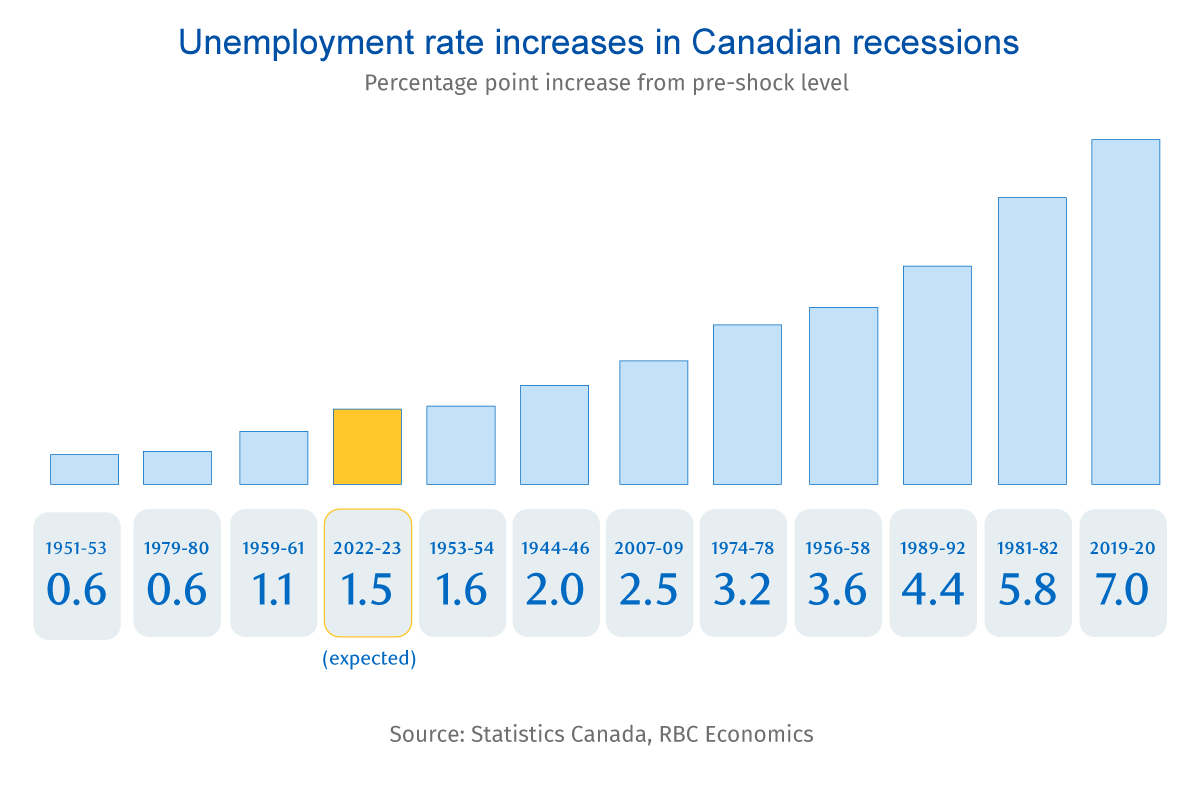

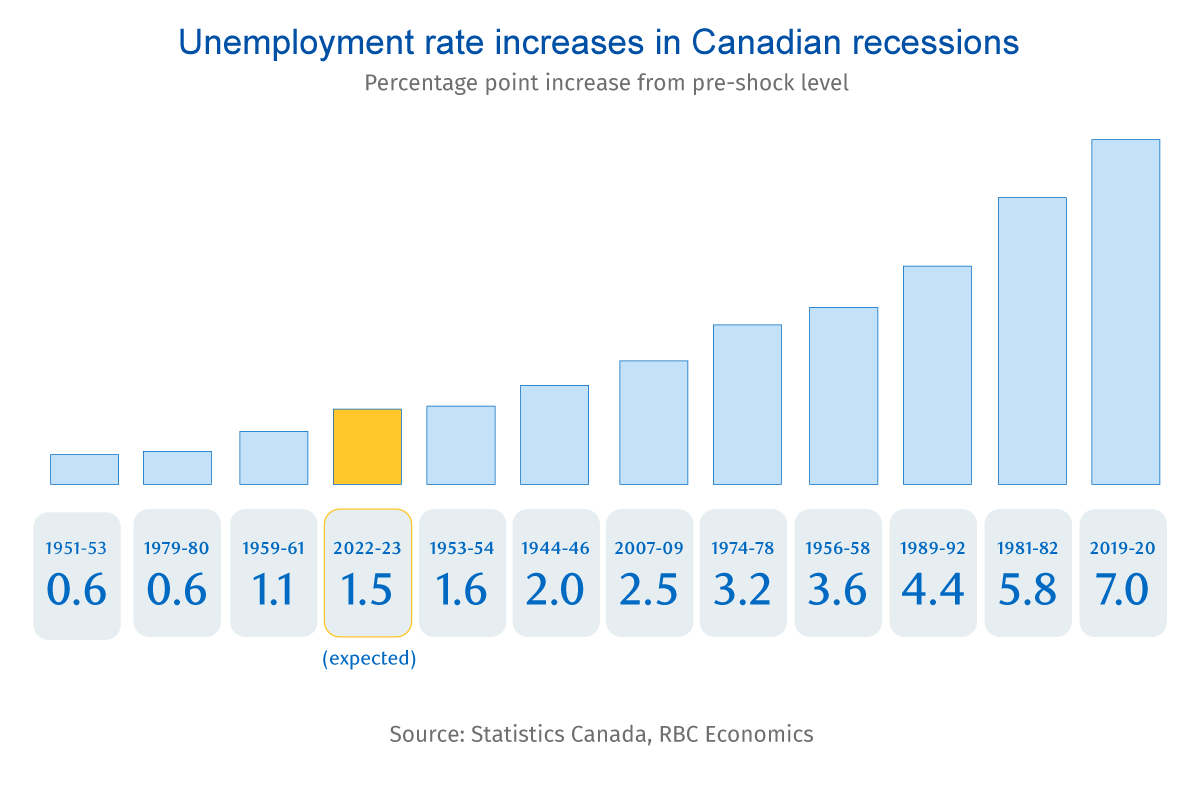

Canada's Economy: Deeper Recession Predicted Despite Lower Tariffs

Table of Contents

Weakening Global Demand Impacts Canadian Exports

Reduced global trade is significantly impacting Canadian exports, particularly in key sectors like natural resources and automobiles. This weakening global demand is a major contributor to the concerns of a deeper recession.

Reduced Global Trade

- Decline in demand from major trading partners: The United States, China, and the European Union represent significant export markets for Canada. A slowdown in these economies directly translates to reduced demand for Canadian goods and services. This is especially true for resource-based industries like forestry and mining which rely heavily on exports.

- Impact on commodity prices: Decreased global demand leads to lower prices for commodities like oil, lumber, and metals, directly affecting the profitability of Canadian producers and impacting overall economic growth. Fluctuations in these prices are a key factor affecting Canada's economy's stability.

- Effect on manufacturing and resource extraction industries: These sectors are particularly vulnerable to reduced global trade. Job losses and production cutbacks are likely consequences, further dampening economic activity and impacting Canada's GDP. Recent data shows a significant decline in manufacturing output, reflecting this trend.

Supply Chain Disruptions

Lingering supply chain issues continue to plague Canadian businesses, adding another layer of complexity to the economic challenges. These disruptions amplify the impact of weakening global demand.

- Increased transportation costs: Global supply chain bottlenecks have led to significantly higher transportation costs, increasing the price of goods and reducing profit margins for businesses. This inflationary pressure further complicates economic recovery efforts.

- Material shortages: Businesses are facing shortages of essential raw materials and components, leading to production delays and impacting their ability to meet consumer demand. The automotive sector, for example, has been severely affected by microchip shortages.

- Production delays: Supply chain disruptions are resulting in significant production delays across various industries, impacting both domestic and export markets. This directly affects economic output and contributes to the predicted recession.

High Interest Rates and Inflationary Pressures

The Bank of Canada's aggressive response to inflation through interest rate hikes is impacting borrowing costs and consumer spending, exacerbating the economic slowdown. The effects of Canada's monetary policy are rippling across the economy.

The Bank of Canada's Response

- Rising mortgage rates: Increased interest rates have led to significantly higher mortgage payments, reducing the disposable income of homeowners and dampening consumer spending. This affects the housing market and broader consumer confidence.

- Decreased consumer confidence: The combination of high inflation and rising interest rates has eroded consumer confidence, leading to reduced spending and investment. This is a key indicator of the economic downturn.

- Impact on housing market: The housing market, a significant driver of economic activity, is showing signs of cooling down as a result of higher mortgage rates and reduced affordability. This slowdown impacts related industries like construction and real estate. Data shows that house prices are declining in several major Canadian cities.

Impact on Household Debt

High interest rates are placing considerable strain on Canadian households already burdened with significant levels of debt.

- Increased debt servicing costs: Higher interest rates mean increased debt servicing costs, reducing disposable income and further limiting consumer spending. This could lead to a dangerous cycle of debt.

- Reduced disposable income: The squeeze on disposable income is limiting consumer spending and impacting the overall demand for goods and services, further depressing economic activity.

- Potential for defaults: As debt servicing costs rise, the risk of defaults on mortgages and other loans increases, potentially destabilizing the financial system. This is a major concern for economists monitoring Canada's economy. The level of household debt-to-income ratio is a crucial metric to watch.

The Limited Effectiveness of Lower Tariffs

While the Canadian government has implemented tariff reductions, their impact on mitigating the predicted recession is likely to be limited given the magnitude of other economic challenges. This highlights the need for a more comprehensive strategy.

Tariff Reductions and Their Impact

- Sectors benefiting from tariff reductions: Certain sectors, particularly those involved in import-export activities, may experience some short-term relief from lower tariffs. However, the benefits are likely to be overshadowed by the broader economic slowdown.

- Limited impact due to global slowdown: The global economic slowdown is a more significant factor affecting Canada's economy than tariff levels. Lower tariffs alone cannot offset the impact of weak global demand.

- Long-term vs. short-term effects: While tariff reductions might offer some long-term benefits, their impact on the current economic downturn is likely to be minimal. The short-term focus should be on addressing the immediate concerns. Specific examples of tariff changes and their predicted short-term economic impact should be analyzed carefully.

Other Necessary Economic Policies

To mitigate the predicted recession, the Canadian government needs to consider implementing additional economic policies beyond tariff reductions.

- Government spending initiatives: Targeted government spending on infrastructure projects and social programs can stimulate economic activity and provide support for vulnerable populations. This could offset some of the negative impact of the recession.

- Social support programs: Enhanced social support programs are vital to provide a safety net for those most affected by the economic downturn and protect consumer spending.

- Investment in infrastructure: Significant investments in infrastructure projects can create jobs, boost economic activity, and enhance Canada's long-term economic prospects. This is a key aspect of fiscal policy that can assist Canada's economy.

Conclusion

Despite the introduction of lower tariffs, Canada's economy faces significant challenges, including weakening global demand, high interest rates, and persistent inflationary pressures. These factors point towards a potentially deeper recession than initially anticipated. The limited impact of tariff reductions underscores the need for a more comprehensive approach to addressing the current economic downturn. Understanding the inter-relatedness of these factors is crucial for developing effective policies.

Call to Action: Understanding the complexities of Canada's economy is crucial for businesses and individuals alike. Stay informed about the latest economic developments and consider consulting with financial experts to navigate these challenging times. Follow future analyses on Canada's economy for further insights and strategic planning. A proactive approach is crucial for businesses and individuals seeking to weather this economic storm and leverage potential opportunities when the economy recovers.

Featured Posts

-

Mlb Record Set Reds String Of 1 0 Losses Continues

Apr 23, 2025

Mlb Record Set Reds String Of 1 0 Losses Continues

Apr 23, 2025 -

Vehicle Subsystem Issue Forces Blue Origin To Cancel Rocket Launch

Apr 23, 2025

Vehicle Subsystem Issue Forces Blue Origin To Cancel Rocket Launch

Apr 23, 2025 -

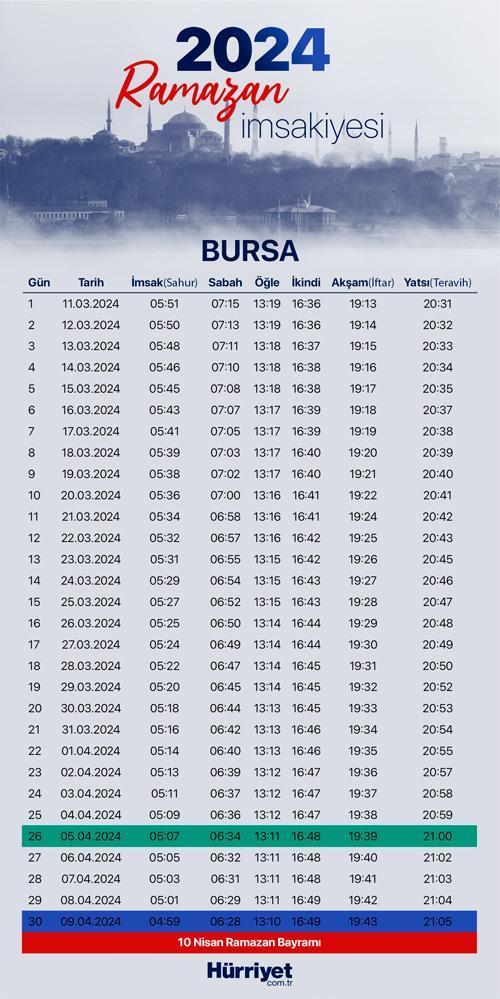

Ankara 3 Mart Pazartesi Iftar Ve Sahur Vakitleri 2024

Apr 23, 2025

Ankara 3 Mart Pazartesi Iftar Ve Sahur Vakitleri 2024

Apr 23, 2025 -

Ankhfad Ser Aldhhb Terf Ela Asearh Balsaght Alywm

Apr 23, 2025

Ankhfad Ser Aldhhb Terf Ela Asearh Balsaght Alywm

Apr 23, 2025 -

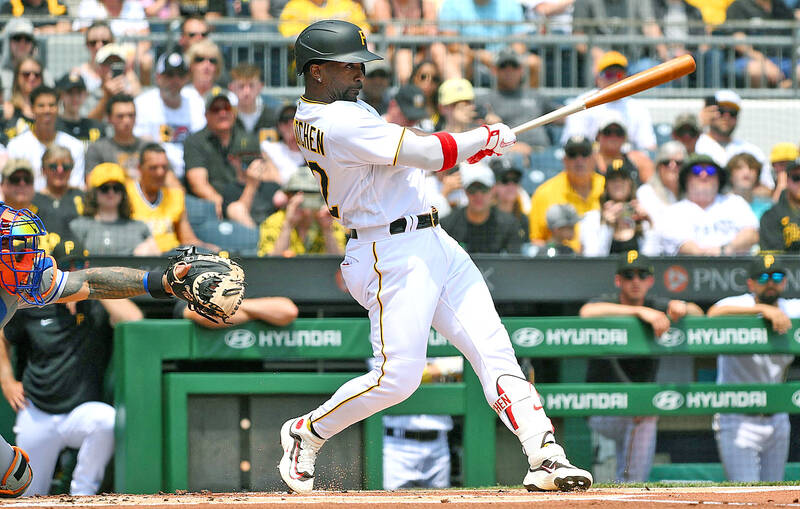

Jorge Lopez Suspended Three Game Ban For Hitting Andrew Mc Cutchen

Apr 23, 2025

Jorge Lopez Suspended Three Game Ban For Hitting Andrew Mc Cutchen

Apr 23, 2025