Carney's Economic Transformation: A Generational Shift?

Table of Contents

Does Mark Carney's influence signal a fundamental shift in economic paradigms, impacting generations to come? This question lies at the heart of understanding Carney's economic transformation. From his leadership at the Bank of Canada to his pivotal role at the Bank of England, and beyond, Carney has left an undeniable mark on global finance. This article examines his key policy initiatives and assesses whether they represent a genuine generational shift in economic thinking and practice.

Carney's Key Policy Initiatives and Their Impact

Mark Carney's career has been defined by a proactive approach to addressing emerging economic challenges. His impact spans several key areas, each with profound implications for the future of finance and the global economy.

Climate Change and Sustainable Finance

Carney's pivotal role in integrating climate risk into financial regulation is arguably his most significant contribution. He forcefully argued that climate change poses a systemic risk to the financial system, a perspective that was initially met with skepticism but has since become mainstream.

- Task Force on Climate-related Financial Disclosures (TCFD): As the chair of the TCFD, Carney spearheaded the development of a framework for companies to disclose their climate-related financial risks. This initiative has had a significant impact on investment strategies, pushing investors to consider ESG (Environmental, Social, and Governance) factors in their decision-making.

- Sustainable Finance Initiatives: Carney championed numerous initiatives promoting sustainable finance, urging the integration of climate risk into stress tests and encouraging the growth of green bonds. The long-term implications are far-reaching, potentially redirecting trillions of dollars towards climate-friendly investments.

- Impact: The increasing awareness of climate risk, driven in part by Carney's advocacy, has led to a surge in ESG investing and a greater focus on sustainable finance across the globe. This represents a significant shift away from traditional, purely profit-driven approaches.

Central Bank Independence and Monetary Policy

Carney's approach to monetary policy during his tenure at both the Bank of Canada and the Bank of England was characterized by a commitment to central bank independence and a pragmatic approach to inflation targeting.

- Quantitative Easing (QE): Carney oversaw the implementation of extensive QE programs in response to the 2008 financial crisis and subsequent economic downturns. While controversial, these policies helped to stabilize financial markets and prevent a deeper recession.

- Forward Guidance: He also pioneered the use of forward guidance, communicating the central bank's intentions more transparently to influence market expectations and manage inflation.

- Challenges: While his monetary policy approaches were generally credited with economic stability, criticisms focused on the potential for asset bubbles and the limitations of QE in addressing underlying economic inequalities.

Regulation of the Financial Sector

Under Carney's leadership, significant reforms were implemented to enhance the stability and resilience of the financial system, aiming to prevent future crises.

- Basel III: Carney played a key role in the implementation of Basel III regulations, strengthening capital requirements for banks to improve their ability to withstand financial shocks.

- Macroprudential Policy: He also championed the use of macroprudential policies, focusing on the overall stability of the financial system rather than just individual institutions.

- Criticisms: Some critics argued that these regulations imposed undue burdens on banks, potentially hindering economic growth. Others pointed to the limitations of regulation in preventing all forms of financial instability.

The Generational Impact of Carney's Reforms

The long-term consequences of Carney's policies are still unfolding, but their potential to reshape the global economic landscape is undeniable.

Long-Term Economic Consequences

Carney's focus on sustainable finance and climate risk could significantly influence long-term economic growth.

- Positive Impacts: Increased investment in green technologies and sustainable infrastructure could lead to job creation and economic diversification.

- Negative Impacts: The transition to a low-carbon economy could also lead to job losses in certain sectors, requiring significant retraining and reskilling initiatives.

- Economic Inequality: The distribution of the benefits and costs of the transition remains a significant concern, potentially exacerbating existing income inequality.

Shifting Economic Paradigms

Carney's emphasis on sustainability and long-term risks represents a stark departure from traditional economic models that often prioritized short-term growth above all else.

- Sustainable Economics: His work has significantly contributed to the growing field of sustainable economics, which integrates environmental and social considerations into economic decision-making.

- Long-Term Economic Thinking: He successfully pushed for a longer-term perspective in policymaking, acknowledging the interconnectedness of economic, social, and environmental factors.

- Influence on Future Thinking: His ideas have significantly influenced a new generation of economists and policymakers who are increasingly incorporating sustainability and long-term risk assessments into their work.

The Legacy of Mark Carney

Mark Carney's legacy extends far beyond specific policies. His influence on global economics and international cooperation is undeniable.

- Key Achievements: His achievements include strengthening financial regulation, promoting sustainable finance, and raising awareness of climate risk.

- International Cooperation: He played a key role in fostering international cooperation on financial regulation and climate change.

- Enduring Influence: His emphasis on long-term thinking and the integration of sustainability into economic policy will continue to shape the work of future generations of economists and policymakers.

Conclusion

Mark Carney's influence on global economics is profound. His commitment to central bank independence, his pioneering work in integrating climate risk into financial regulation, and his advocacy for a more sustainable and long-term approach to economic policy represent a significant departure from traditional approaches. Whether this constitutes a complete generational shift is still a matter of debate, but his impact on future economic thinking and policymaking is undeniable. Continue exploring Carney's economic transformation by researching the ongoing impact of his initiatives on sustainable finance and the evolving landscape of global economic policy.

Featured Posts

-

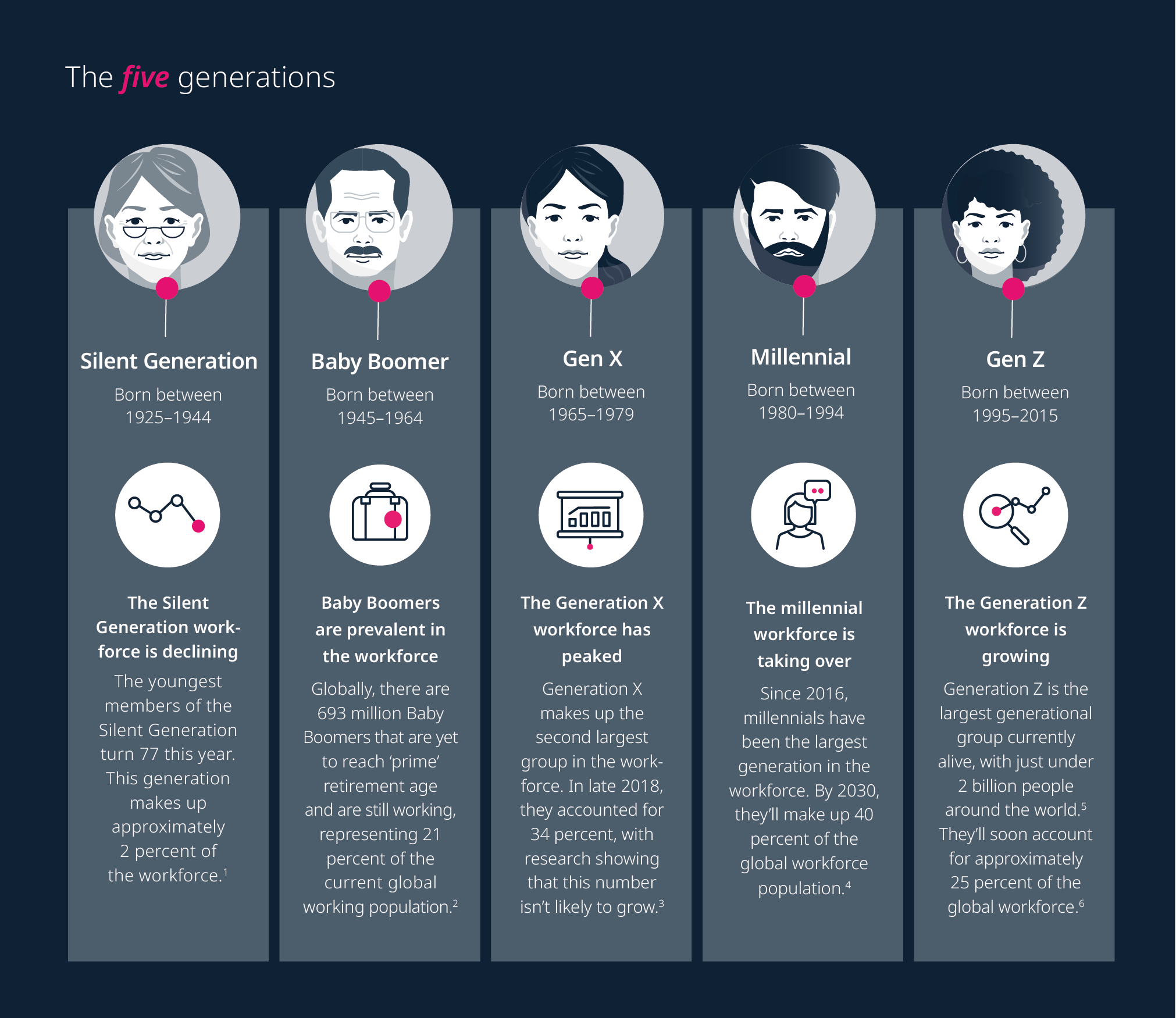

Renovation Race Against Time Churchill Downs Prepares For Kentucky Derby

May 05, 2025

Renovation Race Against Time Churchill Downs Prepares For Kentucky Derby

May 05, 2025 -

Australia Votes Albaneses Labor Party Favored In Early Election Results

May 05, 2025

Australia Votes Albaneses Labor Party Favored In Early Election Results

May 05, 2025 -

West Bengal Weather Forecast High Tide And Temperature Surge Expected During Holi

May 05, 2025

West Bengal Weather Forecast High Tide And Temperature Surge Expected During Holi

May 05, 2025 -

Me T Department Issues Alert High Temperature And High Tide Predicted For West Bengals Holi Celebrations

May 05, 2025

Me T Department Issues Alert High Temperature And High Tide Predicted For West Bengals Holi Celebrations

May 05, 2025 -

1 2 Inches Of Spring Snow Possible Tomorrow In Select Nyc Suburbs

May 05, 2025

1 2 Inches Of Spring Snow Possible Tomorrow In Select Nyc Suburbs

May 05, 2025

Latest Posts

-

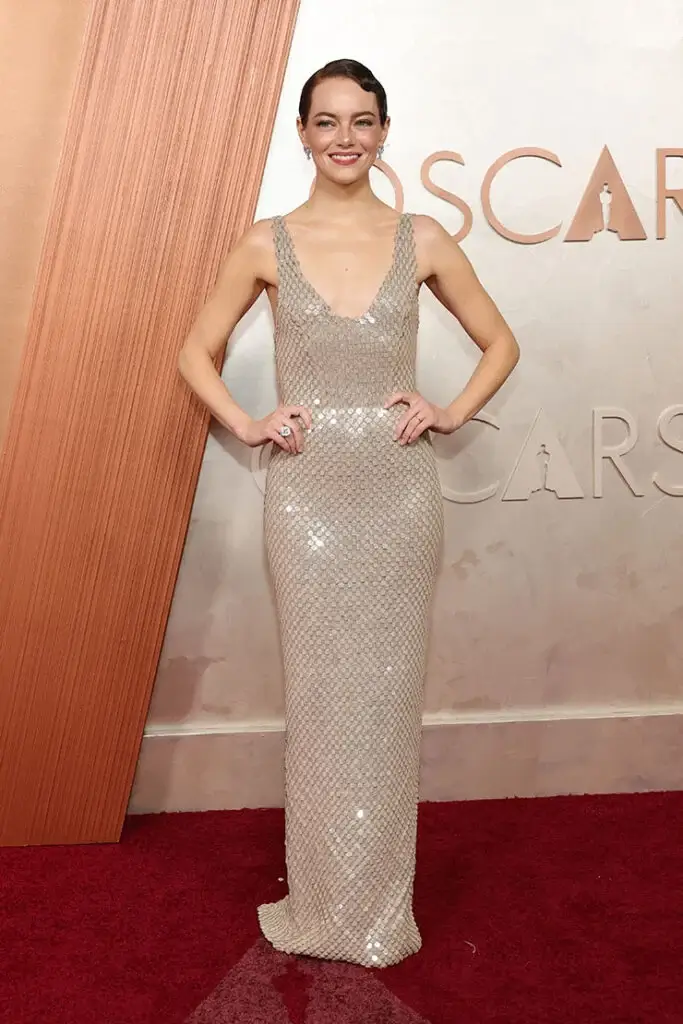

Emma Stones Daring Oscars 2025 Look Sequin Louis Vuitton And Pixie Cut

May 05, 2025

Emma Stones Daring Oscars 2025 Look Sequin Louis Vuitton And Pixie Cut

May 05, 2025 -

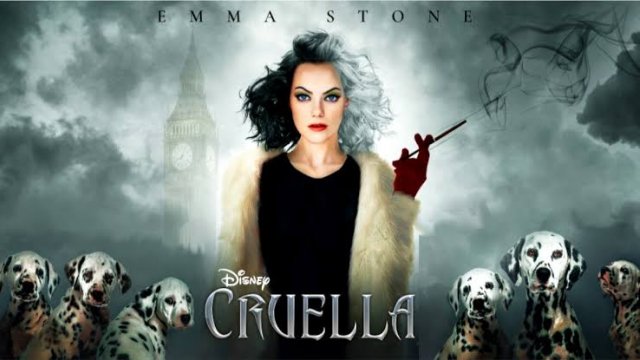

Bollywood News Cruella Trailer Showcases Emma Stone And Emma Thompsons Confrontation

May 05, 2025

Bollywood News Cruella Trailer Showcases Emma Stone And Emma Thompsons Confrontation

May 05, 2025 -

Disneys Cruella Trailer Shows Escalating Rivalry Between Emma Stone And Baroness Von Hellman

May 05, 2025

Disneys Cruella Trailer Shows Escalating Rivalry Between Emma Stone And Baroness Von Hellman

May 05, 2025 -

Emma Stone And Emma Thompsons Clash In New Disneys Cruella Trailer

May 05, 2025

Emma Stone And Emma Thompsons Clash In New Disneys Cruella Trailer

May 05, 2025 -

New Cruella Trailer Highlights Stone And Thompsons Intense Conflict

May 05, 2025

New Cruella Trailer Highlights Stone And Thompsons Intense Conflict

May 05, 2025