Canadian Labour Market Report: Rosenberg's Analysis And Rate Cut Outlook

Table of Contents

Rosenberg's Key Observations on the Canadian Labour Market Report

David Rosenberg, a highly respected voice in Canadian economic analysis, offers a nuanced perspective on the latest employment data. His analysis often challenges conventional interpretations, providing valuable insights for investors and policymakers. Key aspects of his assessment typically include:

-

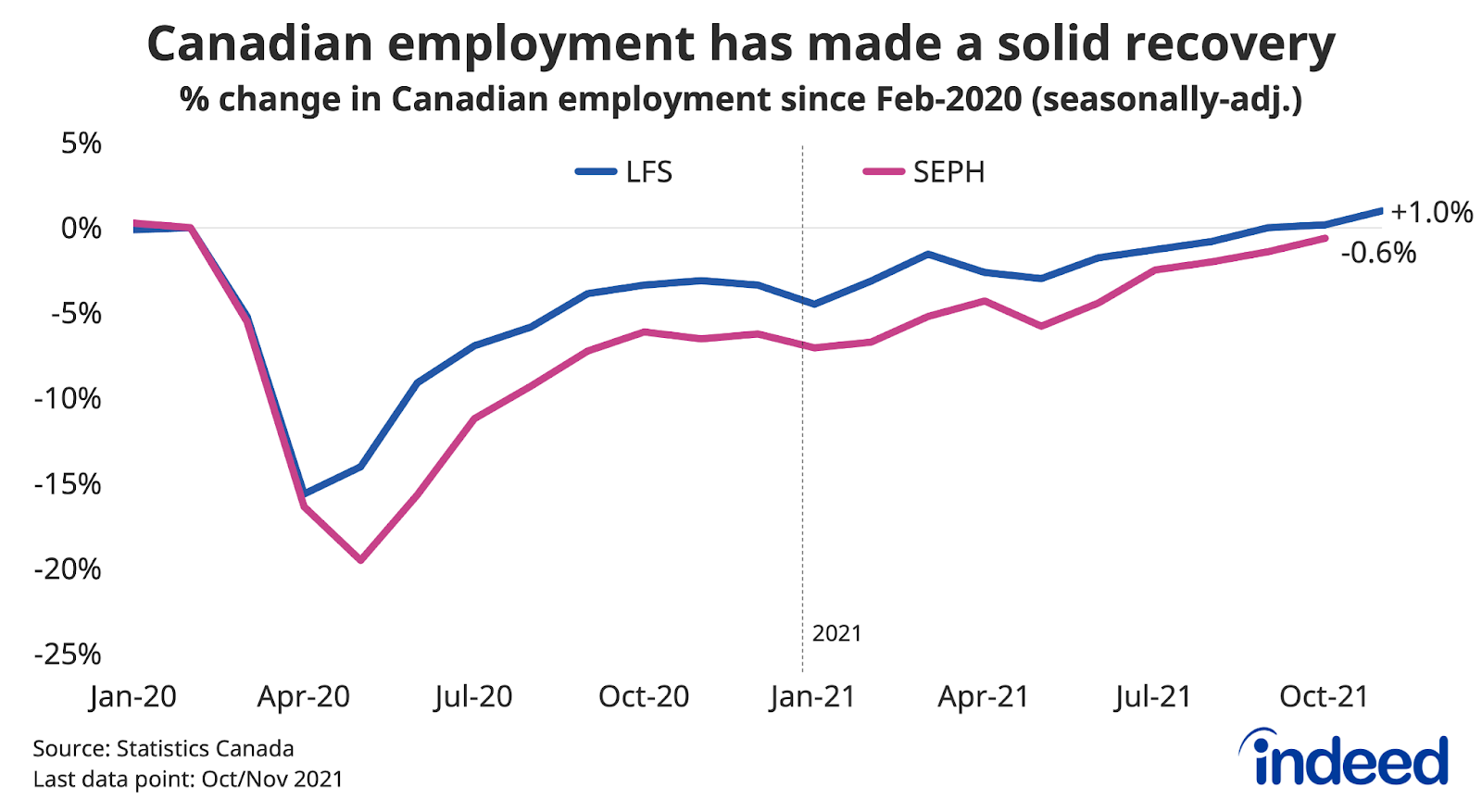

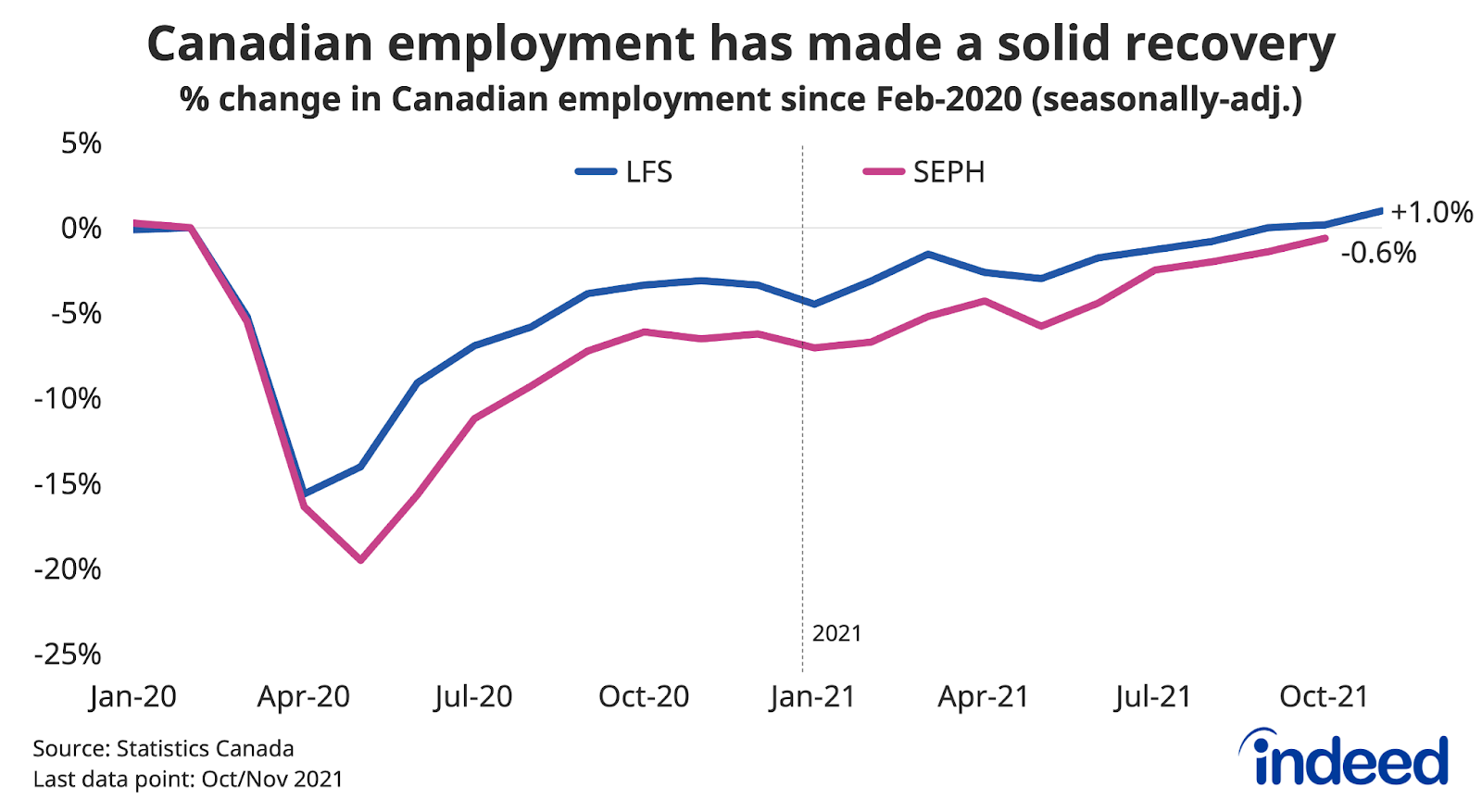

Employment Growth and Job Creation: Rosenberg scrutinizes the headline numbers on employment growth, often digging deeper than simply the net change in jobs. He examines the quality of jobs created, considering factors like full-time versus part-time positions and the prevalence of contract work. His analysis often highlights discrepancies between headline employment figures and underlying labour market dynamics.

-

Participation Rates: Rosenberg pays close attention to labour force participation rates, examining the proportion of the working-age population actively seeking employment. Changes in participation rates can significantly affect the unemployment rate and provide insights into the overall health of the labour market. A declining participation rate, for example, can mask underlying weakness in job creation.

-

Sector-Specific Trends: Rather than focusing solely on aggregate numbers, Rosenberg often dissects employment trends across various sectors of the Canadian economy. This granular analysis reveals the health of specific industries, highlighting potential strengths and weaknesses. He might, for instance, compare employment growth in the manufacturing sector to that of the service sector, providing a more nuanced picture of the labour market.

-

Regional Variations: Recognizing the diversity of the Canadian economy, Rosenberg also considers regional variations in employment data. He analyzes differences in job creation, unemployment rates, and participation rates across provinces and territories, providing a more comprehensive understanding of the national labour market.

Inflationary Pressures and their Impact on Rate Cut Expectations

The interplay between the Canadian labour market and inflation is crucial in shaping the Bank of Canada's monetary policy decisions. High inflation, often fueled by strong wage growth in a tight labour market, can lead to interest rate hikes to cool down the economy. Conversely, weak employment and low inflation might prompt rate cuts to stimulate economic activity.

-

Inflation Rate and Labour Market Data: Rosenberg carefully examines the correlation between the current inflation rate and the latest labour market data. He analyzes whether the employment figures support or contradict the prevailing inflation narrative. A surprisingly strong labour market, for example, might suggest that inflationary pressures are more persistent than initially anticipated.

-

Bank of Canada's Inflation Target: The Bank of Canada has a mandated inflation target, usually around 2%. Rosenberg's analysis considers how the reported labour market data affects the Bank's ability to meet this target. If inflation is consistently above the target, despite potential weaknesses in the labour market, it could lead to continued interest rate hikes.

-

Wage Pressures and Inflation: Rosenberg meticulously analyzes the potential for wage pressures stemming from a tight labour market. Rapid wage growth can fuel inflation as businesses pass increased labour costs onto consumers. He assesses the likelihood and magnitude of these wage pressures and their potential impact on the overall inflation rate.

-

The Phillips Curve: Rosenberg might also draw on the Phillips Curve, an economic model suggesting an inverse relationship between unemployment and inflation. However, the reliability of this model has been debated, and its application requires careful consideration of other economic factors.

Probability of a Rate Cut: Rosenberg's Predictions and Market Sentiment

Based on his analysis of the Canadian Labour Market Report and other economic indicators, Rosenberg often makes predictions regarding the Bank of Canada's future interest rate decisions. His predictions are closely watched by investors and market analysts.

-

Rosenberg's Rate Cut Predictions: Rosenberg's forecasts typically consider the interplay between inflation, employment data, and other economic factors. He weighs the potential benefits of a rate cut (stimulating economic growth) against the risks (fueling inflation). His analysis might lead him to predict a rate cut, a pause in rate changes, or further interest rate hikes.

-

Market Reaction: The market's response to Rosenberg's analysis and the latest labour market data is a crucial element in understanding the overall economic outlook. A positive market reaction might signal confidence in the economy's resilience, while a negative reaction could indicate increased concerns about a potential recession.

-

Impact on Bond Yields: Changes in interest rate expectations significantly influence bond yields. Rosenberg’s analysis can impact bond prices and yields, providing insight into investor sentiment and expectations about future monetary policy.

-

Alternative Scenarios and Risks: Rosenberg typically acknowledges the uncertainty inherent in economic forecasting. He outlines potential alternative scenarios, considering factors like unexpected inflation surges or geopolitical events that could impact his initial predictions.

Long-Term Implications for the Canadian Economy

The current state of the Canadian labour market and the Bank of Canada's interest rate decisions have significant long-term implications for the Canadian economy. Rosenberg's analysis provides valuable insights into these potential consequences.

-

Long-Term Economic Outlook: Rosenberg's overall assessment of the Canadian economy considers the sustainability of current economic trends. His insights extend beyond short-term fluctuations to encompass a longer-term perspective on economic growth and stability.

-

Impact on Consumer Spending and Business Investment: Interest rates directly influence consumer spending and business investment decisions. A rate cut might stimulate both, while higher interest rates could have a dampening effect. Rosenberg's analysis helps in understanding the potential impact on these key drivers of economic growth.

-

Potential Policy Responses: Rosenberg's commentary often touches upon potential government policy responses to address economic challenges. He might analyze the effectiveness of fiscal policy measures or suggest alternative approaches to support economic growth and stability.

-

Rosenberg's Overall View: Rosenberg's overall perspective on the future trajectory of the Canadian economy provides valuable context for investors, policymakers, and the general public. His assessments often challenge prevailing narratives, offering alternative perspectives and valuable insights.

Conclusion

This analysis of the Canadian Labour Market Report, informed by David Rosenberg's perspective, presents a multifaceted view of the Canadian economy. While recent employment figures show some positive signs, inflationary pressures and their implications for the Bank of Canada's monetary policy remain significant concerns. Rosenberg's insights offer crucial context for understanding the probability of future rate cuts and the long-term economic outlook.

Call to Action: Stay informed about the dynamic Canadian labour market and its influence on interest rates. Follow our blog for regular updates on the Canadian Labour Market Report and insightful analyses from leading economists like David Rosenberg. Subscribe now to receive regular updates on the Canadian Labour Market and rate cut outlook.

Featured Posts

-

Dren Bio Et Sanofi Collaboration Strategique Pour Le Traitement Des Maladies Immunologiques

May 31, 2025

Dren Bio Et Sanofi Collaboration Strategique Pour Le Traitement Des Maladies Immunologiques

May 31, 2025 -

Arnarulunguaq L Heritage D Une Femme Inuit

May 31, 2025

Arnarulunguaq L Heritage D Une Femme Inuit

May 31, 2025 -

Reeves Labour Policies Parallels With Scargills Militancy

May 31, 2025

Reeves Labour Policies Parallels With Scargills Militancy

May 31, 2025 -

Rosemary And Thyme Recipes Flavorful Dishes For Every Occasion

May 31, 2025

Rosemary And Thyme Recipes Flavorful Dishes For Every Occasion

May 31, 2025 -

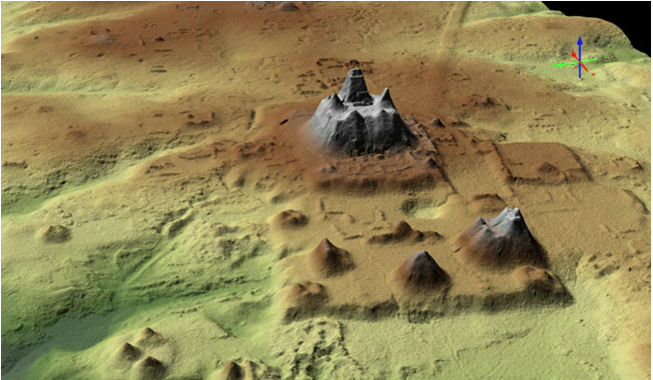

Ancient Mayan City Discovered Extensive Canal System And Pyramids Found

May 31, 2025

Ancient Mayan City Discovered Extensive Canal System And Pyramids Found

May 31, 2025