Chainalysis' Acquisition Of Alterya: Implications For The Blockchain Industry

Table of Contents

Enhanced Blockchain Data Analysis Capabilities

The integration of Alterya's technology into Chainalysis's existing platform promises a dramatic enhancement in blockchain data analysis capabilities. This translates into broader coverage, improved data quality, and a more efficient analytical process.

Expanded Data Sources and Coverage

Alterya's expertise brings a wealth of new data sources to Chainalysis's arsenal. This expanded coverage provides a more holistic view of blockchain activity, leading to more comprehensive and insightful analysis.

- Wider Network Coverage: Access to data from a broader range of blockchain networks, extending beyond the limitations of previously available datasets.

- Enhanced DeFi Data: Improved coverage of Decentralized Finance (DeFi) protocols, allowing for more effective tracking of transactions and identification of vulnerabilities within these ecosystems.

- NFT Marketplace Insights: Deeper insights into Non-Fungible Token (NFT) marketplaces, enabling better tracking of transactions and identification of potentially fraudulent activities.

- Faster Data Processing: Streamlined data processing techniques leading to quicker analysis and faster response times to emerging threats.

Improved Data Visualization and Reporting

The combined platform promises a significantly improved user experience. More intuitive dashboards, customized reports, and real-time data analysis features will simplify the complexities of blockchain data for investigators, regulators, and businesses alike.

- Intuitive Dashboards: User-friendly dashboards that provide clear and concise visualizations of complex blockchain data.

- Customizable Reports: Ability to generate tailored reports based on specific needs and requirements, making the data more actionable.

- Real-time Data Analysis: Access to real-time data, enabling faster responses to emerging threats and opportunities.

- Advanced Reporting Functionalities: New reporting features that provide deeper insights into blockchain activity and trends.

Strengthened Blockchain Security and Anti-Money Laundering (AML) Efforts

The synergy between Chainalysis and Alterya's technologies is poised to significantly enhance blockchain security and AML efforts. This translates into more effective cryptocurrency investigations and improved regulatory compliance.

More Effective Cryptocurrency Investigations

The acquisition will enhance the ability to trace illicit funds and identify malicious actors more effectively. This improvement stems from the combined access to a wider range of data sources and more powerful analytical tools.

- Improved Transaction Tracing: More accurate and efficient tracing of cryptocurrency transactions, leading to quicker identification of suspicious activities.

- Enhanced Malicious Actor Identification: More effective identification of individuals and entities involved in illicit activities.

- Faster Investigation Times: Reduced investigation times through improved data processing and visualization capabilities.

- Reduced Cryptocurrency-Related Crime: A potential decrease in cryptocurrency-related crime through more effective prevention and detection efforts.

Enhanced Regulatory Compliance

By providing a more comprehensive and accurate data platform, the merger will assist blockchain companies and financial institutions in meeting evolving regulatory requirements related to AML and Know Your Customer (KYC) guidelines.

- Simplified Regulatory Reporting: Streamlined regulatory reporting processes through automated data analysis and reporting features.

- Reduced Compliance Risks: Mitigation of compliance risks through improved data accuracy and comprehensive reporting.

- Improved Due Diligence: Enhanced due diligence capabilities, allowing for more thorough checks on customers and transactions.

Implications for the Competitive Landscape

The acquisition solidifies Chainalysis's position as a market leader in blockchain analytics, potentially reshaping the competitive landscape.

Increased Market Dominance for Chainalysis

The combined resources and technologies of Chainalysis and Alterya give Chainalysis a significant advantage over its competitors, potentially leading to increased market share and further growth.

- Expanded Market Reach: Access to new markets and customer segments.

- Enhanced Product Offering: A more comprehensive and competitive product offering.

- Potential for Further Acquisitions: Increased financial capacity to pursue further acquisitions and expand market share.

Consolidation of the Blockchain Analytics Sector

This acquisition exemplifies a broader trend of mergers and acquisitions within the blockchain analytics industry. This consolidation may lead to both increased innovation and reduced competition.

- Increased Innovation: Potential for increased innovation driven by the integration of different technologies and expertise.

- Reduced Competition: Potential for reduced competition in the market, leading to higher prices and potentially less choice for consumers.

Potential Challenges and Concerns

While the acquisition holds significant promise, potential challenges and concerns remain.

Data Privacy and Security Concerns

The increased access to sensitive user data raises concerns about data privacy and security. Robust data protection measures and adherence to regulations like GDPR and CCPA are critical.

- Data Protection Measures: Strong data protection measures must be implemented to mitigate potential privacy risks.

- Compliance with Regulations: Strict adherence to relevant data privacy regulations is essential.

- Ethical Data Handling: A commitment to ethical data handling practices is crucial to build and maintain trust.

Antitrust and Regulatory Scrutiny

The acquisition could attract antitrust scrutiny from regulatory authorities concerned about potential monopolistic practices.

- Competition Concerns: Regulatory authorities might investigate whether the merger reduces competition in the market.

- Market Dominance: Concerns about Chainalysis's potential for excessive market dominance.

Conclusion

Chainalysis' acquisition of Alterya represents a significant step forward in blockchain analytics. The merger promises enhanced data analysis capabilities, improved blockchain security and AML efforts, and a strengthened market position for Chainalysis. However, addressing concerns regarding data privacy and potential antitrust scrutiny is crucial for the long-term success of this integration. The combined strengths of these two companies offer a powerful platform for navigating the complexities of the blockchain world. To explore how Chainalysis's advanced blockchain analytics and security solutions can benefit your organization, visit the Chainalysis website and discover the comprehensive features available for cryptocurrency investigation tools and robust blockchain security solutions.

Featured Posts

-

Jim Cramer On Foot Locker Fl Investment Analysis And Stock Outlook

May 15, 2025

Jim Cramer On Foot Locker Fl Investment Analysis And Stock Outlook

May 15, 2025 -

Max Muncys Torpedo Bat Test A Short Lived Experiment

May 15, 2025

Max Muncys Torpedo Bat Test A Short Lived Experiment

May 15, 2025 -

Padres Vs Yankees Prediction Will San Diego Continue Their Winning Streak In New York

May 15, 2025

Padres Vs Yankees Prediction Will San Diego Continue Their Winning Streak In New York

May 15, 2025 -

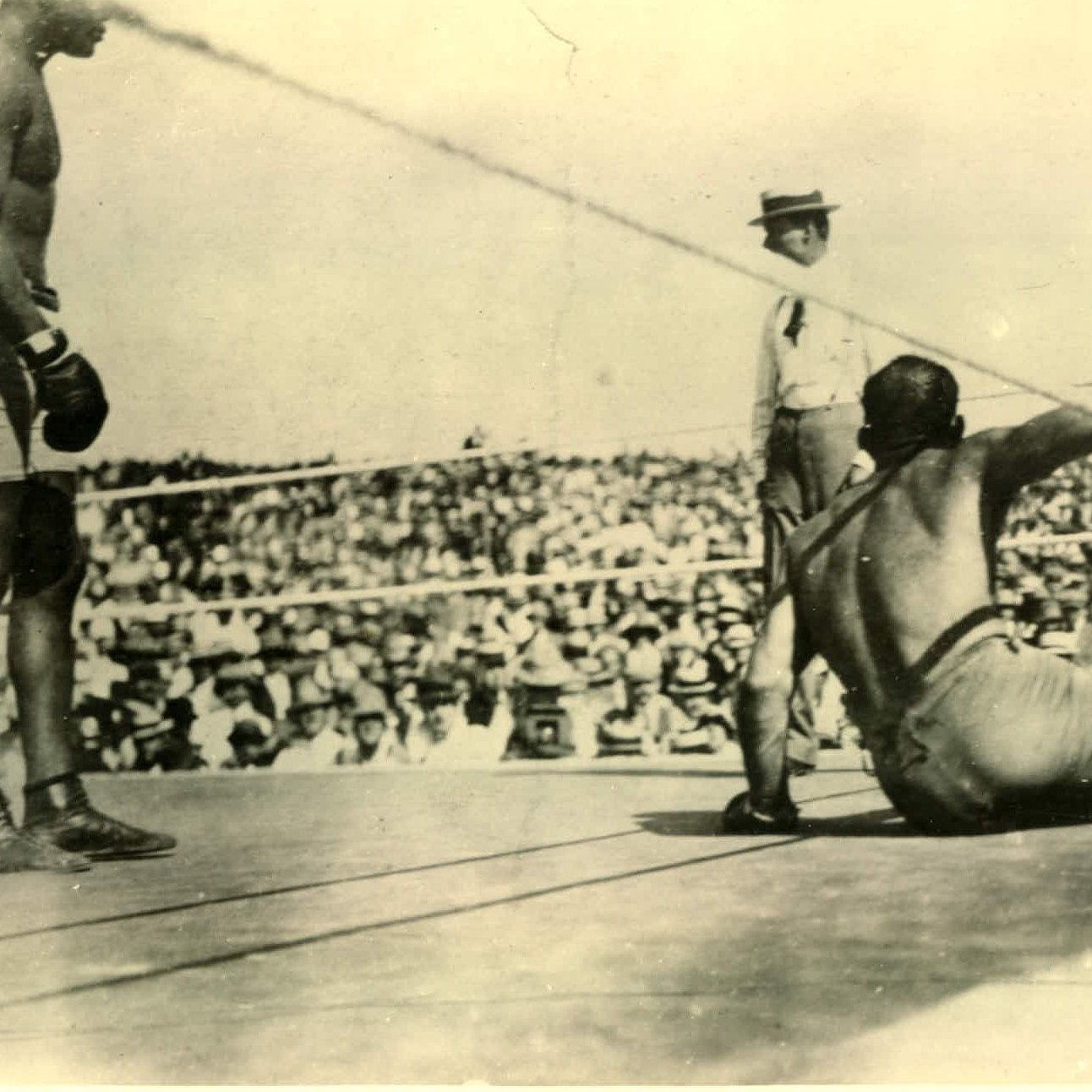

Bringing Back The Thrill Heavyweight Champions Reno Boxing Project

May 15, 2025

Bringing Back The Thrill Heavyweight Champions Reno Boxing Project

May 15, 2025 -

Dangerous Everest Ascent Week Long Climb With Anesthetic Gas Under Scrutiny

May 15, 2025

Dangerous Everest Ascent Week Long Climb With Anesthetic Gas Under Scrutiny

May 15, 2025