Cenovus CEO: MEG Acquisition Unlikely Amid Focus On Internal Growth

Table of Contents

Cenovus's Current Strategic Priorities: A Focus on Internal Expansion

Cenovus's current strategic plan hinges on strengthening its core business, reducing debt, and embracing technological innovation for sustainable growth. This multifaceted approach forms the bedrock of their commitment to organic growth.

Strengthening the Core Business

Cenovus boasts strong operational performance and a healthy financial position. The company is actively engaged in several key initiatives designed to boost production and enhance efficiency, leading to increased profitability.

- Increased Oil Sands Production: Cenovus is investing heavily in optimizing its oil sands operations to increase production volumes while maintaining high safety and environmental standards. This includes upgrades to existing facilities and leveraging advanced extraction techniques.

- Improved Refining Margins: The company is focusing on improving refining margins through operational efficiencies and strategic product diversification. This involves optimizing refinery operations and adapting to shifting market demands.

- Exploration in Promising Areas: Cenovus continues to explore and develop new oil and gas reserves in promising areas, both domestically and internationally, to secure long-term resource supply and fuel future growth.

Debt Reduction and Financial Stability

A key component of Cenovus's strategy is a commitment to responsible debt management. The company is actively working to reduce its debt levels, enhancing financial stability and strengthening its credit rating. This fiscally conservative approach allows for greater flexibility and resilience in the face of market volatility.

- Share Buybacks: Cenovus is utilizing share buybacks as a mechanism to return capital to shareholders and increase shareholder value.

- Dividend Policy: A consistent and sustainable dividend policy demonstrates Cenovus's commitment to rewarding shareholders while simultaneously investing in future growth.

- Strategic Asset Sales: Where appropriate, Cenovus strategically sells non-core assets to streamline operations and improve its overall financial position. This frees up capital for reinvestment in higher-return opportunities.

Technological Innovation and Sustainability

Cenovus is committed to embracing technological advancements to improve operational efficiency, reduce its environmental footprint, and enhance its sustainability profile. This commitment extends beyond operational improvements, encompassing a broader ESG (Environmental, Social, and Governance) strategy.

- Carbon Capture, Utilization, and Storage (CCUS): Cenovus is actively involved in CCUS projects, which aim to significantly reduce greenhouse gas emissions.

- Renewable Energy Integration: The company is exploring opportunities to integrate renewable energy sources into its operations, reducing its reliance on fossil fuels.

- Data Analytics and Digitalization: Cenovus utilizes data analytics and digitalization to optimize its operations, improve decision-making, and enhance efficiency across its value chain.

Why a MEG Acquisition is Unlikely at This Time

While acquisitions can be a route to growth, Cenovus believes that pursuing organic growth is the most efficient and strategically aligned path forward. The decision to forgo acquiring MEG Energy stems from several key factors.

Strategic Misalignment

Acquiring MEG Energy presents several strategic misalignments with Cenovus's current priorities. The integration complexities of such a large acquisition would divert resources and potentially delay the realization of the company’s internal growth objectives.

- Integration Complexities: Merging two large companies involves significant challenges in integrating systems, cultures, and personnel, potentially leading to disruptions and inefficiencies.

- Potential for Cost Overruns: Large acquisitions often involve unforeseen costs and delays, potentially exceeding initial estimates and impacting profitability.

- Dilution of Shareholder Value: A poorly executed acquisition can dilute shareholder value, contradicting Cenovus's commitment to maximizing returns for its investors.

Focus on Organic Growth Opportunities

Cenovus sees significant potential for growth within its existing assets and operations. Focusing on organic growth allows for more controlled expansion, reducing risk and maximizing return on investment.

- Expansion of Existing Facilities: Cenovus can strategically expand its existing facilities to increase production capacity and efficiency.

- Exploration of New Reserves: Further exploration within existing licenses and pursuing new exploration opportunities provides a path to expanding reserves and production.

- Optimization of Existing Processes: Continual improvement and optimization of existing operational processes delivers immediate returns and improved efficiency.

Conclusion: Cenovus's Commitment to Internal Growth over External Acquisitions

Cenovus's decision to prioritize internal growth over acquiring MEG Energy reflects a strategic focus on operational excellence, debt reduction, and sustainable practices. This commitment to organic growth offers a more controlled, less risky, and ultimately more efficient path to long-term value creation for shareholders. By concentrating on improving existing operations, investing in technological advancements, and pursuing responsible debt management, Cenovus is positioning itself for sustainable and profitable growth. To learn more about Cenovus's strategic plan and its commitment to delivering strong returns through organic growth, visit [link to Cenovus investor relations website].

Featured Posts

-

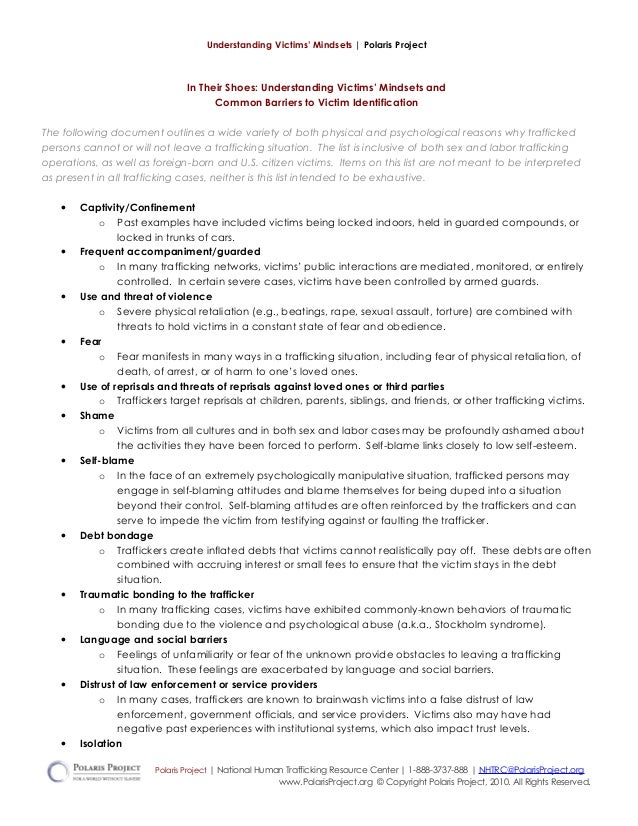

The Psychology Of Disappearance Understanding The Victims And Perpetrators

May 26, 2025

The Psychology Of Disappearance Understanding The Victims And Perpetrators

May 26, 2025 -

The Best Office Chairs Of 2025 A Comprehensive Guide

May 26, 2025

The Best Office Chairs Of 2025 A Comprehensive Guide

May 26, 2025 -

The Complex Emotions Of Loss And Reunion Jonathan Peretzs Journey

May 26, 2025

The Complex Emotions Of Loss And Reunion Jonathan Peretzs Journey

May 26, 2025 -

Competition Heats Up Alternative Delivery Services Outperforming Canada Post

May 26, 2025

Competition Heats Up Alternative Delivery Services Outperforming Canada Post

May 26, 2025 -

Le Dossier Du Siege De La Rtbf Demande D Explications De La Ministre Galant

May 26, 2025

Le Dossier Du Siege De La Rtbf Demande D Explications De La Ministre Galant

May 26, 2025

Latest Posts

-

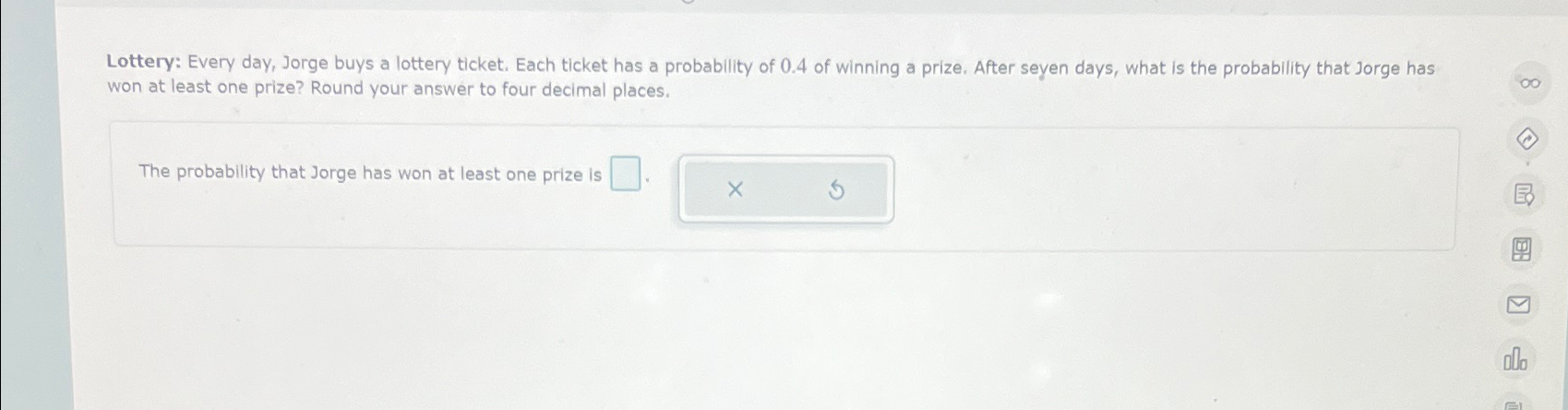

Claim Your Prize Winning Lottery Ticket Sold At This Specific Location

May 28, 2025

Claim Your Prize Winning Lottery Ticket Sold At This Specific Location

May 28, 2025 -

Spurs Ligue 1 Pursuit Winger Transfer News And Expected Timeline

May 28, 2025

Spurs Ligue 1 Pursuit Winger Transfer News And Expected Timeline

May 28, 2025 -

Winning Lotto Ticket Claim Your Millions At Shop Name

May 28, 2025

Winning Lotto Ticket Claim Your Millions At Shop Name

May 28, 2025 -

Tottenham Target Ligue 1 Winger Confirmed Departure Fuels Transfer Race

May 28, 2025

Tottenham Target Ligue 1 Winger Confirmed Departure Fuels Transfer Race

May 28, 2025 -

Discover The Shop Where A Winning Lotto Ticket Was Sold Claim Your Fortune

May 28, 2025

Discover The Shop Where A Winning Lotto Ticket Was Sold Claim Your Fortune

May 28, 2025