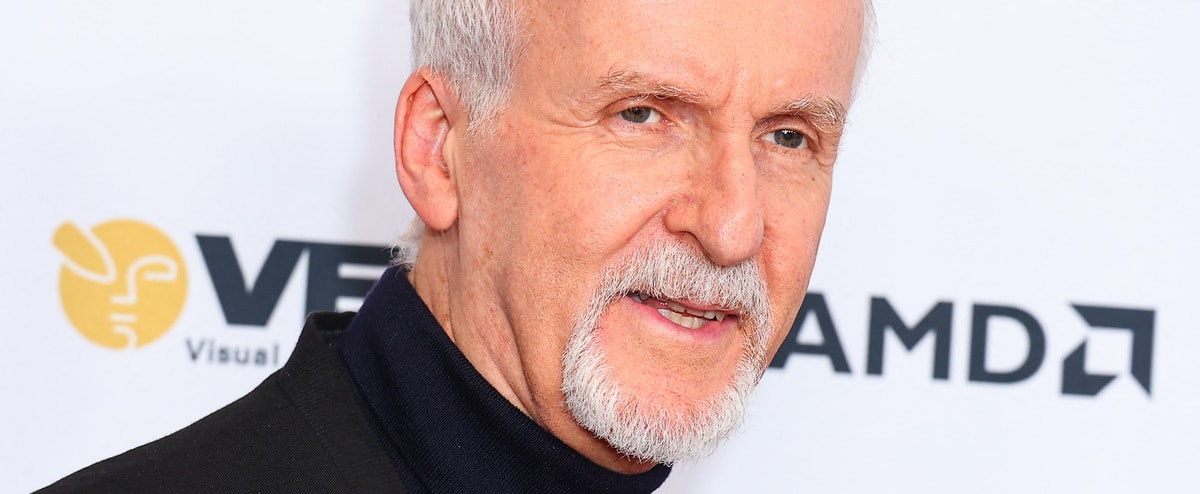

Canadian Dollar's Gain: Analyzing Trump's Influence On Currency Markets

Table of Contents

Trump's Trade Policies and their Impact on the CAD

Trump's administration pursued protectionist trade policies, significantly impacting the US-Canada relationship. The imposition of tariffs and the initiation of trade wars created considerable uncertainty in the North American market. Key Canadian exports, such as lumber and oil, faced direct consequences, influencing the CAD's value. The renegotiation of NAFTA, resulting in the USMCA (United States-Mexico-Canada Agreement), also played a significant role.

-

Increased Uncertainty in the Market: The unpredictable nature of Trump's trade policies led to increased volatility in the USD/CAD exchange rate, making it challenging for businesses to plan and manage their foreign exchange risk.

-

Short-Term Fluctuations in the CAD: Tariffs and trade disputes caused short-term declines in the CAD as investors reacted to the negative impact on Canadian exports and the overall economic outlook.

-

Potential Long-Term Benefits or Drawbacks: While the USMCA aimed to modernize trade rules, the long-term effects on the Canadian economy and the CAD remain a subject of ongoing debate among economists. Some argue that the agreement provided stability, while others point to lingering uncertainties.

-

Increased Volatility in the USD/CAD Exchange Rate: The period witnessed heightened volatility in the USD/CAD pair, presenting both opportunities and challenges for forex traders.

Economic Uncertainty Under Trump and its Effect on the Canadian Dollar

The economic uncertainty prevalent during the Trump administration had a ripple effect on global markets, impacting investor confidence in the Canadian dollar. Unpredictable policy decisions and often inflammatory rhetoric created a climate of doubt, influencing investment flows. Safe-haven assets, often sought during periods of instability, saw increased demand, indirectly affecting the CAD's value.

-

Impact of US Interest Rate Changes on CAD: Changes in US interest rates, influenced by Federal Reserve policy under Trump, significantly impacted the USD/CAD exchange rate, as investors adjusted their portfolios based on relative interest rate differentials.

-

Flight to Safety Impacting Demand for CAD: During periods of heightened global uncertainty, investors sometimes viewed the CAD as a relatively safe haven, increasing demand and supporting its value.

-

Investor Sentiment and its Effect on CAD Value: Negative investor sentiment towards the US economy often translated into increased demand for the CAD, acting as a safe haven currency.

Alternative Explanations for CAD Movements Beyond Trump's Influence

While Trump's policies played a significant role, it's crucial to acknowledge other factors influencing the Canadian dollar's performance. These include:

-

Commodity Prices (oil, natural gas): Canada is a major exporter of commodities. Fluctuations in oil and natural gas prices directly impact the CAD, often overriding other factors.

-

Canadian Interest Rates: The Bank of Canada's monetary policy decisions, including interest rate adjustments, significantly affect the attractiveness of the CAD to investors.

-

Global Economic Growth: Global economic conditions, including growth rates in major trading partners, have a considerable impact on the CAD's value.

-

Political Stability within Canada: Domestic political stability and economic policies within Canada also influence investor confidence and the CAD's value.

These factors often interact complexly with those stemming from US policies, creating a multifaceted picture of CAD movements. Analyzing these interactions requires a careful consideration of various economic indicators and their interplay.

Predicting Future Trends for the Canadian Dollar

Predicting future CAD performance requires a cautious approach, considering evolving geopolitical situations and economic factors. While Trump's influence is receding, the lingering effects of his policies, coupled with new global challenges, will continue to shape the currency's trajectory. Future US administrations and their policies will also play a significant role.

-

Scenario 1: Continued Global Uncertainty: If global uncertainty persists, the CAD could maintain its position as a relatively safe-haven asset, leading to increased demand.

-

Scenario 2: Strong Global Growth: Robust global economic growth, particularly in key trading partners, would likely strengthen the CAD, driven by increased demand for Canadian exports.

-

Scenario 3: Commodity Price Volatility: Significant fluctuations in commodity prices, especially oil, will continue to exert a major influence on the CAD's value.

Conclusion: Understanding the Complex Relationship Between Trump's Legacy and the Canadian Dollar

The Canadian dollar's performance during and after the Trump presidency reveals a complex interplay of factors. While Trump's trade policies and economic uncertainty played a considerable role, it's essential to remember the influence of commodity prices, Canadian interest rates, and global economic growth. Understanding the USD/CAD exchange rate requires a nuanced approach, considering diverse economic indicators. To stay informed, continue monitoring the Canadian dollar, conduct further research on currency market analysis, and stay updated on global events impacting foreign exchange rates and the USD/CAD pair. Understanding these dynamics is crucial for informed decision-making in forex trading and international business. Develop effective Canadian dollar forecast models and refine your currency trading strategies based on your analysis of the forex market outlook.

Featured Posts

-

Explosive Texts Reveal Bitter Row Between Nigel Farage And Rupert Lowe

May 03, 2025

Explosive Texts Reveal Bitter Row Between Nigel Farage And Rupert Lowe

May 03, 2025 -

Reform Uk And Farming Promises Vs Reality

May 03, 2025

Reform Uk And Farming Promises Vs Reality

May 03, 2025 -

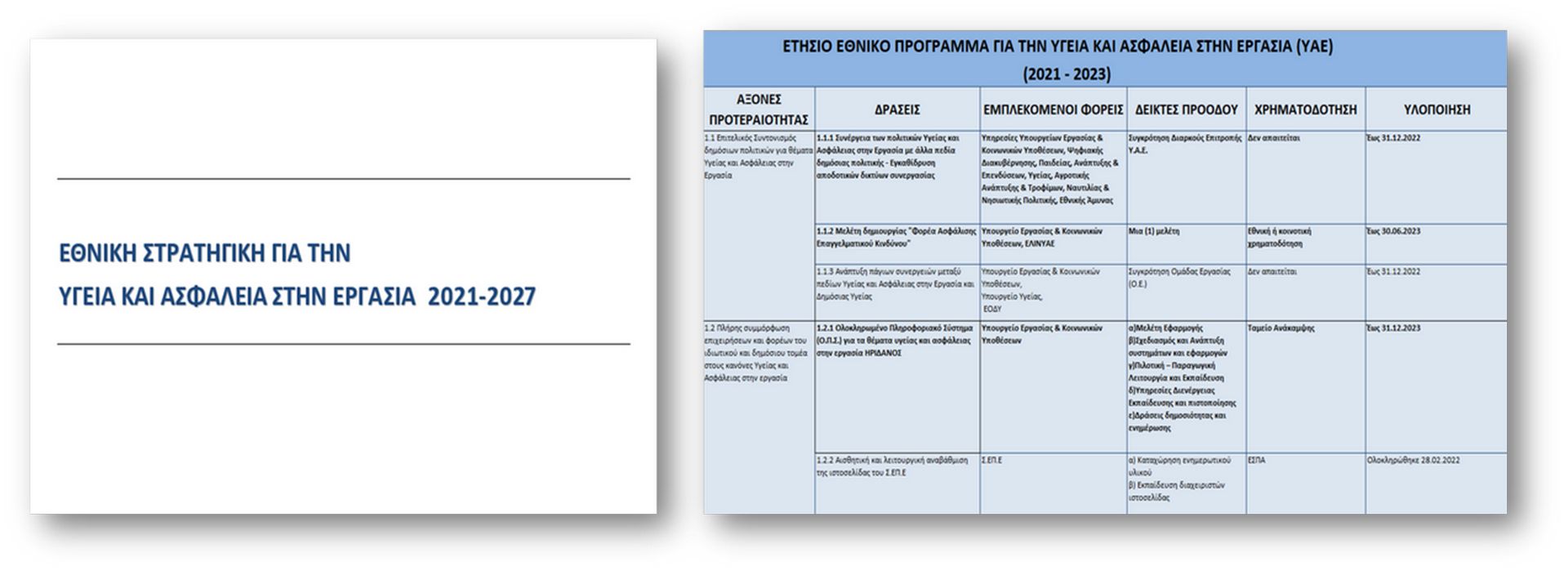

Ethniki Stratigiki P Syxikis Ygeias 2025 2028 Kyrioi Stoxoi Kai Draseis

May 03, 2025

Ethniki Stratigiki P Syxikis Ygeias 2025 2028 Kyrioi Stoxoi Kai Draseis

May 03, 2025 -

Christina Aguileras Altered Image A Discussion On Body Image And Photoshop

May 03, 2025

Christina Aguileras Altered Image A Discussion On Body Image And Photoshop

May 03, 2025 -

How To Obtain All Fortnite Tmnt Skins A Step By Step Guide

May 03, 2025

How To Obtain All Fortnite Tmnt Skins A Step By Step Guide

May 03, 2025

Latest Posts

-

Gaza Macron Met En Garde Contre Une Militarisation Israelienne De L Aide Humanitaire

May 04, 2025

Gaza Macron Met En Garde Contre Une Militarisation Israelienne De L Aide Humanitaire

May 04, 2025 -

Nigel Farages Reform Party Tory Claims Of A Sham Defection Announcement

May 04, 2025

Nigel Farages Reform Party Tory Claims Of A Sham Defection Announcement

May 04, 2025 -

Zakharova O Situatsii S Makronami Kommentariy I Reaktsiya

May 04, 2025

Zakharova O Situatsii S Makronami Kommentariy I Reaktsiya

May 04, 2025 -

Shrewsbury Visit Farage Attacks Conservatives Over Relief Road Plans

May 04, 2025

Shrewsbury Visit Farage Attacks Conservatives Over Relief Road Plans

May 04, 2025 -

Tories Accuse Nigel Farage Of Sham Announcement Reform Party Defections

May 04, 2025

Tories Accuse Nigel Farage Of Sham Announcement Reform Party Defections

May 04, 2025