Canadian Tire Acquisition Of Hudson's Bay: Potential Benefits And Risks

Table of Contents

Potential Benefits of the Canadian Tire-Hudson's Bay Acquisition

A successful acquisition could yield significant advantages for Canadian Tire, propelling it to a position of unprecedented dominance within the Canadian market.

Increased Market Share and Dominance

The merger of these two retail giants would undoubtedly lead to a substantial increase in Canadian Tire's market share. By absorbing Hudson's Bay's extensive network of stores and loyal customer base, Canadian Tire could solidify its position as the leading player in the Canadian retail sector.

- Increased Customer Base: Access to Hudson's Bay's existing customer base would instantly broaden Canadian Tire's reach and increase its overall customer volume.

- Expanded Geographic Reach: Combining store locations would eliminate geographical limitations and enhance market penetration across the country.

- Elimination of Competition: The acquisition could reduce direct competition, streamlining the market and potentially leading to increased pricing power.

While precise figures are speculative without official confirmation, analysts predict a substantial increase in Canadian Tire's market share, potentially surpassing its closest competitors by a significant margin.

Synergies and Operational Efficiencies

The integration of Canadian Tire and Hudson's Bay presents opportunities for substantial synergies and operational efficiencies. Combining their resources could streamline operations and unlock significant cost savings.

- Combined Purchasing Power: Joint purchasing of goods would lead to significantly lower costs for both companies.

- Streamlined Operations: Combining logistics and supply chain networks could create efficiencies, optimizing delivery times and reducing warehousing costs.

- Cost Savings Through Shared Infrastructure: Overlapping functions could be consolidated, reducing redundancy and creating cost savings across various departments.

Improved supply chain management and inventory control, achieved through advanced technology and shared expertise, represent further potential areas of synergy.

Diversification and Expansion into New Market Segments

The acquisition would enable Canadian Tire to diversify its product offerings and penetrate new market segments currently dominated by Hudson's Bay.

- Access to Hudson's Bay's Higher-End Customer Base: This allows Canadian Tire to expand its appeal beyond its traditional customer demographic.

- Expansion into Apparel and Home Goods Markets: This diversification strengthens Canadian Tire's overall retail presence and provides access to new revenue streams.

- Potential for Cross-selling Opportunities: The combined brands could create cross-selling opportunities, offering a broader range of products to existing customers.

This diversification strategy aims to create a more comprehensive and appealing retail experience, attracting a wider range of consumers and enhancing brand loyalty.

Potential Risks of the Canadian Tire-Hudson's Bay Acquisition

Despite the potential benefits, the acquisition is fraught with potential risks that require careful consideration.

Integration Challenges and Costs

Integrating two large and complex retail organizations is a significant undertaking, presenting potential challenges and substantial costs.

- IT System Integration: Merging disparate IT systems can be a complex, time-consuming, and costly process, potentially leading to disruptions in operations.

- Cultural Clashes: Differences in corporate culture and management styles could create friction and hinder effective integration.

- Potential Job Losses: Overlapping roles and functions may necessitate job cuts, resulting in negative publicity and employee morale issues.

- High Integration Costs: The overall cost of integrating the two businesses could significantly exceed initial projections, impacting profitability.

The complexity of combining different retail formats (e.g., big-box stores versus department stores) adds further challenges to the integration process.

Regulatory Scrutiny and Antitrust Concerns

The acquisition will likely face significant regulatory scrutiny and antitrust concerns from the Competition Bureau of Canada.

- Competition Bureau Review: A thorough review is expected, assessing the impact on market competition and consumer choice.

- Potential for Regulatory Delays or Rejection: The regulatory process could be lengthy, potentially delaying or even preventing the acquisition.

- Need for Divestments to Address Antitrust Concerns: To secure approval, Canadian Tire might be required to divest certain assets or store locations to alleviate competition concerns.

Navigating these regulatory hurdles successfully is crucial for the acquisition's success.

Financial Risks and Debt Burden

The acquisition will significantly increase Canadian Tire's debt burden, presenting potential financial risks.

- Increased Debt Levels: Financing the acquisition will likely involve substantial borrowing, increasing the company's financial leverage.

- Potential Impact on Credit Rating: A higher debt load could negatively impact Canadian Tire's credit rating, increasing borrowing costs in the future.

- Risk of Overpaying for Hudson's Bay: Overestimating Hudson's Bay's value could lead to a financially detrimental acquisition.

- Potential for Shareholder Value Dilution: Increased debt and integration costs could negatively impact shareholder returns.

Careful financial planning and due diligence are crucial to mitigate these risks.

Conclusion

The potential Canadian Tire-Hudson's Bay acquisition presents a compelling strategic opportunity with the potential for significant benefits, including increased market share, operational synergies, and diversification. However, considerable risks, including integration challenges, regulatory hurdles, and financial burdens, must be carefully addressed. Weighing these pros and cons is crucial for understanding the ultimate success or failure of this ambitious retail merger. To stay updated on this significant development in the Canadian retail landscape and its implications, follow reputable financial news sources for ongoing updates on the Canadian Tire and Hudson's Bay acquisition.

Featured Posts

-

Philippines And Us To Hold Major Balikatan Military Exercises

May 20, 2025

Philippines And Us To Hold Major Balikatan Military Exercises

May 20, 2025 -

Baggelis Giakoymakis I Tragodia Toy 20xronoy To Bullying Kai Oi Vasanismoi

May 20, 2025

Baggelis Giakoymakis I Tragodia Toy 20xronoy To Bullying Kai Oi Vasanismoi

May 20, 2025 -

How Climate Change Could Impact Your Mortgage Application And Credit Score

May 20, 2025

How Climate Change Could Impact Your Mortgage Application And Credit Score

May 20, 2025 -

Live Bundesliga 2023 2024 Schedule Teams And Viewing Options

May 20, 2025

Live Bundesliga 2023 2024 Schedule Teams And Viewing Options

May 20, 2025 -

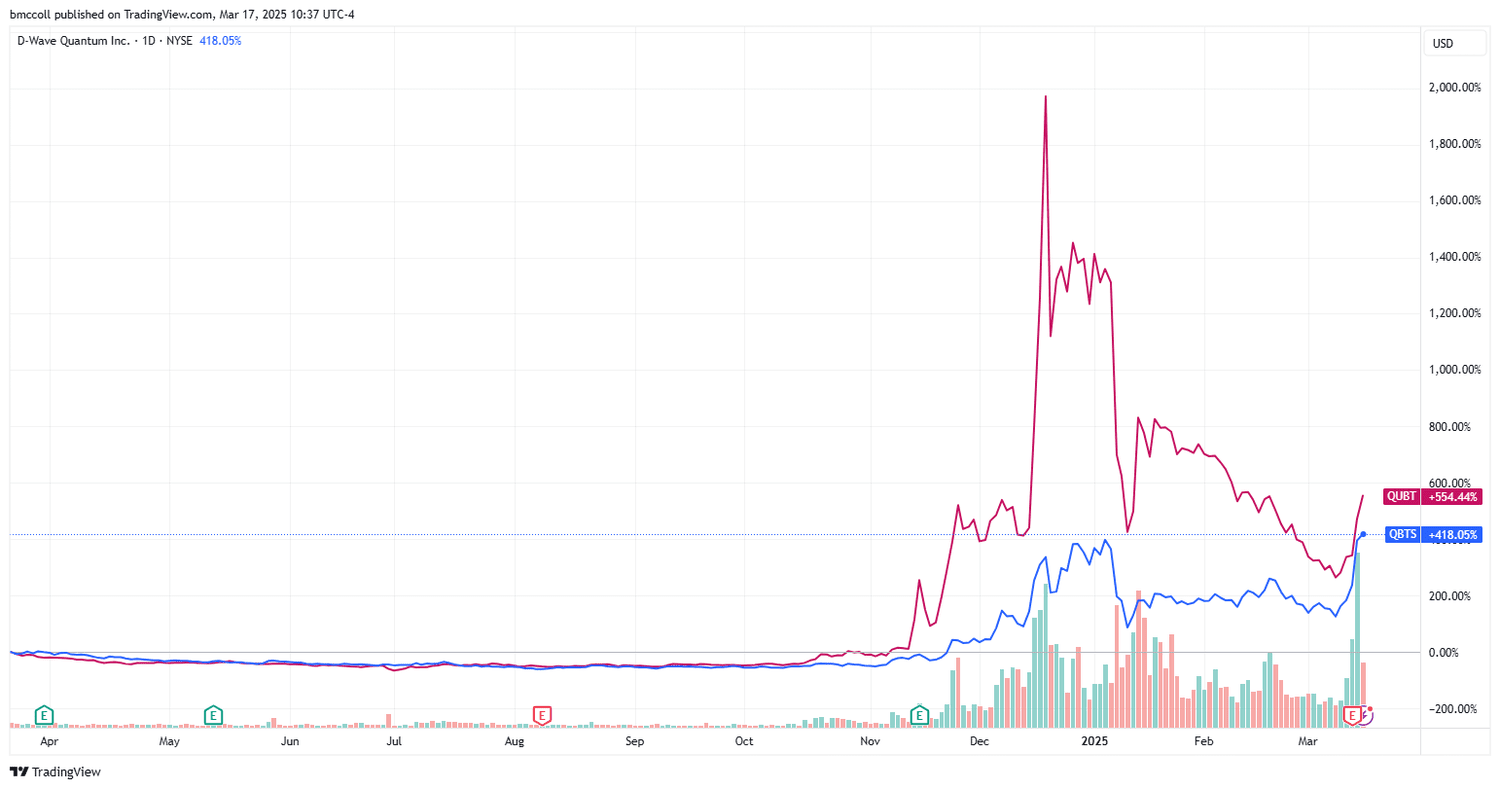

D Wave Quantum Qbts Stock Soars Understanding The Market Rally

May 20, 2025

D Wave Quantum Qbts Stock Soars Understanding The Market Rally

May 20, 2025