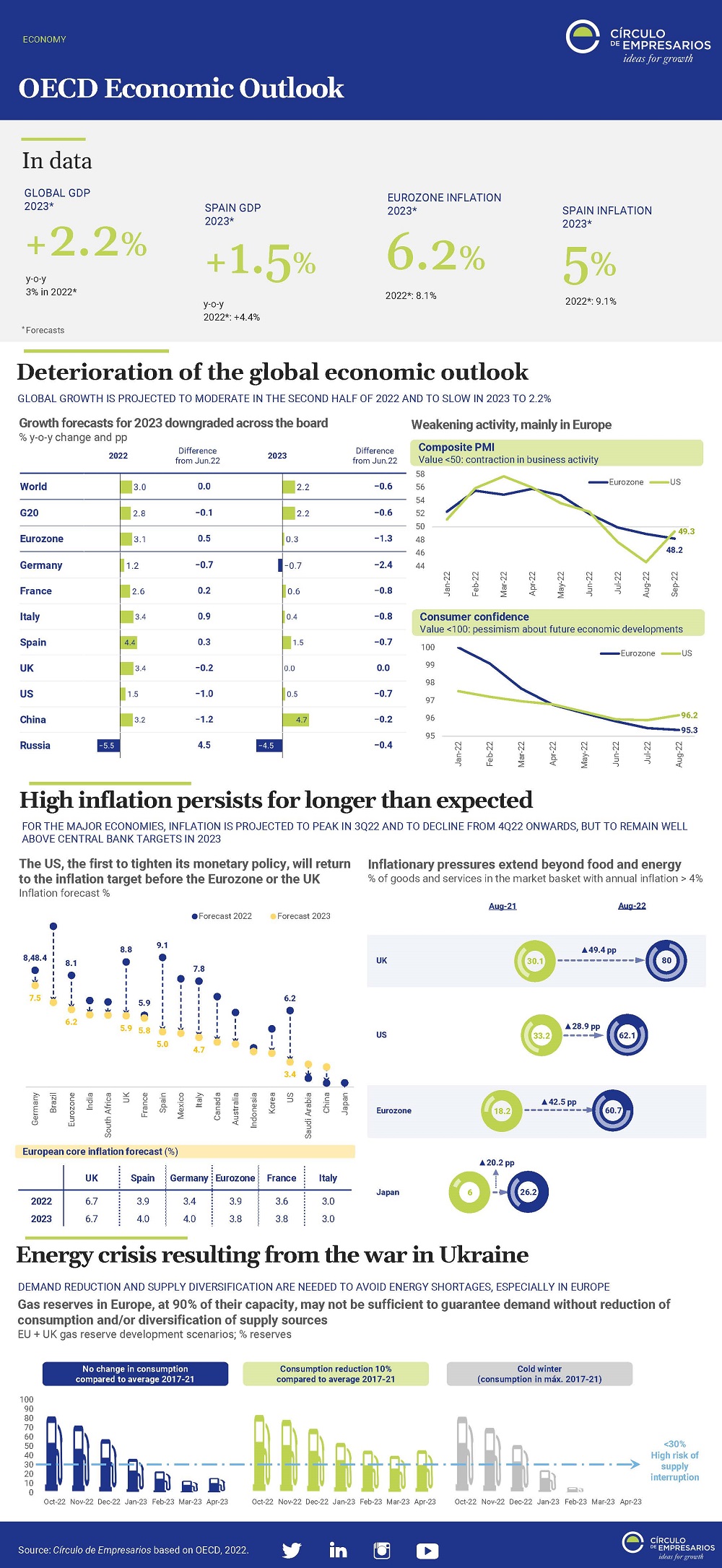

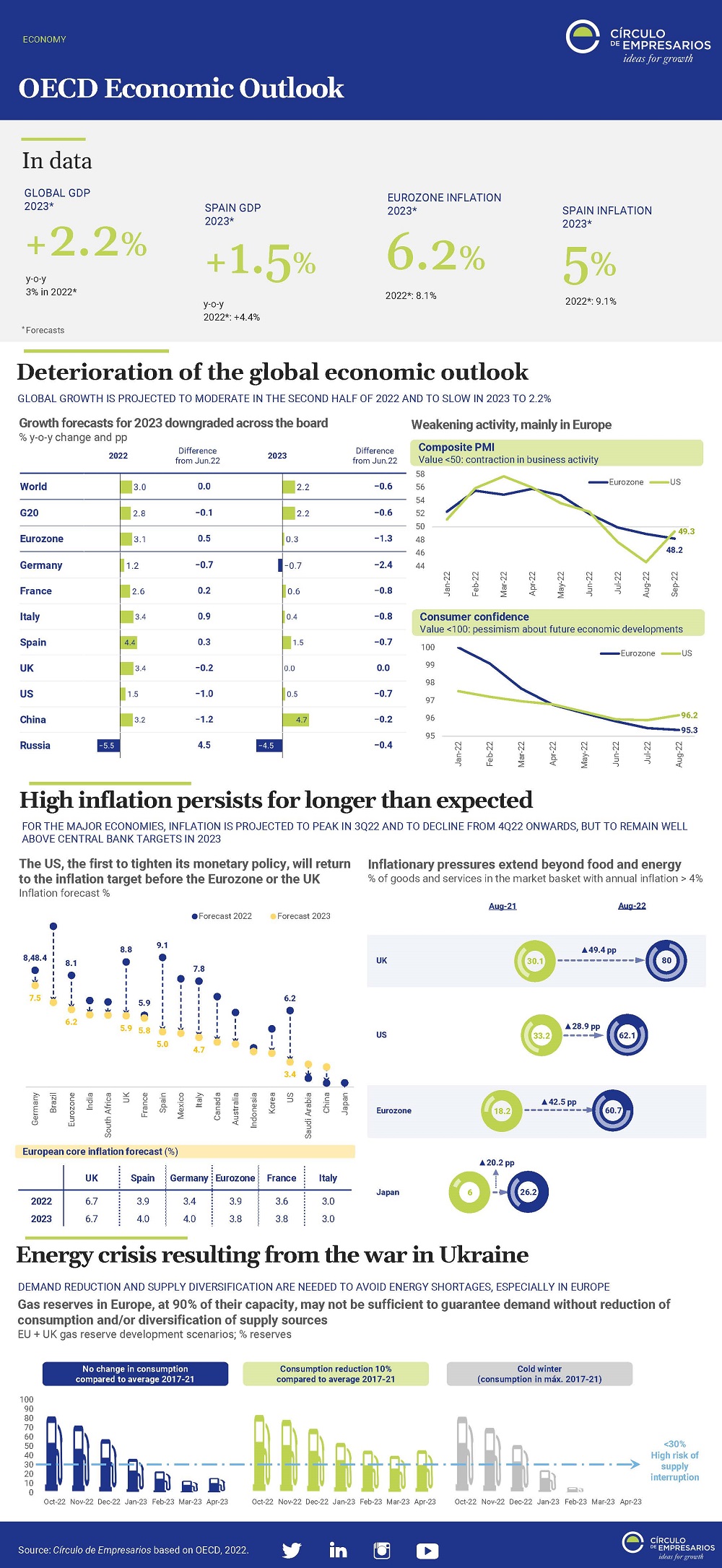

Global economic conditions significantly influence Canada's economic performance. Several headwinds threaten to dampen growth in 2025. The interconnected nature of the global economy means that challenges originating elsewhere directly impact Canadian businesses and consumers.

-

Impact of global inflation on Canadian consumer prices: Persistently high inflation worldwide continues to exert upward pressure on the cost of imported goods, impacting Canadian consumer prices and potentially reducing consumer spending. This inflationary environment necessitates careful management by the Bank of Canada to avoid a wage-price spiral.

-

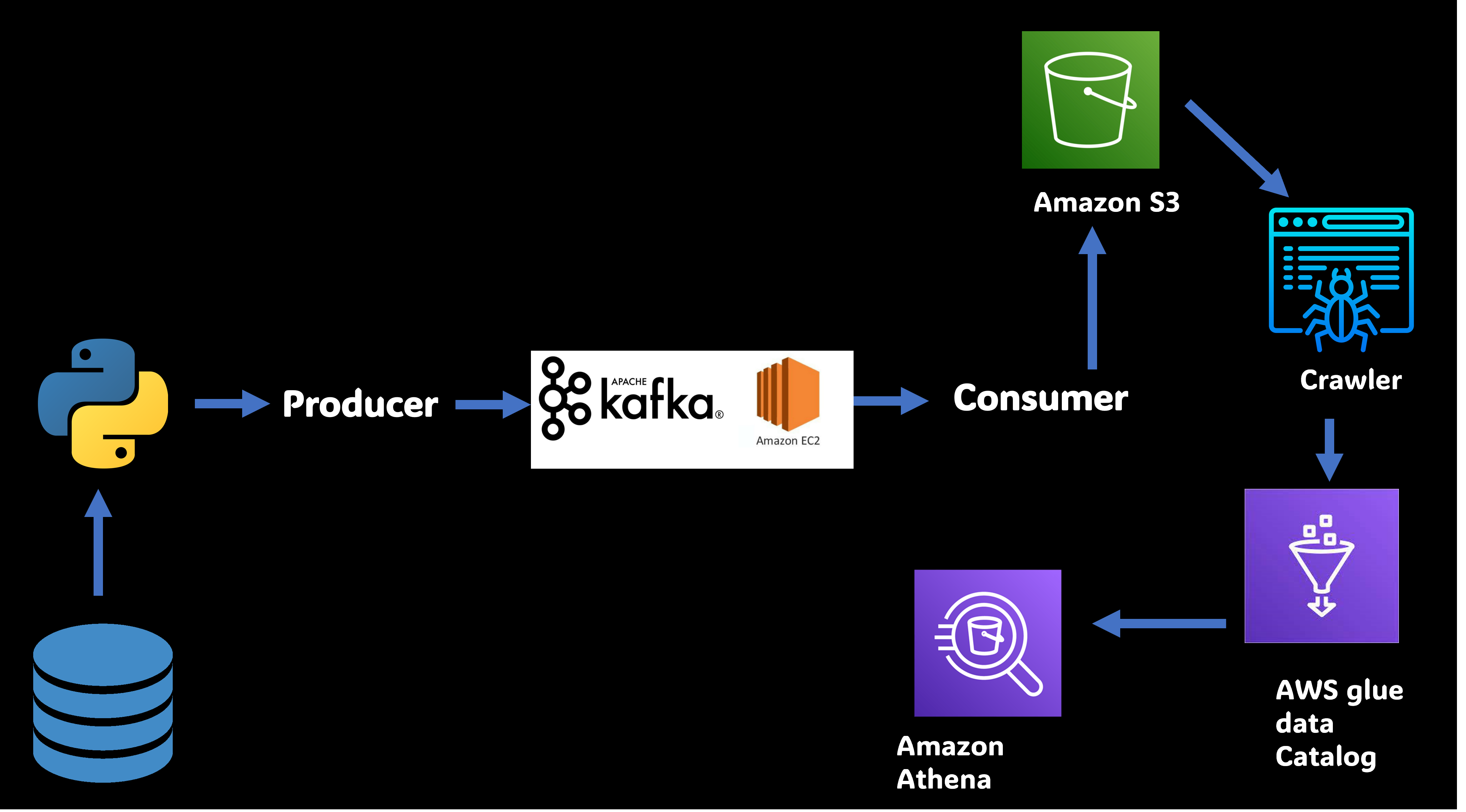

Effect of supply chain issues on Canadian businesses: Ongoing supply chain disruptions, exacerbated by geopolitical instability, create uncertainty and increase costs for Canadian businesses. Delays in receiving essential materials and components impact production schedules and profitability.

-

Geopolitical risks and their influence on Canadian trade and investment: The war in Ukraine, for example, has significantly impacted energy prices, creating volatility in global markets and affecting Canadian energy exports and imports. Other geopolitical uncertainties also contribute to risk aversion and reduced investment.

-

The ripple effect of the global economic slowdown: A global economic slowdown, even if moderate, inevitably impacts Canadian exports and economic activity, particularly in sectors heavily reliant on international trade.

Domestic Economic Factors Shaping Canada's 2025 Forecast

Beyond global factors, several domestic issues contribute to the OECD's prediction of weak growth for Canada in 2025. These internal economic dynamics significantly influence the country's overall trajectory.

-

Impact of interest rate hikes by the Bank of Canada: The Bank of Canada's efforts to combat inflation through interest rate hikes have a direct impact on borrowing costs for businesses and consumers. Higher interest rates can cool down economic activity, affecting investment and consumer spending.

-

State of the Canadian housing market and its influence on the economy: The Canadian housing market's performance is a crucial economic indicator. A cooling housing market, characterized by decreased prices and sales, can negatively impact consumer confidence and overall economic growth.

-

Performance of key Canadian economic sectors (e.g., manufacturing, resources): The health of key sectors, such as manufacturing and natural resources, significantly determines Canada's overall economic performance. Challenges within these sectors can ripple throughout the economy.

-

Employment trends and their effect on consumer spending: Employment levels directly influence consumer spending, a major driver of economic growth. High unemployment or a slowing job market can reduce consumer confidence and spending.

The OECD's 2025 Growth Prediction: A Detailed Analysis

The OECD's prediction of weak growth, but no recession, for Canada in 2025 is based on a comprehensive analysis of various economic indicators and assumptions. Their report offers a nuanced perspective on the country's economic prospects.

-

Key assumptions made by the OECD in their forecast: The OECD's forecast relies on several key assumptions, including the projected trajectory of global inflation, the resilience of the Canadian labor market, and the pace of government spending.

-

Potential upside and downside risks to their prediction: The OECD acknowledges both upside and downside risks to its prediction. Positive surprises, such as faster-than-expected global growth, could lead to stronger-than-predicted performance. Conversely, unforeseen shocks, such as a sharper-than-expected global recession, could significantly impact Canada.

-

Comparison with predictions from other economic organizations: It's important to compare the OECD's prediction with those of other reputable organizations like the International Monetary Fund (IMF) to gain a more comprehensive understanding of the range of potential outcomes.

-

Specific numerical predictions from the OECD report (e.g., GDP growth rate): The OECD report will likely include specific numerical predictions regarding Canada's GDP growth rate for 2025, offering a quantitative assessment of the expected economic performance.

Potential Mitigation Strategies and Policy Responses

The Canadian government can implement various policies to mitigate potential risks and stimulate economic growth. These strategies play a crucial role in shaping the country's economic trajectory.

-

Government spending plans and their effect on the economy: Government spending on infrastructure projects and social programs can provide a significant stimulus to the economy, boosting demand and creating jobs.

-

Potential changes to fiscal or monetary policies: Adjustments to fiscal policy (government spending and taxation) and monetary policy (interest rates) can be used to influence economic activity. Careful calibration is crucial to avoid unintended consequences.

-

Role of innovation and technological advancements in driving growth: Investing in innovation and technological advancements is vital for long-term economic growth. Support for research and development can create new industries and increase productivity.

-

Strategies to address specific challenges (e.g., housing affordability, inflation): Targeted policies addressing specific challenges, such as housing affordability and inflation, are needed to create a more sustainable and equitable economic environment.

Conclusion: Understanding Canada's Economic Outlook for 2025

The OECD's 2025 forecast for Canada's economy indicates weak growth, but no recession. This outlook is shaped by a complex interplay of global and domestic factors, including persistent inflation, supply chain disruptions, interest rate hikes, and the performance of key economic sectors. While the prediction offers a degree of reassurance, vigilance is crucial. Staying updated on Canada's economic outlook is essential for businesses and investors to make informed decisions. Closely follow the 2025 economic forecast and the ongoing analysis from the OECD and other reliable sources to understand Canada's economic future and adapt your strategies accordingly. Understanding Canada's economic future is critical for navigating the complexities of the coming year.

Featured Posts

-

Inside Kyle Stowers Journal Insights Into His Marlins Success

May 28, 2025

Inside Kyle Stowers Journal Insights Into His Marlins Success

May 28, 2025 -

Padres Aim To Secure Victory Over Rockies

May 28, 2025

Padres Aim To Secure Victory Over Rockies

May 28, 2025 -

Real Time Stock Market Data Dow S And P 500 And Nasdaq For May 27

May 28, 2025

Real Time Stock Market Data Dow S And P 500 And Nasdaq For May 27

May 28, 2025 -

Dodgers Diamondbacks Prediction Mlb Picks And Odds For Tonights Matchup

May 28, 2025

Dodgers Diamondbacks Prediction Mlb Picks And Odds For Tonights Matchup

May 28, 2025 -

Cherkis Lyon Future Uncertain Amidst Liverpool Transfer Links

May 28, 2025

Cherkis Lyon Future Uncertain Amidst Liverpool Transfer Links

May 28, 2025

Latest Posts

-

Rezkiy Rost Zabolevaemosti Koryu V Mongolii

May 30, 2025

Rezkiy Rost Zabolevaemosti Koryu V Mongolii

May 30, 2025 -

V Mongolii Vspyshka Kori Ekstrennaya Pomosch Peregruzhena

May 30, 2025

V Mongolii Vspyshka Kori Ekstrennaya Pomosch Peregruzhena

May 30, 2025 -

Exclusive Bts Begin Recording Their New Album This Summer

May 30, 2025

Exclusive Bts Begin Recording Their New Album This Summer

May 30, 2025 -

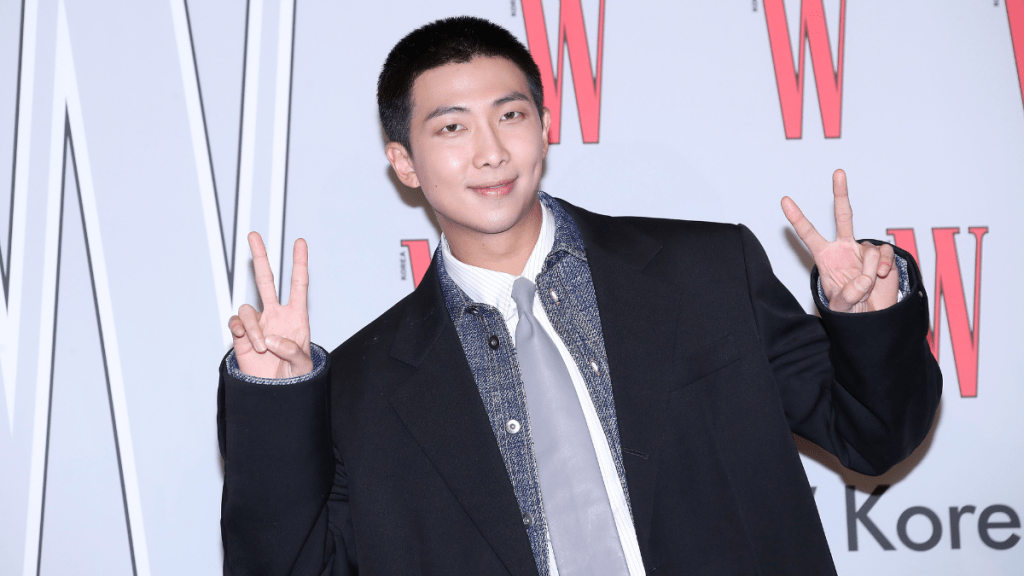

Rm Bts Nominasi Amas 2025 Kolaborasi Baru Dengan Tablo

May 30, 2025

Rm Bts Nominasi Amas 2025 Kolaborasi Baru Dengan Tablo

May 30, 2025 -

Bts New Album Summer Recording Confirmed Exclusive Details

May 30, 2025

Bts New Album Summer Recording Confirmed Exclusive Details

May 30, 2025