Canadian Recession Deepens: Economists' Posthaste Warnings

Table of Contents

The Canadian economy is facing increasing headwinds, with leading economists issuing posthaste warnings of a deepening recession. Concerns over inflation, rising interest rates, and global uncertainty are fueling fears of a prolonged and potentially severe economic downturn. This article examines the key factors contributing to this escalating economic crisis and explores the potential consequences for Canadian households and businesses. The Canadian recession is a developing situation that requires careful monitoring and proactive planning.

<h2>Rising Interest Rates and Their Impact</h2>

The Bank of Canada's aggressive interest rate hikes, aimed at curbing inflation, are significantly impacting consumer spending and investment. Higher borrowing costs are making it more expensive for businesses to expand and for individuals to purchase homes or make large purchases. This monetary policy, while intended to control inflation, is creating a ripple effect throughout the Canadian economy.

- Increased mortgage payments are leading to reduced disposable income for many Canadians. Higher mortgage rates are forcing households to cut back on spending, impacting various sectors from retail to entertainment. This reduced consumer spending further dampens economic growth.

- Businesses are delaying investment projects due to higher borrowing costs. The increased cost of capital is making expansion and investment less attractive, leading to slower job creation and reduced economic activity. This hesitancy contributes to a slowdown in overall economic growth.

- The housing market is experiencing a significant slowdown, impacting related industries. The combination of higher interest rates and reduced consumer confidence is leading to a decline in home sales and construction activity, affecting jobs and investment in the housing sector and related industries.

<h2>Inflationary Pressures and Their Persistence</h2>

Persistently high inflation continues to erode consumer purchasing power. Rising costs of essential goods like food and energy are disproportionately affecting lower-income households. Supply chain disruptions and geopolitical instability are contributing factors, making the inflationary pressures particularly challenging to overcome. The sustained high inflation rate is a major driver of the worsening Canadian recession.

- Food inflation is at a multi-decade high. The rising cost of groceries is putting a strain on household budgets, forcing families to make difficult choices about their spending. This impacts food security and overall economic well-being.

- Energy prices remain elevated, impacting transportation and manufacturing costs. Higher energy costs increase the price of goods and services across the board, further fueling inflation and impacting businesses' profitability. This has knock-on effects throughout the supply chain.

- Wage growth is not keeping pace with inflation, squeezing household budgets. Even with modest wage increases, many Canadians are finding it difficult to keep up with the rising cost of living, leading to reduced spending and increased financial stress.

<h2>Global Economic Uncertainty and its Ripple Effect on Canada</h2>

The global economic outlook remains uncertain, with many countries facing potential recessions. This global instability is impacting Canadian exports and commodity prices, further exacerbating economic challenges. The interconnected nature of the global economy means that Canada is not immune to international economic headwinds.

- A slowdown in the US economy directly affects Canadian trade. The US is Canada's largest trading partner, so any economic downturn south of the border has significant repercussions for the Canadian economy. This is particularly true for sectors heavily reliant on US exports.

- Fluctuations in global commodity prices impact Canadian resource-based industries. Canada's economy is significantly reliant on resource extraction and export. Global commodity price volatility creates instability and uncertainty within these crucial sectors.

- Geopolitical tensions contribute to increased uncertainty and volatility in the markets. Global events, such as the war in Ukraine, create uncertainty and volatility, impacting investor confidence and investment flows into the Canadian economy.

<h3>Economists' Predictions and Forecasts</h3>

Leading economists are forecasting a significant contraction in Canada's GDP, with varying predictions on the depth and duration of the recession. These predictions are based on complex economic models and analyses of current economic indicators. The consensus, however, points to a concerning economic outlook. Different models offer differing levels of severity, but all indicate a significant economic downturn. The probability of a prolonged Canadian recession is increasing.

<h2>Conclusion</h2>

The Canadian economy is facing a serious threat of a deepening recession driven by rising interest rates, persistent inflation, and global economic uncertainty. Economists' warnings are increasingly dire, highlighting the need for proactive measures and careful financial planning. The severity of this Canadian recession will depend on several factors, including government policy responses and the evolution of the global economic landscape.

Call to Action: Stay informed about the evolving situation and understand how the deepening Canadian recession might impact you. Monitor economic news, consult with financial advisors, and develop a robust financial plan to mitigate potential risks and navigate the challenges of this economic downturn. Learn more about the Canadian recession and its potential consequences to proactively protect yourself and your family.

Featured Posts

-

T Mobiles 16 Million Fine Three Years Of Data Breaches

Apr 23, 2025

T Mobiles 16 Million Fine Three Years Of Data Breaches

Apr 23, 2025 -

Over The Counter Birth Control A Post Roe Game Changer

Apr 23, 2025

Over The Counter Birth Control A Post Roe Game Changer

Apr 23, 2025 -

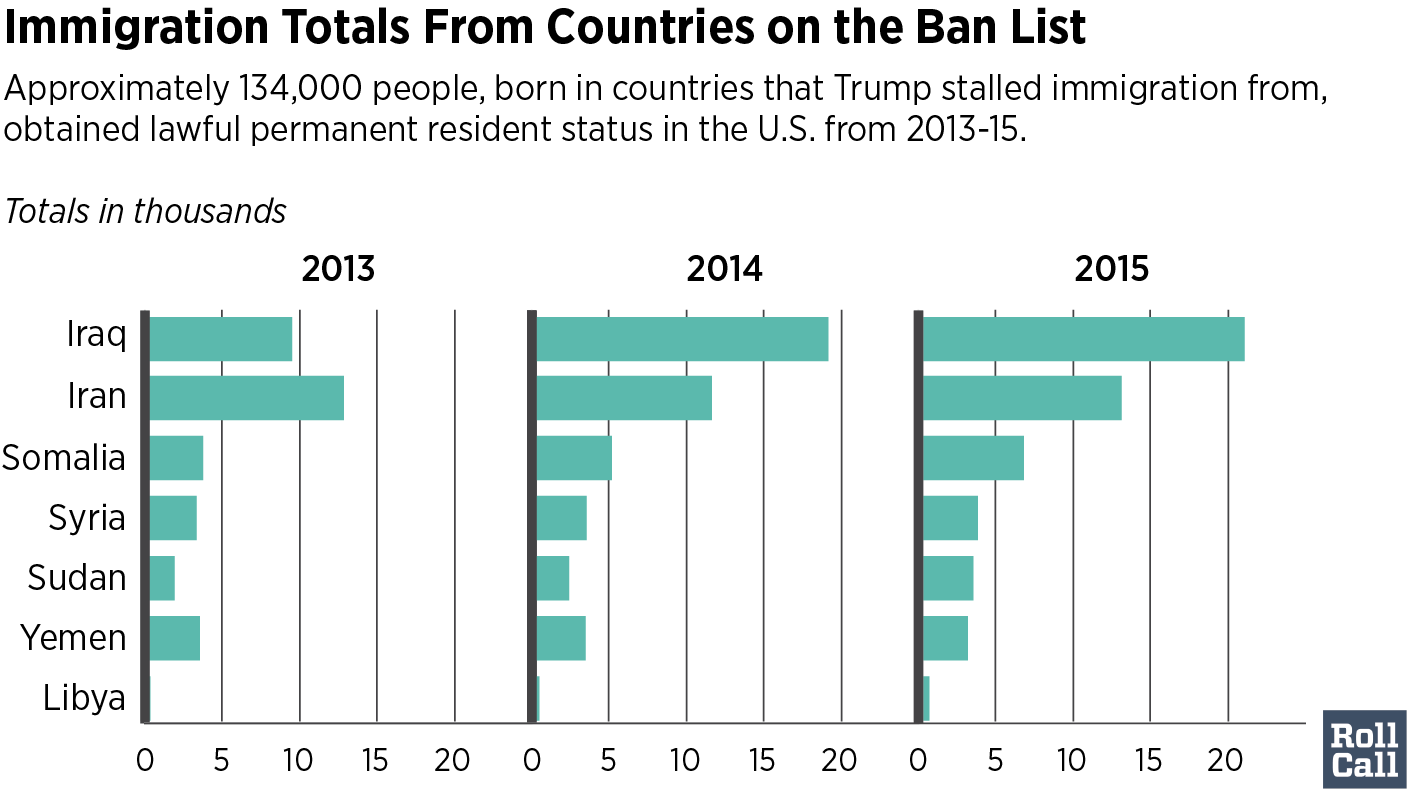

Us Immigration Restrictions How Trumps Policies Affected Canadians

Apr 23, 2025

Us Immigration Restrictions How Trumps Policies Affected Canadians

Apr 23, 2025 -

How Netflix Defied The Big Tech Slump And Attracted Wall Street Investment

Apr 23, 2025

How Netflix Defied The Big Tech Slump And Attracted Wall Street Investment

Apr 23, 2025 -

Trumps Tariffs A Systemic Threat To The Global Financial System According To The Imf

Apr 23, 2025

Trumps Tariffs A Systemic Threat To The Global Financial System According To The Imf

Apr 23, 2025