CATL's $1 Billion Loan Bid For Indonesia Plant Expansion

Table of Contents

Indonesia's Strategic Importance for CATL's Global Expansion

Indonesia holds a key position in CATL's global expansion strategy, primarily due to its vast nickel reserves. Nickel is a crucial component in the production of lithium-ion batteries, the dominant technology powering most EVs. The Indonesian government has proactively implemented policies and incentives to attract foreign investment in the EV battery sector, making it an attractive destination for companies like CATL. This strategic move positions CATL to benefit from Indonesia's abundant resources while simultaneously contributing to the nation's economic growth.

- Abundant nickel reserves: Indonesia boasts some of the world's largest nickel reserves, providing a secure and readily available supply chain for CATL's battery production.

- Government incentives: Indonesia offers attractive tax breaks, streamlined regulatory processes, and other incentives designed to encourage foreign direct investment (FDI) in the EV battery industry.

- Job creation and economic growth: CATL's investment is expected to generate thousands of high-skilled jobs in Indonesia, boosting the nation's economy and fostering technological advancement.

- Strategic location: Indonesia's location provides easy access to Southeast Asian markets, a rapidly growing region for EV adoption.

Details of the $1 Billion Loan Application

CATL's application for a $1 billion loan, the source of which is currently under review, aims to significantly expand its Indonesian battery plant. The funds are earmarked for increased production capacity, the implementation of cutting-edge battery technologies, and improvements to the overall plant infrastructure. The timeline for loan approval and project completion remains to be seen, however, the project is expected to unfold over several years. Securing such a substantial loan presents inherent risks, including geopolitical uncertainties and fluctuations in global nickel prices, both of which could impact the project's feasibility.

- Loan amount: $1 billion for expansion and upgrades.

- Purpose of the loan: Expanding production capacity, implementing new technologies, and upgrading infrastructure.

- Timeline: The exact timeline for loan approval and project completion is yet to be officially confirmed.

- Potential risks: Geopolitical instability, price volatility in nickel markets, and potential supply chain disruptions.

Impact on the Global Electric Vehicle Market

CATL's Indonesian plant expansion will have far-reaching consequences for the global EV battery market. The increased production capacity will contribute to a greater supply of batteries, potentially easing price pressures and making EVs more accessible to consumers worldwide. This expansion will also intensify competition within the EV battery sector, spurring innovation and further driving down costs. Ultimately, this contributes to the broader global shift towards sustainable transportation.

- Increased battery production capacity: A substantial increase in global EV battery production, potentially alleviating supply chain bottlenecks.

- Potential impact on battery prices: Increased production could lead to lower battery prices, making EVs more affordable.

- Increased competition: CATL's expansion will intensify competition in the global EV battery market, accelerating technological innovation.

- Contribution to global EV adoption: Greater battery availability will support the wider adoption of electric vehicles globally.

Environmental Considerations and Sustainability

CATL has expressed its commitment to environmentally responsible battery production. The company is actively exploring and implementing sustainable mining practices to minimize the environmental impact of nickel extraction. Furthermore, CATL plans to integrate renewable energy sources into the Indonesian plant's operations, reducing its carbon footprint. Waste management and recycling initiatives are also central to CATL's sustainability strategy.

- Sustainable mining practices: CATL is committed to responsible sourcing of nickel and minimizing the ecological impact of mining operations.

- Renewable energy integration: The plant will incorporate renewable energy sources such as solar and wind power to reduce its carbon emissions.

- Waste management and recycling: CATL is investing in innovative waste management and battery recycling technologies.

Conclusion

CATL's $1 billion loan bid for its Indonesian plant expansion represents a substantial investment with significant implications for both Indonesia's economic development and the global EV market. This project will not only boost Indonesia's economic growth but also play a crucial role in accelerating the global transition to cleaner energy and sustainable transportation. The expansion underscores the growing importance of Indonesia as a strategic hub for EV battery production and highlights CATL's commitment to leading the charge in the renewable energy sector. Stay tuned for updates on CATL's Indonesian plant expansion and the future of electric vehicle battery production. Learn more about CATL's commitment to sustainable energy solutions and its impact on the global EV market.

Featured Posts

-

Anthony Edwards Surrenders Custody To Ayesha Howard After Paternity Dispute

May 07, 2025

Anthony Edwards Surrenders Custody To Ayesha Howard After Paternity Dispute

May 07, 2025 -

Gewinnzahlen Lotto 6aus49 Ziehung Vom 9 4 2025

May 07, 2025

Gewinnzahlen Lotto 6aus49 Ziehung Vom 9 4 2025

May 07, 2025 -

Steelers Packers Trade Impact On Josh Jacobs And Green Bays Receiving Corps

May 07, 2025

Steelers Packers Trade Impact On Josh Jacobs And Green Bays Receiving Corps

May 07, 2025 -

Red Carpet Glamour A List Celebrities At The Met Gala

May 07, 2025

Red Carpet Glamour A List Celebrities At The Met Gala

May 07, 2025 -

Gobert Out Edwards And Conley Lead Jazz Vs Rockets

May 07, 2025

Gobert Out Edwards And Conley Lead Jazz Vs Rockets

May 07, 2025

Latest Posts

-

The Impact Of Saturday Night Live On Counting Crows Popularity

May 08, 2025

The Impact Of Saturday Night Live On Counting Crows Popularity

May 08, 2025 -

Tuerkiye De Kripto Varlik Duezenlemesi Spk Nin Kripto Platformlarina Yoenelik Sartlari

May 08, 2025

Tuerkiye De Kripto Varlik Duezenlemesi Spk Nin Kripto Platformlarina Yoenelik Sartlari

May 08, 2025 -

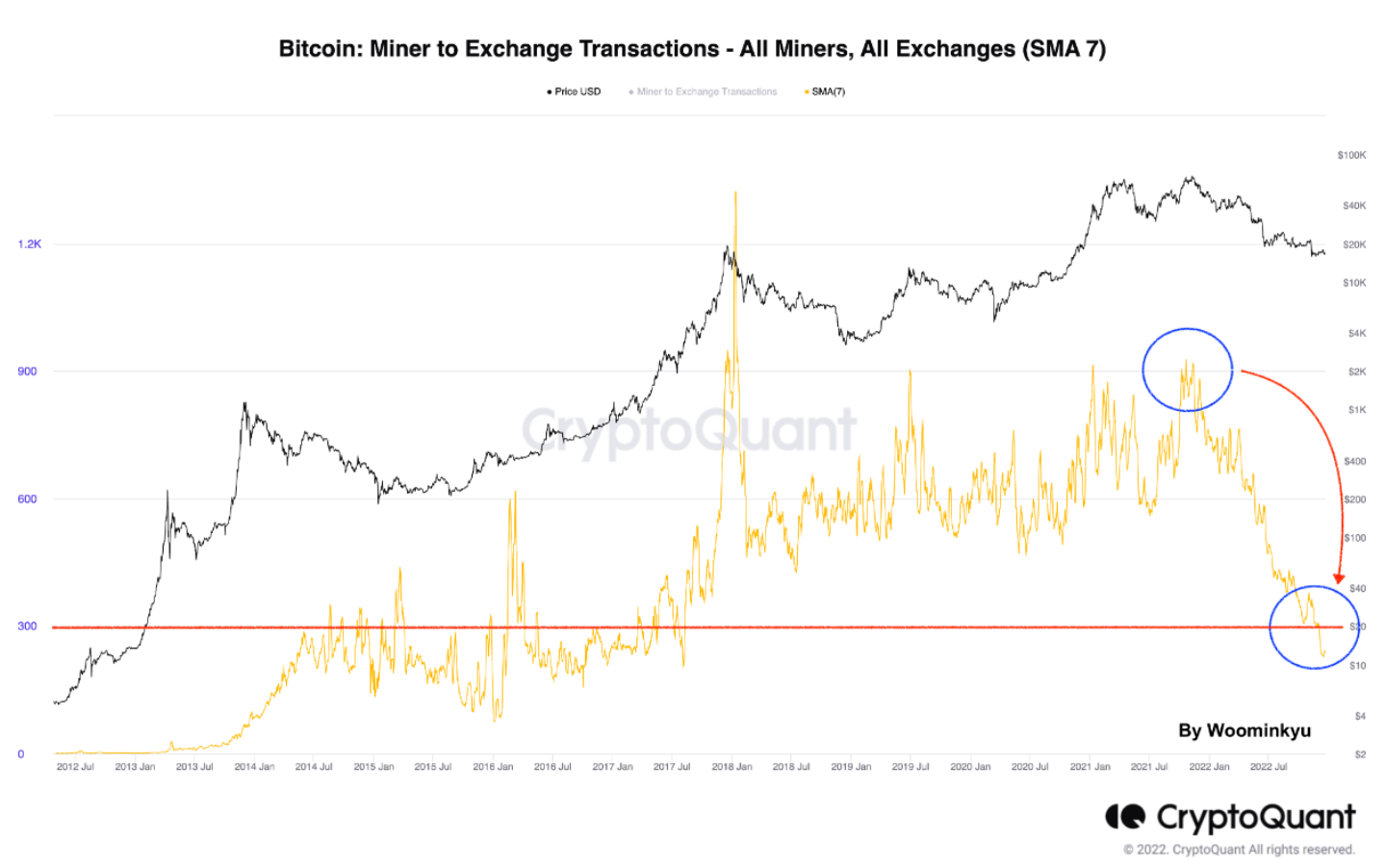

Kripto Para Duesuesue Yatirimcilarin Satis Kararlarini Etkileyen Faktoerler

May 08, 2025

Kripto Para Duesuesue Yatirimcilarin Satis Kararlarini Etkileyen Faktoerler

May 08, 2025 -

Counting Crows Snl Performance A Turning Point In Their Career

May 08, 2025

Counting Crows Snl Performance A Turning Point In Their Career

May 08, 2025 -

Kripto Para Platformlari Icin Yeni Kurallar Sermaye Ve Guevenlik Odakli Duezenleme

May 08, 2025

Kripto Para Platformlari Icin Yeni Kurallar Sermaye Ve Guevenlik Odakli Duezenleme

May 08, 2025