Canadian Mortgage Trends: The Unpopularity Of 10-Year Terms

Table of Contents

The Risk-Reward Equation: Why Canadians Hesitate with 10-Year Mortgages

The decision to opt for a 10-year mortgage in Canada involves carefully weighing the potential benefits against significant risks. Many Canadians find the scales tip in favor of shorter-term options.

Predicting Long-Term Interest Rates:

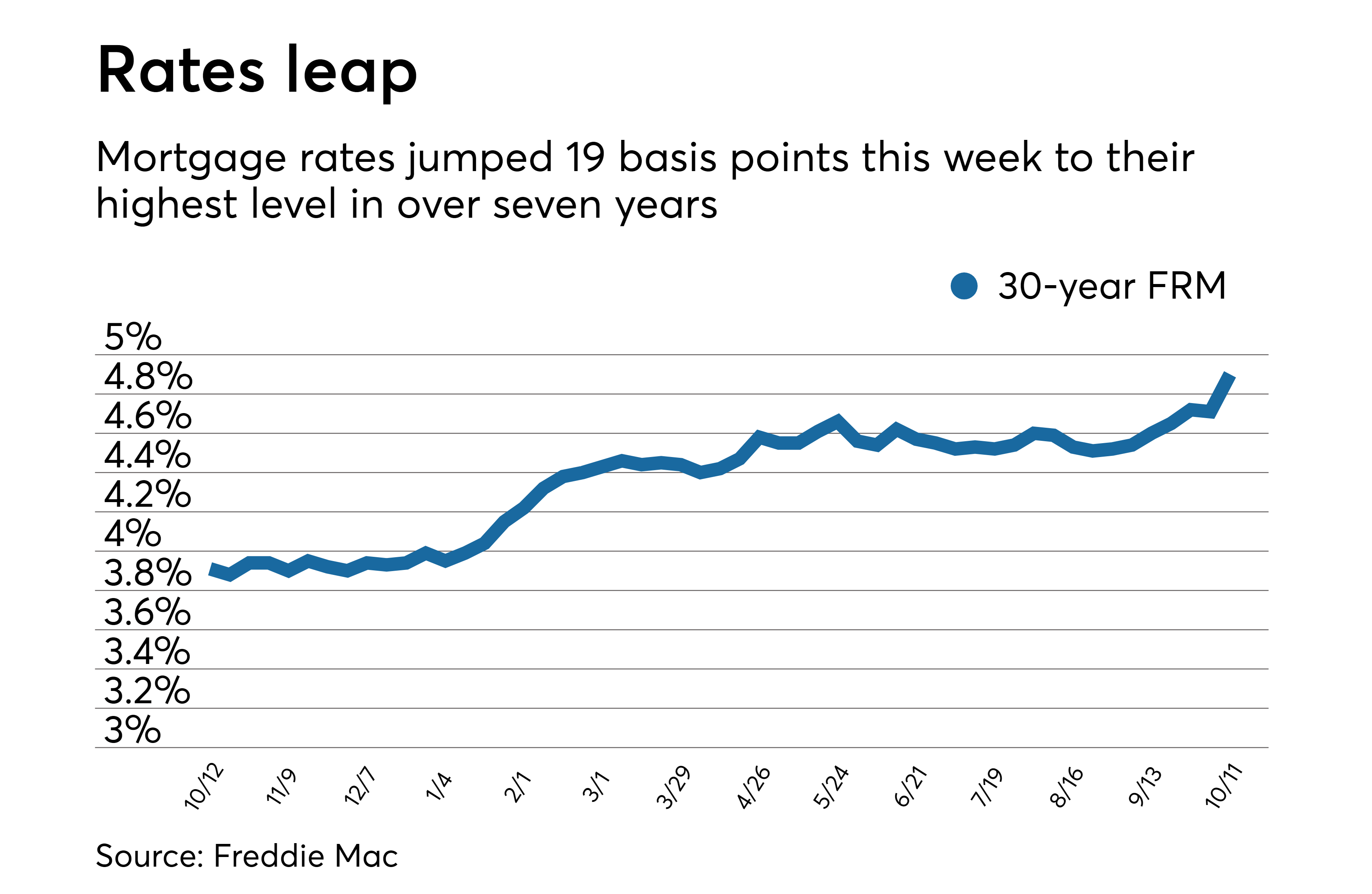

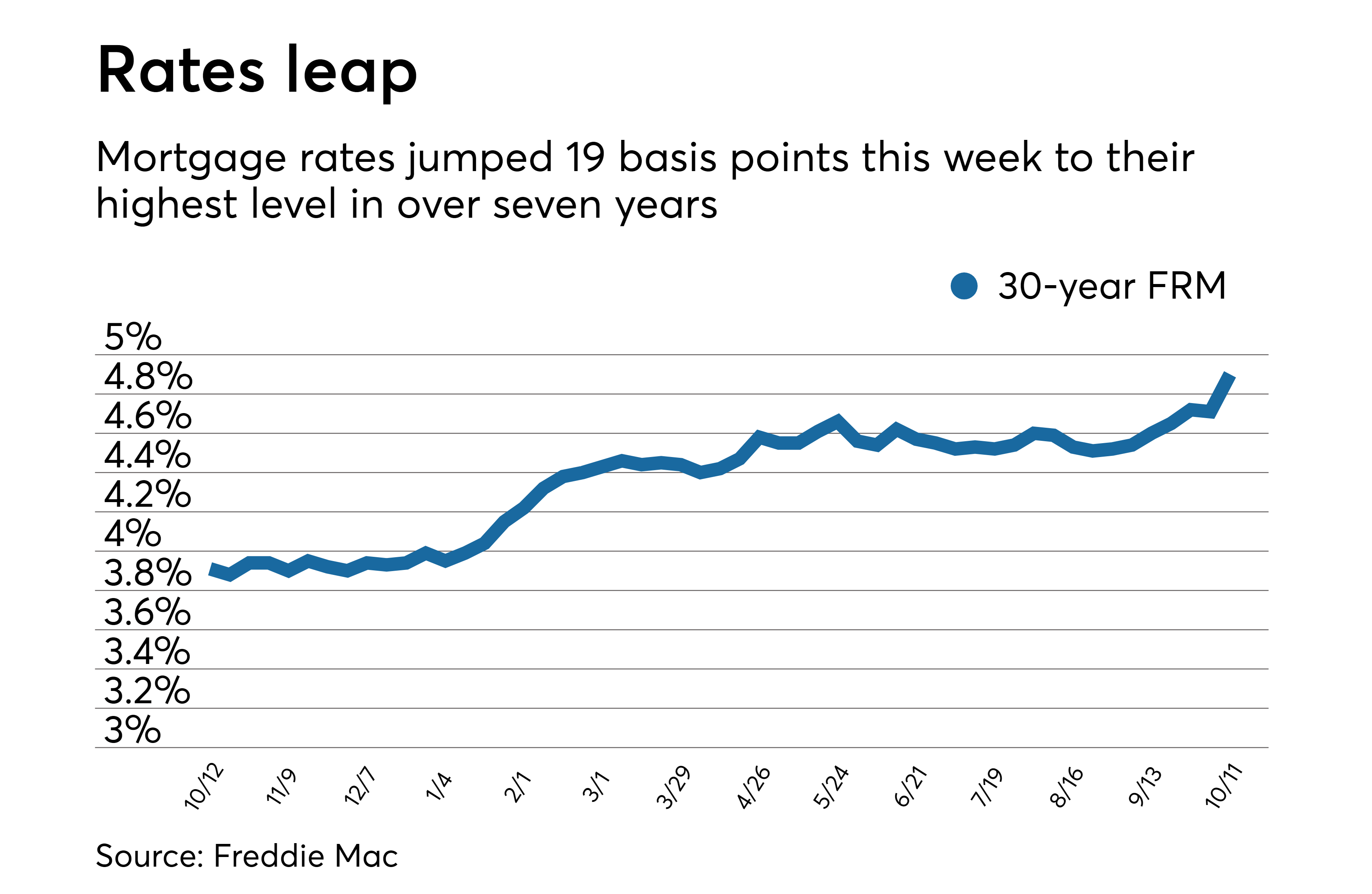

The inherent uncertainty of predicting interest rate fluctuations over a decade is a significant deterrent for many potential borrowers considering a 10-year mortgage. A fixed rate, while offering the perceived stability of predictable monthly payments, might lock borrowers into a high rate if market conditions shift favorably. This is a major risk associated with long-term mortgage options.

- Economic uncertainty and global events impact interest rate predictions, making long-term commitments risky. Unforeseen economic downturns or international crises can dramatically alter the interest rate environment, leaving borrowers potentially overpaying for the duration of their 10-year term.

- Potential for rate drops during the term leads to lost opportunities for refinancing. If interest rates fall significantly during the 10-year period, borrowers are locked into a higher rate, missing out on potential savings through refinancing with a lower rate mortgage. This lost opportunity cost is a key factor in the unpopularity of 10-year mortgages Canada-wide.

Flexibility and Life Changes:

Life is unpredictable. A 10-year commitment significantly limits flexibility to adapt to unforeseen circumstances such as job loss, relocation, or changing family needs. The long-term nature of this commitment makes it less appealing to many Canadians.

- Prepayment penalties on 10-year mortgages can be substantial. Breaking a 10-year mortgage early, even for justifiable reasons, can result in significant financial penalties that offset any perceived advantages of a lower initial interest rate.

- Difficulty in selling a home with a lengthy mortgage term. A long-term mortgage can make it harder to sell a property quickly if circumstances require it, as potential buyers might be less interested in inheriting a lengthy mortgage commitment.

The Rise of Shorter-Term Mortgages in Canada

The declining popularity of 10-year mortgages in Canada is directly correlated with the increasing popularity of shorter-term options offering more flexibility and manageable risk.

Popularity of 5-Year Terms:

The 5-year fixed-rate mortgage remains the dominant choice for Canadian homeowners, providing a balance between stability and flexibility. This term length offers a sweet spot for many, providing enough time to benefit from a fixed rate while maintaining the opportunity for refinancing as market conditions change.

- Regular refinancing opportunities allow borrowers to adapt to changing market conditions. At the end of the 5-year term, borrowers can reassess their financial situation and refinance at a potentially more favorable interest rate.

- Lower prepayment penalties compared to longer terms. While prepayment penalties still apply, they are generally less substantial than those associated with 10-year mortgages, offering greater flexibility to manage the mortgage over time.

Open Mortgages Gaining Ground:

Open mortgages provide greater flexibility, allowing for larger prepayments or even full repayment without penalty. While usually carrying a slightly higher interest rate, the increased flexibility makes them attractive to many Canadians.

- Ideal for borrowers anticipating significant financial changes or large lump sum payments. This option is particularly beneficial for those expecting inheritances, bonuses, or other windfalls that they may wish to apply towards their mortgage.

- Provides greater peace of mind for those seeking flexibility. The lack of stringent penalties for early repayment offers a safety net for unexpected events or financial shifts.

Other Factors Influencing Mortgage Term Selection

Several other factors beyond interest rate predictions and flexibility influence Canadian homeowners' choices of mortgage terms.

The Role of Mortgage Brokers:

Experienced mortgage brokers play a crucial role in guiding clients towards the most suitable mortgage term. Their expertise goes beyond simply comparing interest rates.

- Personalized advice considers factors beyond interest rates. Brokers assess individual financial situations, risk tolerance, and long-term financial goals to recommend the optimal mortgage term.

- Access to a broader range of mortgage products and lenders. Brokers have access to a wider selection of mortgage products and lenders, increasing the chances of finding the best deal for each client's specific needs.

Impact of Down Payment Size:

The size of the down payment significantly influences mortgage term selection. A larger down payment provides borrowers more leverage and potentially more favorable terms.

- Higher down payments reduce lender risk and increase choice. A larger down payment reduces the lender's perceived risk, potentially opening up more options, including shorter-term mortgages.

- Potentially higher initial costs to consider. While a larger down payment offers advantages, it also requires a larger upfront investment, a factor to be considered in the overall financial planning.

Conclusion

While a 10-year mortgage in Canada offers the potential for lower interest rates, the inherent risks associated with long-term rate predictions, coupled with the need for flexibility, contribute to their unpopularity. Shorter-term mortgages, particularly 5-year fixed-rate and open mortgages, are increasingly preferred by Canadian homeowners due to their adaptability and reduced risk. Understanding these trends and seeking professional advice from a mortgage broker is crucial when making your mortgage decision. Don't hesitate to explore the options beyond a 10-year mortgage; find the best fit for your needs and financial goals by carefully comparing shorter-term mortgages and open mortgage options available in the Canadian market. Make an informed decision about your 10-year mortgage in Canada today.

Featured Posts

-

Chinas Automotive Landscape A Deep Dive Into The Bmw And Porsche Situation

May 05, 2025

Chinas Automotive Landscape A Deep Dive Into The Bmw And Porsche Situation

May 05, 2025 -

Anna Kendrick And The Accountant Franchise A Necessary Partnership

May 05, 2025

Anna Kendrick And The Accountant Franchise A Necessary Partnership

May 05, 2025 -

Ai And Blockchain Convergence Chainalysiss Strategic Acquisition Of Alterya

May 05, 2025

Ai And Blockchain Convergence Chainalysiss Strategic Acquisition Of Alterya

May 05, 2025 -

Sheung Wans Honjo A Review Of A Modern Japanese Izakaya

May 05, 2025

Sheung Wans Honjo A Review Of A Modern Japanese Izakaya

May 05, 2025 -

Economic Growth In Canada Gary Mar Advocates For Prioritizing Western Development

May 05, 2025

Economic Growth In Canada Gary Mar Advocates For Prioritizing Western Development

May 05, 2025

Latest Posts

-

Sarajevo Book Fair Gibonni Predstavlja Novo Djelo

May 05, 2025

Sarajevo Book Fair Gibonni Predstavlja Novo Djelo

May 05, 2025 -

Gibonni Gost Na Sarajevo Book Fair U

May 05, 2025

Gibonni Gost Na Sarajevo Book Fair U

May 05, 2025 -

Why Fleetwood Macs Albums Remain Popular A Deep Dive Into Their Catalog

May 05, 2025

Why Fleetwood Macs Albums Remain Popular A Deep Dive Into Their Catalog

May 05, 2025 -

Gibonni Na Sarajevo Book Fair Promocija Novog Izdanja

May 05, 2025

Gibonni Na Sarajevo Book Fair Promocija Novog Izdanja

May 05, 2025 -

Exploring Fleetwood Macs Vast And Popular Music Catalog

May 05, 2025

Exploring Fleetwood Macs Vast And Popular Music Catalog

May 05, 2025