Canadian Auto Industry's Response To Trump: A Call For Increased Ambition

Table of Contents

Navigating NAFTA's Demise and the USMCA's Impact

The Shifting Trade Landscape

The renegotiation of NAFTA into the United States-Mexico-Canada Agreement (USMCA) presented significant challenges for Canadian auto manufacturers. The changes impacted the entire Canadian automotive sector, from parts suppliers to assembly plants.

- Changes in rules of origin: Stricter rules of origin meant a higher percentage of vehicle content had to be sourced from within North America to qualify for tariff-free trade. This increased costs and complexity for Canadian automakers.

- Impact on supply chains: Canadian automakers had to restructure their supply chains to comply with the new rules, potentially leading to disruptions and increased transportation costs. This involved reassessing existing partnerships and seeking new suppliers within North America.

- Increased costs: Meeting the stricter rules of origin often meant higher production costs, impacting profitability and competitiveness.

- Potential for trade disputes: The complexities of the new agreement increased the potential for future trade disputes between Canada and the US, adding uncertainty to the industry.

For example, the shift in rules of origin forced some Canadian parts manufacturers to invest heavily in upgrading facilities or even relocate to meet the new requirements, impacting employment and investment decisions across the country.

Adaptation Strategies

Canadian automakers responded to the USMCA by implementing several key adaptation strategies:

- Restructuring supply chains: Companies actively sought to diversify their sourcing, strengthening partnerships with domestic suppliers and exploring new options within North America to reduce reliance on specific regions or suppliers.

- Investing in domestic production: To meet the rules of origin, significant investments were made in domestic manufacturing capabilities, boosting Canadian production and employment.

- Exploring new markets: Canadian automakers expanded their focus beyond the North American market, exploring export opportunities to Europe, Asia, and other regions to diversify revenue streams.

- Focusing on innovation and technology: Investments in advanced technologies, such as electric vehicles and autonomous driving systems, helped position Canadian automakers for future growth and competitiveness.

Companies like Magna International, a major auto parts supplier, invested heavily in expanding their domestic manufacturing capacity and developing innovative technologies to maintain their competitive edge in the post-NAFTA era.

Investing in Innovation and Technological Advancement

Electric Vehicles (EVs) and the Green Shift

The global push towards electric vehicles presents both challenges and opportunities for the Canadian auto industry.

- Government incentives: Federal and provincial governments have introduced various incentives to encourage EV adoption and support domestic EV manufacturing.

- Investments in EV manufacturing: Canadian automakers and parts suppliers are making significant investments to expand their production capacity for electric vehicles and related components.

- Battery production: There’s a growing focus on establishing domestic battery production to reduce reliance on foreign sources and capture value along the entire EV supply chain.

- Charging infrastructure development: Investments are also being made in building a robust network of EV charging stations across the country to support the increasing adoption of EVs.

Canadian companies are at the forefront of EV battery technology development, creating opportunities for jobs and economic growth within the sector.

Autonomous Driving and AI Integration

The Canadian auto industry is also actively pursuing advancements in autonomous driving and artificial intelligence (AI).

- Research and development initiatives: Universities and research institutions are collaborating with automakers and technology companies to advance autonomous driving technologies.

- Collaborations with tech companies: Partnerships between automakers and tech companies are crucial for integrating advanced AI and software capabilities into vehicles.

- Attracting skilled talent: The industry is focusing on attracting and retaining highly skilled engineers, programmers, and data scientists to support these technological advancements.

Several Canadian companies are developing cutting-edge autonomous driving software and sensor technologies, positioning Canada as a leader in this rapidly evolving field.

Strengthening Domestic Supply Chains and Workforce Development

Building a Resilient Supply Chain

Creating a more resilient and diversified supply chain is crucial for the long-term health of the Canadian auto industry.

- Strengthening partnerships with domestic suppliers: Strengthening relationships with Canadian suppliers reduces reliance on imports and strengthens the domestic economy.

- Investing in domestic manufacturing: Investments in domestic production facilities enhance resilience and reduce vulnerability to global supply chain disruptions.

- Reducing reliance on US components: Diversifying sourcing beyond the US improves resilience and reduces dependence on a single trading partner.

Reshoring and nearshoring initiatives are proving successful in strengthening the Canadian auto supply chain, leading to increased job creation and economic benefits within the country.

Investing in Skilled Labour

Addressing the skills gap is critical to the success of the Canadian auto industry's transformation.

- Apprenticeship programs: Expanding and improving apprenticeship programs to train the next generation of skilled tradespeople is paramount.

- Retraining initiatives: Programs are needed to help existing workers transition to new roles within the evolving automotive industry, focusing on advanced technologies and digital skills.

- Collaborations with educational institutions: Partnerships between industry and educational institutions ensure that training programs align with the evolving needs of the sector.

Investing in education and training is vital to ensuring the Canadian auto industry has the skilled workforce needed to compete globally.

Conclusion

The Canadian auto industry demonstrated remarkable resilience in response to the challenges posed by the Trump administration's trade policies. By adapting to the new USMCA, investing heavily in innovation, and focusing on strengthening domestic supply chains and workforce development, the industry is paving the way for future growth. However, continued ambition and proactive strategies are crucial to maintaining competitiveness in the ever-changing global automotive landscape. The future success of the Canadian auto industry hinges on a sustained commitment to innovation and strategic planning. Let's continue to support the growth and development of the Canadian auto industry through informed policy and investment. Investing in the Canadian automotive sector means investing in Canada's future.

Featured Posts

-

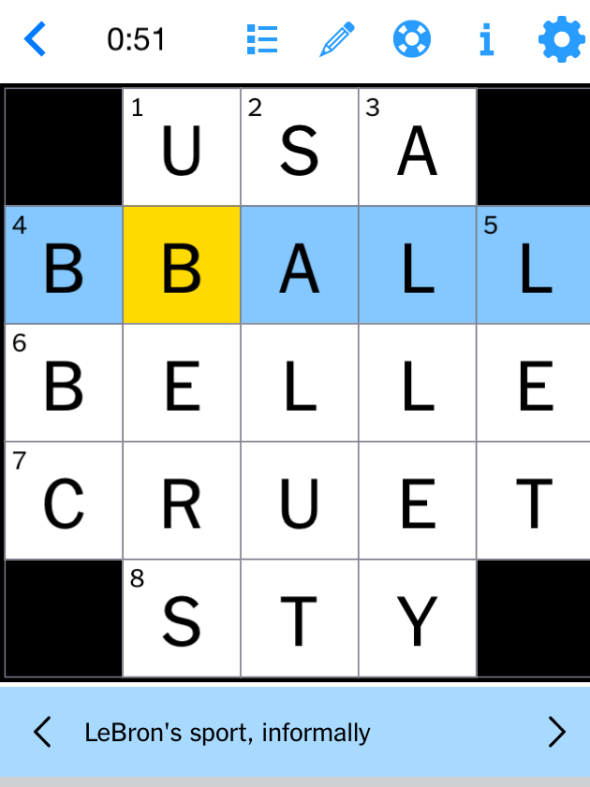

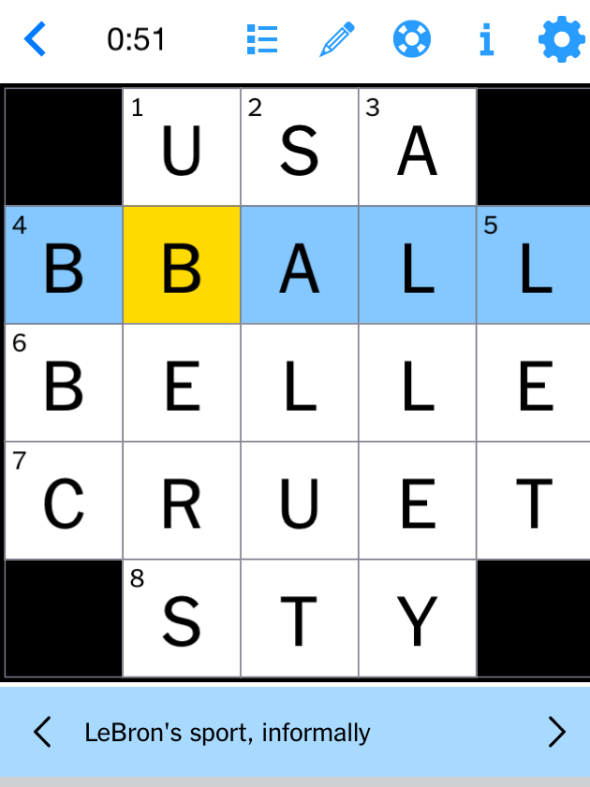

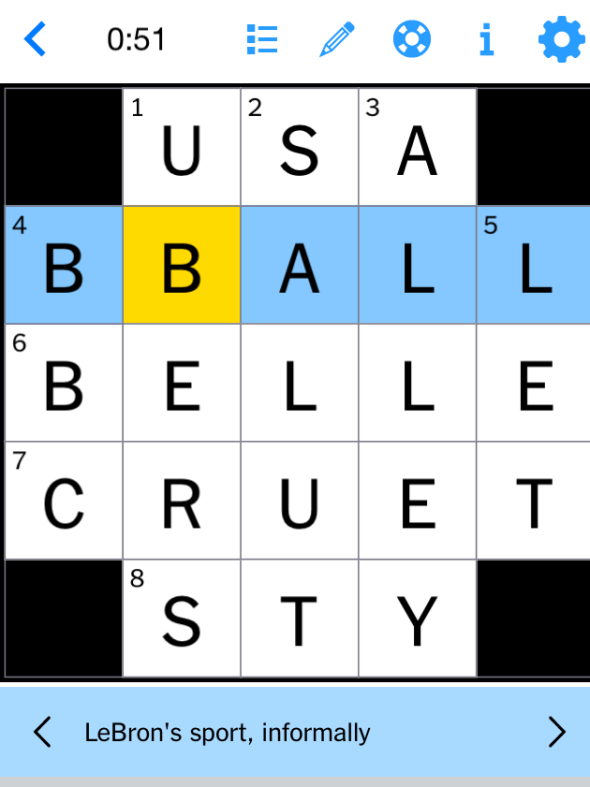

March 13 2025 Nyt Mini Crossword Solutions And Clues

May 23, 2025

March 13 2025 Nyt Mini Crossword Solutions And Clues

May 23, 2025 -

Witness Family Honor And Tradition The Karate Kid Legends Trailer

May 23, 2025

Witness Family Honor And Tradition The Karate Kid Legends Trailer

May 23, 2025 -

Tu Horoscopo Semanal 1 Al 7 De Abril De 2025

May 23, 2025

Tu Horoscopo Semanal 1 Al 7 De Abril De 2025

May 23, 2025 -

Actualizacion Del Coe Alerta Amarilla Para 9 Provincias Verde Para 5

May 23, 2025

Actualizacion Del Coe Alerta Amarilla Para 9 Provincias Verde Para 5

May 23, 2025 -

The Karate Kids Influence On Netflixs Cobra Kai

May 23, 2025

The Karate Kids Influence On Netflixs Cobra Kai

May 23, 2025

Latest Posts

-

Bestechungsskandal An Der Uni Duisburg Essen Umfang Und Folgen Des Gestaendnisses

May 23, 2025

Bestechungsskandal An Der Uni Duisburg Essen Umfang Und Folgen Des Gestaendnisses

May 23, 2025 -

March 13 2025 Nyt Mini Crossword Solutions And Clues

May 23, 2025

March 13 2025 Nyt Mini Crossword Solutions And Clues

May 23, 2025 -

April 8 2025 Nyt Mini Crossword Hints Clues And Answers

May 23, 2025

April 8 2025 Nyt Mini Crossword Hints Clues And Answers

May 23, 2025 -

Essen Gesundheitsamt Schliesst Shajee Traders Wegen Hygieneproblemen

May 23, 2025

Essen Gesundheitsamt Schliesst Shajee Traders Wegen Hygieneproblemen

May 23, 2025 -

Uni Duisburg Essen Mitarbeiterin Gesteht Bestechung Details Zum Skandal

May 23, 2025

Uni Duisburg Essen Mitarbeiterin Gesteht Bestechung Details Zum Skandal

May 23, 2025