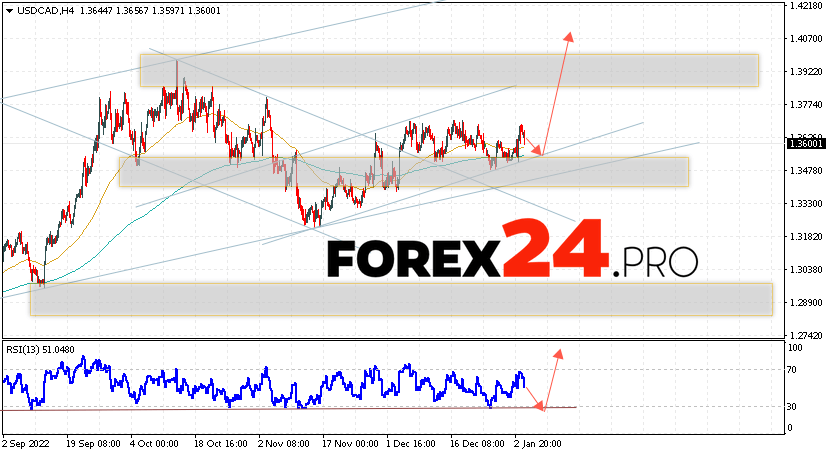

Canadian Dollar Forecast: Minority Government's Impact

Table of Contents

Political Instability and its Effect on the CAD: Minority Government and CAD Volatility

Minority governments, by their very nature, introduce an element of uncertainty into the Canadian economic landscape. The need for consensus-building and the potential for frequent elections contribute to a less predictable policy environment. This inherent instability directly impacts the Canadian Dollar Forecast. Slower decision-making processes can hinder timely responses to economic challenges, potentially delaying crucial policy implementations.

- Increased frequency of elections: The threat of snap elections creates a climate of uncertainty, discouraging long-term investment.

- Potential for budget impasses and delays: Disagreements among coalition partners can lead to stalled budgets and delayed infrastructure projects, hindering economic growth.

- Challenges in implementing long-term economic strategies: The short-term focus often associated with minority governments makes it difficult to implement sustainable, long-term economic plans.

- Impact on foreign investment: Political instability reduces investor confidence, potentially leading to decreased foreign investment in Canada, further impacting the CAD's value. This uncertainty creates volatility in the Canadian Dollar Forecast.

Government Economic Policies and their Influence on CAD Value: Canadian Economic Policy and the Dollar

Government economic policies play a crucial role in shaping the Canadian Dollar Forecast. Fiscal policies, including government spending and taxation, directly influence inflation and consumer spending. Monetary policies, primarily determined by the Bank of Canada's interest rate decisions, impact borrowing costs and the overall economy.

- Impact of government spending on inflation: Increased government spending can fuel inflation, potentially leading to a weaker CAD.

- Effect of tax policies on consumer spending and investment: Tax cuts can stimulate economic activity, but may also increase the national debt. Tax increases can have the opposite effect.

- Influence of Bank of Canada's interest rate decisions on the CAD: Higher interest rates generally attract foreign investment, strengthening the CAD, while lower rates can weaken it.

- Analysis of potential trade agreements and their influence: Successful trade negotiations can boost exports and strengthen the CAD, while trade disputes can have the opposite effect. Understanding these interconnected factors is vital for an accurate Canadian Dollar Forecast.

Investor Sentiment and the Canadian Dollar: Investor Confidence and CAD Predictions

Investor sentiment is a powerful driver of the CAD's value. Positive sentiment leads to increased investment, strengthening the currency, while negative sentiment can trigger capital flight and weaken it. The Canadian Dollar Forecast is highly dependent on investor confidence in the Canadian economy.

- Impact of political uncertainty on investor confidence: Political instability directly erodes investor confidence, leading to capital outflows and a weaker CAD.

- Role of economic indicators (GDP growth, employment rates) in shaping investor sentiment: Strong economic indicators boost confidence, while weak data can trigger negative sentiment.

- Influence of global economic events on the CAD: Global economic downturns or geopolitical crises can negatively impact investor sentiment towards the Canadian economy.

- Analysis of capital flows and their impact on the CAD's exchange rate: Significant capital inflows strengthen the CAD, while outflows weaken it. Monitoring these flows is crucial for projecting the Canadian Dollar Forecast.

Key External Factors Affecting the Canadian Dollar Forecast: Global Factors Impacting the Canadian Dollar

The Canadian Dollar Forecast is not solely determined by domestic factors. Global economic conditions, commodity prices, and the value of other major currencies, particularly the US dollar (USD), significantly influence the CAD.

- Impact of oil price fluctuations on the CAD: Canada is a major oil producer, so oil price changes directly impact the economy and the CAD. Higher oil prices typically strengthen the CAD.

- Relationship between the USD and CAD exchange rate: The CAD is closely tied to the USD. A strong USD usually weakens the CAD.

- Influence of global economic growth on Canadian exports and the CAD: Strong global growth boosts demand for Canadian exports, strengthening the CAD.

- Geopolitical risks and their potential impact on the CAD: Global geopolitical events can create uncertainty and volatility in the currency markets, affecting the CAD's value. Considering these global factors impacting the Canadian dollar is critical for a comprehensive forecast.

Conclusion: Understanding the Canadian Dollar Forecast in a Minority Government Context

In conclusion, the Canadian Dollar Forecast under a minority government is a complex interplay of political stability, government economic policies, investor sentiment, and external global factors. Political instability can significantly impact investor confidence, leading to currency volatility. Government policies, both fiscal and monetary, directly influence the economy and the CAD's value. Furthermore, global economic conditions and commodity prices play a substantial role. Understanding these interconnected factors is essential for navigating the complexities of the Canadian dollar's future trajectory.

To stay informed about the latest developments impacting the Canadian Dollar Forecast and its future predictions, regularly consult reputable financial news sources and economic analysis. Continue your research by exploring resources such as the Bank of Canada's website and reports from leading financial institutions. Stay updated on the latest economic data and policy announcements to make informed decisions about your investments and financial planning.

Featured Posts

-

El Futbol Argentino Llora La Perdida De Un Joven Referente De Afa

Apr 30, 2025

El Futbol Argentino Llora La Perdida De Un Joven Referente De Afa

Apr 30, 2025 -

Car Dealerships Renew Their Resistance To Electric Vehicle Requirements

Apr 30, 2025

Car Dealerships Renew Their Resistance To Electric Vehicle Requirements

Apr 30, 2025 -

Akhbar Srf Rwatb Abryl 2025 Melwmat Mwthwqt Wmsadr Rsmyt

Apr 30, 2025

Akhbar Srf Rwatb Abryl 2025 Melwmat Mwthwqt Wmsadr Rsmyt

Apr 30, 2025 -

Disneys Tv And Abc News Layoffs Nearly 200 Jobs Cut

Apr 30, 2025

Disneys Tv And Abc News Layoffs Nearly 200 Jobs Cut

Apr 30, 2025 -

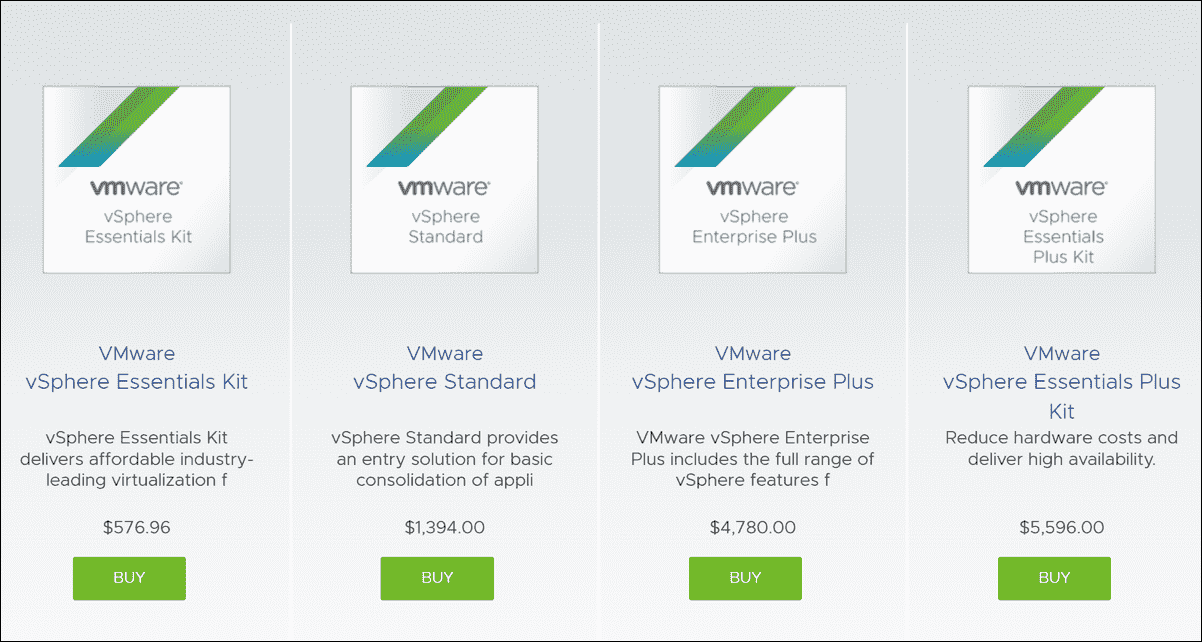

Broadcoms Proposed V Mware Price Hike A 1050 Increase Concerns At And T

Apr 30, 2025

Broadcoms Proposed V Mware Price Hike A 1050 Increase Concerns At And T

Apr 30, 2025

Latest Posts

-

The Backlash Against Michael Sheens Charitable Documentary

May 01, 2025

The Backlash Against Michael Sheens Charitable Documentary

May 01, 2025 -

Christopher Stevens Reviews Michael Sheens Million Pound Giveaway Pointless Or Purposeful

May 01, 2025

Christopher Stevens Reviews Michael Sheens Million Pound Giveaway Pointless Or Purposeful

May 01, 2025 -

1 Million Debt Erased Michael Sheens Generous 100 000 Contribution

May 01, 2025

1 Million Debt Erased Michael Sheens Generous 100 000 Contribution

May 01, 2025 -

Arc Raider Tech Test 2 Console Players Invited Registration Now Open

May 01, 2025

Arc Raider Tech Test 2 Console Players Invited Registration Now Open

May 01, 2025 -

Sheens Million Pound Documentary Controversy And Response

May 01, 2025

Sheens Million Pound Documentary Controversy And Response

May 01, 2025