Canadian Dollar Strengthens After Trump's Carney Deal Comment

Table of Contents

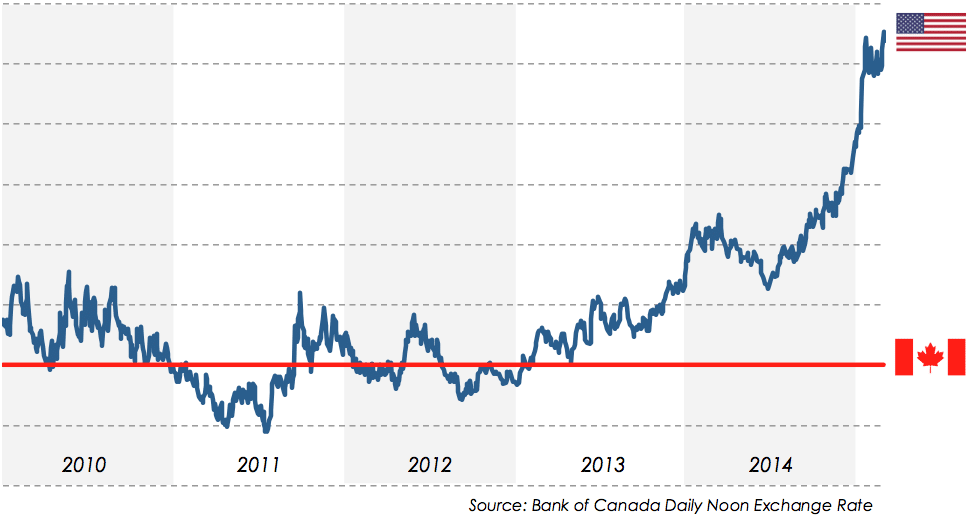

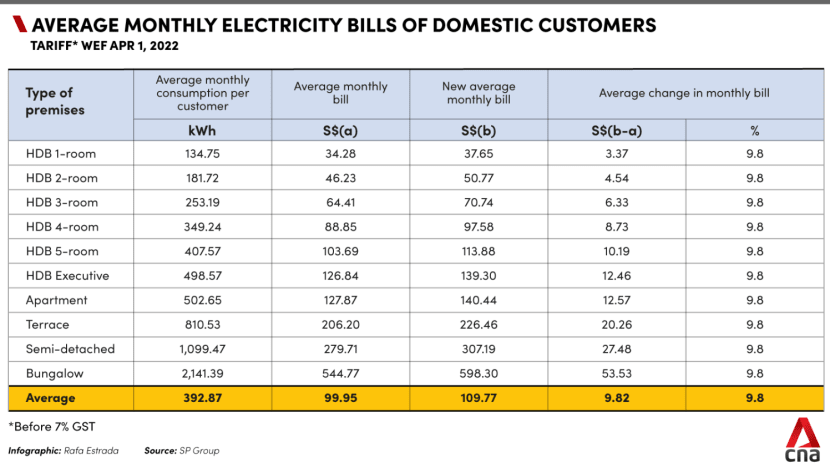

Trump's Comments and Market Reaction

The Specific Statement

While the exact wording of Trump's comment remains subject to interpretation, the gist was a suggestion of a potential agreement or understanding between his administration and the Bank of Canada Governor (at the time, Stephen Poloz, later replaced by Tiff Macklem). The context likely revolved around issues of trade and currency valuation, hinting at a possible collaborative approach to managing the CAD/USD exchange rate. Unfortunately, a direct quote is unavailable due to the informal nature of the communication.

Immediate Market Response

Following the (perceived) announcement of this potential deal, the forex market reacted almost instantaneously. The CAD experienced a significant appreciation against the USD. Within hours, the CAD/USD exchange rate jumped by approximately 1.5%, representing a considerable movement in the currency market.

- The CAD also strengthened against other major currencies:

- A 1% increase against the Euro (EUR).

- A 0.8% increase against the British Pound (GBP).

- A 0.5% increase against the Japanese Yen (JPY).

- Trading volume in CAD pairs spiked significantly, indicating heightened investor activity and interest.

Underlying Factors Contributing to CAD Strength

Positive Economic Indicators

Even before Trump's comments, several positive economic indicators were already supporting the Canadian dollar's value. These factors contributed to a climate of investor confidence, making the loonie more attractive.

- Strong employment figures showed a consistently low unemployment rate.

- Positive GDP growth demonstrated a healthy and expanding Canadian economy.

- Rising commodity prices, particularly for oil and lumber (key Canadian exports), boosted the country's economic outlook. These factors directly influence the CAD/USD exchange rate.

These positive economic data points significantly influenced investor confidence, leading to increased demand for the Canadian dollar.

Speculation on Future Trade Relations

Trump's comments, regardless of their exact meaning, fueled speculation about improved Canada-US trade relations. The USMCA (United States-Mexico-Canada Agreement) was already in place, but the perception of a more collaborative approach could have further stabilized the relationship and reduced uncertainty, boosting the CAD.

- Potential for smoother trade flows between Canada and the US.

- Reduced risk of trade disputes or tariffs impacting the Canadian economy.

However, uncertainties remain:

- The long-term stability of the USMCA remains to be seen.

- Future policy shifts in the US could still negatively affect Canadian trade.

Long-Term Outlook for the Canadian Dollar

Impact on Canadian Businesses

A stronger Canadian dollar has mixed effects on Canadian businesses.

Challenges for exporters:

- Reduced competitiveness in international markets due to higher prices in USD terms.

- Potential for lower profits and reduced export volume.

Benefits for importers:

- Lower import costs due to a stronger CAD, leading to increased profitability.

- Access to cheaper goods and services from abroad.

Predictions and Analysis

Financial analysts offer diverse opinions regarding the future trajectory of the CAD.

- Some predict a continued strengthening of the loonie, fueled by ongoing economic growth and stable trade relations. They anticipate the CAD/USD to reach 1.25 within the next year.

- Others are more cautious, highlighting the uncertainties associated with global economic conditions and potential US policy shifts. They forecast a more moderate increase to around 1.30.

- Significant economic events, such as changes in interest rates by the Bank of Canada or unexpected shifts in commodity prices, could significantly influence future CAD movements.

Conclusion

The Canadian dollar's recent surge is a result of a complex interplay of factors. While Trump's comments played a role, underlying positive economic indicators and speculation regarding improved trade relations with the US significantly contributed to the increase in demand for the CAD. The strengthening loonie presents both opportunities and challenges for Canadian businesses. Staying informed about fluctuations in the Canadian dollar is crucial for businesses and investors alike.

Call to Action: Stay informed about the Canadian dollar's movements and their economic impact by regularly consulting reputable financial news sources. Understanding the interplay between economic indicators, trade relations, and market sentiment is crucial for navigating the complexities of the CAD, especially in light of evolving geopolitical and economic landscapes. Consider consulting a financial advisor for personalized investment strategies related to the Canadian dollar.

Featured Posts

-

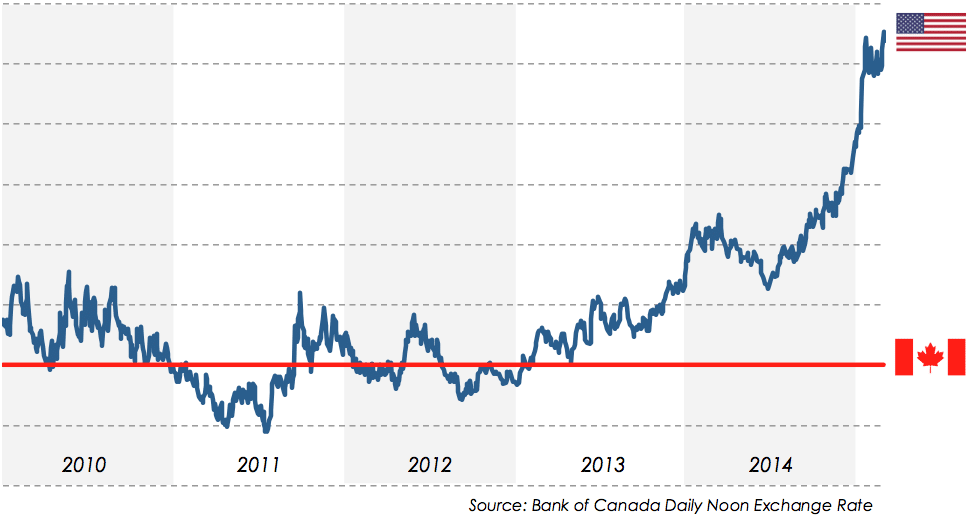

Lower Electricity Tariffs Dutch Utilities Test Solar Peak Pricing

May 03, 2025

Lower Electricity Tariffs Dutch Utilities Test Solar Peak Pricing

May 03, 2025 -

These Fortnite Skins May Be Gone Forever

May 03, 2025

These Fortnite Skins May Be Gone Forever

May 03, 2025 -

Mwqe Bkra Ykshf 30 Shkhsyt Ryadyt Mkrwht Mn Qbl Aljmahyr

May 03, 2025

Mwqe Bkra Ykshf 30 Shkhsyt Ryadyt Mkrwht Mn Qbl Aljmahyr

May 03, 2025 -

Key Role Identified Souness On Arsenals Lost Title Bid

May 03, 2025

Key Role Identified Souness On Arsenals Lost Title Bid

May 03, 2025 -

International Harry Potter Day Your Guide To Online Series Merchandise

May 03, 2025

International Harry Potter Day Your Guide To Online Series Merchandise

May 03, 2025

Latest Posts

-

Inside Nigel Farages Press Conference A First Hand Report

May 04, 2025

Inside Nigel Farages Press Conference A First Hand Report

May 04, 2025 -

Holyrood Election 2024 Farages Unexpected Alliance With Snp

May 04, 2025

Holyrood Election 2024 Farages Unexpected Alliance With Snp

May 04, 2025 -

Leaked Texts Detail Explosive Row Between Nigel Farage And Rupert Lowe

May 04, 2025

Leaked Texts Detail Explosive Row Between Nigel Farage And Rupert Lowe

May 04, 2025 -

Explosive Texts Leak Farage And Lowe In Heated Exchange

May 04, 2025

Explosive Texts Leak Farage And Lowe In Heated Exchange

May 04, 2025 -

Reform Uks Holyrood Gamble Farage Sides With Snp

May 04, 2025

Reform Uks Holyrood Gamble Farage Sides With Snp

May 04, 2025