Canada's Economic Slowdown: Posthaste Analysis And Predictions

Table of Contents

Rising Inflation and Interest Rates: A Double-Edged Sword

Persistent inflation, exceeding the Bank of Canada's target rate, is a major contributor to Canada's economic slowdown. To combat this, the Bank of Canada has implemented aggressive interest rate hikes. While aiming to curb inflation, these hikes have a significant downside: increased borrowing costs. This directly impacts consumer spending and investment, two key drivers of economic growth.

-

Persistent inflation exceeding the Bank of Canada's target rate: Inflation in Canada has remained stubbornly high, eroding purchasing power and dampening consumer confidence. This necessitates further scrutiny of the underlying causes of inflation, such as supply chain disruptions and global energy prices.

-

Aggressive interest rate hikes impacting borrowing costs: The Bank of Canada's monetary policy, characterized by successive interest rate increases, aims to cool down the economy and bring inflation under control. However, higher interest rates translate to more expensive mortgages, loans, and credit, leading to reduced consumer spending and business investment.

-

Reduced consumer spending and investment due to higher interest rates: As borrowing becomes more expensive, consumers are likely to postpone major purchases like houses and cars, while businesses may delay expansion plans. This ripple effect weakens overall economic activity.

-

Analysis of the effectiveness of current monetary policy: The effectiveness of the Bank of Canada's monetary policy in curbing inflation without triggering a sharp economic contraction remains a subject of ongoing debate and analysis. The lag effect of monetary policy makes accurate prediction challenging.

-

Potential for a further increase in interest rates and its consequences: The possibility of further interest rate hikes hangs over the Canadian economy. While necessary to control inflation, such increases could deepen the economic slowdown and potentially lead to a recession. Careful monitoring of economic indicators is crucial to inform future decisions.

Global Economic Headwinds: Impact on Canadian Exports

Canada's economy is significantly reliant on exports, making it vulnerable to global economic fluctuations. The current slowdown in global economic growth is directly impacting demand for Canadian exports, particularly in resource-heavy sectors. Geopolitical instability and ongoing trade tensions further exacerbate this challenge.

-

Slowdown in global economic growth impacting demand for Canadian exports: Reduced global demand means lower export revenues for Canadian businesses, affecting employment and overall economic output. This is particularly true for commodity-dependent sectors.

-

The impact of geopolitical instability and trade tensions on Canadian trade: Events such as the war in Ukraine and ongoing trade disputes create uncertainty and disrupt global supply chains, negatively impacting Canadian exports and creating volatility in commodity prices.

-

Analysis of the vulnerability of specific Canadian export sectors: Certain sectors, such as energy, agriculture, and forestry, are particularly exposed to global economic headwinds and price fluctuations. A diversified export strategy is crucial to mitigate risk.

-

Exploration of potential diversification strategies for Canadian businesses: Canadian businesses need to actively pursue diversification strategies, exploring new markets and developing new products to reduce their reliance on specific export destinations or commodities.

-

Discussion of the role of supply chain disruptions in impacting exports: Ongoing supply chain disruptions, partly stemming from the pandemic and geopolitical factors, continue to hamper exports and increase production costs for Canadian businesses.

Housing Market Correction: A Significant Economic Factor

The Canadian housing market, a key driver of economic activity, is undergoing a significant correction. Declining housing prices and sales activity are impacting consumer wealth and confidence, contributing to the overall economic slowdown.

-

Significant decrease in housing prices and sales activity across Canada: Higher interest rates are the primary factor behind the cooling housing market. Affordability has drastically decreased, leading to reduced demand.

-

The impact of higher interest rates on mortgage affordability: Higher interest rates have significantly increased mortgage payments, making homeownership less attainable for many Canadians, reducing demand and impacting house prices.

-

Analysis of the impact on consumer wealth and overall economic confidence: The decline in house prices is impacting consumer wealth, leading to reduced confidence and potentially lower spending. This further contributes to the economic slowdown.

-

Potential for further declines in the housing market and ripple effects: The possibility of further price declines remains, potentially leading to a deeper correction and further impacting the economy.

-

Discussion on government policies aimed at stabilizing the market: Government policies are being debated to address the challenges in the housing market, including measures to improve affordability and prevent a more severe correction.

Labour Market Dynamics: A Mixed Picture

While the Canadian unemployment rate remains relatively low, certain sectors are experiencing job losses or slower job growth. This mixed picture requires a nuanced understanding of current labour market dynamics.

-

Examination of current unemployment rates and job creation figures: While unemployment remains low, job creation has slowed, indicating a weakening labour market.

-

Analysis of sector-specific employment trends: Certain sectors, particularly those sensitive to interest rate hikes, are experiencing layoffs or slower hiring.

-

Discussion on the potential impact of automation and technological advancements: Automation and technological advancements are transforming the labour market, requiring workforce adaptation and potentially leading to job displacement in certain sectors.

-

Addressing the skills gap and its implications for future economic growth: A skills gap exists in several sectors, hampering economic growth and requiring investment in education and training.

-

Assessing the impact of immigration on the Canadian labor market: Immigration plays a significant role in the Canadian labour market, but effective integration and skills matching are crucial to maximize its positive contributions.

Conclusion

This analysis highlights the complex interplay of factors contributing to Canada's economic slowdown, including inflation, global uncertainties, a housing market correction, and labour market dynamics. While the outlook presents challenges, it's not without opportunities for strategic adaptation and growth. Understanding Canada's economic slowdown is crucial for businesses and individuals alike. Stay informed about the latest developments and adapt your strategies accordingly. Continue to monitor the evolving situation and consult reliable sources for further analysis on Canada's economic outlook and predictions. For in-depth insights and expert forecasts, explore further resources on Canada's economic slowdown.

Featured Posts

-

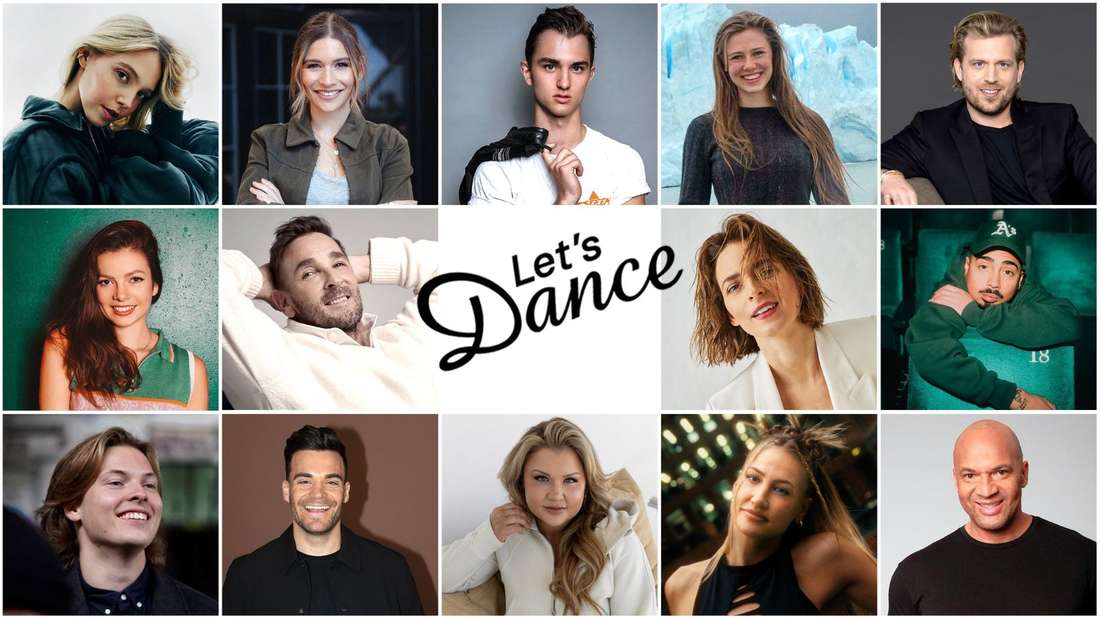

Die 50 Teilnehmer Sendetermine Stream And Mehr 2025

Apr 23, 2025

Die 50 Teilnehmer Sendetermine Stream And Mehr 2025

Apr 23, 2025 -

Vetrine Spaccate La Protesta Di 200 Persone Contro L Attacco Ai Ristoranti Palestinesi

Apr 23, 2025

Vetrine Spaccate La Protesta Di 200 Persone Contro L Attacco Ai Ristoranti Palestinesi

Apr 23, 2025 -

Ice Blocks Father From Meeting Newborn Son Mahmoud Khalils Case

Apr 23, 2025

Ice Blocks Father From Meeting Newborn Son Mahmoud Khalils Case

Apr 23, 2025 -

Uskrs I Uskrsni Ponedjeljak Popis Otvorenih Trgovina

Apr 23, 2025

Uskrs I Uskrsni Ponedjeljak Popis Otvorenih Trgovina

Apr 23, 2025 -

Milwaukee Brewers Defeat Chicago Cubs 9 7 In Windy Conditions

Apr 23, 2025

Milwaukee Brewers Defeat Chicago Cubs 9 7 In Windy Conditions

Apr 23, 2025