Canola Trade Diversification: China's Response To Canada Tensions

Table of Contents

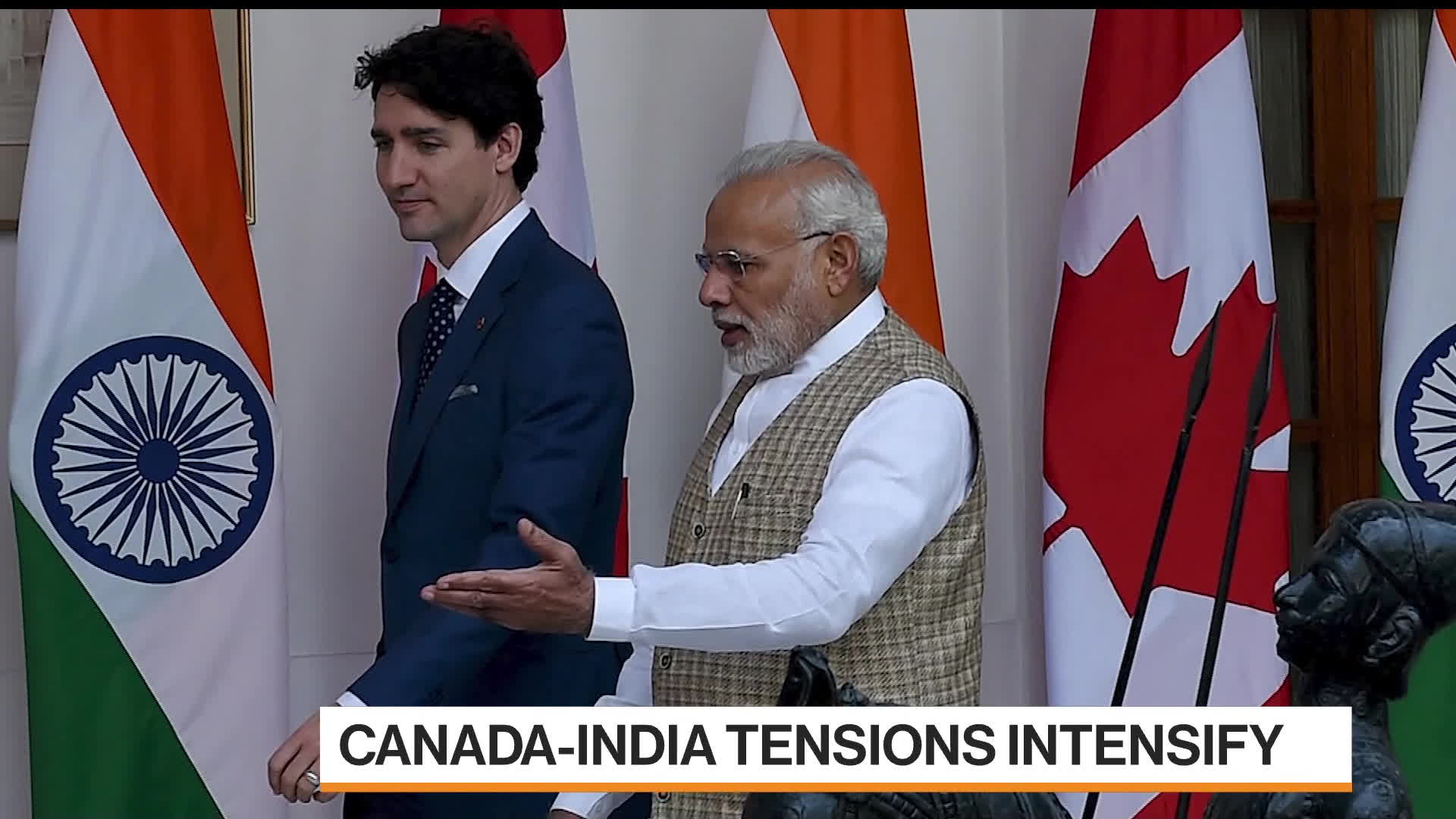

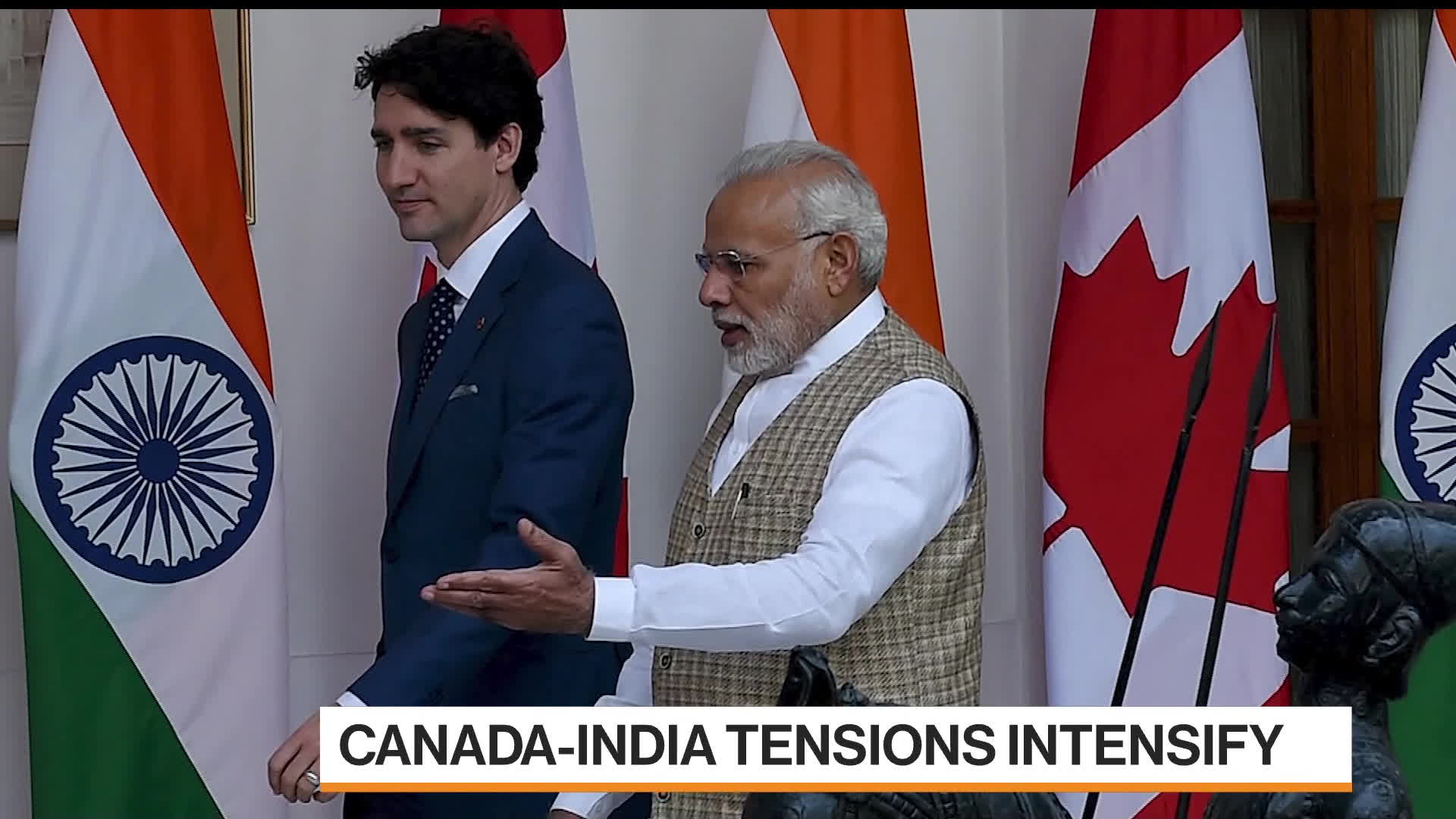

The Impact of Canada-China Tensions on Canola Trade

Political and Economic Factors Fueling the Dispute

The strained relationship between Canada and China, culminating in significant disruptions to canola trade, stems from a complex interplay of political and economic factors.

- The Meng Wanzhou Arrest: The detention of Meng Wanzhou, CFO of Huawei, in Canada in 2018, triggered retaliatory measures from China.

- Trade Restrictions and Sanctions: China imposed various restrictions and sanctions on Canadian canola imports, citing phytosanitary concerns, which Canada refuted.

- Diplomatic Tensions: The overall deterioration of diplomatic relations between the two countries further exacerbated the trade disputes.

- Impact on Canadian Farmers: Canadian canola farmers faced significant financial losses due to the reduced access to the Chinese market, impacting farm income and rural economies.

China's Reliance on Canadian Canola Prior to the Dispute

Before the trade disputes, China heavily relied on Canadian canola.

- Volume of Imports: Canada was a major supplier, accounting for a significant percentage of China's total canola imports. (Specific data on import volumes should be inserted here, sourced from reputable statistical organizations).

- High-Quality Canola: Canadian canola was valued for its quality, consistent yield, and favorable characteristics for processing.

- Established Trade Relationships: Decades of established trade relationships and supply chains existed between Canadian exporters and Chinese importers.

China's Strategies for Canola Trade Diversification

Faced with reduced access to Canadian canola, China has implemented several strategies to diversify its supply sources.

Increased Imports from Other Countries

China has actively sought alternative suppliers, notably increasing imports from:

- Australia: Australia has emerged as a key alternative, increasing its canola exports to China to fill the gap.

- Ukraine: Ukraine, despite its own geopolitical challenges, has also seen a rise in canola exports to China.

- Russia: Russia also contributes to China's diversified canola supply, although logistical challenges might exist.

- Other Countries: Smaller volumes have come from countries like France and Brazil, demonstrating a broader sourcing strategy.

These alternative sources, however, present their own challenges: logistical complexities, price volatility, and potentially lower quality compared to Canadian canola.

Domestic Canola Production Enhancement

China is simultaneously investing heavily in boosting its domestic canola production.

- Government Policies: The Chinese government has implemented policies aimed at increasing domestic yields and expanding cultivated areas.

- Investment in Technology and Research: Significant investments are being made in agricultural technology and research to improve domestic canola production efficiency.

- Challenges of Self-Sufficiency: Achieving self-sufficiency in canola production remains a long-term goal, facing hurdles such as land availability and climate conditions.

Strategic Partnerships and Trade Agreements

China has also been pursuing strategic partnerships and trade agreements to secure canola supplies.

- New Trade Deals: The exploration and signing of new trade agreements with other canola-producing countries are key elements of this diversification strategy.

- Strengthening Bilateral Relations: China has focused on cultivating stronger diplomatic and economic relations with alternative suppliers.

Geopolitical Implications of Canola Trade Diversification

Shifting Global Power Dynamics in the Agricultural Sector

China's canola trade diversification significantly reshapes the global agricultural landscape.

- Increased Competition: Increased competition among canola-producing nations intensifies as China seeks to secure consistent supplies.

- Impact on Global Prices: The shifting dynamics influence global canola prices and market stability.

- Food Security Implications: The diversification strategy has broader implications for global food security, particularly concerning vegetable oil supplies.

Impact on Canada-China Relations

The long-term impact of China's diversification strategy on Canada-China relations remains uncertain.

- Potential for Reconciliation: While the immediate prospects for trade normalization seem limited, future reconciliation remains a possibility.

- Long-term Implications: The diversification strategy might permanently alter the dynamics of the bilateral trade relationship, even if tensions eventually ease.

- Future Trade Disputes: The possibility of future trade disputes, even in other agricultural sectors, cannot be discounted.

Conclusion: The Future of Canola Trade Diversification

China's response to strained relations with Canada has driven significant changes in global canola markets. The country's multifaceted approach to canola trade diversification—including increased imports from alternative sources, investment in domestic production, and strategic partnerships—reflects a determined effort to secure its canola supply chain's stability and resilience. This shift has profound implications for global canola prices, the competitiveness of various producing nations, and broader food security concerns. Understanding the complexities of canola trade diversification is crucial for navigating future global agricultural challenges. Further research into the long-term implications of China's strategy is needed to fully grasp its impact on the global canola market.

Featured Posts

-

Benson Boone Clarifies Harry Styles Influence On His Music

May 09, 2025

Benson Boone Clarifies Harry Styles Influence On His Music

May 09, 2025 -

To Buy Or Not To Buy Palantir Stock Before May 5th A Comprehensive Look

May 09, 2025

To Buy Or Not To Buy Palantir Stock Before May 5th A Comprehensive Look

May 09, 2025 -

Analyzing Figmas Ai Update Competitive Advantages And Implications

May 09, 2025

Analyzing Figmas Ai Update Competitive Advantages And Implications

May 09, 2025 -

Rio Ferdinand Predicts Champions League Finalists Arsenals Chances

May 09, 2025

Rio Ferdinand Predicts Champions League Finalists Arsenals Chances

May 09, 2025 -

9 Maya V Kieve Kto Iz Soyuznikov Ukrainy Priedet

May 09, 2025

9 Maya V Kieve Kto Iz Soyuznikov Ukrainy Priedet

May 09, 2025