Car Dealers Double Down Against Mandatory Electric Vehicle Sales

Table of Contents

Financial Risks and Investment Concerns for Dealerships

The transition to electric vehicles presents significant financial hurdles for car dealerships, threatening their profitability and long-term viability. These concerns are driving much of the opposition to mandatory EV sales.

High Upfront Costs of EV Infrastructure

Dealerships face substantial upfront costs to adapt to the realities of EV sales. These expenses go beyond simply adding a few charging stations.

- Expensive EV charging infrastructure installation: Installing fast-charging stations requires significant capital investment, especially for larger dealerships needing to accommodate multiple vehicles simultaneously. The cost of installation, maintenance, and electricity consumption can be substantial.

- Need for specialized EV mechanic training programs: Electric vehicles require specialized knowledge and tools for maintenance and repair. Dealerships must invest in training their mechanics on high-voltage systems, battery technology, and software diagnostics, a process that takes time and money.

- Higher initial inventory costs due to EV battery technology: The cost of EV batteries is a significant factor in the overall price of the vehicle. Holding a larger inventory of EVs, compared to gasoline-powered cars, ties up significant capital.

The lack of government subsidies for infrastructure adaptation places a heavy financial burden on dealerships, particularly smaller, independent businesses. This disparity in financial resources could exacerbate existing inequalities within the automotive retail sector.

Uncertainty in EV Market Demand and Consumer Adoption

The transition to EVs is not guaranteed to be smooth, and the uncertainty surrounding consumer adoption is a major concern for dealerships.

- Fluctuating EV prices: The price of EVs, largely influenced by battery costs and government incentives, can fluctuate significantly, making it difficult for dealerships to accurately forecast profitability.

- Varying consumer acceptance levels based on region and demographics: Consumer adoption rates for EVs vary considerably depending on geographical location, access to charging infrastructure, and demographic factors like income levels and driving habits. This uneven demand creates challenges for inventory management and sales forecasting.

- Potential for technological obsolescence: The rapid pace of technological advancement in EVs means that dealership investments in specific models or technologies could quickly become outdated, leading to losses on inventory and equipment.

The rapid pace of technological advancement in EVs makes it challenging for dealerships to invest confidently in a quickly evolving market. This uncertainty is a significant driver of their opposition to mandatory sales targets.

Logistical Challenges and Supply Chain Issues

Beyond financial considerations, dealerships face considerable logistical challenges in transitioning to EV sales.

Limited EV Inventory and Supply Chain Disruptions

The global chip shortage and ongoing supply chain bottlenecks continue to impact the availability of EVs, creating headaches for dealerships.

- Difficulty in securing sufficient EV inventory: Manufacturers are struggling to meet the growing demand for EVs, leading to limited inventory for dealerships and longer wait times for customers.

- Inconsistent delivery times from manufacturers: Unpredictable delivery schedules make it difficult for dealerships to plan their sales and marketing strategies effectively.

- Logistical hurdles in transporting and storing EVs due to their size and charging requirements: EVs are often larger and heavier than comparable gasoline cars, requiring specialized transportation and storage solutions. The need for charging infrastructure at dealerships adds another layer of complexity.

These disruptions force dealerships to operate with leaner inventories, potentially impacting sales and customer satisfaction. This further contributes to their resistance against mandatory EV sales quotas.

Need for Specialized Service and Repair Facilities

Maintaining and repairing EVs requires different skills and equipment than traditional vehicles.

- Investment in specialized diagnostic equipment: Diagnosing and repairing EV systems requires specialized tools and software, which represents a significant investment for dealerships.

- Training staff on high-voltage battery systems: Working with high-voltage battery systems requires specialized training to ensure the safety of technicians and prevent accidents.

- Potential for longer repair times: Repairing complex EV systems can take longer than repairing traditional vehicles, potentially impacting service department efficiency and customer satisfaction.

Adapting existing service departments to accommodate EV servicing requires significant investment, which is a considerable burden for many dealerships, especially smaller ones.

Concerns Regarding Consumer Choice and Market Competition

Mandatory EV sales also raise concerns about consumer choice and the competitive landscape of the automotive market.

Restriction of Consumer Choice

A mandated shift to EVs could restrict consumer choice, potentially alienating customers who are not yet ready or able to transition.

- Inadequate charging infrastructure in some areas: The lack of widespread and reliable charging infrastructure, particularly in rural areas, remains a major barrier to EV adoption for many consumers.

- Higher upfront cost of EVs compared to gasoline cars: The initial purchase price of EVs is generally higher than comparable gasoline-powered vehicles, making them inaccessible to some consumers.

- Concerns about EV range anxiety: Many consumers remain concerned about the limited range of EVs and the potential for running out of charge, especially on longer journeys.

Forcing consumers towards EVs before the infrastructure and technology are fully mature could lead to dissatisfaction and negatively impact market adoption in the long run.

Impact on Competition and Market Dynamics

Mandatory EV sales could disproportionately impact smaller dealerships and manufacturers, potentially leading to market consolidation.

- Uneven playing field for smaller dealerships and manufacturers: Larger dealerships and manufacturers have more resources to invest in the necessary infrastructure and training to adapt to EV sales, creating an uneven playing field.

- Potential for market consolidation: The high cost of transitioning to EV sales could force smaller dealerships and manufacturers out of business, leading to reduced competition and potentially higher prices for consumers.

- Reduction in consumer choice due to limited product offerings: If smaller manufacturers struggle to compete, the overall number of EV models available to consumers could decrease, limiting consumer choice.

A rapid shift to mandatory EV sales could stifle innovation and potentially lead to a less competitive automotive market.

Conclusion

Car dealers' opposition to mandatory electric vehicle sales stems from genuine concerns about financial viability, logistical challenges, and the impact on consumer choice and market competition. While the transition to EVs is vital for environmental sustainability, a balanced approach that addresses the concerns of dealerships and ensures a smooth transition for consumers is crucial. A collaborative effort between policymakers, manufacturers, and dealerships is essential to navigate this complex transition effectively. Open dialogue and strategies that mitigate the risks and challenges faced by car dealers are critical to ensuring a successful and equitable shift towards electric vehicle adoption. Ignoring the concerns surrounding mandatory electric vehicle sales will only hinder the transition and potentially stifle innovation within the automotive industry. A phased approach, coupled with substantial government support for infrastructure development and dealer adaptation, is necessary to achieve a successful transition to a sustainable automotive future.

Featured Posts

-

Copa Libertadores Todo Sobre Liga De Quito Vs Flamengo Grupo C Fecha 3

May 08, 2025

Copa Libertadores Todo Sobre Liga De Quito Vs Flamengo Grupo C Fecha 3

May 08, 2025 -

Ukraines Cemetery Scandal Corruption And The Exploitation Of War Dead

May 08, 2025

Ukraines Cemetery Scandal Corruption And The Exploitation Of War Dead

May 08, 2025 -

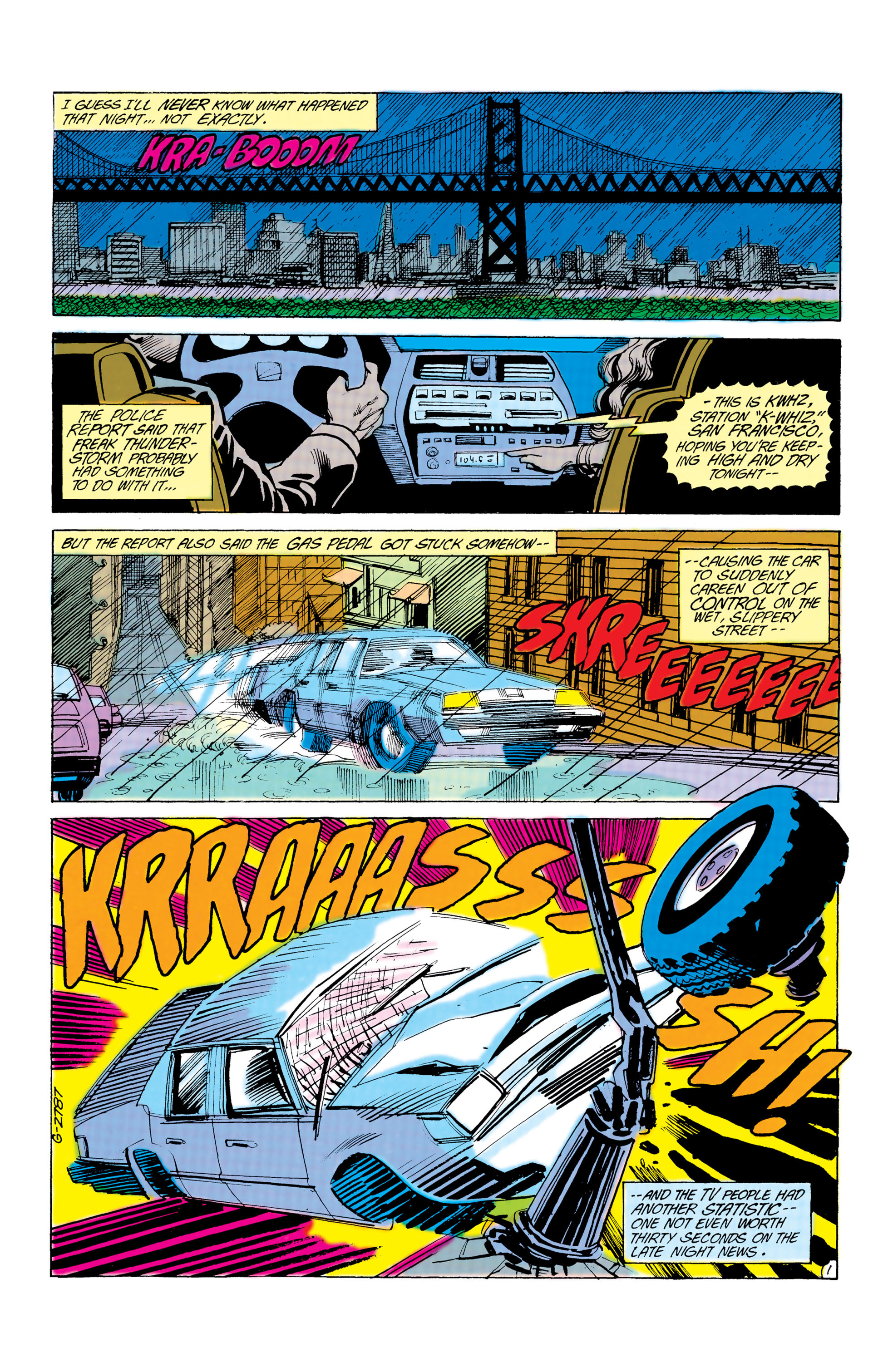

Dcs Batman A Brand New Beginning With Issue 1 And Costume Redesign

May 08, 2025

Dcs Batman A Brand New Beginning With Issue 1 And Costume Redesign

May 08, 2025 -

Dossier On Papal Candidates Cardinals Face Crucial Choice

May 08, 2025

Dossier On Papal Candidates Cardinals Face Crucial Choice

May 08, 2025 -

El Betis Forjando Una Historia Inolvidable

May 08, 2025

El Betis Forjando Una Historia Inolvidable

May 08, 2025