Canadian Dollar: Potential For Drop After Federal Election

Table of Contents

Impact of Fiscal Policies on the Canadian Dollar

Government policies significantly influence the Canadian dollar's strength. Fiscal decisions directly impact economic growth, inflation, and investor confidence, all of which affect the CAD's exchange rate.

Government Spending and Debt

Increased government spending can boost economic activity in the short term, but it also leads to higher deficits and debt. This can trigger inflation, forcing the Bank of Canada to raise interest rates to control it. Higher interest rates can attract foreign investment, initially strengthening the CAD. However, excessive debt can erode investor confidence, ultimately weakening the currency in the long run.

- Potential scenarios under different parties' platforms: Some parties may propose significant infrastructure investments, potentially leading to higher debt but also stimulating economic growth. Others might prioritize fiscal conservatism, potentially limiting spending and keeping debt under control.

- Debt-to-GDP ratios and their impact on investor confidence: A high debt-to-GDP ratio signals increased financial risk, potentially leading to credit rating downgrades. Credit rating agencies like Moody's, S&P, and Fitch closely monitor Canada's fiscal health and their assessments directly impact investor sentiment and the CAD's value.

- Potential for credit rating downgrades and their effect on the CAD: A credit downgrade would significantly damage investor confidence, leading to capital flight and a likely drop in the Canadian dollar.

Taxation Policies and Their Influence

Tax policies, both corporate and personal, play a crucial role in shaping investor sentiment and capital flows. Changes in tax rates can affect business investment decisions, individual spending, and overall economic growth, all of which influence the CAD.

- Comparison of tax policies of different major parties: Each party's platform offers different approaches to taxation, with some proposing tax cuts to stimulate the economy and others advocating for increased taxes to fund social programs. These differences directly affect investor expectations and consequently the CAD's value.

- Potential effects on foreign investment and business confidence: High corporate tax rates can deter foreign investment, impacting economic growth and the CAD. Conversely, attractive tax policies can attract foreign investment, potentially boosting the currency.

- Influence of capital gains taxes on investment decisions: Changes in capital gains taxes influence investment decisions, particularly in the real estate and stock markets. Increased capital gains taxes could lead to reduced investment and a weaker CAD.

Uncertainty and Market Volatility

The inherent uncertainty surrounding election outcomes significantly impacts the CAD. Investors often adopt a "wait-and-see" approach, leading to increased market volatility until a clear winner and their policy intentions emerge.

Election Uncertainty and Investor Sentiment

Political uncertainty creates instability in the market, impacting investor confidence and leading to fluctuations in the CAD. Speculation before and during an election fuels volatility, sometimes leading to dramatic short-term movements.

- Role of market speculation and the influence of opinion polls: Pre-election polls heavily influence market sentiment. Close races heighten uncertainty, leading to significant fluctuations in the CAD. Speculative trading based on poll results adds to the volatility.

- Potential for short-term volatility and "flight to safety" trading strategies: During periods of uncertainty, investors often move towards "safe haven" assets like the US dollar, leading to a weakening of the CAD.

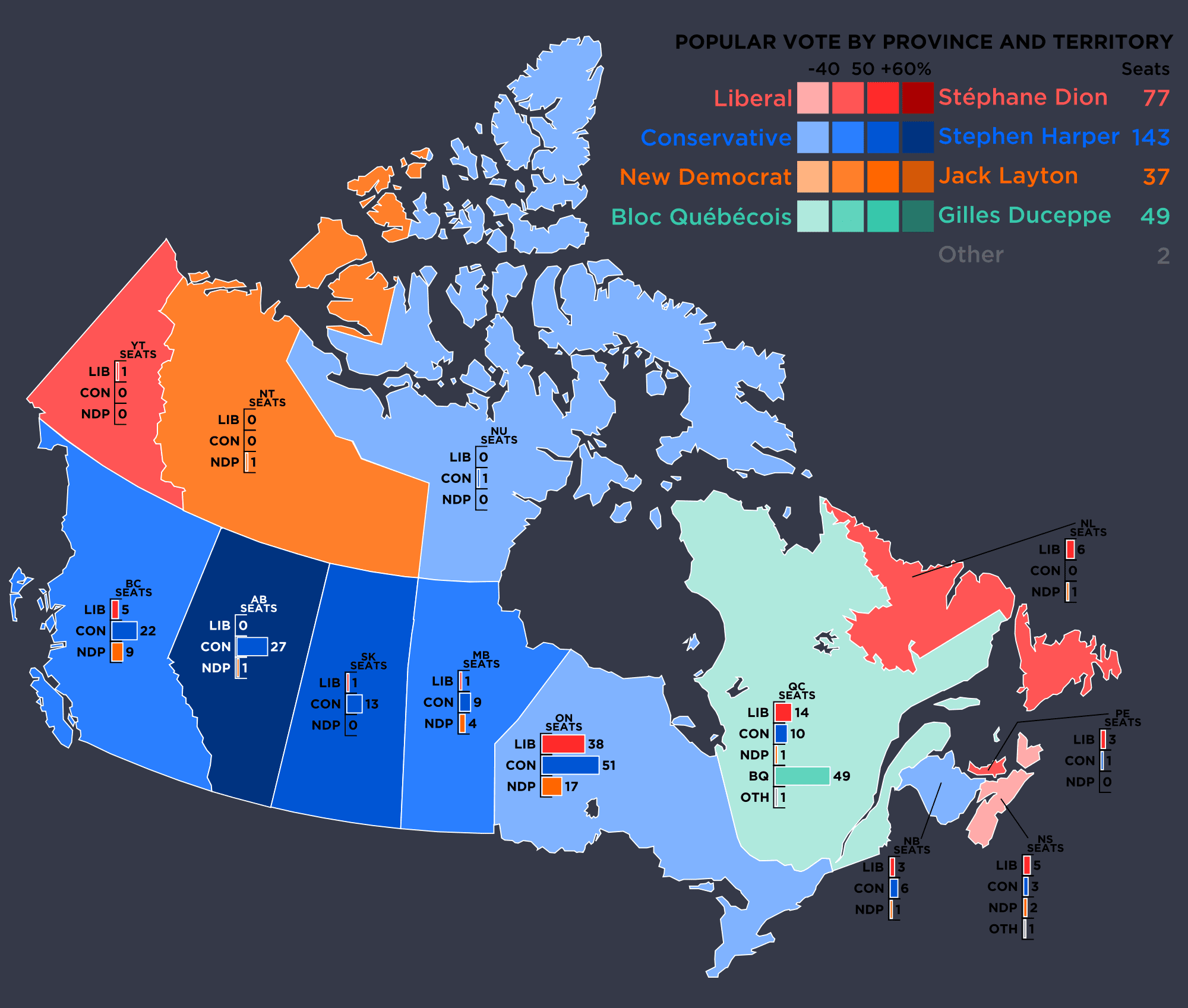

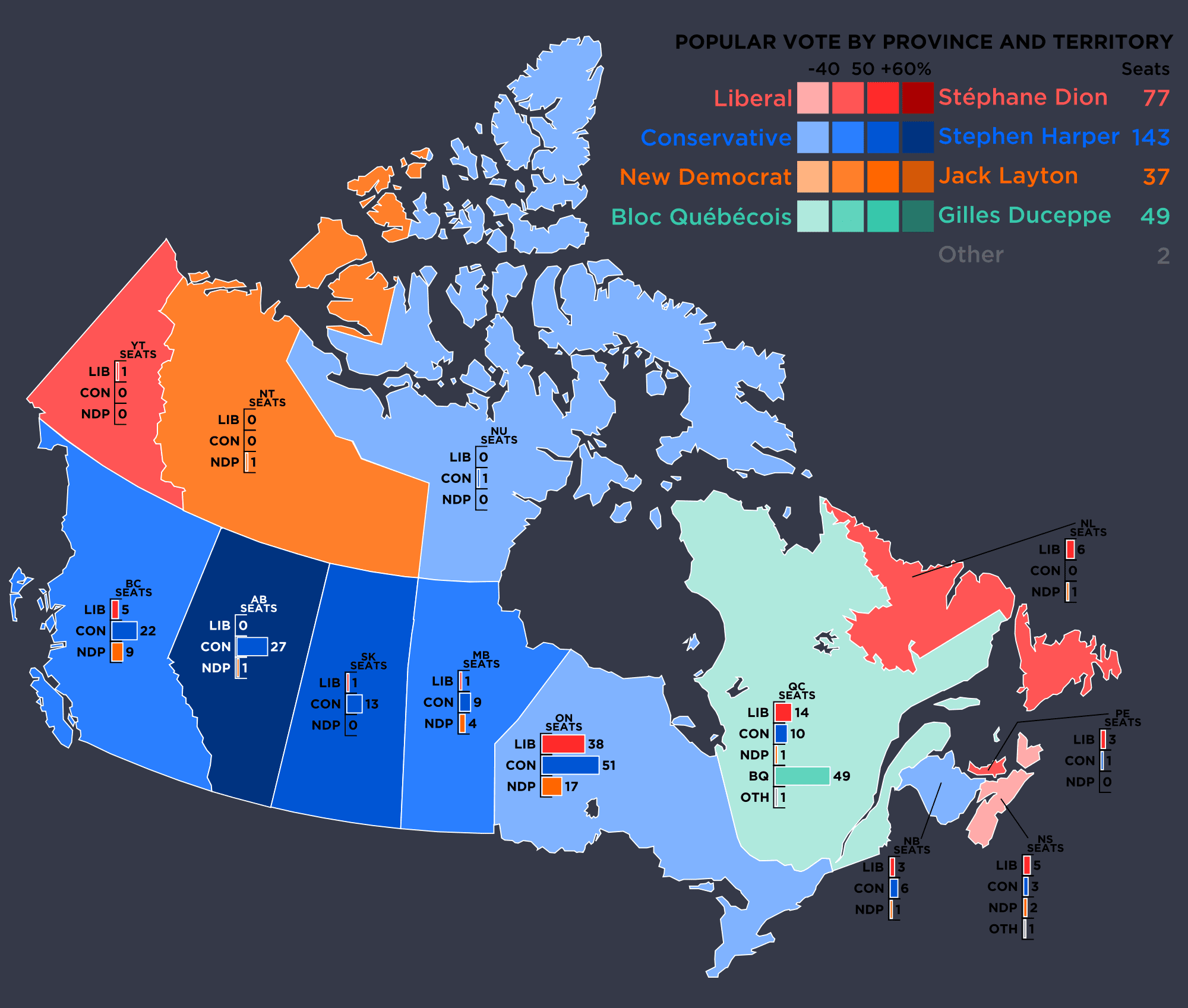

- Examples of previous elections and their effects on the currency: Examining the impact of previous Canadian federal elections on the CAD provides valuable insights into potential post-election scenarios. Historical data can help investors gauge the potential magnitude of fluctuations.

Global Economic Factors and Their Interaction

Global economic conditions significantly influence the CAD, interacting with election-related uncertainty to create a complex interplay of factors.

- Impact of trade agreements and international relations on the CAD: Trade agreements and international relations significantly influence Canada's economy and therefore, the CAD. Positive relations with trading partners can strengthen the CAD, while trade disputes can weaken it.

- Influence of oil prices (as a major Canadian export) on the currency's value: Oil prices directly impact Canada's economy, as it's a major oil exporter. Fluctuations in oil prices directly correlate with fluctuations in the CAD.

- How global inflation affects interest rate differentials and consequently the CAD: Global inflation affects interest rate differentials between Canada and other countries. Higher interest rates in Canada relative to other countries can attract foreign investment, strengthening the CAD.

Potential Scenarios for the Canadian Dollar Post-Election

The post-election trajectory of the CAD depends heavily on the election outcome and the resulting government's policies.

Scenario 1: A Strong Mandate and Pro-Growth Policies

A decisive victory for a party with clear pro-growth policies could boost investor confidence, potentially leading to a stronger CAD.

- How investor confidence could increase leading to a stronger CAD: A strong mandate signals political stability and the likelihood of policy implementation, attracting foreign investment and strengthening the CAD.

- Potential effects on investment and economic growth: Pro-growth policies would likely stimulate investment and economic growth, further strengthening the Canadian dollar.

Scenario 2: A Minority Government and Policy Gridlock

A minority government could result in policy gridlock and uncertainty, negatively affecting investor confidence and potentially weakening the CAD.

- How uncertainty can cause a weakening of the CAD due to investor hesitancy: Uncertainty about future policies discourages investment and leads to a weakening of the currency.

- Potential negative impacts on investment and economic growth: Policy gridlock could stifle economic growth, leading to a weaker Canadian dollar.

Scenario 3: Unexpected Election Outcomes and Market Reactions

Unexpected election results can trigger unpredictable market reactions, with the CAD potentially experiencing significant volatility.

- Potential "shock" reactions and their impact on the CAD: Unexpected outcomes can lead to sharp short-term fluctuations in the CAD as investors react to the surprise.

- Need for investors to remain vigilant and adapt their strategies accordingly: Investors need to remain vigilant and adapt their strategies to manage risk effectively during periods of heightened uncertainty.

Conclusion

The upcoming Canadian federal election poses significant risks and opportunities for the Canadian dollar. Changes in fiscal policies, the level of political uncertainty, and global economic conditions will all play a role in determining the post-election trajectory of the CAD. Investors and businesses should carefully analyze the platforms of different parties and prepare for potential volatility in the currency markets. Staying informed about the evolving political landscape and its potential impact on the Canadian dollar is crucial for making sound financial decisions. Monitor the situation closely and consider consulting a financial advisor to manage your exposure to CAD exchange rate fluctuations. Understanding the potential for a Canadian dollar drop after the election is key to proactive risk management.

Featured Posts

-

Kentucky Facing Storm Damage Assessment Delays A Comprehensive Look

Apr 30, 2025

Kentucky Facing Storm Damage Assessment Delays A Comprehensive Look

Apr 30, 2025 -

Tien Linh Tu San Bong Den Trai Tim Nhan Ai Dai Su Tinh Nguyen Tinh Binh Duong

Apr 30, 2025

Tien Linh Tu San Bong Den Trai Tim Nhan Ai Dai Su Tinh Nguyen Tinh Binh Duong

Apr 30, 2025 -

Yueksekten Duesme Kazasi Nevsehir De Goeruenmez Tehlike

Apr 30, 2025

Yueksekten Duesme Kazasi Nevsehir De Goeruenmez Tehlike

Apr 30, 2025 -

Nws Kentucky Focus On Severe Weather During Awareness Week

Apr 30, 2025

Nws Kentucky Focus On Severe Weather During Awareness Week

Apr 30, 2025 -

16 Million Penalty T Mobiles Three Year Data Breach Settlement

Apr 30, 2025

16 Million Penalty T Mobiles Three Year Data Breach Settlement

Apr 30, 2025

Latest Posts

-

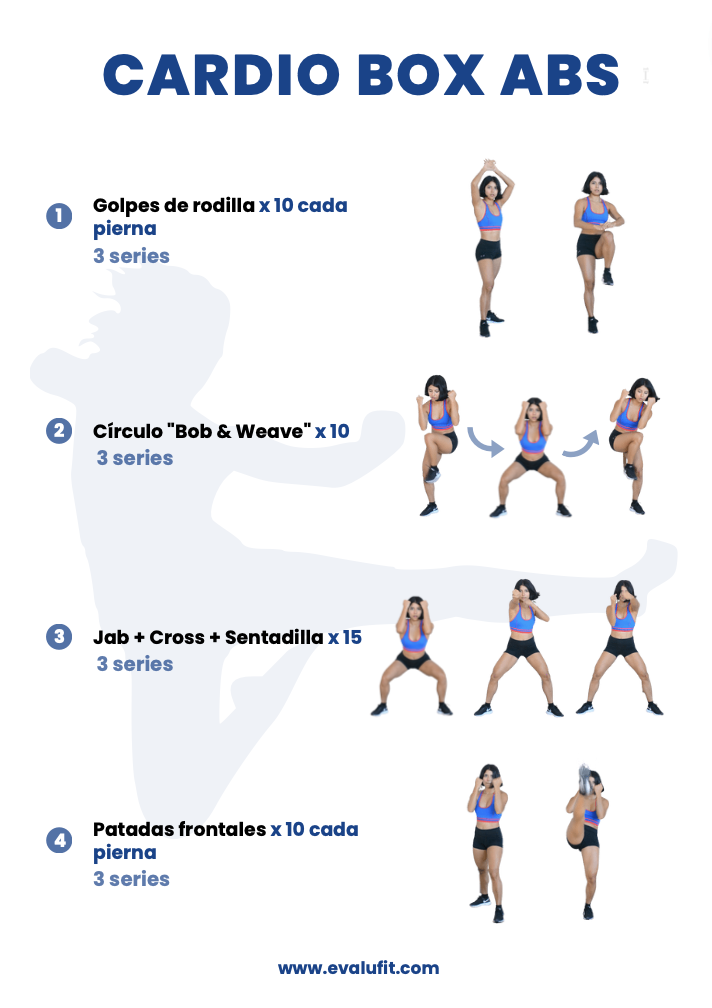

3 Dias Para Comenzar Clases De Boxeo En Estado De Mexico

Apr 30, 2025

3 Dias Para Comenzar Clases De Boxeo En Estado De Mexico

Apr 30, 2025 -

Solo 3 Dias Para Clases De Boxeo En El Edomex Apurate

Apr 30, 2025

Solo 3 Dias Para Clases De Boxeo En El Edomex Apurate

Apr 30, 2025 -

Reserva Tu Lugar Clases De Boxeo Edomex 3 Dias Restantes

Apr 30, 2025

Reserva Tu Lugar Clases De Boxeo Edomex 3 Dias Restantes

Apr 30, 2025 -

Boxeo En Edomex Comienza Tu Entrenamiento En 3 Dias

Apr 30, 2025

Boxeo En Edomex Comienza Tu Entrenamiento En 3 Dias

Apr 30, 2025 -

Anchetele Dosarelor X Se Apropie O Noua Investigatie

Apr 30, 2025

Anchetele Dosarelor X Se Apropie O Noua Investigatie

Apr 30, 2025