Canadian Dollar Fluctuation: Strength Against USD, Weakness Elsewhere

Table of Contents

CAD Strength Against the USD

Several factors contribute to the Canadian dollar's relative strength against the US dollar. Let's delve into the most significant ones:

Impact of Interest Rate Differentials

The Bank of Canada's monetary policy is a primary driver of CAD/USD exchange rate movements. Higher interest rates in Canada compared to the US make Canadian assets more attractive to foreign investors.

- Increased demand leads to appreciation against the USD: When foreign investors seek higher returns, they buy Canadian dollars, increasing demand and pushing up its value.

- Conversely, lower Canadian interest rates can weaken the CAD against the USD: A lower interest rate differential makes the USD a more attractive investment, reducing demand for the CAD.

- Analyzing the interest rate differential is crucial for forecasting CAD/USD exchange rates: Investors and traders closely monitor the gap between Canadian and US interest rates to anticipate future movements. This analysis often involves looking at forward rate agreements and interest rate swaps.

Energy Prices and Commodity Exports

Canada's economy is heavily reliant on exporting commodities, with energy (particularly oil) playing a dominant role. Fluctuations in global energy prices directly impact the CAD's value.

- Increased demand for Canadian resources strengthens the CAD: Higher oil prices translate to increased revenue for Canadian energy companies and a stronger CAD.

- Global energy market volatility directly impacts the CAD/USD exchange rate: Geopolitical instability, supply chain disruptions, or changes in global demand can cause significant swings in the CAD.

- Diversification of the Canadian economy could lessen this dependence: While energy remains a cornerstone of the Canadian economy, diversification into other sectors could help reduce the CAD's sensitivity to oil price shocks.

Geopolitical Factors and Safe-Haven Status

During periods of global uncertainty, the Canadian dollar can benefit from its perceived safe-haven status relative to some emerging market currencies.

- Investors seek stability, leading to increased CAD demand: In times of crisis, investors often move their funds to perceived safer assets, including the Canadian dollar.

- Global events like political instability or trade wars can influence CAD strength: Uncertainty in global markets often increases the demand for stable currencies like the CAD.

- Understanding geopolitical risks is essential for predicting CAD movements: Staying informed about global events and their potential impact on market sentiment is crucial for accurately forecasting CAD fluctuations.

CAD Weakness Against Other Currencies

While the CAD often holds its own against the USD, its performance against other major currencies can be weaker. Let's explore the reasons behind this:

Performance Against the Euro (EUR) and other Global Currencies

Despite CAD strength against the USD, the Canadian dollar frequently shows weakness against the Euro and other global currencies.

- The Eurozone's economic performance impacts the EUR/CAD exchange rate: A strong Eurozone economy often translates to a stronger Euro, weakening the CAD in comparison.

- Global economic growth trends influence the overall strength of the CAD: Slower global growth often dampens demand for commodities, negatively impacting the CAD.

- Divergence in monetary policies between Canada and other economies is a key factor: Differences in interest rates and monetary policy approaches between Canada and other countries influence relative currency values.

Impact of Global Trade and Economic Slowdowns

Global economic downturns or trade disputes can significantly impact commodity demand, leading to a weaker CAD against many currencies.

- Reduced exports lead to lower demand for the CAD: A global recession can suppress demand for Canadian goods, reducing the demand for the CAD.

- Trade wars and protectionist policies can severely impact the CAD's value: Increased trade barriers disrupt global trade flows, negatively affecting commodity-dependent economies like Canada.

- Monitoring global trade dynamics is crucial for assessing CAD performance: Keeping abreast of global trade developments is essential for understanding the factors influencing CAD exchange rates.

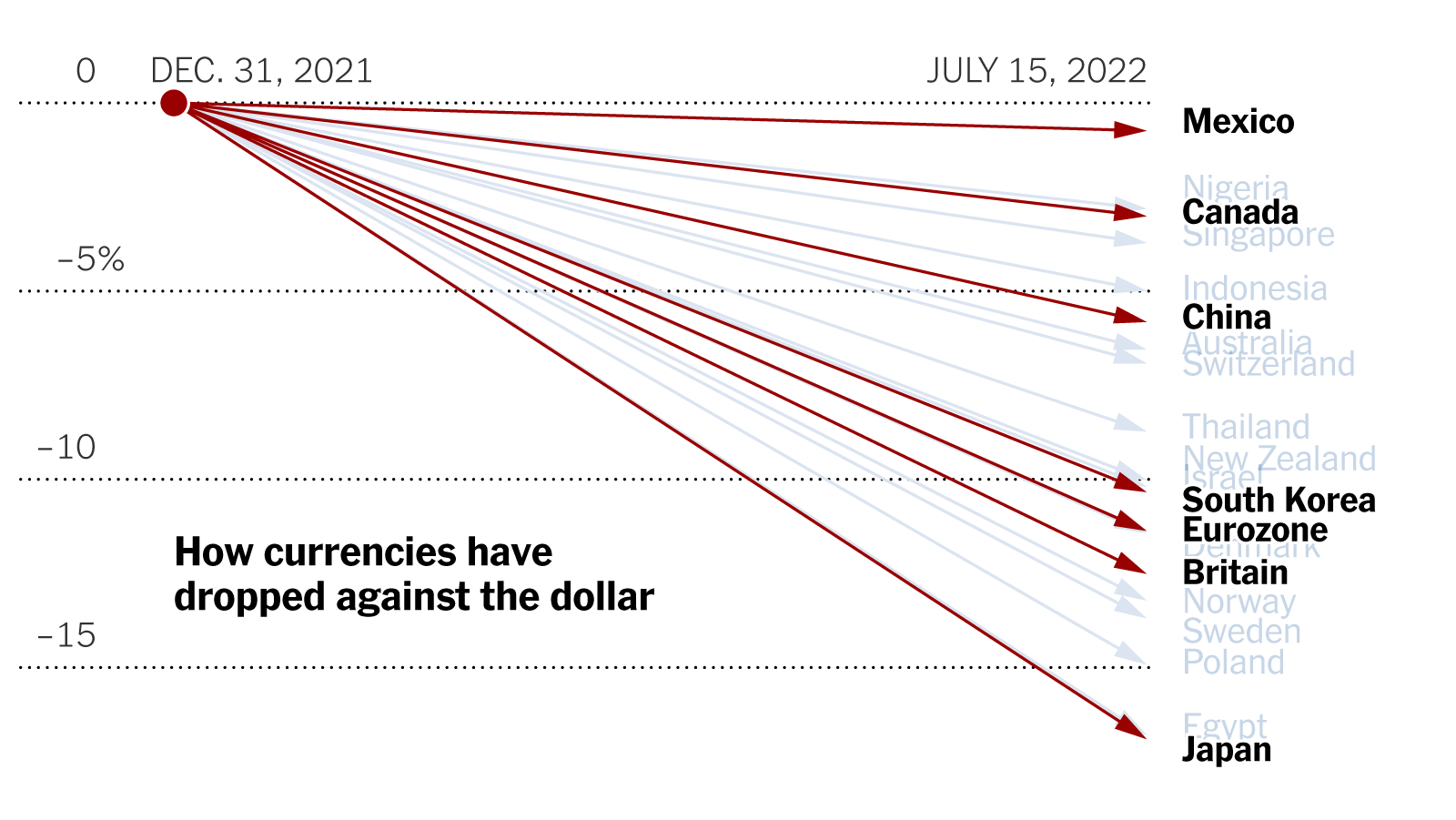

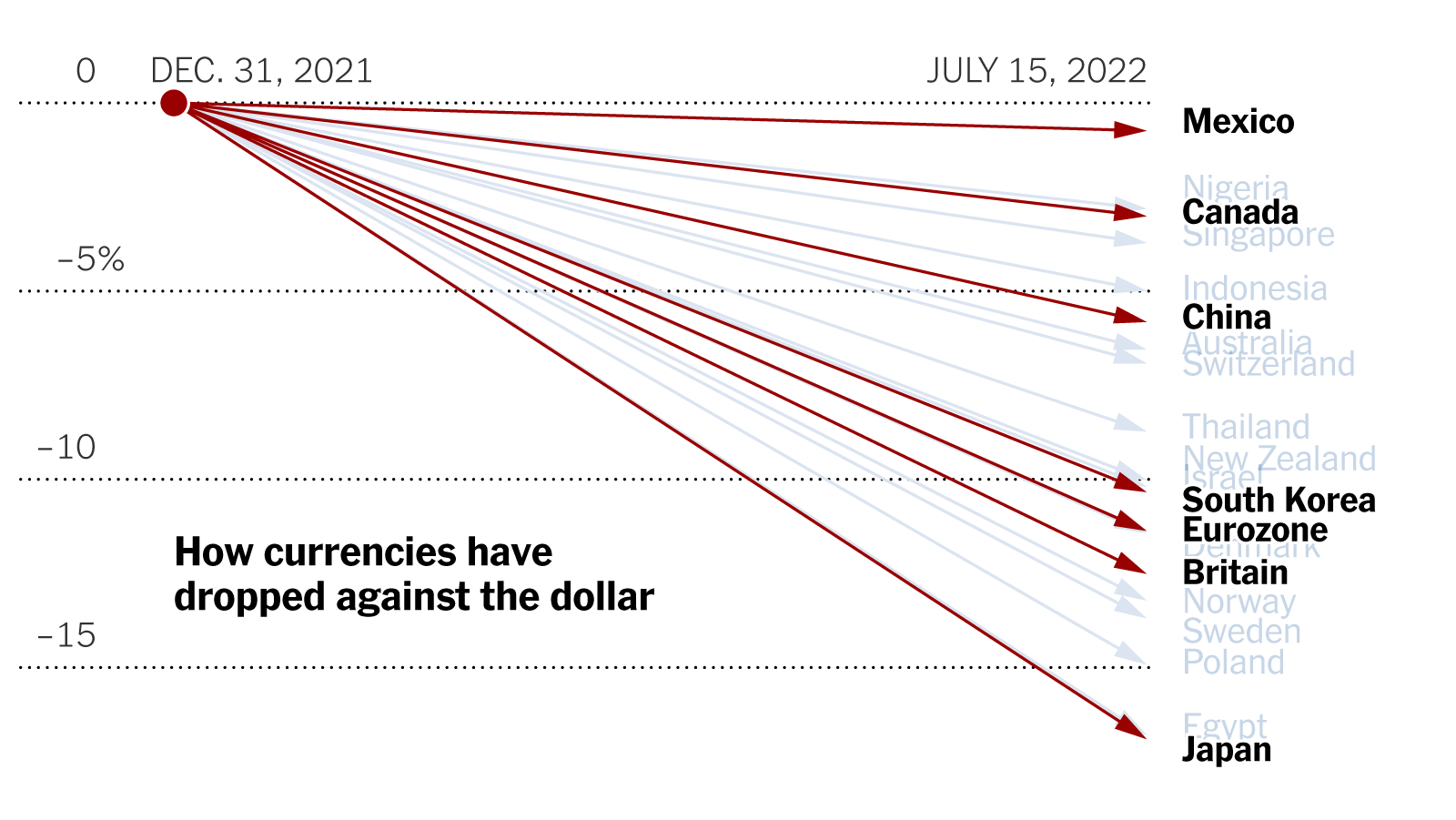

US Dollar Strength and its Ripple Effect

A strong USD can indirectly weaken the CAD against other currencies, even if the CAD/USD rate remains relatively stable.

- The USD's dominance in global markets influences many other exchange rates: Many currency pairs are quoted against the USD, so USD movements have a ripple effect.

- A strong USD can make Canadian goods less competitive internationally: A strong USD makes Canadian exports more expensive for buyers in other currencies.

- Tracking USD performance is crucial for understanding CAD fluctuations against other currencies: Monitoring the USD's strength is critical for understanding the CAD's overall performance in the global forex market.

Conclusion

The Canadian dollar's value is a complex interplay of various economic and geopolitical factors. While its current relative strength against the US dollar is noteworthy, its performance against other currencies highlights a more nuanced picture. Understanding the impact of interest rate differentials, commodity prices, global economic conditions, and US dollar strength is crucial for anyone involved in international finance, trade, or investment. Stay informed about these key factors to effectively navigate the complexities of Canadian dollar fluctuation and make well-informed decisions. Learn more about currency exchange rates and strategies for managing your financial exposure to CAD fluctuations.

Featured Posts

-

Live Eurovision 2025 Viewing Options In Australia

Apr 25, 2025

Live Eurovision 2025 Viewing Options In Australia

Apr 25, 2025 -

The Long Term Effects Of Cool Sculpting Lessons From Linda Evangelistas Case

Apr 25, 2025

The Long Term Effects Of Cool Sculpting Lessons From Linda Evangelistas Case

Apr 25, 2025 -

Apple Tv S Rise As A Crime Thriller Powerhouse Is Its Next Series The Best Yet

Apr 25, 2025

Apple Tv S Rise As A Crime Thriller Powerhouse Is Its Next Series The Best Yet

Apr 25, 2025 -

Tim The Yowie Man And The Unique Anzac Day Heater Custom In Canberra

Apr 25, 2025

Tim The Yowie Man And The Unique Anzac Day Heater Custom In Canberra

Apr 25, 2025 -

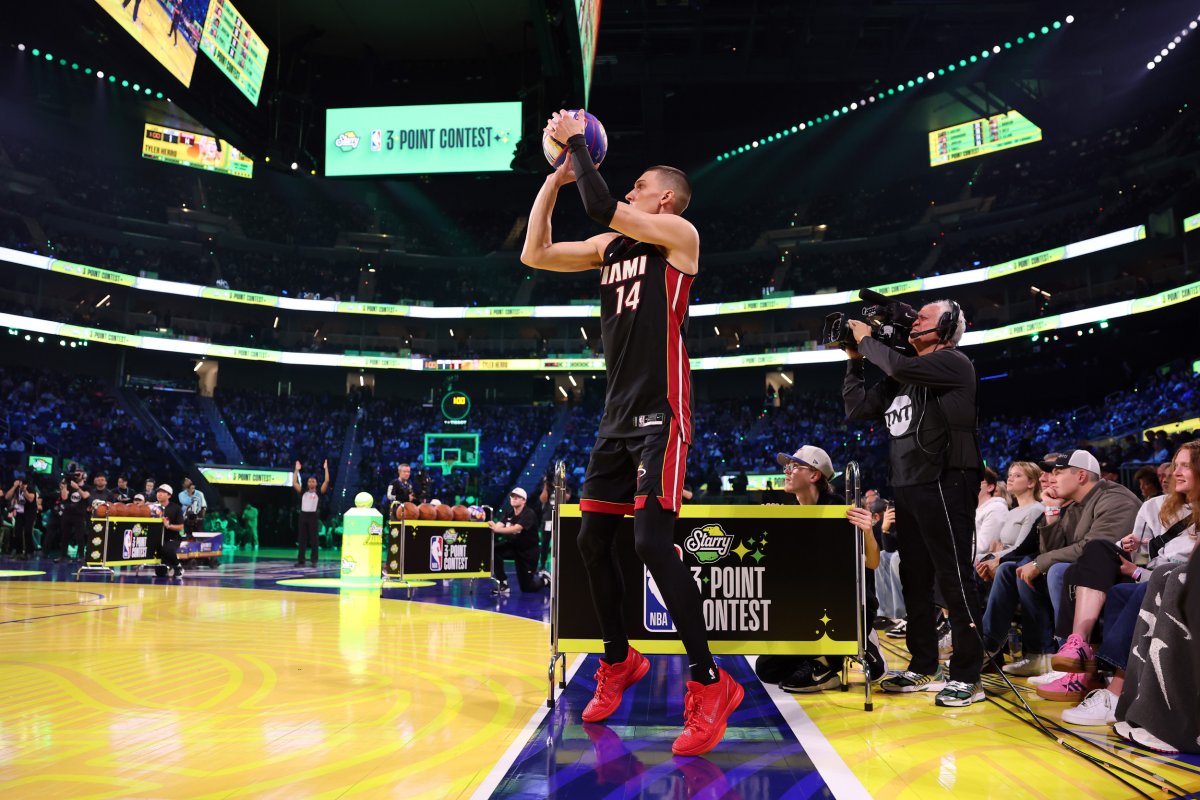

Nba 3 Point Contest 2024 Herros Victory Over Hield

Apr 25, 2025

Nba 3 Point Contest 2024 Herros Victory Over Hield

Apr 25, 2025

Latest Posts

-

The China Factor Analyzing The Difficulties Faced By Bmw Porsche And Other Auto Brands

Apr 26, 2025

The China Factor Analyzing The Difficulties Faced By Bmw Porsche And Other Auto Brands

Apr 26, 2025 -

The Growing Problem Of Betting On Natural Disasters Focus On Los Angeles

Apr 26, 2025

The Growing Problem Of Betting On Natural Disasters Focus On Los Angeles

Apr 26, 2025 -

Los Angeles Wildfires A Case Study In Disaster Speculation

Apr 26, 2025

Los Angeles Wildfires A Case Study In Disaster Speculation

Apr 26, 2025 -

How Middle Management Drives Company Growth And Employee Development

Apr 26, 2025

How Middle Management Drives Company Growth And Employee Development

Apr 26, 2025 -

Analyzing The Trend People Betting On The Los Angeles Wildfires

Apr 26, 2025

Analyzing The Trend People Betting On The Los Angeles Wildfires

Apr 26, 2025