Canadian Tire Acquires Hudson's Bay Assets For $30 Million

Table of Contents

Details of the Canadian Tire Hudson's Bay Acquisition

While specific details surrounding the assets acquired by Canadian Tire remain somewhat limited in public announcements, the $30 million deal signals a noteworthy strategic shift. The lack of transparency regarding the exact nature of the acquired assets has fueled speculation, with many industry analysts anticipating a focus on prime real estate locations or potentially valuable intellectual property.

- Known Acquired Assets: At present, the exact list of assets transferred remains undisclosed by both companies. Further announcements are anticipated to clarify the specific components of this acquisition.

- Purchase Price: The deal closed at a reported $30 million.

- Deal Conditions: The specific conditions and stipulations of the agreement haven't been made public.

- Acquisition Date: The official date of the acquisition is yet to be publicly confirmed.

Strategic Implications for Canadian Tire

This Canadian Tire Hudson's Bay acquisition presents several potential advantages for Canadian Tire:

- Expanded Retail Footprint and Increased Market Share: Acquiring select Hudson's Bay assets could allow Canadian Tire to expand its presence in key geographic locations, potentially increasing its overall market share.

- Synergies Between Brands: While seemingly disparate at first glance, synergies between the two brands may emerge, especially regarding shared customer demographics and potential cross-promotional opportunities.

- Cross-Promotion and Customer Reach: The acquisition could open avenues for enhanced cross-promotion, leveraging the customer bases of both brands to drive sales and increase brand awareness.

- Business Model Diversification: The deal could represent Canadian Tire’s strategy to diversify its business model beyond its core offerings, potentially integrating new product lines or services.

Industry experts predict that the long-term effects of this acquisition will significantly bolster Canadian Tire’s competitive position within the Canadian retail market. Further analysis is needed once the specifics of the acquired assets are released.

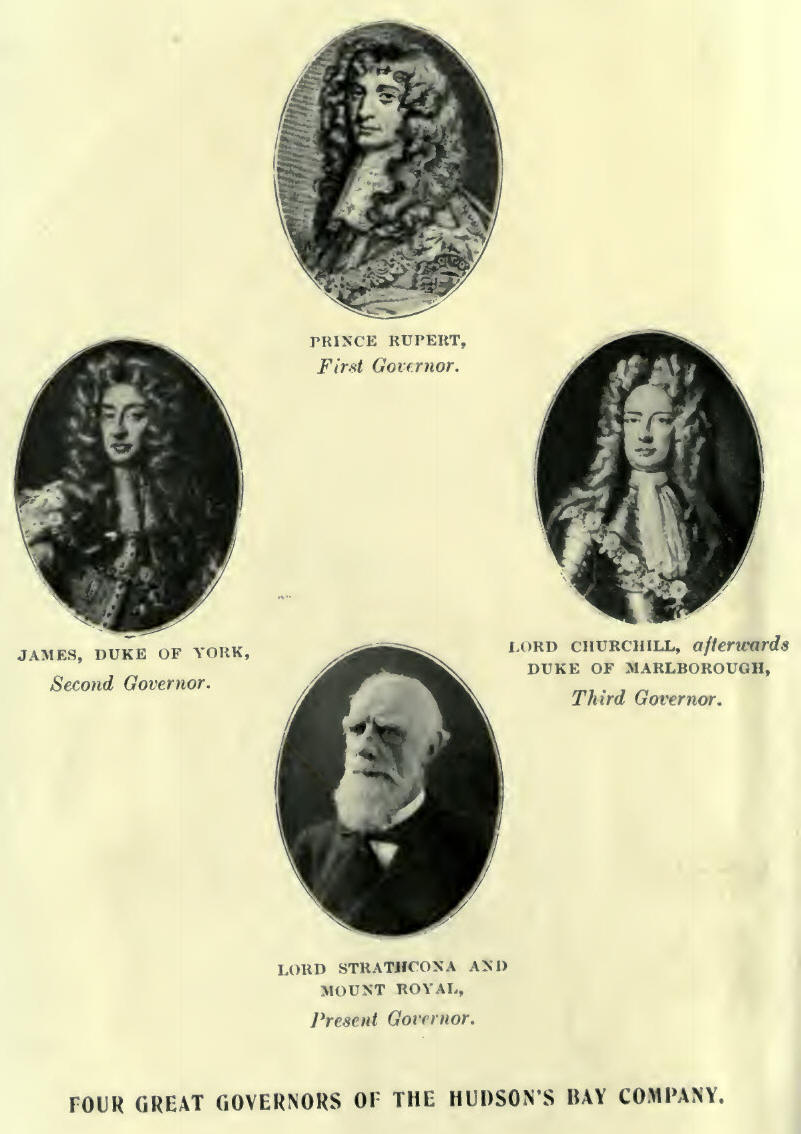

Impact on Hudson's Bay Company

For the Hudson's Bay Company (HBC), the sale of these assets represents a strategic repositioning. While the $30 million generated will likely have a positive impact on their financial statements, the long-term effects depend entirely on the assets that were sold.

- Financial Implications: The sale provides HBC with immediate capital infusion, which can be utilized to address debt, invest in other growth initiatives, or strengthen core business operations.

- Strategic Repositioning: The asset sale likely reflects HBC's ongoing strategic review, focusing on its core business and streamlining operations.

- Future Plans: HBC's future plans will likely evolve based on the outcome of this strategic repositioning and the broader market dynamics.

- Investor and Analyst Reaction: The market reaction will depend on the specifics of the deal, with a focus on the long-term value creation potential for HBC.

Competitive Landscape and Future Outlook

The Canadian Tire Hudson's Bay acquisition undoubtedly reshapes the Canadian retail landscape. This move introduces new dynamics in the competition among major retailers such as Walmart, Loblaws, and other prominent players.

- Impact on Competitors: The acquisition could intensify competition, forcing competitors to adapt their strategies to maintain market share.

- Future Mergers and Acquisitions: This deal may trigger further mergers and acquisitions within the retail sector as companies seek to consolidate their positions.

- Impact on Consumers: The long-term impact on consumers will depend on how Canadian Tire integrates the acquired assets and whether it results in changes in pricing, product offerings, or customer experience.

- Challenges for Canadian Tire: Integrating the acquired assets seamlessly and realizing synergies will be crucial for Canadian Tire to avoid potential challenges post-acquisition.

Conclusion

The Canadian Tire Hudson's Bay acquisition, finalized for $30 million, represents a significant shift in the Canadian retail landscape. While details surrounding the specific assets remain scarce, the potential impact on both companies and the broader market is undeniable. This deal highlights the ongoing consolidation and strategic repositioning within the retail sector. Canadian Tire's acquisition could lead to increased market share and diversification, while HBC's strategic move allows for reinvestment and refocusing. To stay updated on further developments regarding this Canadian Tire's acquisition and other impactful retail industry news, subscribe to our newsletter or follow us on social media. This deal underscores the dynamism and competitive pressures within the Canadian retail sector.

Featured Posts

-

Is Jim Morrison Still Alive The Maintenance Man Theory Explored

May 17, 2025

Is Jim Morrison Still Alive The Maintenance Man Theory Explored

May 17, 2025 -

Are Those Angel Reese Quotes Real A Fact Check

May 17, 2025

Are Those Angel Reese Quotes Real A Fact Check

May 17, 2025 -

Latest Police Blotter Updates Austintown And Boardman

May 17, 2025

Latest Police Blotter Updates Austintown And Boardman

May 17, 2025 -

New York Daily News Back Pages May 2025 Archive

May 17, 2025

New York Daily News Back Pages May 2025 Archive

May 17, 2025 -

Trump Tariffs How They Affected My Phone Battery Replacement

May 17, 2025

Trump Tariffs How They Affected My Phone Battery Replacement

May 17, 2025

Latest Posts

-

The Persistence Of The Morrison Legend A New York Maintenance Man Claim

May 17, 2025

The Persistence Of The Morrison Legend A New York Maintenance Man Claim

May 17, 2025 -

Fan Claims To Spot Jim Morrison Alive And Working In New York City

May 17, 2025

Fan Claims To Spot Jim Morrison Alive And Working In New York City

May 17, 2025 -

Jim Morrison Sighting New York Maintenance Man Claim Investigated

May 17, 2025

Jim Morrison Sighting New York Maintenance Man Claim Investigated

May 17, 2025 -

Is Jim Morrison Still Alive The Maintenance Man Theory Explored

May 17, 2025

Is Jim Morrison Still Alive The Maintenance Man Theory Explored

May 17, 2025 -

Severance Season 3 Lehigh Valley Live Coms Prediction

May 17, 2025

Severance Season 3 Lehigh Valley Live Coms Prediction

May 17, 2025