Canadian Tire And Hudson's Bay: A Strategic Fit?

Table of Contents

Overlapping Customer Base and Synergies

Both Canadian Tire and Hudson's Bay cater to a largely overlapping Canadian middle-class demographic, presenting significant opportunities for synergy. This shared customer base forms the foundation for a potentially powerful combined retail entity.

Shared Demographics

- Strong Brand Recognition: Both brands enjoy high levels of trust and recognition among Canadian shoppers, a valuable asset in a merger scenario. This established brand equity translates to immediate market acceptance of any combined offerings.

- Combined Loyalty Programs: Merging the respective loyalty programs could create a powerful retail ecosystem, increasing customer engagement and driving repeat business. This unified program would offer enhanced rewards and benefits, further incentivizing customer loyalty.

- Joint Marketing Campaigns: Leveraging existing customer databases through joint marketing initiatives could dramatically improve efficiency and reach, maximizing return on investment (ROI) for advertising spend. Targeted campaigns could showcase complementary products and services, boosting overall sales.

Supply Chain Optimization

A Canadian Tire and Hudson's Bay merger would present considerable opportunities for supply chain optimization, resulting in significant cost savings and operational efficiencies.

- Reduced Transportation Costs: Consolidating warehousing and distribution networks could significantly reduce transportation costs through shared infrastructure and optimized delivery routes.

- Streamlined Procurement: Combining procurement processes would lead to greater bargaining power with suppliers, resulting in lower costs for goods and enhanced efficiency.

- Improved Inventory Management: Integrated inventory management systems would enable better forecasting, reduced waste through optimized stock levels, and improved overall supply chain agility.

Diversification and Reduced Risk

The potential merger offers significant diversification benefits, reducing reliance on individual product categories and mitigating risk associated with market volatility.

Expanding Product Portfolio

- Complementary Offerings: Canadian Tire's strength in automotive, sporting goods, and home improvement complements HBC's focus on apparel, home furnishings, and beauty, creating a broader and more resilient product portfolio. This diversification shields the combined entity from the fluctuations affecting individual sectors.

- Economic Resilience: A wider consumer base, encompassing various product categories, creates resilience against economic downturns. The diverse product portfolio would ensure continued customer demand even during economic uncertainty.

- New Market Opportunities: The merger could facilitate expansion into new market segments and customer demographics, opening new avenues for growth and revenue generation. This strategic expansion could leverage existing brand recognition to easily enter new markets.

Enhanced Omnichannel Presence

Integrating online and offline retail experiences is crucial for success in today's market. A merger would allow for a more seamless and efficient omnichannel strategy.

- Integrated E-commerce: Combining e-commerce platforms and improving website functionality would provide a unified and enhanced online shopping experience. This seamless integration would cater to the growing preference for online shopping.

- Improved Customer Service: Integrating customer relationship management (CRM) systems would allow for personalized customer service, fostering loyalty and improving customer satisfaction. Personalized marketing based on shopping history would greatly improve customer engagement.

- Data-Driven Decisions: Combining data analytics capabilities would provide valuable insights into customer behavior, enabling informed decisions on product assortment, marketing strategies, and supply chain management. This data-driven approach would optimize operational efficiency and profitability.

Potential Challenges and Risks

While the potential benefits are significant, a Canadian Tire Hudson's Bay merger also presents considerable challenges and risks that need careful consideration.

Integration Difficulties

Merging two large, complex organizations is a significant undertaking with potential pitfalls.

- Workforce Integration: Employee redundancies and workforce disruption are likely, requiring careful management to minimize negative impacts and maintain employee morale. A transparent and well-communicated integration plan is crucial.

- IT System Integration: Integrating different IT systems and supply chains will be a complex and time-consuming process, requiring substantial investment and expertise. A phased integration approach may be necessary to mitigate risks.

- Cultural Differences: Reconciling different corporate cultures can be challenging, requiring careful planning and communication to foster a unified and collaborative work environment. Addressing cultural differences proactively is essential for success.

Regulatory Hurdles

The Competition Bureau's scrutiny will be critical. The merger may face antitrust concerns, requiring negotiation and potentially concessions to secure approval.

- Antitrust Scrutiny: The Competition Bureau will carefully assess the merger's potential impact on competition within the Canadian retail sector, and this process may be lengthy and complex. Proactive engagement with regulatory bodies is crucial.

- Addressing Anti-Competitive Issues: Strategies to address potential anti-competitive concerns must be developed and presented to the regulators to ensure a smooth approval process. Transparency and a commitment to fair competition are essential.

- Negotiating Concessions: The companies may need to negotiate concessions to gain regulatory approval, potentially including divesting certain assets or making other commitments. This will require careful consideration and strategic planning.

Conclusion

The potential Canadian Tire Hudson's Bay merger presents a complex picture. While synergies in customer base, supply chain, and product portfolio are compelling, integration difficulties and regulatory hurdles pose significant challenges. The success of any merger hinges on careful planning, effective management, and a clear vision. Continued monitoring of the Canadian Tire Hudson's Bay merger proposal is crucial to fully understanding its implications for the Canadian retail landscape. Stay informed on all developments regarding this significant potential Canadian Tire Hudson's Bay merger.

Featured Posts

-

Critics Honest Reviews Jennifer Lawrences New Film

May 20, 2025

Critics Honest Reviews Jennifer Lawrences New Film

May 20, 2025 -

Ajax Fenerbahce Yildizini Transfer Etti Mourinho Faktoerue

May 20, 2025

Ajax Fenerbahce Yildizini Transfer Etti Mourinho Faktoerue

May 20, 2025 -

Pacific Reinforcement Us Army Deploys Additional Typhon Battery

May 20, 2025

Pacific Reinforcement Us Army Deploys Additional Typhon Battery

May 20, 2025 -

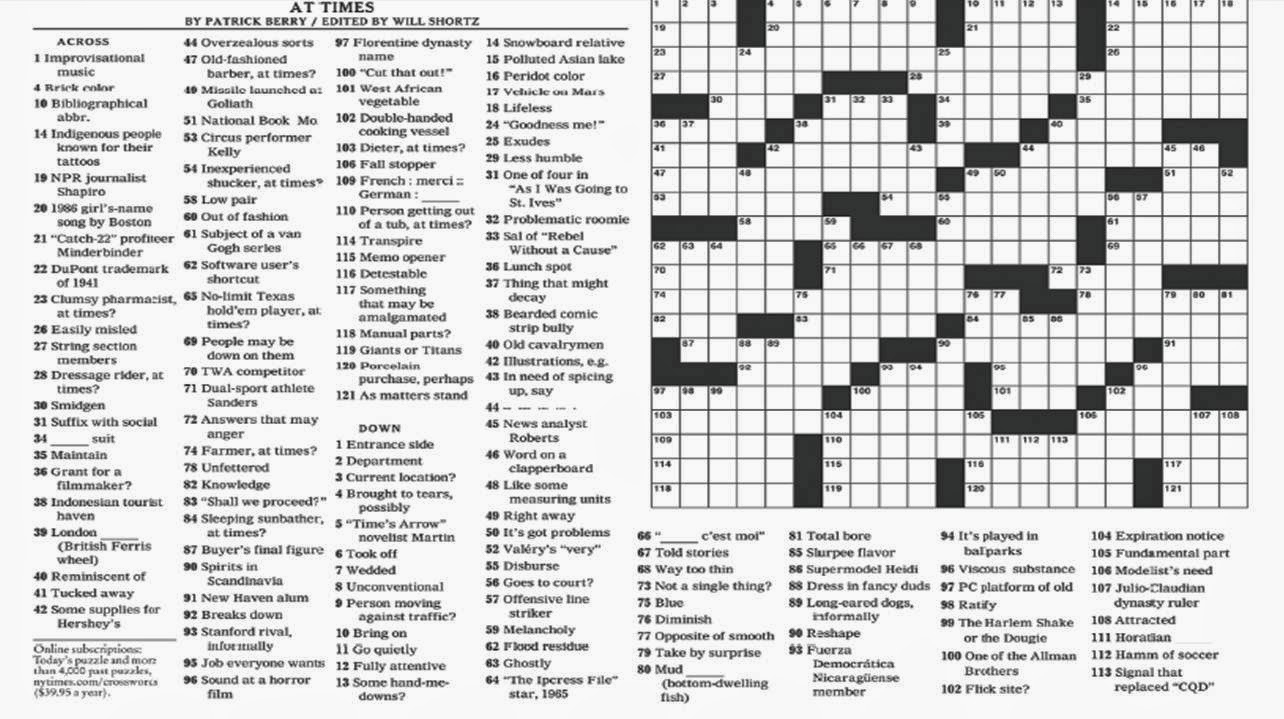

Nyt Mini Crossword Clues April 26 2025

May 20, 2025

Nyt Mini Crossword Clues April 26 2025

May 20, 2025 -

A Hell Of A Run Analyzing Ftv Lives Controversies And Contributions

May 20, 2025

A Hell Of A Run Analyzing Ftv Lives Controversies And Contributions

May 20, 2025