Canada's Housing Crisis: The Impact Of High Down Payments

Table of Contents

The Rising Barrier to Entry: High Down Payments and Affordability

The escalating home prices coupled with the necessity of large down payments (often 20% or even 25%) creates an insurmountable barrier for first-time homebuyers, especially those with average incomes. This is a key driver of Canada's housing crisis.

The Math of Unaffordability

Let's look at the numbers. The average price of a home in major Canadian cities like Toronto and Vancouver far surpasses the average income for many Canadians.

- Example: A $1 million home in Toronto requires a $200,000 down payment (20%). For a family earning an average income, saving this amount can take years, even decades, especially considering other living expenses.

- CMHC Insurance Limitations: While the Canada Mortgage and Housing Corporation (CMHC) offers mortgage loan insurance allowing for smaller down payments (as low as 5%), the high purchase prices still mean substantial upfront costs and higher monthly payments. This makes homeownership challenging even with this option.

- Impact of Interest Rates: Rising interest rates further exacerbate the problem, increasing the monthly mortgage payments and making it harder for people to qualify for a mortgage, even with a large down payment.

The Disproportionate Impact on Vulnerable Groups

High down payments disproportionately affect marginalized communities, widening the wealth gap. This includes:

- Young Adults: Entering the workforce with student debt and limited savings makes accumulating a large down payment extremely difficult for young Canadians.

- New Immigrants: Newcomers often face language barriers and a lack of established credit history, making it harder to secure a mortgage, even with savings.

- Low- to Moderate-Income Earners: For those already struggling to meet living expenses, saving a significant portion of their income for a down payment is practically impossible.

Statistics consistently show lower homeownership rates among these groups, highlighting the systemic inequalities embedded in the current system. Addressing these inequalities requires targeted policies and programs to bridge the gap.

Market Distortion: How High Down Payments Shape the Housing Landscape

High down payments significantly distort the Canadian housing market, fueling a cycle of escalating prices and reduced accessibility.

Fueling Competition and Price Inflation

High demand coupled with limited supply creates intense competition among buyers, leading to bidding wars and inflated prices. This is further exacerbated by:

- Investor Activity: Investors, often with access to more capital, can easily afford higher down payments, driving up prices and further pricing out first-time homebuyers.

- Rental Market Impact: The difficulty in accessing homeownership leads to increased demand for rental properties, causing rent prices to rise significantly. This creates a financial strain on renters, who face higher living costs.

Limiting Market Mobility

The high down payment requirements also hinder market mobility. For individuals and families who want to upgrade or relocate:

- Trading Up is Difficult: Moving to a larger home or a different location becomes significantly more challenging, as the down payment required on a larger, more expensive property will be substantially higher.

- Family Growth and Relocation: Expanding families might be constrained from moving to accommodate their changing needs due to financial restrictions. Similarly, career changes that necessitate relocation can become difficult, impacting economic mobility.

These limitations have broader implications for the Canadian economy, affecting workforce mobility and contributing to regional imbalances.

Potential Solutions and Policy Implications

Addressing the impact of high down payments requires a multifaceted approach involving both government action and private sector initiatives.

Government Interventions and Affordable Housing Initiatives

Governments can play a crucial role in improving affordability through various initiatives:

- Mortgage Insurance Changes: Adjusting CMHC insurance parameters to allow for even lower down payments, with appropriate risk mitigation measures, could help.

- Grants for First-Time Homebuyers: Targeted grants to assist first-time buyers, particularly those from vulnerable communities, could significantly ease the financial burden.

- Investments in Social Housing: Increased investment in social housing projects provides affordable rental options, reducing pressure on the market and supporting lower-income families.

Learning from successful affordable housing programs in other countries can inform the development of effective strategies tailored to the Canadian context. A critical evaluation of existing Canadian policies is needed to identify areas for improvement.

The Role of Financial Institutions

Financial institutions have a vital role to play in providing more accessible financing options:

- Alternative Mortgage Products: Banks and lenders should explore innovative mortgage products that cater to the specific needs of first-time buyers, such as shared-equity mortgages.

- Innovation in Financial Services: Technological advancements should be leveraged to streamline the mortgage process and make it more accessible.

- Transparency and Consumer Protection: Clearer communication about mortgage options and consumer protection measures can help individuals make informed decisions.

Conclusion

Canada's housing crisis is deeply intertwined with the increasingly prohibitive nature of high down payments. This barrier to homeownership exacerbates affordability issues, distorts the market, and disproportionately impacts vulnerable populations. Addressing this crisis requires a multifaceted approach involving government intervention, innovative financial solutions, and a concerted effort to increase housing supply. Understanding the impact of high down payments is crucial to developing effective strategies to make homeownership a reality for more Canadians. Let's work together to find solutions to alleviate the burden of high down payments and create a more accessible housing market for all.

Featured Posts

-

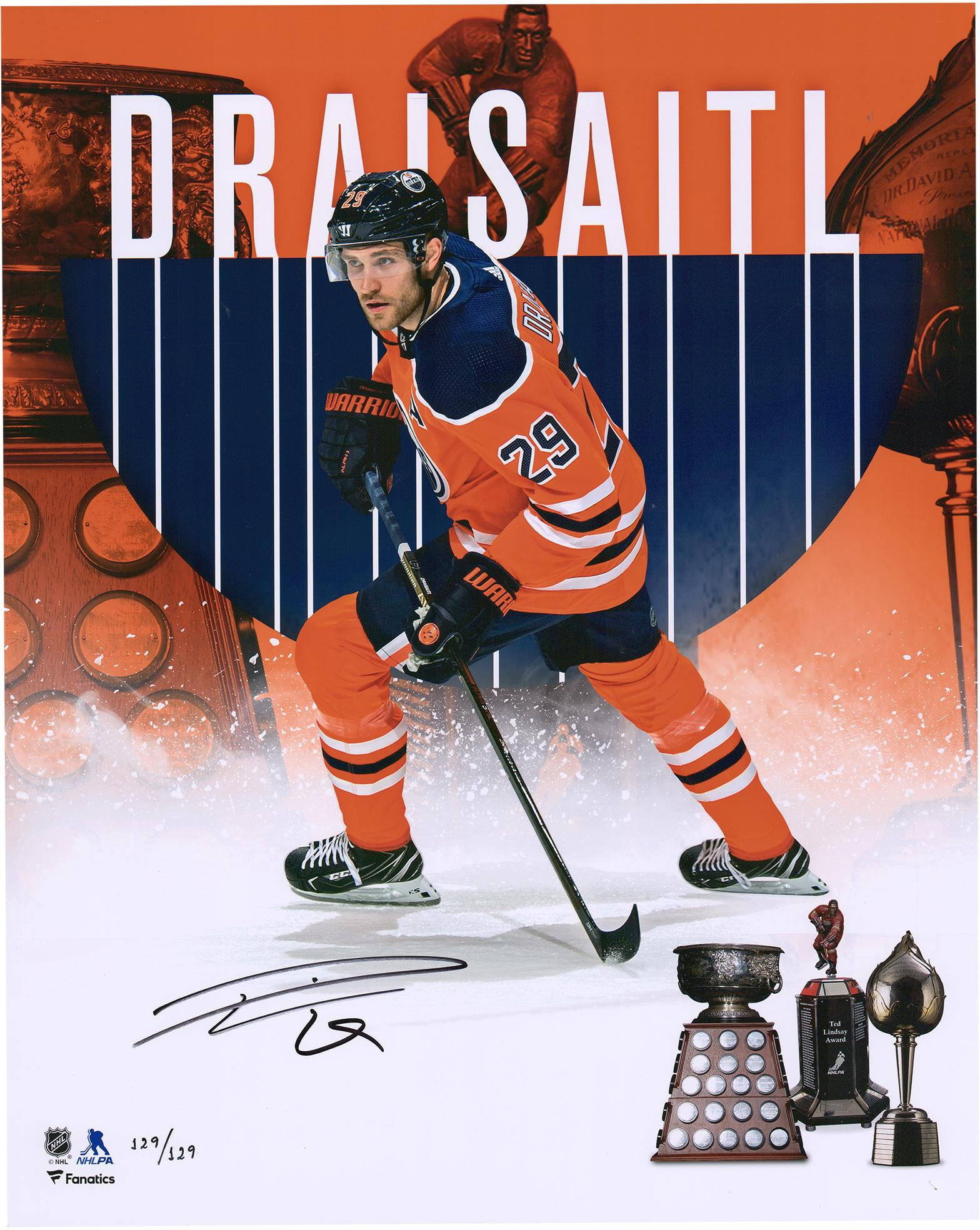

Leon Draisaitls Exceptional Season Hart Trophy Nomination

May 09, 2025

Leon Draisaitls Exceptional Season Hart Trophy Nomination

May 09, 2025 -

Su Viec Bao Mau Danh Tre O Tien Giang Can Siet Chat Quan Ly Co So Giu Tre

May 09, 2025

Su Viec Bao Mau Danh Tre O Tien Giang Can Siet Chat Quan Ly Co So Giu Tre

May 09, 2025 -

Stephen King In 2025 Even A Bad Movie Cant Diminish A Strong Year

May 09, 2025

Stephen King In 2025 Even A Bad Movie Cant Diminish A Strong Year

May 09, 2025 -

5 Times Morgan Faltered High Potential Season 1

May 09, 2025

5 Times Morgan Faltered High Potential Season 1

May 09, 2025 -

Liga Chempionov 2024 2025 Predvaritelniy Obzor Polufinalnykh Matchey Arsenal Ps Zh I Barselona Inter

May 09, 2025

Liga Chempionov 2024 2025 Predvaritelniy Obzor Polufinalnykh Matchey Arsenal Ps Zh I Barselona Inter

May 09, 2025