Canadians Rethink Condo Investments: A Market In Transition

Table of Contents

Rising Interest Rates and Their Impact on Condo Investment Returns

Increased interest rates are significantly impacting the Canadian condo investment market, creating challenges for both investors and buyers.

Mortgage Affordability Challenges

Increased interest rates directly impact mortgage affordability, making condo purchases less accessible. This translates to several key challenges for condo investors:

- Higher monthly payments reduce potential rental income: Higher mortgage payments eat into the potential rental income, decreasing the overall return on investment.

- Increased borrowing costs decrease overall profitability: The increased cost of borrowing directly reduces the profitability of condo investments. Investors need to carefully analyze their projected cash flow to ensure positive returns.

- Impacts on cash flow and return on investment (ROI): The combined effect of higher mortgage payments and potentially lower rental income can significantly reduce cash flow and ROI.

- Difficulty securing financing for new condo projects: Developers are finding it harder to secure financing for new projects, potentially leading to fewer new condo units entering the market.

The Shift in Investor Demand

The higher cost of borrowing is forcing investors to re-evaluate their investment strategies. We're seeing a noticeable shift in the market:

- Increased competition among investors for existing condos: With new construction slowing down, existing condos are becoming more sought after, leading to increased competition amongst investors.

- Reduced demand for new condo developments: The higher cost of borrowing is making new condo purchases less attractive for investors, resulting in reduced demand.

- Potential for price corrections in certain markets: In some areas, we may see price corrections as supply outweighs demand, particularly in markets oversaturated with new condo developments.

The Impact of Increased Construction Costs on Condo Prices

Soaring construction costs are another significant factor reshaping the Canadian condo market.

Supply Chain Disruptions and Labor Shortages

Ongoing global supply chain issues and labor shortages are driving up the cost of materials and labor, significantly impacting condo prices.

- Increased development costs are passed on to buyers: These increased costs are inevitably passed on to buyers, leading to higher purchase prices for new condos.

- Potential for slower condo construction rates: Delays in securing materials and labor can lead to slower construction rates, further impacting supply.

- Impact on the overall supply of condos: The combination of higher costs and slower construction rates is leading to a tighter supply of condos, potentially influencing prices.

Affordability Concerns for Buyers

Higher construction costs exacerbate affordability concerns for both investors and owner-occupiers.

- Limits the pool of potential buyers, affecting resale values: Fewer buyers can afford to purchase condos, which directly impacts resale values.

- May lead to a slowdown in the market: Reduced affordability can lead to a significant slowdown in the market, as fewer transactions take place.

- Potential for price stagnation or decline in specific regions: In markets with high levels of new construction and reduced buyer demand, we may see price stagnation or even declines.

Changing Buyer Preferences and Their Effect on Condo Investment Strategy

Buyer preferences are evolving, further influencing the Canadian condo investment landscape.

Demand for Larger Living Spaces

A notable shift towards larger living spaces and suburban living is impacting demand for smaller condo units.

- Reduced appeal of smaller condo units to investors: Smaller units may become less attractive to both investors and buyers, potentially leading to lower rental yields and slower resale times.

- Increased competition among larger condo units: Larger units, offering more space and potentially better amenities, will see increased competition.

- Impact on rental yields and occupancy rates: Rental yields and occupancy rates for smaller units may suffer due to decreased demand.

Emphasis on Amenities and Location

Buyers are increasingly prioritizing amenities and location, impacting the desirability and value of specific condo developments.

- Constructions with superior amenities command higher prices: Condos with high-quality amenities such as gyms, pools, and concierge services are in high demand and command premium prices.

- Location plays a significant role in rental demand and resale value: Condos located in desirable neighborhoods with good access to transit, employment hubs, and amenities will retain higher value.

- Influence of proximity to public transport, employment hubs, and amenities: The proximity to key amenities significantly influences rental demand and resale value.

Conclusion

The Canadian condo investment market is undeniably in a period of transition. Rising interest rates, increased construction costs, and evolving buyer preferences are reshaping the landscape, creating both challenges and opportunities. While the market presents complexities, astute investors can still find success by carefully considering these factors and adapting their strategies. Thorough market research, a focus on prime locations and desirable amenities, and a realistic assessment of risk are crucial for navigating this evolving market. Don't hesitate to seek professional advice before making significant decisions about your condo investments in Canada. Remember to carefully assess your risk tolerance and investment goals to make informed decisions regarding your Canadian condo investment portfolio.

Featured Posts

-

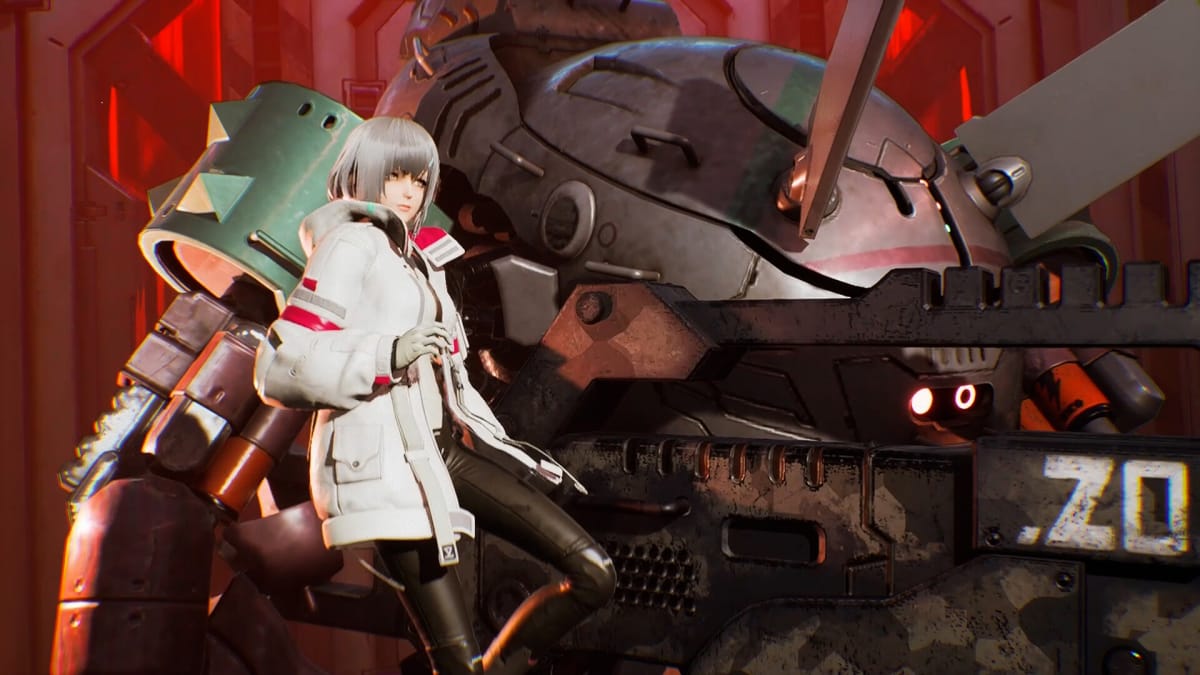

Synduality Echo Of Ada Season 1 Release Date Plot And Characters

Apr 25, 2025

Synduality Echo Of Ada Season 1 Release Date Plot And Characters

Apr 25, 2025 -

Where To Go In The North East This Easter Holiday

Apr 25, 2025

Where To Go In The North East This Easter Holiday

Apr 25, 2025 -

New 2025 Anzac Day Guernsey Design Unveiled

Apr 25, 2025

New 2025 Anzac Day Guernsey Design Unveiled

Apr 25, 2025 -

Jack O Connell Cast In Godzilla X Kong Sequel

Apr 25, 2025

Jack O Connell Cast In Godzilla X Kong Sequel

Apr 25, 2025 -

Is Sadie Sink The Next Jean Grey Spider Man 4 Casting Rumors Explored

Apr 25, 2025

Is Sadie Sink The Next Jean Grey Spider Man 4 Casting Rumors Explored

Apr 25, 2025

Latest Posts

-

Los Angeles Palisades Fire A List Of Celebrities Whose Homes Were Damaged Or Destroyed

Apr 26, 2025

Los Angeles Palisades Fire A List Of Celebrities Whose Homes Were Damaged Or Destroyed

Apr 26, 2025 -

The China Factor Analyzing The Difficulties Faced By Bmw Porsche And Other Auto Brands

Apr 26, 2025

The China Factor Analyzing The Difficulties Faced By Bmw Porsche And Other Auto Brands

Apr 26, 2025 -

The Growing Problem Of Betting On Natural Disasters Focus On Los Angeles

Apr 26, 2025

The Growing Problem Of Betting On Natural Disasters Focus On Los Angeles

Apr 26, 2025 -

Los Angeles Wildfires A Case Study In Disaster Speculation

Apr 26, 2025

Los Angeles Wildfires A Case Study In Disaster Speculation

Apr 26, 2025 -

How Middle Management Drives Company Growth And Employee Development

Apr 26, 2025

How Middle Management Drives Company Growth And Employee Development

Apr 26, 2025