Canadian Tire's Potential Hudson's Bay Acquisition: Challenges And Opportunities

Table of Contents

Strategic Rationale for a Canadian Tire Hudson's Bay Acquisition

A Canadian Tire Hudson's Bay merger could offer compelling strategic advantages for both companies. The key rationales center around expanding market reach, achieving synergies, and capitalizing on the strengths of each brand.

Expanding Market Reach and Customer Base

- Access to Prime Real Estate: HBC boasts a portfolio of prime retail locations in major Canadian cities. Acquiring these properties would give Canadian Tire access to high-traffic areas, significantly expanding its retail footprint and brand visibility. This would be especially beneficial in urban centers where securing desirable retail space is highly competitive.

- Diversified Customer Base: Canadian Tire's focus on automotive, home improvement, and sporting goods could be complemented by HBC's offerings in apparel, home furnishings, and luxury goods. This broadened product range would attract a wider and more diverse customer base.

- Cross-Selling Opportunities: The combined entity could leverage cross-selling opportunities, offering bundled promotions and loyalty programs that integrate the strengths of both brands. Imagine a Canadian Tire flyer featuring Hudson's Bay home decor items or a Hudson's Bay rewards program offering discounts on Canadian Tire products.

- Increased Market Share and Brand Recognition: Combining the market share of these two retail giants would create a dominant force in the Canadian market, enhancing overall brand recognition and consumer loyalty. The combined entity could potentially achieve greater bargaining power with suppliers.

Synergies and Cost Savings

A merger could unlock significant synergies and cost savings through operational efficiencies:

- Economies of Scale: Combining procurement and logistics operations would lead to economies of scale, resulting in lower costs for sourcing goods and managing supply chains. This enhanced purchasing power could translate into lower prices for consumers and increased profitability.

- Reduced Operational Costs: Sharing resources and infrastructure, such as distribution centers and IT systems, could significantly reduce operational costs. This includes streamlining administrative functions, reducing redundancies, and improving overall efficiency.

- Streamlined Supply Chains: A unified supply chain would optimize inventory management, reduce waste, and improve delivery times. This would result in a more efficient and cost-effective operation.

- Digital Synergy: Integrating online platforms and enhancing e-commerce capabilities would create a more robust and seamless digital shopping experience. This could include a unified loyalty program and improved online ordering and delivery options.

Challenges of a Canadian Tire Hudson's Bay Acquisition

Despite the potential benefits, a Canadian Tire Hudson's Bay acquisition presents considerable challenges:

Integration Difficulties

Merging two large organizations with distinct cultures and operational styles presents significant integration hurdles:

- Cultural Clash: Integrating two different corporate cultures can be complex and time-consuming. Differences in management styles, employee expectations, and operational procedures need to be carefully addressed to avoid conflict and ensure a smooth transition.

- Job Losses and Employee Disruption: Restructuring is inevitable in any merger, leading to potential job losses and employee unrest. A well-managed integration process would prioritize minimizing job losses and providing support to affected employees.

- IT System Integration: Integrating different IT systems and data management strategies can be technically challenging and expensive. This requires significant investment in IT infrastructure and expertise.

- Regulatory Hurdles and Antitrust Concerns: The merger would likely face regulatory scrutiny and potential antitrust concerns. Securing necessary approvals could be a lengthy and complex process.

Financial and Economic Considerations

The financial implications of a Canadian Tire Hudson's Bay acquisition are significant:

- Acquisition Cost: The high cost of acquiring HBC and the potential for significant debt need careful consideration. Overpaying for HBC's assets could negatively impact Canadian Tire's financial health.

- Economic Downturn Risk: The current economic climate adds another layer of complexity. The risk of overvaluation and the potential for decreased consumer spending need to be carefully weighed.

- Capital Investment: Significant capital investment would be needed to upgrade HBC's infrastructure and operations, further impacting Canadian Tire's financial resources.

- Shareholder Value: A critical factor is the potential impact on shareholder value. Any acquisition needs to demonstrably increase long-term shareholder returns.

Opportunities Presented by a Canadian Tire Hudson's Bay Acquisition

Beyond cost savings and expanded reach, a merger could create exciting new opportunities:

Enhanced Omnichannel Capabilities

A combined entity could offer a superior omnichannel experience:

- Combined Online and Offline Presence: Canadian Tire’s strong online presence combined with HBC's extensive brick-and-mortar network would create a powerful omnichannel retail experience.

- Improved Delivery Options: Customers would benefit from a wider range of delivery options and improved convenience.

- Seamless Shopping Experience: Integration of online and offline shopping would create a seamless and consistent shopping experience across all channels.

- Data-Driven Personalization: Leveraging data analytics to personalize marketing and promotions would enhance customer engagement and loyalty.

Growth in New Product Categories

The merger opens doors to new product categories and market segments:

- Expansion into Apparel and Fashion: Access to the Hudson's Bay brand provides immediate entry into the apparel and fashion market.

- New Market Segments: This would allow Canadian Tire to tap into new customer demographics and expand its market reach.

- Private Label Development: Opportunities exist for developing and expanding private label brands, increasing profitability and brand loyalty.

- Risk Mitigation: Diversification into new product categories helps mitigate risk and improve overall profitability.

Conclusion

The potential Canadian Tire Hudson's Bay acquisition presents a complex mix of challenges and opportunities. While significant synergies and expanded market reach are possible, integration difficulties and financial risks need careful consideration. A successful merger would require a well-defined integration strategy, addressing employee relations, operational efficiencies, and regulatory approvals. The ultimate success will depend on Canadian Tire's ability to effectively leverage HBC's assets while mitigating inherent challenges. Further analysis and due diligence are crucial before definitive conclusions can be drawn about the viability and long-term impact of this potential Canadian Tire Hudson's Bay acquisition. To stay informed on the latest developments in this exciting potential merger, continue following news and analyses of the Canadian Tire Hudson's Bay Acquisition.

Featured Posts

-

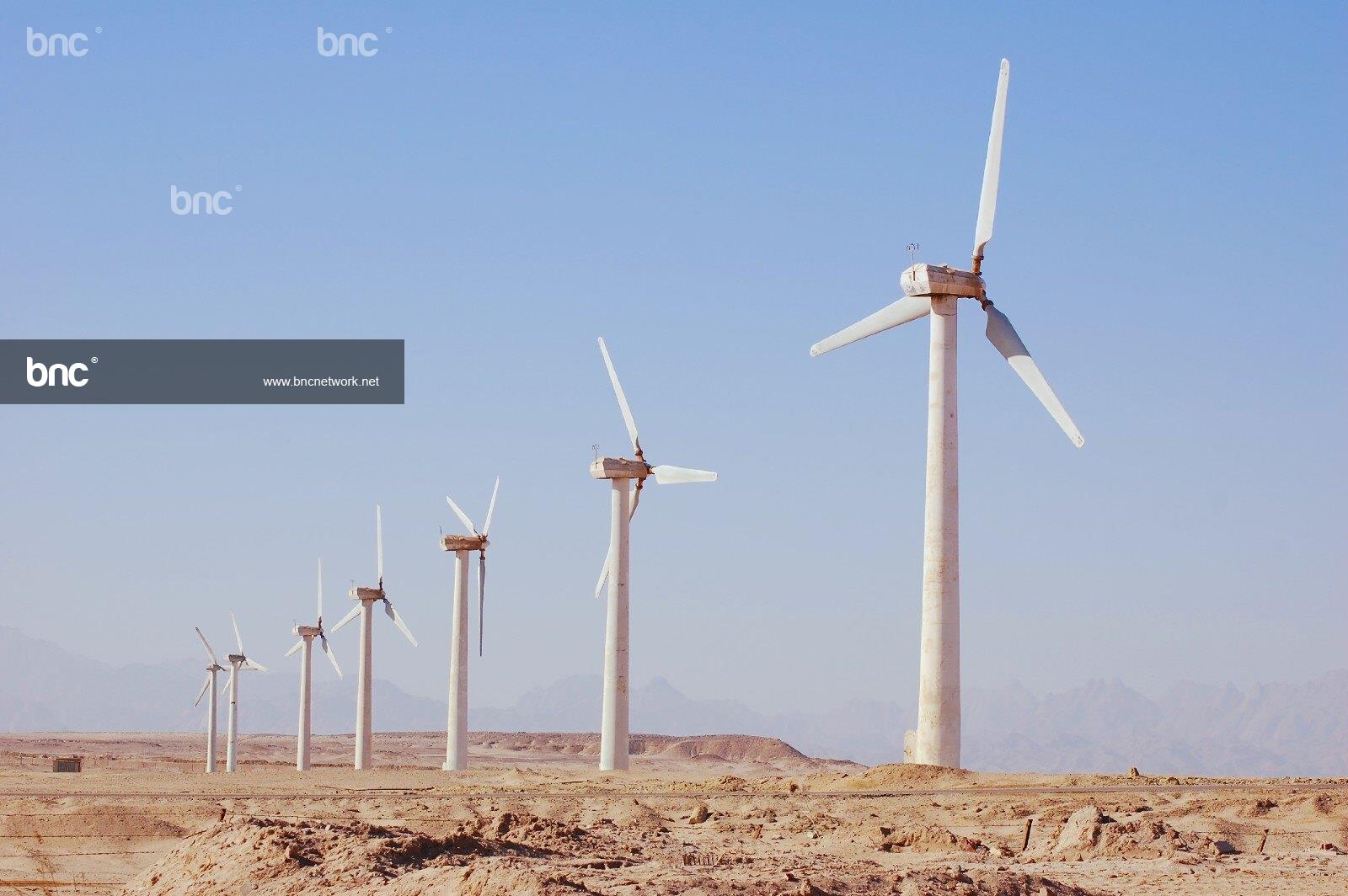

Find The Answers Nyt Mini Crossword March 20 2025

May 20, 2025

Find The Answers Nyt Mini Crossword March 20 2025

May 20, 2025 -

Philippine Missile Deployment In South China Sea Chinas Concerns

May 20, 2025

Philippine Missile Deployment In South China Sea Chinas Concerns

May 20, 2025 -

La Buena Nueva De Michael Schumacher Una Historia Conmovedora

May 20, 2025

La Buena Nueva De Michael Schumacher Una Historia Conmovedora

May 20, 2025 -

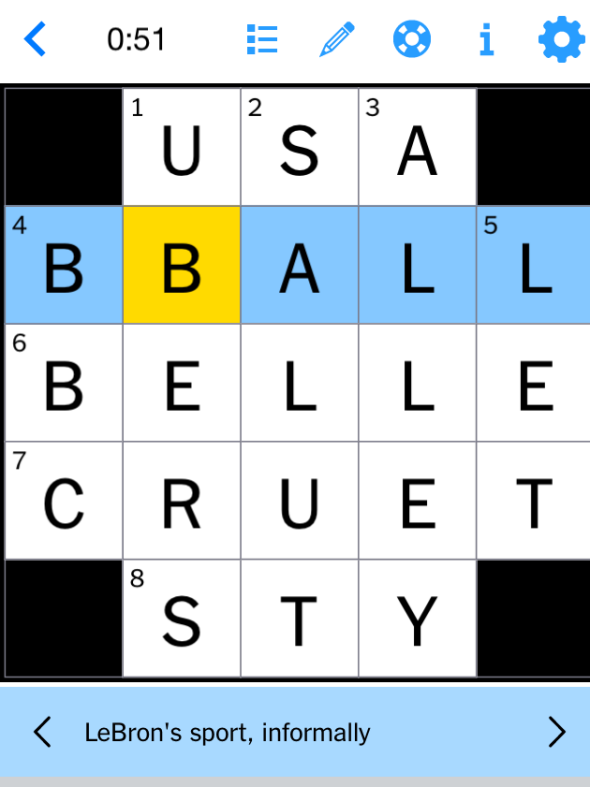

Ris Former Us Attorney Zachary Cunha Begins New Chapter In Private Practice

May 20, 2025

Ris Former Us Attorney Zachary Cunha Begins New Chapter In Private Practice

May 20, 2025 -

Todays Nyt Mini Crossword Answers For April 25th

May 20, 2025

Todays Nyt Mini Crossword Answers For April 25th

May 20, 2025