Canadian Tire's Hudson's Bay Acquisition: A Complete Analysis

Table of Contents

The Deal: Key Terms and Financial Aspects

Acquisition Price and Funding

The acquisition of Hudson's Bay by Canadian Tire represented a substantial investment. While the exact final figure may vary depending on the source, it involved a significant outlay of capital, utilizing a mix of debt and equity financing. Securing this funding was crucial for the successful completion of the transaction. Specific details regarding the debt-to-equity ratio and the involvement of financial institutions were subject to confidentiality agreements and only partially released publicly.

- Purchase Price: [Insert the most reliable figure available from public sources, with a citation].

- Financing Method: A combination of debt and equity financing.

- Transaction Structure: [Describe the structure, e.g., asset purchase, stock acquisition, etc.]

- Associated Fees: Legal, advisory, and other transaction costs.

Rationale Behind the Acquisition

Canadian Tire's stated rationale for acquiring Hudson's Bay centers around several key strategic objectives:

- Expansion into New Markets: Gaining access to Hudson's Bay's higher-end retail market segment and customer base.

- Diversification of Product Offerings: Expanding beyond Canadian Tire's traditional offerings to include apparel, home goods, and other merchandise sold by Hudson's Bay.

- Synergy Opportunities: Identifying and exploiting cost savings and efficiencies by combining operations and supply chains.

- Potential Cost Savings: Economies of scale and streamlining of operations across both brands.

Regulatory Approvals and Legal Considerations

The acquisition process involved navigating various regulatory hurdles and legal considerations. This included:

- Competition Bureau Review: The Competition Bureau of Canada assessed the merger to ensure it didn't stifle competition or harm consumers.

- Shareholder Approvals: Both Canadian Tire and HBC shareholders needed to approve the deal.

- Antitrust Concerns: Potential concerns about reduced competition in specific retail sectors were addressed during the review process.

Impact on the Canadian Retail Landscape

Market Share and Competition

The acquisition significantly altered the competitive landscape of the Canadian retail market:

- Increased Market Share: Canadian Tire gained a substantial increase in its overall market share, particularly in the apparel and home goods sectors.

- Displacement of Smaller Competitors: The combined entity's size and scale might put pressure on smaller retail businesses.

- Effect on Consumer Choice: The long-term impact on consumer choice needs further observation as the integration progresses.

Consumer Reactions and Brand Perception

Consumer perception of the acquisition was mixed:

- Changes in Customer Loyalty: Some consumers expressed concerns about potential changes to their preferred shopping experiences.

- Potential Brand Dilution: Concerns were raised about whether the merging of distinct brands might lead to brand dilution.

- Shifts in Consumer Spending Habits: The merger may influence how consumers allocate their spending within the Canadian retail market.

Job Security and Employment Implications

The merger had significant employment implications:

- Job Losses: Some job losses were anticipated due to redundancies in overlapping roles and operational streamlining.

- Relocation: Some employees might have been offered relocation opportunities.

- Restructuring: Organizational restructuring was likely necessary to integrate the two companies effectively.

- Potential for New Job Creation: The merger might also create new job opportunities in areas such as integrated logistics and marketing.

Strategic Implications and Future Outlook

Synergies and Integration Challenges

The successful integration of Canadian Tire and Hudson's Bay depends on realizing synergies while overcoming challenges:

- Supply Chain Efficiencies: Opportunities for cost savings through shared logistics and distribution networks.

- Shared Resources: Consolidation of certain functions like IT and human resources.

- Marketing Collaborations: Leveraging combined brand strength for more effective marketing campaigns.

- Integration Obstacles: Differing corporate cultures and operational practices might present obstacles to seamless integration.

Long-Term Growth Strategy

Canadian Tire's long-term strategy post-acquisition likely includes:

- Expansion Plans: Exploring opportunities for further growth and expansion across Canada.

- New Product Lines: Developing and introducing new product lines based on the combined strengths of both companies.

- Technological Advancements: Investing in technology to enhance the customer experience and improve operational efficiency.

- Overall Vision: A unified vision for a diversified retail business that caters to a broader customer base.

Potential Risks and Uncertainties

The acquisition presents inherent risks and uncertainties:

- Integration Difficulties: Challenges in merging diverse corporate cultures and systems.

- Economic Downturn: Sensitivity to economic fluctuations and potential consumer spending reductions.

- Changes in Consumer Behaviour: Adapting to evolving consumer preferences and shopping habits.

- Competition from Other Retailers: Facing competition from other major retailers in the Canadian market.

Conclusion: Assessing the Long-Term Success of Canadian Tire's Hudson's Bay Acquisition

Canadian Tire's acquisition of Hudson's Bay is a significant event with far-reaching consequences for the Canadian retail market. While the deal presents opportunities for growth and synergy, it also carries considerable risks. The success of the integration will depend on the effectiveness of merging distinct corporate cultures, capitalizing on synergies, and addressing potential challenges proactively. The long-term implications remain to be seen, requiring ongoing monitoring of market share, consumer reactions, and the company's financial performance. What are your thoughts on the Canadian Tire Hudson's Bay merger? Stay tuned for further analysis of this significant Canadian retail acquisition, and keep reading for more updates on the impact of this Canadian Tire Hudson's Bay deal.

Featured Posts

-

Is Rayan Cherki Liverpools Next Signing

May 28, 2025

Is Rayan Cherki Liverpools Next Signing

May 28, 2025 -

1 Year Later That Brutal Wolverine X Men 97 Scene Still Shocks Me

May 28, 2025

1 Year Later That Brutal Wolverine X Men 97 Scene Still Shocks Me

May 28, 2025 -

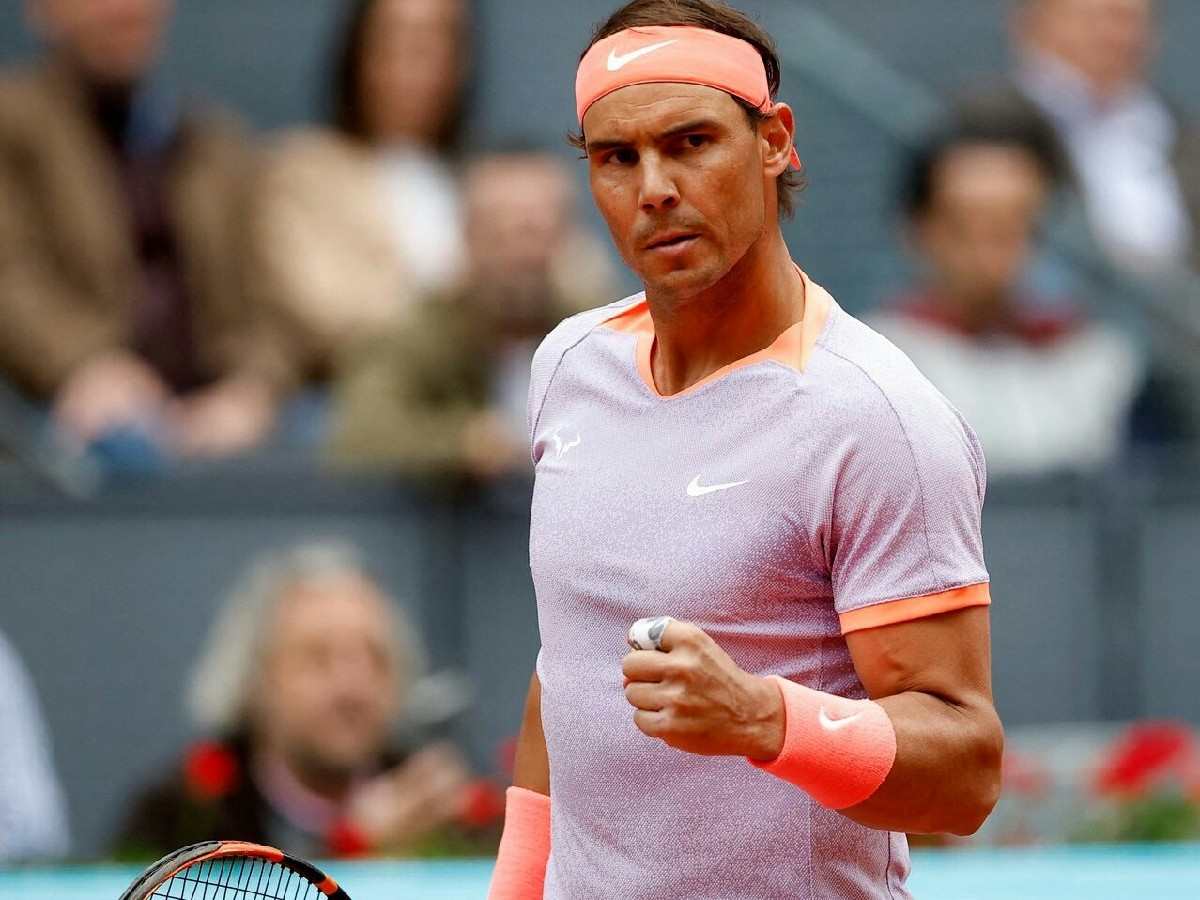

Roland Garros 2024 Nadals Farewell And Sabalenkas Championship Win

May 28, 2025

Roland Garros 2024 Nadals Farewell And Sabalenkas Championship Win

May 28, 2025 -

Cuaca Jawa Tengah Besok 22 4 Peringatan Hujan Di Semarang

May 28, 2025

Cuaca Jawa Tengah Besok 22 4 Peringatan Hujan Di Semarang

May 28, 2025 -

Ronaldo Portekiz Kampinda Neler Yasadi Fenerbahce Hayranlarini Heyecanlandiran Anlar

May 28, 2025

Ronaldo Portekiz Kampinda Neler Yasadi Fenerbahce Hayranlarini Heyecanlandiran Anlar

May 28, 2025

Latest Posts

-

Bayern Verdacht Des Illegalen Marihuana Verkaufs In Automatenkiosk

May 30, 2025

Bayern Verdacht Des Illegalen Marihuana Verkaufs In Automatenkiosk

May 30, 2025 -

Nieuwe Trainer Gezocht Augsburg Na Ontslag Thorup

May 30, 2025

Nieuwe Trainer Gezocht Augsburg Na Ontslag Thorup

May 30, 2025 -

Frau In Bayern Soll Marihuana In Automatenkiosk Verkauft Haben Ermittlungen Laufen

May 30, 2025

Frau In Bayern Soll Marihuana In Automatenkiosk Verkauft Haben Ermittlungen Laufen

May 30, 2025 -

Augsburg Op Zoek Naar Vervanger Voor Thorup

May 30, 2025

Augsburg Op Zoek Naar Vervanger Voor Thorup

May 30, 2025 -

Bayern Frau Wegen Marihuana Verkaufs In Automatenkiosk Angeklagt

May 30, 2025

Bayern Frau Wegen Marihuana Verkaufs In Automatenkiosk Angeklagt

May 30, 2025