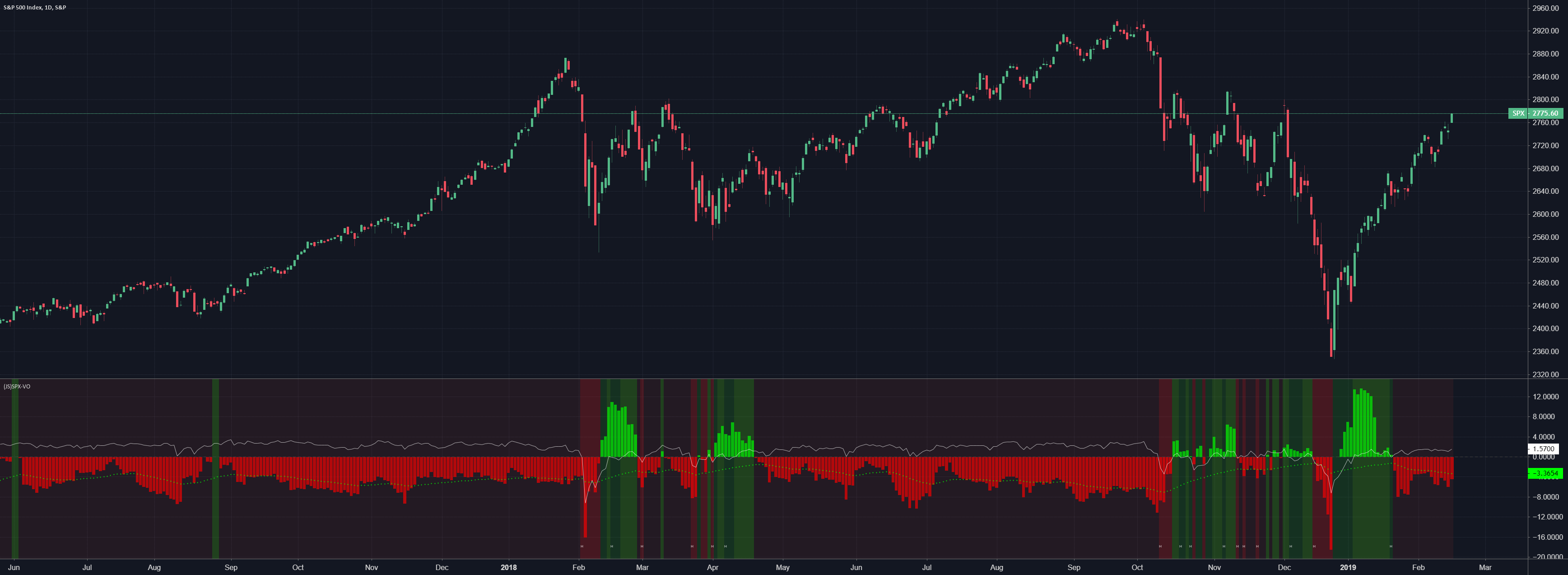

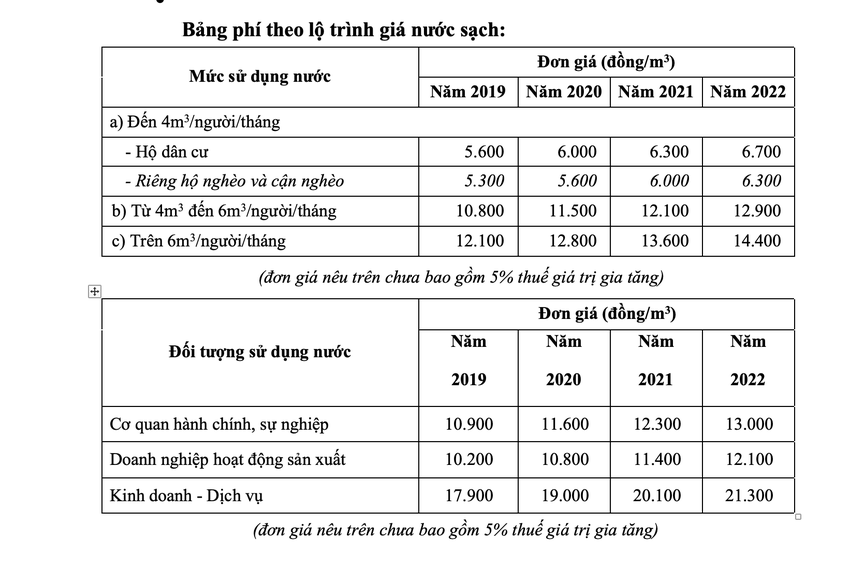

Capital Preservation: Strategies For Navigating S&P 500 Volatility

Table of Contents

Capital preservation, in the context of S&P 500 investment, refers to minimizing the risk of losing principal while still participating in potential market growth. It's about strategically managing your portfolio to withstand market fluctuations and ensure your investments remain relatively stable, even during periods of high volatility or downturn. This article will explore key strategies for preserving capital while investing in the S&P 500, even during periods of high volatility.

Diversification: Spreading Risk Across Asset Classes

Diversification is the cornerstone of any robust capital preservation strategy. It involves spreading your investments across different asset classes to reduce the impact of any single investment's poor performance. Heavy reliance on the S&P 500 alone exposes your portfolio to significant risk, as fluctuations in the index can dramatically affect your overall returns.

Beyond the Stock Market

Diversifying beyond the stock market is crucial for capital preservation. Consider allocating a portion of your portfolio to less correlated assets:

- Bonds: Bond Exchange Traded Funds (ETFs) like the iShares Core U.S. Aggregate Bond ETF (AGG) offer diversification within the fixed-income market.

- Real Estate: Real Estate Investment Trusts (REITs), such as the Real Estate Select Sector SPDR Fund (XLRE), provide exposure to the real estate market without direct property ownership.

- Commodities: Gold, often considered a safe haven asset, can act as a hedge against inflation and market downturns. Consider gold ETFs like the SPDR Gold Shares (GLD).

Effective asset allocation is key. A well-diversified portfolio might include a mix of stocks, bonds, and alternative investments, tailored to your risk tolerance and investment goals.

Sector Diversification within Equities

Even within the S&P 500, diversification is essential. Don't put all your eggs in one basket. Consider investing across different sectors:

- Technology: (e.g., Technology Select Sector SPDR Fund (XLK))

- Healthcare: (e.g., Health Care Select Sector SPDR Fund (XLV))

- Energy: (e.g., Energy Select Sector SPDR Fund (XLE))

- Financials: (e.g., Financial Select Sector SPDR Fund (XLF))

Sector rotation, the strategic shifting of investments between sectors based on market trends and economic forecasts, can further enhance risk management and contribute to capital preservation.

Defensive Investment Strategies for S&P 500 Volatility

Defensive investing focuses on preserving capital and generating consistent returns, even in challenging market conditions. This approach prioritizes stability and downside protection over aggressive growth.

Value Investing

Value investing involves identifying undervalued companies within the S&P 500 that are trading below their intrinsic worth. These companies may offer greater resilience during market downturns.

- Key Metrics: Look at Price-to-Earnings (P/E) ratios, dividend yields, and other fundamental metrics to identify undervalued opportunities.

- Fundamental Analysis: Thorough research and understanding of a company's financials are critical for successful value investing.

Dividend Investing

Dividend-paying stocks provide a steady stream of income, helping mitigate losses during market downturns. The income generated can be reinvested or used to supplement your income.

- Dividend Reinvestment Plans (DRIPs): Automatically reinvest dividends to buy more shares, compounding your returns over time.

- Dividend Growth: Focus on companies with a history of increasing their dividend payouts.

Dollar-Cost Averaging (DCA)

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This reduces the risk of investing a lump sum at a market peak.

- Implementation: Invest a set amount each month or quarter, consistently, irrespective of market conditions.

- Emotional Discipline: DCA helps remove emotional decision-making from the process.

Managing Risk Through Hedging and Options Strategies (For Advanced Investors)

For more sophisticated investors, hedging strategies can provide additional protection against market declines.

Put Options

Put options give the holder the right, but not the obligation, to sell an asset at a specific price (strike price) before a certain date (expiration date). They can act as insurance against price drops.

- Terminology: Understanding strike price and expiration date is crucial.

- Disclaimer: Investing in options involves significant risk and is not suitable for all investors. Consult with a financial advisor before using options strategies.

Other Hedging Strategies

Inverse ETFs, for example, aim to profit from market declines. However, these strategies are complex and can amplify losses if the market moves contrary to your expectations.

- Disclaimer: These strategies can be complex and require thorough understanding of market dynamics and risk management.

The Importance of Regular Monitoring and Rebalancing

Regular portfolio review is vital for capital preservation.

Portfolio Rebalancing

Rebalancing involves periodically adjusting your portfolio's asset allocation to maintain your target percentages. This helps capitalize on market fluctuations by selling overperforming assets and buying underperforming ones.

- Rebalancing Strategies: Rebalance periodically (e.g., annually or semi-annually) or when asset allocations deviate significantly from your target.

Emotional Discipline

Sticking to your long-term investment plan, even during market downturns, is critical. Avoid panic selling.

- Tips: Develop a clear investment plan, set realistic goals, and stick to your strategy.

Conclusion: Securing Your Financial Future Through Capital Preservation

Capital preservation within the context of S&P 500 investments requires a multifaceted approach. Diversification across asset classes and sectors, employing defensive investment strategies like value and dividend investing, and using dollar-cost averaging can significantly reduce risk. For advanced investors, carefully considered hedging strategies can further enhance protection. Regular monitoring and disciplined rebalancing are crucial for maintaining your desired asset allocation and navigating market volatility. Implement these capital preservation strategies today to navigate S&P 500 volatility and build a secure financial future. Learn more about effective capital preservation techniques for your S&P 500 investments.

Featured Posts

-

Richmond Man Sentenced For Hiding Gun Near 6 Year Old Nephew

Apr 30, 2025

Richmond Man Sentenced For Hiding Gun Near 6 Year Old Nephew

Apr 30, 2025 -

Analyzing Vusion Groups Amf Cp Document 2025 E1029754

Apr 30, 2025

Analyzing Vusion Groups Amf Cp Document 2025 E1029754

Apr 30, 2025 -

Nypd Investigating Pro Israel Mobs Alleged Harassment Of Woman

Apr 30, 2025

Nypd Investigating Pro Israel Mobs Alleged Harassment Of Woman

Apr 30, 2025 -

Beyonce And Jay Z Keeping Sir Carter Out Of The Spotlight

Apr 30, 2025

Beyonce And Jay Z Keeping Sir Carter Out Of The Spotlight

Apr 30, 2025 -

Strong 2024 Financial Results For Schneider Electric Data Center Growth A Key Driver

Apr 30, 2025

Strong 2024 Financial Results For Schneider Electric Data Center Growth A Key Driver

Apr 30, 2025

Latest Posts

-

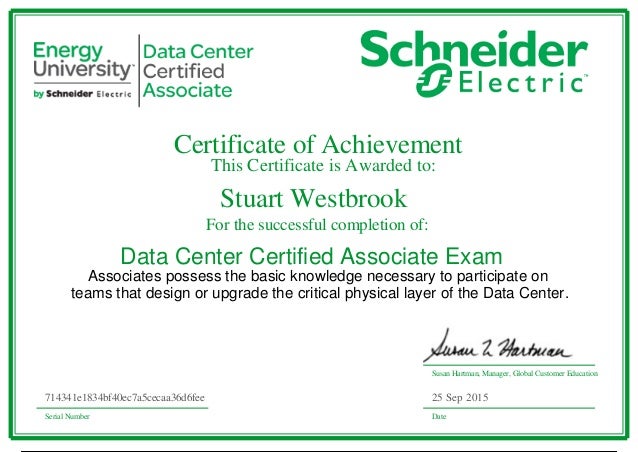

Du An Cap Nuoc Gia Dinh Tam Hop Chien Thang Thuyet Phuc Truoc 6 Doi Thu

Apr 30, 2025

Du An Cap Nuoc Gia Dinh Tam Hop Chien Thang Thuyet Phuc Truoc 6 Doi Thu

Apr 30, 2025 -

The Most Popular Cruise Lines In The Us A 2024 Overview

Apr 30, 2025

The Most Popular Cruise Lines In The Us A 2024 Overview

Apr 30, 2025 -

Ipo

Apr 30, 2025

Ipo

Apr 30, 2025 -

Thang Dam Tam Hop Vuot 6 Doi Thu Trung Thau Du An Cap Nuoc Gia Dinh

Apr 30, 2025

Thang Dam Tam Hop Vuot 6 Doi Thu Trung Thau Du An Cap Nuoc Gia Dinh

Apr 30, 2025 -

Choosing The Right Us Cruise Line For Your Next Vacation

Apr 30, 2025

Choosing The Right Us Cruise Line For Your Next Vacation

Apr 30, 2025